On this picture illustration a Reddit brand is seen displayed on a smartphone.

Mateusz Slodkowski | Sopa Pictures | Lightrocket | Getty Pictures

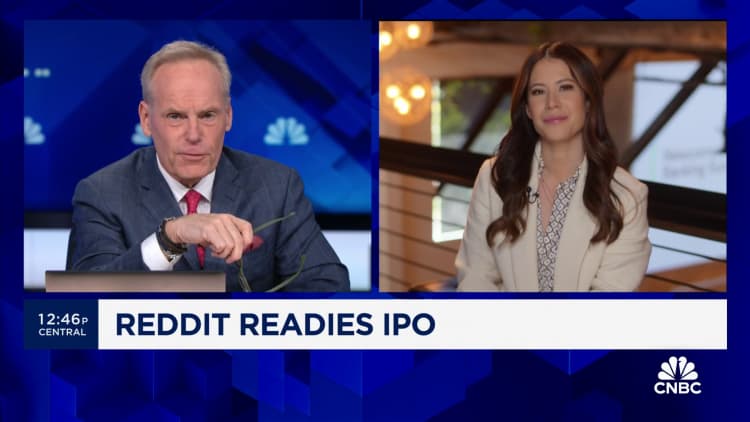

Reddit, the 19-year-old web site that hosts tens of millions of on-line boards, priced its IPO on Wednesday at $34 a share, the highest of the anticipated vary.

The providing introduced in $519 million, in keeping with a press release, and values the corporate at near $6.5 billion. Reddit had deliberate to cost the deal at $31 to $34 a share.

Reddit’s public market debut on Thursday, beneath ticker image “RDDT,” would be the first for a serious social media firm since Pinterest’s debut in 2019 and one of many very few venture-backed tech offers of the previous two years. Reddit offered 15.28 million shares within the providing, whereas present shareholders offered one other 6.72 million.

The corporate is taking a haircut from its non-public market valuation of $10 billion in 2021 on the peak of the tech increase. Hovering inflation and rising rates of interest pushed buyers out of dangerous belongings in 2022, finally forcing startups to downsize, slash their valuations and concentrate on revenue over progress.

On Wednesday, knowledge middle {hardware} firm Astera Labs went public, and noticed its shares skyrocket 72%, as buyers flock to something involving synthetic intelligence. Nonetheless, the IPO market has been in an prolonged dry spell for greater than two years, with Instacart, Klaviyo and Arm Holdings among the many few tech firms to carry choices over that stretch.

Reddit’s core enterprise of internet advertising faces competitors from business giants like Alphabet and Meta. The corporate additionally counts Snap, X, Pinterest, Discord, Wikipedia and Amazon’s Twitch streaming service as opponents, in keeping with its prospectus.

Income elevated 20% final 12 months to $804 from $666.7 million in 2022. Its web loss in 2023 was $90.8 million, marking an enchancment from the $158.6 million web loss it recorded in 2022.

The corporate has stated in filings that knowledge licensing might turn into an enormous cash maker, and that it plans to acknowledge about $66.4 million in such offers in 2024. The corporate not too long ago entered an expanded partnership with Google, permitting the search big extra entry to Reddit knowledge to coach AI fashions and different duties.

Final week, Reddit said the Federal Commerce Fee despatched a letter to the corporate inquiring about its data-licensing practices.

As a part of the IPO, Reddit provided a few of its main moderators and customers, referred to as Redditors, an opportunity to purchase inventory via a directed-share program. It is a mannequin that was beforehand utilized by Airbnb, Doximity and Rivian to reward their energy customers and clients.