Nikada/iStock Unreleased via Getty Images

Back in November of 2022, one company that I was bullish on was Ranpak Holdings Corp. (NYSE:PACK). The company’s primary business is centered around providing paper filling used to fill empty spaces in secondary packages, and it also provides cushioning products like crumpled paper that can be turned into cushioning pads in order to trap air between layers to further protect objects within boxes from things like external shocks and vibrations. Even though this might sound like a boring space to invest in, I find the more boring companies to be the more interesting ones. And at that time, my mindset was the same as it is now.

Ultimately, despite acknowledging that the firm’s fundamental condition was lackluster, I claimed that an eventual turnaround, combined with how shares were priced at the time, warranted some degree of optimism. That led me to rate the business a ‘buy.’ However, I don’t think you could really call that assessment a success. You see, when I rate a company a ‘buy’, I am making the claim that shares are likely to outperform the broader market for the foreseeable future. But that, sadly, has not come to pass. In fact, from the time that article was published through the present day, shares have seen upside of 36.7%. That exactly matches what the S&P 500 has accomplished over the same window of time.

Since then, a lot has transpired. The firm has shown some improvements, not only from a revenue perspective, but also when it comes to profits and cash flows. However, the stock is now rather pricey compared to similar firms and its stock is not exactly cheap on an absolute basis. Given these factors, I’ve decided to downgrade the stock to a ‘hold.’ This is not to say that my mind won’t change in the future. In fact, management will be reporting financial results covering the second quarter of the company’s 2023 fiscal year before the market opens on August 1st. Analysts currently believe that profitability will worsen. But they also think that revenue will rise nicely year over year. If results come in far better than expected, I could change my thinking. But for now, I’m comfortable with a ‘hold’ rating.

Some decent improvements

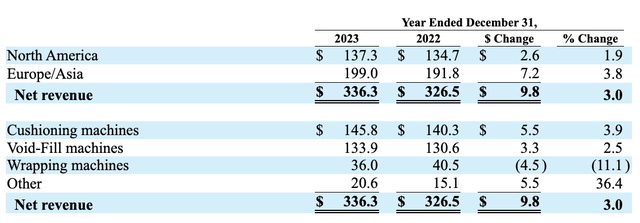

Given the amount of time that has passed since my last article on Ranpak Holdings, it might be best to start off with how the company performed last year compared to the year prior to that. In 2023, revenue for the enterprise came in at $336.3 million. That’s 3% above the $326.5 million reported one year earlier. We should dig a bit into these results and what drove them. Earlier in this article, I talked about some of the products that the company produces. But it’s not just paper and other packaging products. But it would be more accurate to say that the company sells entire packaging systems.

Referred to as PPS (Protective Packaging Solutions), these systems are provided to the firm’s distributors, as well as certain end users, for a small user fee. They charge on a per unit basis for the operation of these systems. And there really are a few of these to talk about. For starters, the company provides cushioning protective systems that convert paper into cushioning pads. They do this by ‘crimping’ paper in order to trap air between layers. Once a customer has one of these systems, Ranpak Holdings then makes available to them, it’s cushioning products under the PadPak brand name. With 34,800 PadPak units at the end of 2023, this is the single largest portion of the company, accounting for $145.8 million, or 43.4%, of the firm’s revenue. That’s up from $140.3 million reported for 2022.

The company also has what it calls a ‘void-fill’ protective system that converts paper in order to fill empty spaces in secondary packages for the purpose of protecting the objects inside. The firm sells these products under its FillPak brand and, at the end of last year, it boasted 83,700 units in operation. In 2023, Ranpak Holdings generated $133.9 million in sales from this set of operations. That marked an improvement over the $130.6 million reported one year earlier. The company also has wrapping protective systems that create pads or paper mesh for the purpose of wrapping and otherwise protecting fragile items during the shipping and handling process. These fall under multiple brand names. But collectively, the firm had 22,700 such systems in operation at the end of last year. This was the weak point of the company, with revenue falling from $40.5 million to $36 million on a year-over-year basis.

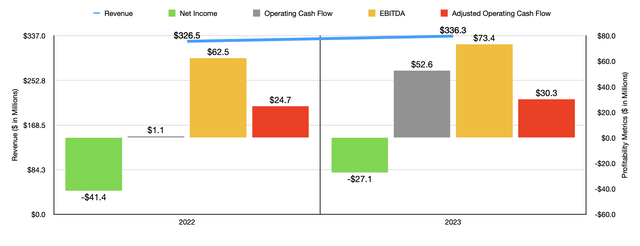

The increase in revenue that Ranpak Holdings saw brought with it an improvement in the company’s bottom line. Net income went from negative $41.4 million to negative $27.1 million. Other profitability metrics followed a very similar path. Operating cash flow surged from $1.1 million to $52.6 million. But if we adjust for changes in working capital, we would get an increase from $24.7 million to $30.3 million. And lastly, EBITDA for the company managed to grow from $62.5 million to $73.4 million.

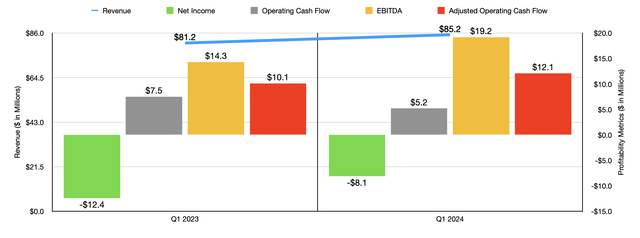

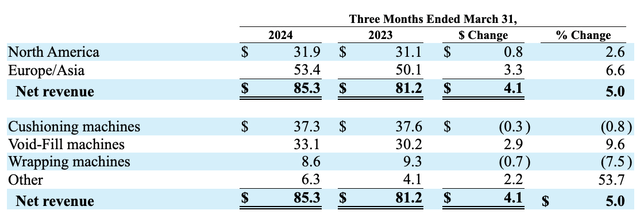

Growth on the top line for the company continued into the 2024 fiscal year. For the first quarter, revenue came in at $85.3 million. That’s a 5% increase over the $81.2 million reported the same time of the 2023 fiscal year. This happened even though revenue associated with the company’s cushioning machines and wrapping machines both worsened on a year-over-year basis. The improvement was only made possible by its void-fill machine sales growing from $30.2 million to $33.1 million, while other miscellaneous revenue jumped from $4.1 million to $6.3 million. This other category largely consists of automated box sizing equipment and non-paper revenue associated with packaging systems that the firm has installed for its customers.

On the bottom line, there was improvement as well. In the first quarter of 2023, Ranpak Holdings generated a net loss of $12.4 million. That loss improved to only $8.1 million this year. It is true that operating cash flow worsened, declining from $7.5 million to $5.2 million. But if we adjust for changes in working capital, we get an increase from $10.1 million to $12.1 million. Meanwhile, EBITDA for the company grew from $14.3 million to $19.2 million.

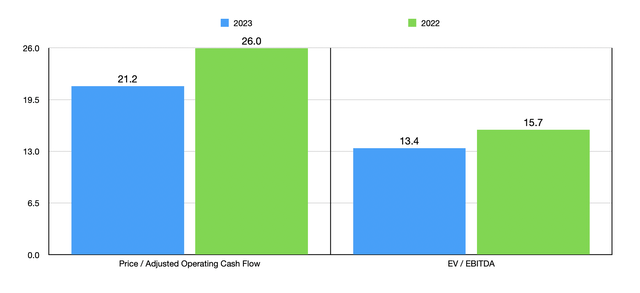

Because it’s too early to really understand what the rest of this year might look like, especially because we don’t have estimates from management, the best way to value the company is to use historical results from 2022 and 2023. In the chart above, you can see precisely that. At this point, shares do look rather pricey, especially relative to operating cash flow. As part of my analysis, I then, in the table below, compared Ranpak Holdings to five companies that have some similarities to it. And using both the price to operating cash flow approach and the EV to EBITDA approach, I found that our candidate was the most expensive of the group.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Ranpak Holdings | 21.2 | 13.4 |

| Pactiv Evergreen (PTVE) | 5.5 | 8.2 |

| Sonoco Products (SON) | 5.4 | 8.1 |

| Graphic Packaging Holding Company (GPK) | 8.0 | 8.1 |

| Sealed Air Corp. (SEE) | 9.1 | 9.9 |

| Packaging Corporation of America (PKG) | 13.2 | 12.5 |

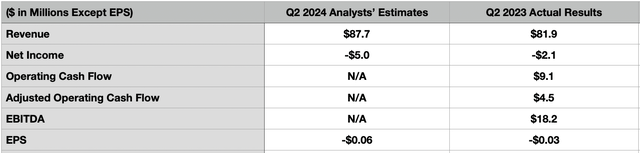

This is not to say that things can’t change. As I mentioned at the start of this article, management will be reporting financial results covering the second quarter of the firm’s 2024 fiscal year in the coming days. This would be an excellent time for the business to surprise investors. From a revenue perspective, analysts are currently anticipating sales of $87.7 million. If this comes to fruition, it would translate to a year-over-year increase of 7.1% compared to the $81.9 million reported for the second quarter of 2023.

On the bottom line, the picture is expected to be a bit different. In the second quarter of last year, management reported a loss per share of $0.03. That loss is expected to double to $0.06 this year. That would take the firm’s net loss from $2.1 million to $5 million. In the table above, you can see some other profitability metrics that are important to the business. Analysts have not provided guidance when it comes to these. But investors should most certainly pay attention to the results that do come out for the second quarter. These will play a very large role, I suspect, in the direction that shares take and the overall health of the enterprise.

One other thing that I would like to touch on briefly is the fear that this might be a space where innovation and growth is difficult or even impossible. That is most certainly not the case. In fact, one of the company’s newest products that it just launched globally is the Geami MV. This is a compact converter that uses sustainable paper. The goal here is to serve as an alternative to plastic wrapping, due not only to regulatory concerns, but also environmental ones. This has been part of a recent trend for the company. In fact, on April 22nd, the management team at Ranpak Holdings announced its North American launch of a product called climaliner Plus. This is a temperature protective paper liner that can be used for cold chain shipping. And the other product launched that day was naturemailer, which is a line of eco-friendly padded mailers. The paper-based products are made with 100% recycled materials. And the objective here is for the firm to further focus on environmentally friendly solutions, not only to meet the needs of customers, but also to grow its slate of offerings for the purpose of expanding revenue opportunities.

Takeaway

Based on the data currently available, Ranpak Holdings seems to be doing pretty well for itself. The company is growing, and cash flows are growing with it. Management has come out with some interesting innovations and the future for the business will likely be positive. But this does not mean that the firm makes for an attractive investment these days. Shares look more or less fairly valued in my book. But relative to similar enterprises, they are quite pricey. While analysts are forecasting further revenue growth, the firm’s bottom line is expected to see some pain. Add all of this together, and I think that downgrading the business to a ‘hold’ makes sense at this time.