Reddit, which formally filed to go public on Thursday, is taking a nontraditional strategy with its IPO, analysts say, by making a portion of its shares obtainable to a few of its most loyal customers earlier than the most of the people. If historical past is any indication, that would yield blended outcomes for buyers.

The social community mentioned it will provide web site moderators an undetermined variety of shares, in accordance with its Form S-1, with extra particulars coming at a later date. Although firms sometimes reserve some shares for retail buyers, the overwhelming majority of inventory on the IPO initially goes to institutional buyers and the wealthiest particular person buyers. The general public can ultimately purchase in after the inventory is listed on an alternate, however typically the worth may have risen by then. In different phrases, an preliminary public providing isn’t, often, open to the general public.

Reddit’s transfer is to attraction to its loyal person base and create a deeper sense of possession amongst those that already contribute a substantial amount of their time to managing the positioning, says Kyle Stanford, an analyst at PitchBook. Connecting their at present unpaid work to the corporate’s longterm efficiency might engender even higher loyalty—and a few good PR within the course of.

“It’s unusual. It’s a nice goodwill thing,” says Stanford. “There’s a lot of benefit that these community-driven apps can receive.”

CEO and cofounder Steve Huffman famous as a lot within the S-1: “Our users have a deep sense of ownership over the communities they create on Reddit. This sense of ownership often extends to all of Reddit. We want this sense of ownership to be reflected in real ownership—for our users to be our owners. Becoming a public company makes this possible.”

However loyalty might come at a price: If the inventory value sinks after the IPO, particular person buyers usually tend to panic and promote, probably making a demise spiral. Institutional buyers, conventional considering goes, have a stronger abdomen for driving out early issues, which may forestall a few of that volatility.

A current transfer to democratize IPOs backfired spectacularly: In 2021, the investing app Robinhood went public and made a a lot bigger portion of its shares obtainable to particular person buyers, however the value dropped greater than 8% on the primary day of buying and selling. Now buying and selling for round $13.50—lower than half of the IPO value—shares have mirrored an organization efficiency deemed “disastrous,” and public goodwill for the corporate has faltered.

That mentioned, Reddit is conscious of the dangers, and there isn’t essentially a correlation between Robinhood’s falling inventory value and providing extra to the general public up entrance, says Stanford. In spite of everything, Reddit has develop into the go-to spot for inventory speak for a lot of retail buyers, which contributed massively to the efficiency of firms like GameStop, the meme stock that soared in 2021. Stanford expects the quantity of shares made obtainable to them to be a small portion of the full, then.

“I wouldn’t expect it to make the IPO better or worse, but it’s a nice little additive they can do,” he says. “They’ve seen what’s happened in threads on their platform. They’re hyper-aware of the possibility.”

‘Ride the wave’

Stanford mentioned he hopes Redditors with entry to shares are also equally conscious of the dangers of investing, together with how lengthy the lock-up interval is. In the event that they purchase in at, say, $25 per share and the inventory pops to $35 the following day, they’ll’t instantly money in. And costs might fall within the meantime.

“If there’s a two-month lock-up period, they have to ride the wave,” says Stanford.

“The market price and trading volume of our Class A common stock could experience extreme volatility for reasons unrelated to our underlying business or macroeconomic or industry fundamentals, which could cause you to lose all or part of your investment if you are unable to sell your shares at or above the initial offering price,” Reddit’s S-1 notes.

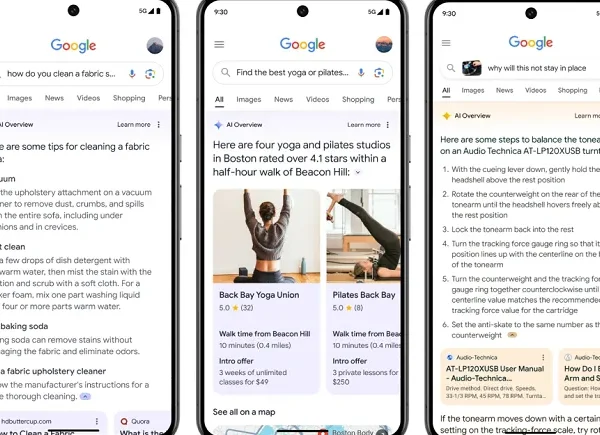

The submitting comes simply as Google and Reddit additionally introduced they’re “deepening” their partnership, in an effort to make it “easier to discover and access the communities and conversations people are looking for on Reddit” by way of Google merchandise, like search.

Talking of Google, the tech big, now often known as Alphabet Inc., had its personal famously “quirky” IPO again in 2004 that concerned auctioning off shares to retail and institutional buyers alike.

Going Dutch

An IPO is historically underwritten by a number of funding banks that certify the standard of the funding. Institutional buyers who purchase in forward of the IPO sometimes have connections to these underwriters, who decide the preliminary share value, which Google’s management discovered unfair. As a substitute, they used a Dutch auction. Put merely, that is when an organization collects bids from buyers for the variety of shares they wish to purchase and at what value, and makes use of these bids to find out the best value at which the providing may be bought. That is dangerous as a result of if the general public doesn’t suppose you’re price a lot, nicely, you’re not.

As a consequence of a confluence of things—dangerous press, the general public probably not figuring out what Google was doing, an ill-timed interview with Playboy that caught the eye of the SEC—the IPO was a disappointment. Google went public at $85 per share, decrease than the corporate’s authentic value expectation of $108 to $135. By the tip of the primary buying and selling day, the stock rose by 18% to over $100—respectable, however as analysis has proven, about average.

However that disappointment didn’t final lengthy. By the tip of 2004, the inventory took off. Nonetheless, the Dutch public sale methodology, whereas utilized by just a few different firms within the U.S. post-Google, will not be tremendous standard.

Spotify had a nontraditional IPO in 2018 when it opted for a direct itemizing, or permitting current shareholders to promote their shares on to the general public, slightly than by way of underwriters. Then, “any prospective purchasers of shares could place orders with their broker of choice, at whatever price they believed was appropriate, and that order would be part of the price-setting process on the [New York Stock Exchange],” Harvard attorneys wrote in a case study concerning the firm’s providing.

Like Reddit’s transfer, Spotify’s was achieved, partially, to attraction to its person base and make the IPO course of extra clear and inclusive. “By almost any standard” Spotify’s IPO was a hit, CNBC wrote a few months later. Airbnb is one other firm that led a profitable IPO whereas permitting market customers to purchase in early.

Different Silicon Valley firms have adopted go well with, and Reddit hopes its IPO will probably be the same success.

“We are going public to advance our mission and become a stronger company,” Huffman wrote. “We hope going public will provide meaningful benefits to our community as well.”