Martin Barraud/OJO Images via Getty Images

Recap

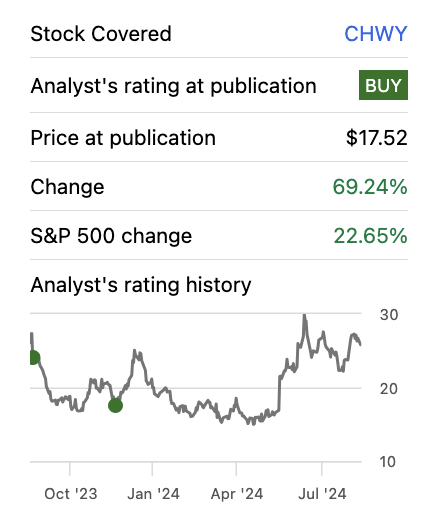

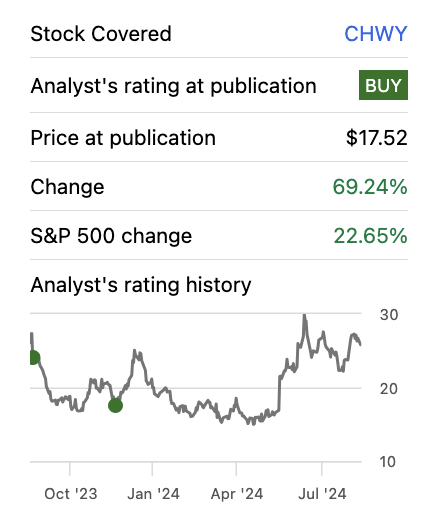

We last discussed Chewy (NYSE:CHWY) in December 2023. Within fewer than eight months, the stock has increased by 70% since we issued a buy rating of $17.5. Despite fierce competition, we think Chewy should be able to endure in this harsh environment, and the market’s response indicates that the company has probably established itself in the sector.

Stock return (Seeking Alpha)

Q2 2024 Performance

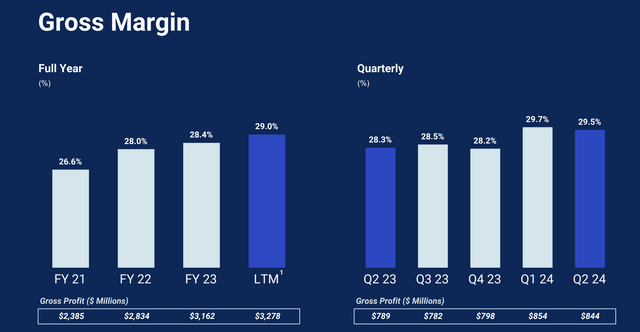

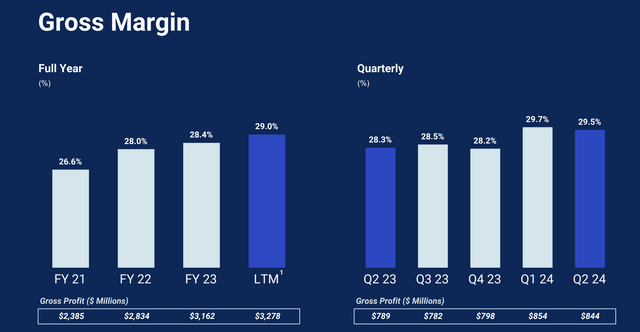

Margin Improvement

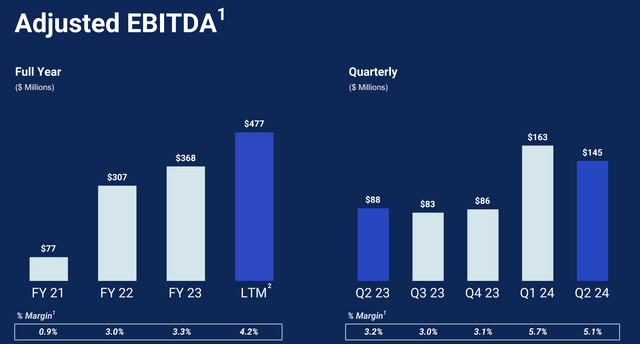

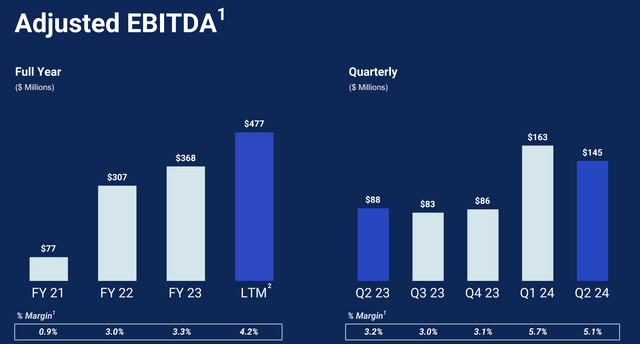

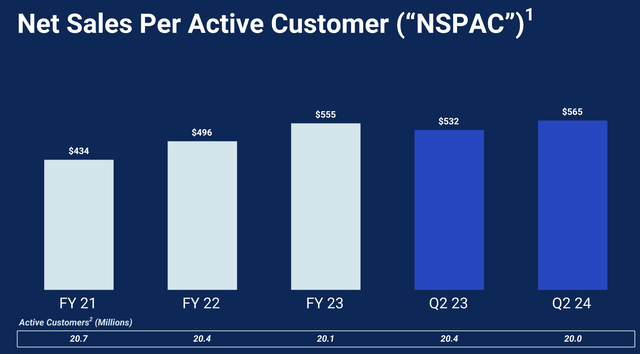

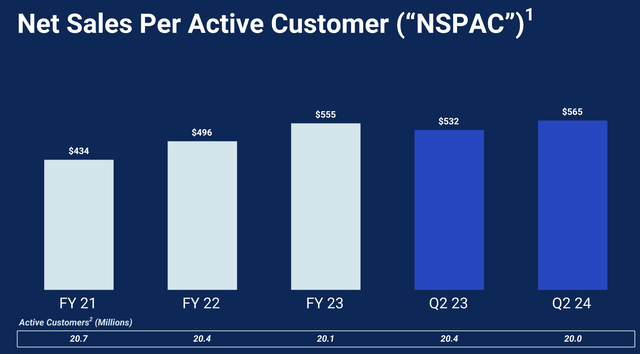

The business demonstrated its capability to strengthen its margins once more in Q2, 2024. This indicates that the management’s plan is effective. The business has made an effort to set itself apart from formidable competitors like Amazon (NYSE:AMZN) by providing services like pet insurance and pet hospitals. As a result, we observed that its margin increased and concluded that it is driven by rising net sales per active customer metrics.

Gross margin (Chewy) EBITDA (Chewy) Net sales per active customer (Chewy)

Customer Base Challenges

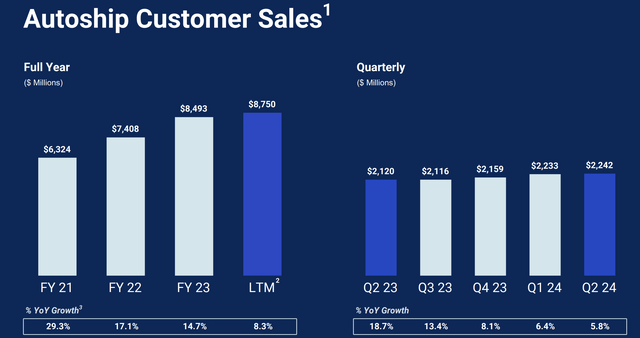

However, its customer base has continued to decline. Even though the company is growing into new markets like Canada and offering more items, the customer count fell to 20 million this quarter. Furthermore, the company’s autoship client sales trend, which increased by 5.8% but at the slowest rate in the previous two quarters, indicates that it still has a strong and devoted customer base, but the company may have had trouble bringing in new customers, particularly in the US.

The management ascribed this to the challenging industry environment brought on by high inflation, and they anticipated an improvement in the situation by 2025. The management reported that while the abandonment rate decreased, the total pet adoption rate increased. This may be the early signs of normalization in the sector. We speculate that this tendency might follow the same trajectory as the inflation trend. The US consumer position may have gotten better over time as the US inflation continued to cool.

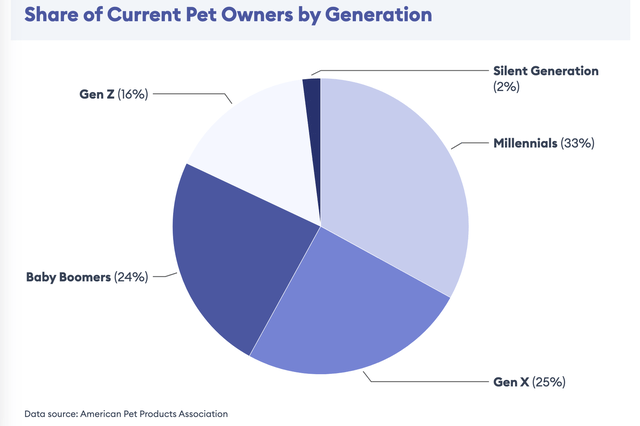

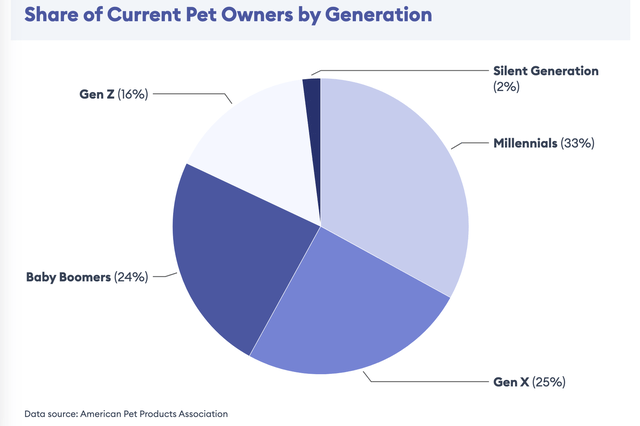

However, the Conference Board reports that while consumers with high incomes (above $100k) continue to show resilience, those with low incomes (between $15–$24k) show an ongoing downward trend. Therefore, given the importance of younger consumers to the pet economy, we may anticipate that the growth prospects for the pet sector will continue to be sluggish.

Pet owners by generation (Pet Products Association)

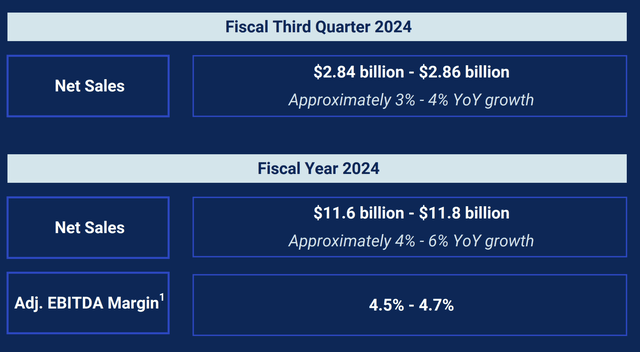

Chewy anticipates reaccelerating revenue growth, led by new product offerings and monetization efforts such as sponsor ads, beginning in Q3 2024. By monetizing website and app traffic, the company currently expects to reboot its revenue growth momentum. This was a smart strategy to allow the business to focus on its existing ecosystem when growth opportunities are few, giving it more ammunition for when the pet industry starts to expand again.

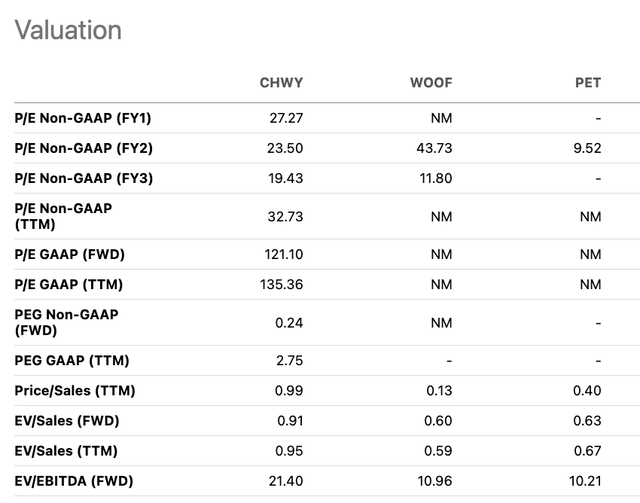

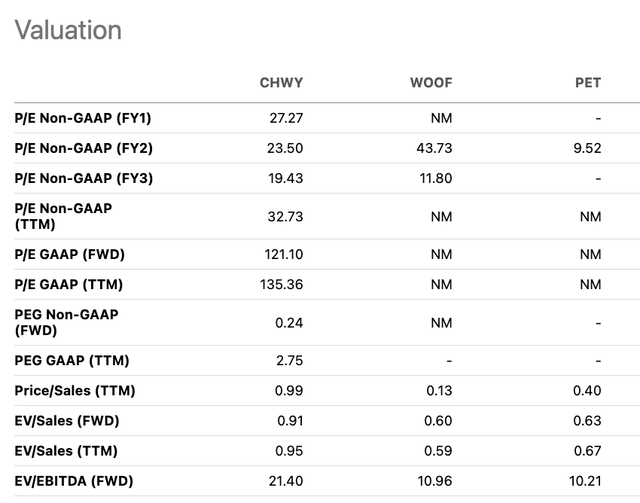

Valuation

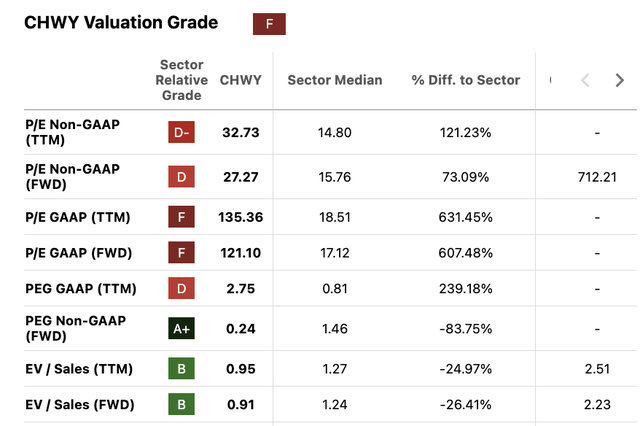

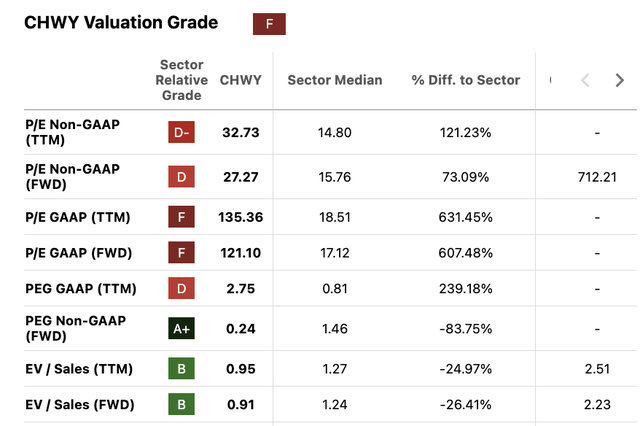

Considering that the pet sector may not be fully recovered, Chewy continues to confront challenges in growing its customer base. The current surge in the stock is primarily due to the company’s better profitability and margins, which essentially indicate that it is no longer in stressed mode. Its stock currently trades at EV/S and P/S ratios comparable to the sector median as a result.

Valuation multiple (Seeking Alpha)

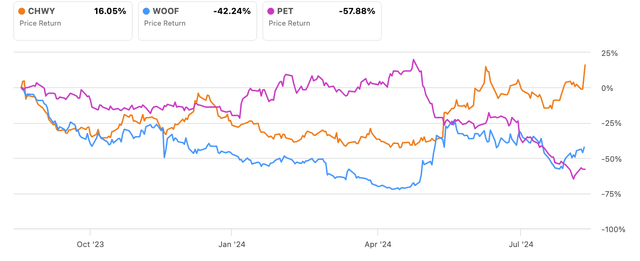

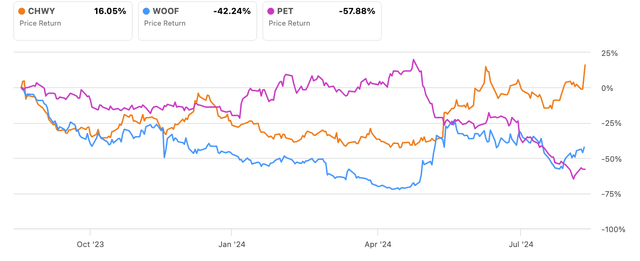

When comparing Chewy’s stock to its contemporaries in the Pet industry, it is trading at a premium due to the P/S ratio. The company’s stock performance has finally surpassed those of its competitors, including Petco (WOOF), indicating that the market has acknowledged its dominant position. As a result, we believe that the stock is probably fair value in the near term given its existing standing in the industry.

Valuation multiple (Seeking Alpha) Stock performance (Seeking Alpha)

Risk

Competitive Landscape

In the long run, the business still needs to set itself apart from smaller competitors like Farmer’s Dog and Amazon.

We appreciate Chewy’s efforts to set itself apart through vertical integration. Chewy already operates six pet hospitals and plans to launch more. Chewy boasts a round-the-clock customer service team with training in pet care and goods. As a result, it might reply with greater professionalism than either Amazon’s AI agent or its customer support staff. Additionally, it offers its own CarePlus insurance plan, which covers veterinary visits by certified professionals. As such, customers who enjoy the one-stop shopping experience might choose it over Amazon.

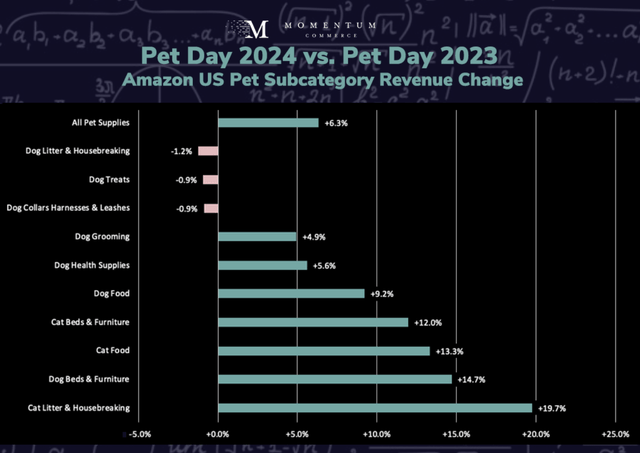

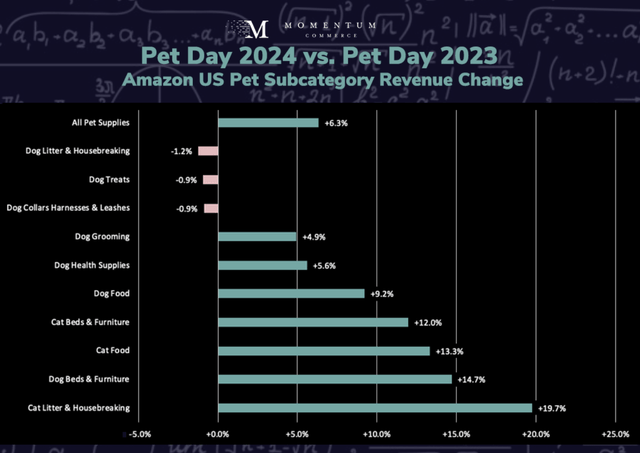

However, big competitors like Amazon typically offer lower costs than Chewy. Thus, we believe that this could be one of the causes of the company’s halt in the expansion of its clientele. Throughout its 2024 Pet Days, Amazon increased its revenues by 6.3%.

Amazon pet day sales (Momentum)

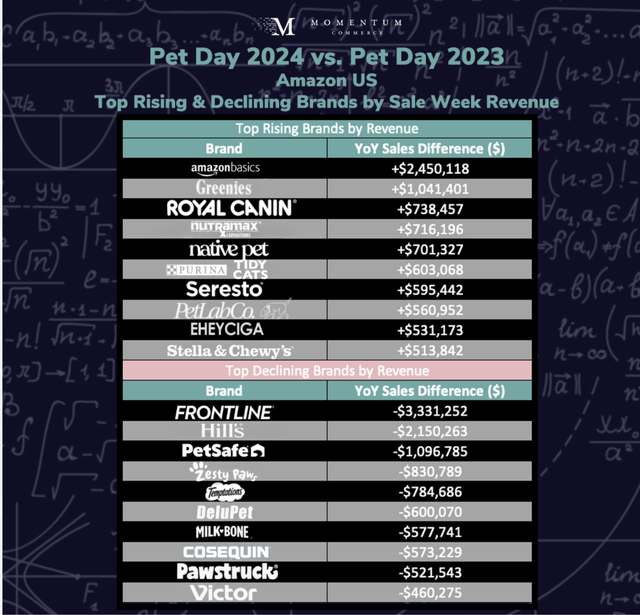

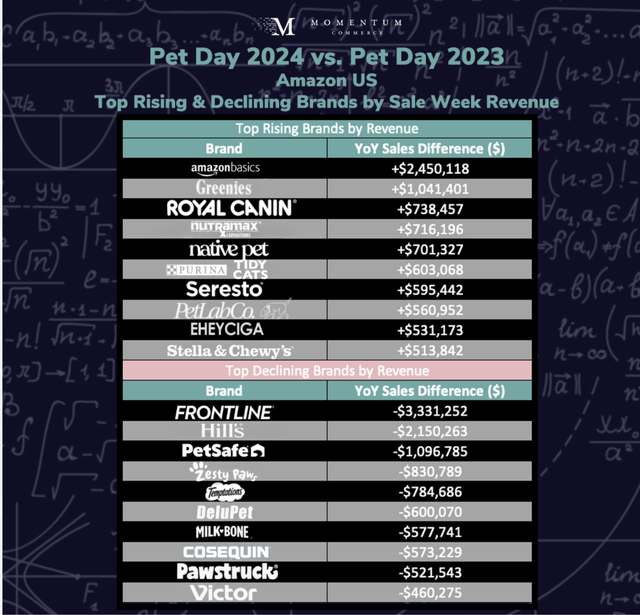

Along with having a larger user base and strong delivery capabilities, Amazon now sells pet supplies under the Amazon Basics brand. Amazon can provide its private brand at a competitive price by leveraging its user base. Chewy should therefore face pricing pressure as a result of this. Hence, we believe that Chewy’s comparative averages are still not very strong, even if Chewy is working on vertical integration and trying to offer additional products for its clients.

Amazon pet product sales change (Momentum)

Conversely, smaller competitors want to set themselves apart from Chewy by offering more customized goods and services. To connect with pet owners on a more emotional level, they also favor selling on their websites and making their social media advertisements. Given that fresh food needs to be delivered on schedule, Chewy might not have an advantage over its smaller competitors in this area.

Chewy might not be very competitive unless it chooses to develop its product as opposed to smaller competitors that ship its product directly. As a result, we like to wait and evaluate Chewy’s competitive advantage when we see Chewy offer additional services and goods.

Farmer’s dog advertisement (Farmer’s dog)

Conclusion

We believe Chewy continues to lead the pet industry, but to set itself apart from competitors, it needs to expand its range of services and products. We believe that the recent increase in stock price indicates that the market now recognizes the company as a leader rather than one that is in crisis. Even while we believe Chewy has room to grow in the long run, we believe the recent rally has priced the stock at a fairer level given its prospects for future growth. We thus downgrade it to hold as a result.