imagedepotpro

Funding Overview

The final time I coated Recursion Prescribed drugs, Inc. (NASDAQ:RXRX) for Looking for Alpha was again in May last year, once I gave the corporate’s inventory a “hold” ranking. Shares had been priced at ~$9 on the time, and briefly spiked to a excessive of $15.5 in June final 12 months, earlier than falling to a price of ~$5.5 late within the 12 months. Throughout the previous month, nonetheless, the share worth has risen by almost 50%, and at present trades at ~$11 per share.

Recursion IPOd in April 2021, issuing 27.88m shares at a worth of $18 per share, and elevating >$500m – making it the sixth largest biotech-focused IPO this decade. Recursion refers to itself as a “techbio” firm, and, in line with its Q3 quarterly report / 10Q submission:

Central to our mission is the Recursion Working System (OS), a platform constructed throughout numerous applied sciences that permits us to map and navigate trillions of organic and chemical relationships inside the Recursion Information Universe, one of many world’s largest proprietary organic and chemical datasets.

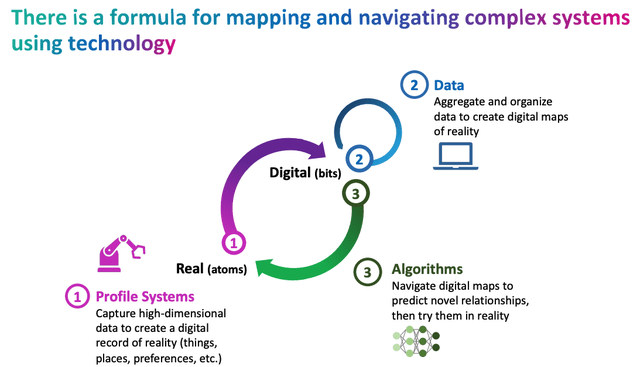

We body this integration of the bodily and digital elements as iterative loops of atoms and bits. Scaled ‘wet-lab’ biology and chemistry information constructed in-house (atoms) are organized into virtuous cycles with ‘dry-lab’ computational instruments (BITS) to quickly translate in silico hypotheses into validated insights and novel chemistry.

Our concentrate on mapping and navigating the complexities of biology and chemistry past the printed literature and in a target-agnostic means differentiates us from different corporations in our area and leads us to confront a basic reason behind failure for almost all of clinical-stage applications – the flawed goal is chosen on account of an incomplete and reductionist view of biology.

A extra simple description of the enterprise mannequin may also be present in Recursion’s newest investor presentation (which runs to >100 slides), as proven under:

Recursion – enterprise description (investor presentation)

As I mentioned in my two earlier notes on Recursion for Looking for Alpha, whereas the mere point out of Synthetic Intelligence (“AI”) is able to giving any firm’s inventory worth a raise throughout nearly any sector, it may be onerous to pin down exactly what profit AI is perhaps taking part in in enhancing outcomes.

Recursion believes it might make the method of drug discovery quicker and extra exact through use of “big data,” algorithms, machine studying, and so on., permitting itself and its companions to seek for and uncover thrilling new drug candidates directed towards novel targets, and in the end develop medicine that may set up themselves as requirements of care in industrial markets. Turning to the newest 10Q once more, Recursion says it has:

a portfolio of clinical-stage, preclinical and discovery applications and continues scaling its Recursion OS with greater than 200 million complete phenomics experiments, multi-timepoint live-cell microscopy, transcriptomics, proteomics, inVivomics, information associated to multi-target compound interactions and physicochemical properties, in addition to massive language mannequin derived illness relevance and target-compound relationships.

Information have been generated in-house by the Recursion OS throughout roughly 50 human cell varieties, an in-house chemical library of roughly 1.7 million compounds, and an in silico library of over 1 trillion small molecules, by a group of roughly 550 Recursionauts that’s balanced between life scientists and computational and technical specialists.

I’ve a number of points with this sort of enterprise mannequin, nonetheless. To start with, Recursion is concentrated on discovering and creating utterly new medicine, beginning on the very starting of the method, by feeding information right into a supercomputer and hoping it finds some optimistic correlations.

That implies that, associate milestone funds apart – that are usually decrease when a drug is in its earlier phases of improvement – Recursion has no prospect of incomes any revenues from the medicine it discovers till it has guided them by means of pre-clinical research, established proof of idea in e.g. mouse of non-human primate fashions, gained approval from the Meals and Drug Company (“FDA”) to start in-human research, performed Part 1, 2 and three medical trials to show its drug is superior presently available on the market, utilized for full approval, and waited 6-12 months for the FDA to review the information and decide on approval.

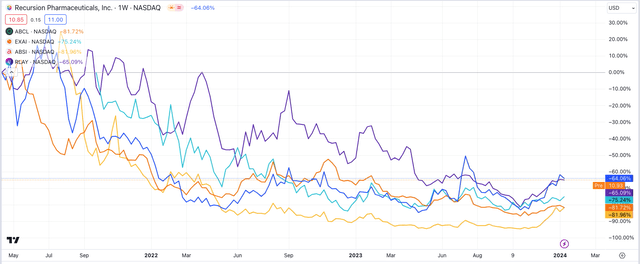

That is why, when AI-driven drug discovery corporations – and there are a number of, e.g., AbCellera Biologics (ABCL), Exscientia (EXAI), Absci Corp (ABSI), and Relay Therapeutics (RLAY) – focus on the prohibitive prices of drug improvement and the distant possibilities of a drug making all of it the way in which to approval – Recursion states in a company video on its home page that the prices are ~$2bn, and failure price ~90% – I think about this to be a weak point of the corporate, relatively than a power.

The drug builders clearly consider they will scale back prices, and improve chance of approval, whereas the truth is their costly super-computers probably improve the prices of the preliminary drug discovery stage. Based mostly on proof to this point, at the very least, there isn’t any compelling purpose to consider a drug goal recognized by a supercomputer is any extra prone to succeed than one picked by scientists who’ve an in depth working data of which drug varieties work during which forms of illness.

The current actuality appears to me to be that in case you are investing in an AI-driven drug discovery firm, you will want to be extraordinarily affected person, as medicine presently take ~5 years to develop from preclinical research by means of to approval, whether or not they’re found by AI or by a PhD scholar, and embrace a excessive degree of danger. This trade remains to be in its infancy and has no tangible monitor file of success to level to, though AI evangelists will likely argue that the information pushed method will ultimately grow to be all-pervasive, and in time, these corporations will reap the advantages.

Within the meantime, witness the 5-year share worth efficiency of the 4 corporations talked about above, and Recursion, over a 5-year interval (or since IPO), with all 5 shares buying and selling down >65%.

Share worth efficiency of chosen AI drug discovery corporations (TradingView)

Recursion – Partnership & Pipeline Overview

Regardless of my reservations round a enterprise mannequin that requires a really excessive money burn – Recursion has recorded web losses of $(187m) and $(240m) in 2021 and 2022 respectively, and $(251m) throughout the primary 9 months of 2023 – that’s primarily wagered on the prospect of discovering a drug able to at some point producing “blockbuster” (i.e., >$1bn every year) revenues, nonetheless distant that risk could also be, Recursion has been in a position to each develop a pipeline and appeal to companions, theoretically de-risking its enterprise considerably.

Recursion’s associate of most significance would be the German Pharma Bayer (OTCPK:BAYZF), which signed an amended and restated settlement with Recursion final 12 months. In accordance with Recursion’s Q3 10Q:

Bayer pays Recursion elevated per program milestones which can be as much as $1.5 billion for as much as 7 oncology applications in addition to royalties on web gross sales.

$1.5bn per profitable oncology candidate actually sounds spectacular, with Recursion moreover incomes mid-single digit royalties on future web gross sales of any medicine developed, however the deal has the truth is price Bayer solely a $30m upfront cost and $50m fairness funding to this point, whereas it appears to me at the very least that Recursion assumes nearly the entire prices of discovering the candidates, and the entire danger, solely receiving significant milestones when the candidate is considerably derisked.

Bayer solely makes funds if Recursion efficiently discovers a drug with “blockbuster” potential. Nonetheless, as Recursion freely admits, the possibilities of discovering such a candidate are extraordinarily low, whereas the prices of searching for such a candidate are nearly prohibitively excessive.

Nonetheless, Recursion additionally has offers in place with Swiss Pharma Roche (OTCQX:RHHBY), and its Genentech drug discovery subsidiary, which included a $150m upfront cost with $500m of milestones on the desk, and as much as $300m throughout an extra 40 applications probably, and on the expertise platform aspect, in its Q3 earnings press launch Recursion notes a deal accomplished with Nvidia (NVDA), involving a $50m fairness funding, as follows:

Growth of Recursion’s in-house supercomputer, BioHive-1, with NVIDIA H100 GPUs will probably make it probably the most highly effective laptop wholly owned or operated by any biopharma firm and among the many 50 strongest supercomputers on the Top500 Checklist

Recursion can be partnering with Tempus in an effort to acquire entry to “over 20 petabytes of multimodal oncology data for the purpose of training causal AI models together with Recursion’s proprietary data.”

On the JPMorgan Healthcare conference this week, Recursion has been offering reside demos of its LOWE drug discovery software program and interface that “can be used by any of our scientists from the comfort of their laptop.” Presumably, Recursion could at some point roll out LOWE as a bespoke product for biotech corporations, however once more, buyers will must be affected person right here and acknowledge that the dangers concerned in launching an untested product right into a aggressive life sciences market, during which budgets dictate that provide usually exceeds demand.

As I famous in a recent post on AbCellera, it strikes me that in biotechnology / drug discovery, it’s a lot better to be the drug developer relatively than the drug developer’s associate, as in the event you genuinely have a “blockbuster” drug candidate in your arms, you could nicely extract billions of {dollars} of revenues, or be purchased out by a Massive Pharma concern at an enormous premium to your final traded share worth. The drug developer’s associate, regardless of really discovering the drug, stands to realize a lot much less.

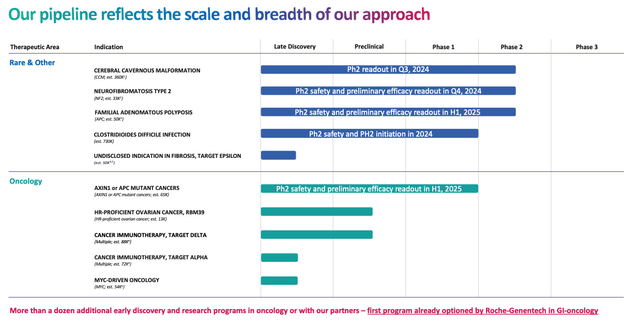

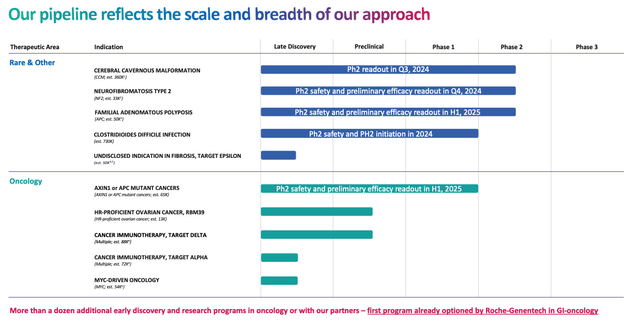

In that spirit, Recursion has been creating its personal pipeline, as we will see under:

Recursion pipeline (investor presentation)

I discover it spectacular that Recursion has been in a position to transfer three property into Part 2 research, though the market alternatives in play could also be considerably unsure.

For instance, Recursion believes that cerebral cavernous malformation (“CCM”) could possibly be a 360k affected person market, primarily based on the variety of symptomatic sufferers within the U.S. and EU – which is 5 occasions bigger than the Cystic Fibrosis market – a market that has enabled Vertex Prescribed drugs to generated almost $10bn revenues every year and command a market cap valuation of >$100bn.

With that mentioned, the truth that there are not any authorised therapy for CCM could indicate that sufferers solely search a medical treatment in additional excessive circumstances, considerably limiting the market alternative. Both means, Recursion has promised Part 2 information in Q3 2024, which is a catalyst buyers ought to pay attention to.

There are additionally no authorised therapies for Neurofibromatosis kind 2 (“NF2”) – a genetic situation that causes tumors to develop alongside the nerves, with a affected person prevalence of ~33k, Recursion estimates. A Part 2/3 examine is underway, with information from the Part 2 portion, involving 23 adults and 9 adolescents, has additionally been promised for 2H24.

The third Part 2 stage examine is in an oncological indication, tumors harboring AXIN-1 mutations, that are presently thought-about “undruggable.” That is arguably an ideal use case for Recursion, its expertise, and its brains belief of employees – serving to drug targets which can be well-known, however inaccessible, as, for instance, Mirati Therapeutics (MRTX) was in a position to do with the KRAS gene / protein, resulting in the approval of its Krazati drug, indicated for non-small cell lung most cancers (“NSCLC”), and a buyout by the Massive Pharma Bristol-Myers Squibb (BMY), for almost $5bn.

Recursion’s pipeline consists of a number of extra intriguing medicine and goal indications, such because the 50k affected person market in Familial Adenomatous Polyposis, Clostridioides Difficile an infection, ovarian most cancers, and most lately, fibrosis, a situation that has defied most therapeutic approaches.

In abstract, we will actually make the case that Recursion has a properly balanced portfolio of in-house medicine, with some intriguing targets, maybe most notably CCM, that might result in “blockbuster” income alternatives, offered the drug is efficient and secure sufficient, and partnership alternatives, the place any breakthrough of observe is prone to be rewarded by a triple-digit million milestone cost, serving to Recursion proceed its heavy R&D spending.

Wanting Forward – RXRX In 2024 – Nonetheless Extra Hype Than Substance

Though it’s doable to really feel comparatively upbeat concerning the progress Recursion is making, it is also argued that the corporate has been given a substantial quantity of leeway owing to its AI capabilities, and that the majority corporations in an identical place to recursion – closely loss making, with no near-term income prospects – could be severely testing shareholder’s endurance.

Regardless of Recursion – and AbCellera, Exscientia, and others’ efforts to demystify and rationalise the drug improvement course of, and boasts of getting world class tremendous computer systems doing their bidding, there should ultimately come an inflection level the place the market considers what particular worth proposition these corporations provide?

Will Recursion in the end have the ability to create a manufacturing line of best-in-class medicine, that it’s going to develop with its companions, incomes billions of {dollars} in milestone payouts? Will the corporate efficiently launch a secure and efficient CCM remedy, and open up a brand new market inside the pharmaceutical trade? Will the corporate discover methods to show “undruggable” targets into “druggable ones.”

Sadly, the fact could also be that no person is aware of how efficient the AI-driven drug discovery enterprise mannequin could grow to be, as a result of the trade is so new. These corporations, like each different Pharma and biotech, are searching for the “needle in the haystack” – the following blockbuster drug – quicker, reaping the monetary advantages of doing so.

It might be attention-grabbing to notice, nonetheless, that medicine are found in all types of various methods – for instance, Novo Nordisk’s (NVO) GLP-1 agonist semaglutide, authorised in weight reduction and diabetes as Wegovy and Ozempic respectively, and anticipated to grow to be an all-time best-selling drug, was discovered through the examine of a lizard’s venom. Would a supercomputer have been in a position to uncover a GLP-1 agonist?

This neatly articulates my drawback with AI drug discovery corporations. As long as they hype their super-computers and processing powers, these corporations will probably discover sufficient buyers keen to speculate massive sums of cash, and never panic about heavy losses – Recursion spent $172m on R&D in 2023 to the tip of Q3, however it’s onerous to know if its partnerships will in the end reap any milestone funds – the Pharma can stroll away at any time with out paying a cent – or if its pipeline has real promise, or is being pushed in direction of extra obscure targets and indications on account of an absence of genuinely promising targets found to this point.

Traders are ready to be affected person, however it’s onerous to successfully quantify what return on their funding they’re anticipating. It might probably really feel as if buyers expect a miracle, akin to purchasing a lottery ticket, given how tough, prolonged, costly, and dangerous the drug improvement course of is.

This dilemma helps to elucidate why Massive Pharma will usually pay a triple-digit proportion premium to amass a biotech with a later examine stage, derisked drug with an excellent likelihood of constructing it to market. The additional again you begin, the upper the chance, AI supercomputer or no AI supercomputer, and the upper the fee, which encapsulates my problem with drug discovery / goal identification as a enterprise mannequin.

As such, my perception is that in 2024, Recursion inventory will probably meander considerably, as the corporate continues its seek for efficient drug targets, whereas the goodwill of buyers is retained. There will probably be a few vital information readouts – in CCM, NF2, and Clostridioides Difficile – though I’d argue that these indications usually are not those that Recursion and its purchasers and buyers would ideally prefer to work inside long-term, with oncology and autoimmune the considerably extra profitable fields.

In abstract, I believe frustration with AI-driven drug improvement could also be a theme of 2024, as buyers resist the truth that in a single day success is just not a characteristic of this trade, regardless of what could have been promised. There’s sufficient substance to what Recursion and others are doing, nonetheless, for my part, for the market to not lose religion.

I hope I’m flawed and we see real volatility in 2024, however in the end, in case you are an investor searching for volatility and worth catalysts galore in 2024, Recursion inventory is probably not for you. If you wish to purchase a ticket for the nice AI drug discovery lottery, a small funding in Recursion Prescribed drugs, Inc. inventory could pay out in 3-5 years’ time.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please concentrate on the dangers related to these shares.