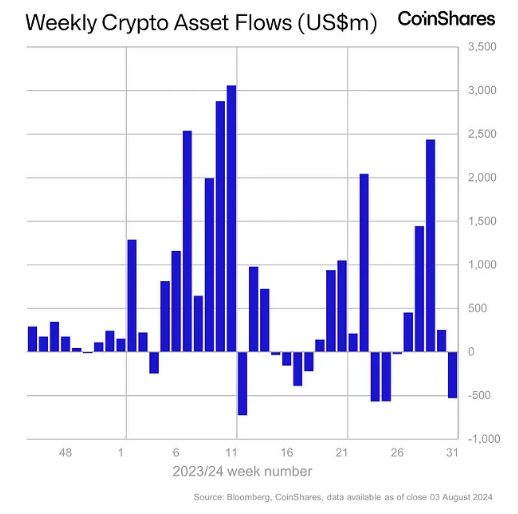

With recent estimates showing a startling $528 million in withdrawals from digital asset investment products, crypto markets are under great flux. Rising US economic worries combined with geopolitical concerns and significant market liquidations help to explain this fall. The outflows capture a general sense of concern among investors as they consider how possible economic downturns would affect the crypto scene.

Data from CoinShares shows that institutional crypto investment products had their first outflow in four weeks last week—$528 million overall. Along with geopolitical issues and more general market liquidations across many asset classes, this fall is ascribed to worries of a recession in the United States.

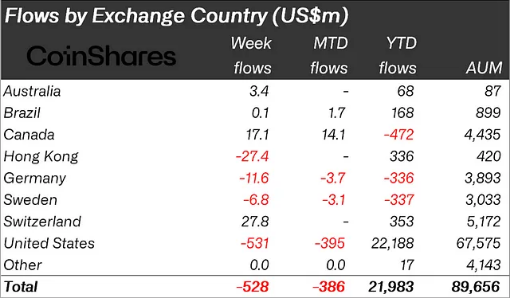

With $531 million, the US led these outflows; other areas like Germany and Hong Kong also helped to drive the trend. Not surprisingly, Bitcoin and Ethereum were affected; respective outflows were $400 million and $146 million.

Source: CoinShares

Patterns And Market Reaction

The general market capitalization of cryptocurrencies has clearly dropped in response to cash outflow. Following the revelation, big cryptocurrencies like Bitcoin and Ethereum saw price declines, which helped to explain the over $10 billion in value lost from exchange-traded products (ETPs).

Particularly Ethereum had net withdrawals of $146 million, which underlines the fragility of even the biggest digital currencies under market stress. Reflecting this volatility, the Nasdaq futures fell 3% as conventional markets responded to the developing turmoil.

Total crypto market cap at $1.9 trillion on the daily chart: TradingView.com

Answers From Business Leaders

The rumors about our positions being liquidated are false. We rarely engage in leveraged trading strategies because we believe such trades do not significantly benefit the industry. Instead, we prefer to engage in activities that provide greater support to the industry and…

— H.E. Justin Sun 孙宇晨 (@justinsuntron) August 5, 2024

Justin Sun, the creator of Tron, addressed the widespread rumors of liquidation floating around the society in the middle of this financial instability. He called these assertions “wrong” and attacked the dependence on leveraged trading techniques aggravating market volatility. Sun’s remarks highlight a growing worry among business executives about the viability of such trading methods, particularly in a situation of uncertainty.

Crypto: Future Direction

The crypto market struggles uphill to rebuild investor trust as economic worries loom huge. Analysts believe that the present withdrawals might be a sign of a longer-term trend as investors flee unstable economies for safer havens. The volatility seen in the crypto market reflects a larger trend of risk aversion most likely to persist until more definite economic signs show.

Finally, the latest $528 million outflow from cryptocurrency assets emphasizes how unstable the market is in front of economic uncertainty. The future of digital assets will be shaped in great part by the reactions of industry leaders and the general market reaction as investors negotiate this stormy terrain.

Featured image from AARP, chart from TradingView

Source:

Source: