JLGutierrez

By Michiel Tukker, Benjamin Schroeder, Padhraic Garvey, CFA

Upside surprise to US CPI, but doesn’t distract from focus on jobs

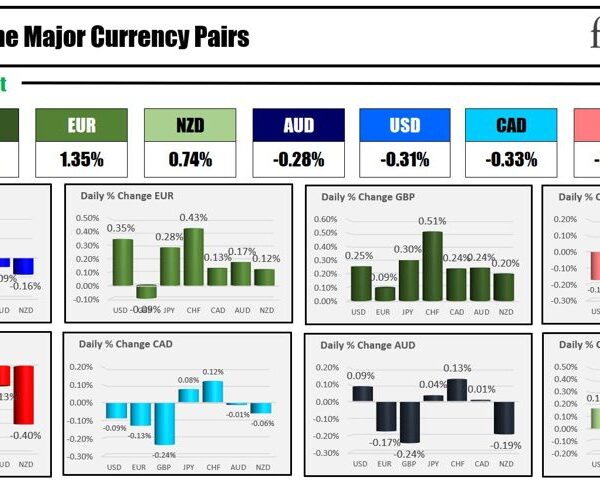

Only a few economists had predicted a 0.3% month-on-month core CPI reading in August, and thus, markets were surprised by this figure. The pricing of a September cut is now 28bp, so a 25bp cut clearly has preference. Nevertheless, markets were not completely spooked by the uptick, which shows that the deterioration of the labour market is the new focus. The yield curve remained disinverted, albeit barely, with the 2Y10Y flattening to just 2bp.

PPI data on Thursday is the next input in shaping inflation expectations, but the weekly jobless claims numbers could end up drawing more attention. The last reading was well in line with consensus, and this time expectations are for the number to remain stable. With lingering concerns about a sharp deterioration of the jobs market, a significant downside surprise could persuade markets that a 50bp cut in September is still a possibility.

ECB will cut again, but a consecutive October cut seems unlikely

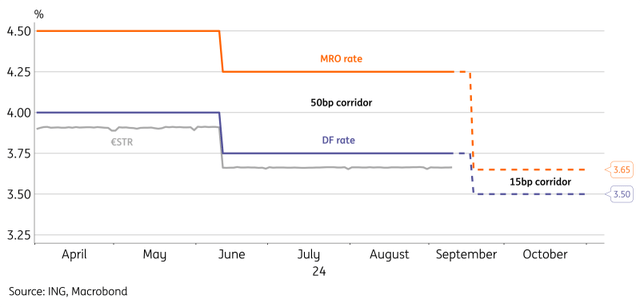

All economists on Bloomberg predict a 25bp cut by the ECB, and here markets will certainly not be caught by surprise. More interesting may be the forward guidance with which the cut is delivered, although we don’t have high expectations about this. Instead, the ECB is likely to just reiterate the data-dependent approach and leave the path forward completely open.

Looking ahead, markets are still pricing in around a 40% chance of another cut for October, which, in our eyes, is highly unlikely. If Christine Lagarde emphasises the importance of quarterly projections during the communications, then that percentage could diminish considerably. Only a severe deterioration of the economy would warrant an October cut, but given the limited amount of additional data available by then, this chance seems negligible.

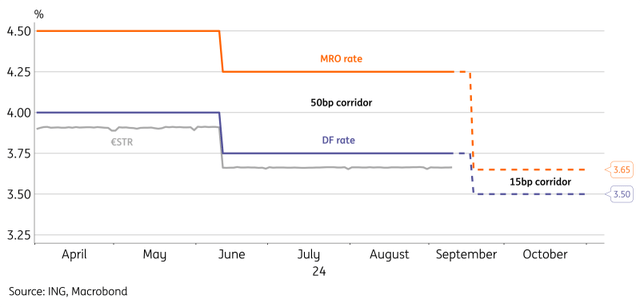

The ECB will also narrow the corridor between the main refinancing rate and the deposit facility rate from 50bp to 15bp, as part of the broader review of the operational framework. This should be seen as a technical adjustment and not a loosening of monetary policy. With plenty of excess liquidity in the system, the deposit rate is the important policy rate for now, and thus, market rates (i.e. ESTR) should not be impacted by this tweak.

ECB will tweak the main refinancing rate, but this shouldn’t impact market rates

Thursday’s events and market views

Besides the ECB’s policy rate decision, we have US PPI numbers. The PPI excluding food, energy and trade is expected to come in at 0.2% MoM, which should help inflation converge towards the target.

Supply includes 3Y & 7Y BTP auctions from Italy (totalling €6.5bn), and Ireland with a 7y green bond and a 10y bond, for a total of €1bn. Later in the day, we have the US with a 30Y Bond for $22bn.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more