Reserve Bank of Australia

more to come

- demand still exceeds supply, although the gap is narrowing.

- Core inflation remains elevated, with service inflation expected to decline only gradually.

- The labour market remains tight, and demand for labour is strong.

- Household consumption has picked up by less than expected and is likely to be flat in Q3.

- Policy in Australia is not as restrictive as in most peers, even after recent rate cuts abroad.

- The RBA has lowered forecasts for growth in GDP and household consumption and has trimmed CPI and core inflation projections.

- The RBA sees CPI at 2.6% in December, 2.5% in June 2025, 3.7% in December 2025, and 2.5% in December 2026.

- The RBA sees trimmed mean inflation at 3.4% in December, 3.0% in June 2025, 2.8% in December 2025, and 2.5% in December 2026.

- The RBA projects GDP growth at 1.5% in December, 2.3% in December 2025, and 2.2% in December 2026.

- The RBA sees unemployment at 4.3% in December, 4.5% in December 2025, and 4.5% in December 2026.

- The RBA has revised up its employment growth forecast to 2.6% in December and 2.2% in June 2025, slowing to 1.3% by the end of 2026.

- The RBA sees wage growth at 3.4% in December, 3.2% in December 2025, and 3.1% in December 2026.

- It is difficult to sustain wage growth at the current level without a pick-up in productivity.

- The RBA has trimmed population growth forecasts, reflecting tougher foreign student entry rules.

- The outlook for China has been revised higher due to Beijing’s stimulus plans.

***

Background to this:

- The RBA meeting next week marks a year of unchanged cash rate at 4.35% – no cut until 2025

- Its unanimous, Reserve Bank of Australia to hold cash rate at 4.35% at next week’s meeting

- Credit Agricole: What we expect from the November RBA meeting

- Barclays: What we expect from the November RBA meeting

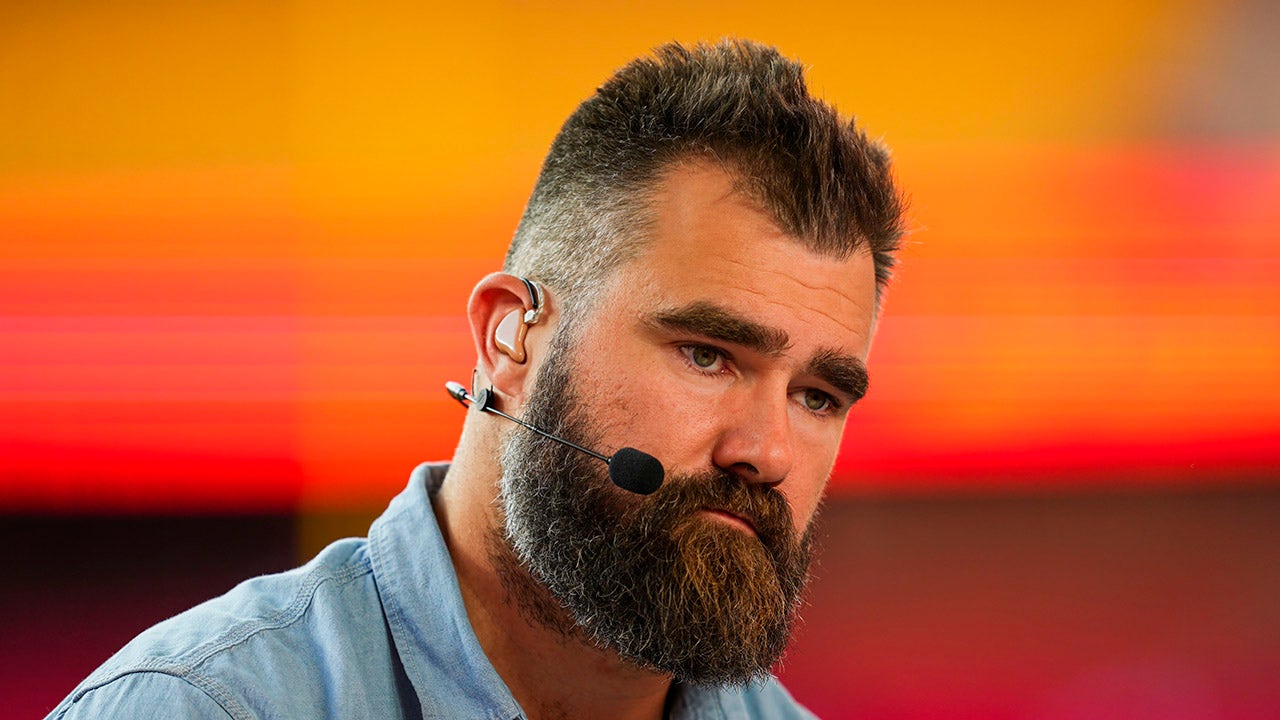

Reserve Bank of Australia Governor Bullock press conference is coming up at 0430 GMT / 1330 US Eastern time

This article was written by Eamonn Sheridan at www.forexlive.com.