Spiderplay/iStock via Getty Images

About the Company

Republic Services Inc. (NYSE:RSG) is one of the leading companies in garbage collection and waste disposal. Thus far in 2024, RSG is outpacing the S&P 500 ETF (SPY) by a healthy margin, 22.7% to 14.4%. Even more impressive, over the past year Republic has outgained SPY by a much larger amount, 36.7% versus 21.3%. RSG typically trades at a premium due to its consistent and predictable earnings and strong pricing power. Additionally, Republic is a serial acquirer, spending a lot of its excess capital on acquisitions as a means to expand. The company appears slightly overvalued right now but companies like this don’t go “on sale” often, so I’ll be keeping a close eye on it for any price weakness.

Financial Metrics

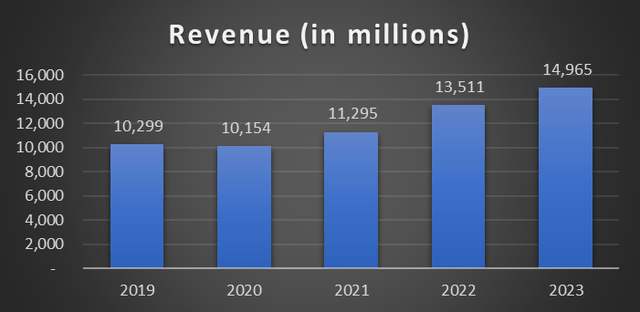

The revenue of Republic Services has grown nicely since a minor dip coming out of Covid in 2020. RSG had a solid increase of more than 11% in revenue from 2020 to 2021 and an even bigger jump from 2021 to 2022 of almost 20%. A significant amount of that nearly 20% increase can be attributed to their acquisition of US Ecology. Finally, in 2023 the company saw another solid increase of almost 11%. Over the past five years RSG has grown revenue at a compound annual growth rate of almost 10% thanks to the company’s acquisitions, necessity for their services and strong pricing power. Management expects FY24 revenue to come in between $16.075 and $16.125 billion, a 7.5% increase from 2023.

Author Created using data from RSG’s annual reports.

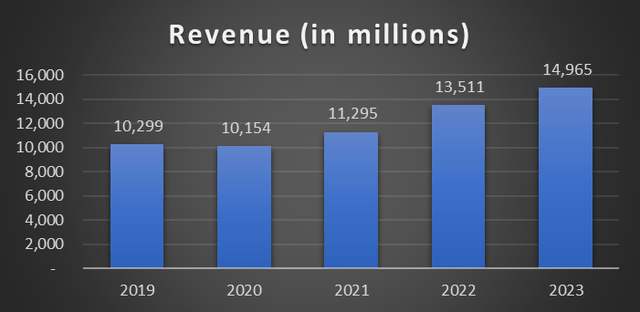

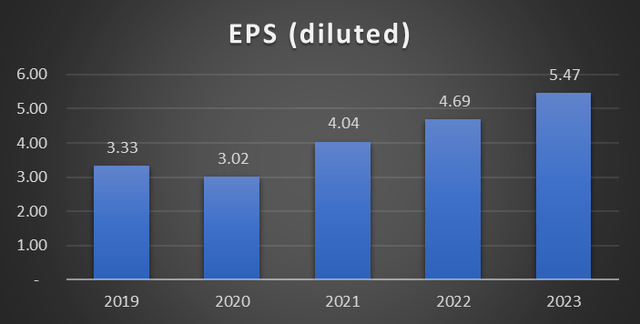

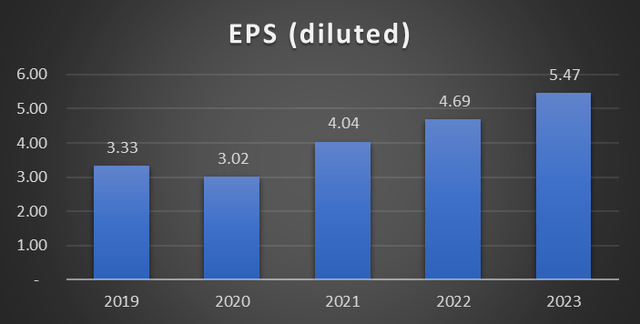

With the exception of 2020, RSG’s earnings per share have also been on the rise. Since 2019 the company’s earnings per share has grown at a rate of more than 13%, with the highest increase coming in 2021 at 33%. This occurred, in part because RSG’s EPS decreased almost 10% from 2019 to 2020, followed by an impressive increase. Furthermore, management has projected 2024 EPS in the range of $6.10 to $6.15, which equates to an increase of about 11.5%.

Author Created using data from RSG’s annual reports.

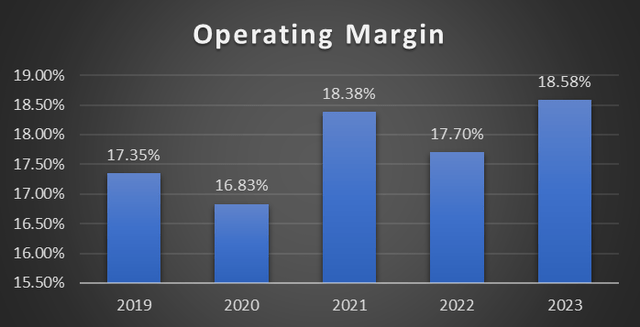

The last financial metric I want to review is the company’s operating margin which has overall been steady with some minor fluctuations. Garbage collection is obviously a fairly consistent business and something all consumers need. Over the past five years Republic Services has gone from a low of 16.83% to a high just north of 18.5%. A company’s ability to at least maintain their operating margin is imperative as it shows their capacity to control variable costs.

Author Created using data from RSG’s annual reports.

The Dividend

Republic Services has paid a dividend for more than 20 years and is well on its way to reaching “Dividend Champion” status in the next couple of years. Currently RSG yields about 1.15% about 40 basis points below the sector median according to Seeking Alpha. Additionally, RSG has been very consistent with its dividend growth with their 3-,5- and 10-year dividend growth rates all above 7% earning it an “A” rating from SA’s quant system. Lastly, the company has seen its payout ratio drop from almost 50% in 2019 to almost 35% in the most recent fiscal year, leaving ample room for future dividend growth.

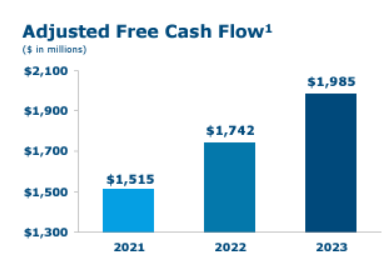

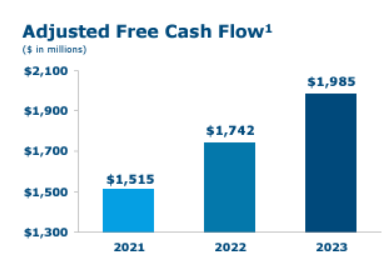

Additionally, the company has been able to grow its free cash flow significantly over the past few years, thus allowing them to sustain and grow its dividend. As you can see from the chart below the company has grown its FCF at a rate of about 14% since 2021. Furthermore, management expects their adjusted free cash flow for 2024 to be in the range of $2.15 and 2.17 billion, leading to a potential increase of about 9%. RSG’s ability to maintain consistent and rising free cash flow through various channels such as their ability to retain customers (94%), route concentration and overall customer satisfaction should allow them to continue delivering a healthy, safe and growing dividend.

RSG Investor Presentation

When comparing RSG’s yield to its closest competitors it is almost right in the middle of both. As previously mentioned, RSG currently yields about 1.15% while Waste Management’s (WM) yield is just above 1.4% and Waste Connections (WCN) is 0.63% as of 8/14/24. Although Republic is trailing Waste Management in yield, over the past five years its stock price has appreciated about 19% annually, while WM and WCN have each returned about 13.7%.

Valuation

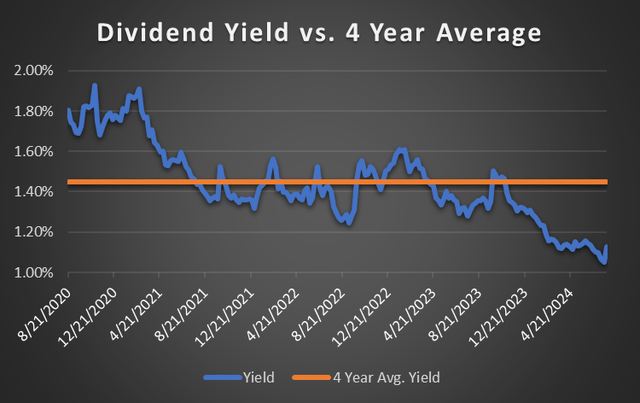

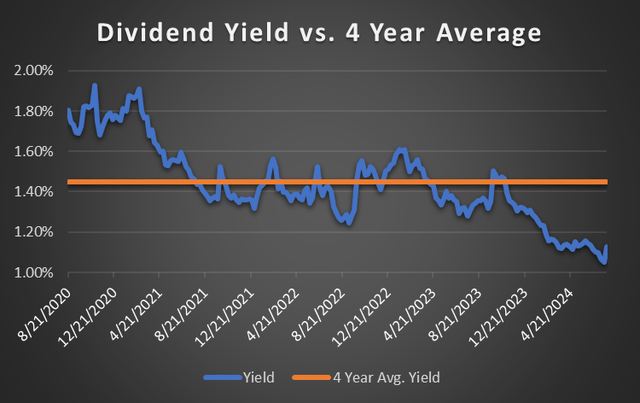

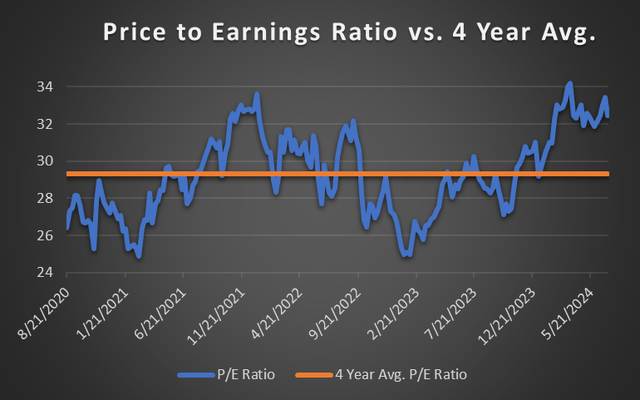

To determine if a stock is possibly over or undervalued, I employ two methods. The first is dividend yield theory, which is based on the premise that if the current yield is higher than its historical yield, the company is undervalued, and vice versa if the yield is lower. The other method is more common, and it is the price to earnings ratio, which is calculated by dividing the current price by the earnings per share for the prior twelve months. While neither is an exact science, both are a quick way to see if a company is worthy of further research.

As you can see from the chart below, coming out of the height of Covid RSG was yielding around 1.9% a chart high before dropping rather quickly during Q2 of 2021. Following said drop, the company’s yield remained very close to its four year average, only fluctuating slightly below and above every so often. Only over the past nine months has the company’s yield declined to a chart low where it sits today. According to DYT, the company is overvalued by quite a bit at the moment and I will need to wait for a pull back before acquiring a position.

Author Created, using data from Zacks.com

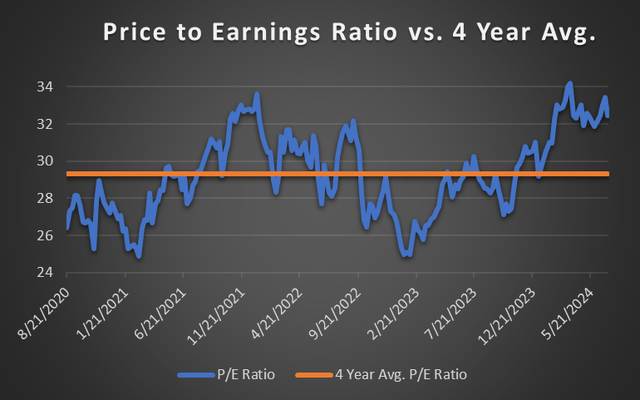

The price to earnings chart below fluctuates quite a bit, from a low near 25 to a high just north of 34. During the first year of the chart the company’s p/e ratio was below its four year average of 29.3. In late 2021 it shot up to nearly 34 and for the most part remained above its average until late 2022 where it began to dip for a brief time period. In Q3 of 2023 the p/e ratio rose above its four year average again and has continued to climb thus far in 2024. As mentioned above, RSG’s four-year average p/e ratio is just a tick above 29, combining this with management’s EPS guidance of $6.10 (low point) and we can arrive at an approximate price of $177, about 15% below its current level. Comparing this approximation and the DYT chart and both are in agreement that the stock is more than likely overvalued and that investors should wait on the sidelines for a better entry point.

Author Created, using data from Zacks.com

Risks

Although Republic is in a very predictable industry it is not without risks. The biggest risk I see with RSG is, at least in part, the company’s main growth strategy of acquisitions. Thus far, Republic Services has been successful at acquiring companies, and at a fair price. However, a good amount of acquisitions do not pan out for one reason or another, either companies do integrate well or the acquiring company paid an unnecessary premium. RSG appears to be doing its due diligence and not overpaying, but a growth strategy like this should be monitored should the company become reckless with their spending.

To a much lesser degree, another risk for Republic is the fluctuation of commodity prices. RSG is able to sell recycled products at market prices and this can have an impact on earnings, albeit a small one. However, during the company’s Q2 2024 earnings, management stated commodity prices were $173 per ton, compared to $119 per ton in the prior year. Now I realize selling recycled items by the ton is not their bread and butter but any drastic dip in commodity prices could suppress their revenue slightly.

Final Thoughts

Republic Services operates in a very reliable market and has shown an ability to grow revenue and earnings per share at healthy pace, something all shareholders want from their investments. RSG has a safe and growing dividend, with increases averaging more than 7% over the past 10 years and appears well on its way to becoming a dividend champion before the end of this decade. The main risk for this company is something management has control over, they should remain disciplined with their acquisitions and avoid overspending. With all the being said, I would love to add this company to my portfolio but at its current levels it is too pricey with no margin of safety. Consequently, I am rating Republic Services a hold and am hoping for a better entry point in the near future.