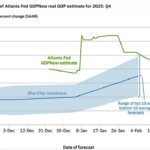

USD/INR has plunged, with the rupee up around 1% after the central bank of India intervened by selling USD/INR into the forex market.

more to comeI’ve been posting in recent days on the Indian rupee trading at fresh record lows, as a deteriorating global risk backdrop compounds persistent flow imbalances that continued to weigh heavily on the currency. The weaker USD on Tuesday had not translated into a stronger INR around the opening, which seems to have been the trigger for the RBI to at today. If they INR continued to weaken in the face of the USD weakness the depreciation could have extended in a more disorderly manner. something the RBI do not want.

As background, market participants said the latest moves lower reflected persistent flow-driven pressure rather than panic. Dealers highlighted an ongoing imbalance between dollar demand and supply, with recurring fixing-related buying, potentially tied to NDF maturities and portfolio outflows, acting as a key source of support for the dollar. Additional demand from state-owned entities has further tightened onshore dollar liquidity.

At the same time, importer hedging demand remained firm, driven by concerns over further rupee weakness. Exporter dollar selling had been comparatively muted, as many exporters were holding back at low rupee levels in the hope of more favourable rates. That they might be eyeing today! This asymmetry left the rupee particularly sensitive to even modest increases in dollar demand.

Portfolio flows, too, continued to weigh heavily on the currency. Sustained foreign outflows from domestic equity and bond markets overshadowed India’s underlying macro strengths, including solid growth and improving fundamentals. In the current environment, these positives provided only limited insulation against a strong U.S. dollar and cautious global risk sentiment.

Importantly, traders described the bout of depreciation as orderly and flow-led rather than driven by speculative capitulation. Volatility remains contained, indicating that the market is adjusting gradually rather than undergoing a disorderly repricing.

Absent a reversal in portfolio flows, an improvement in global risk appetite, or a clear positive trade-related catalyst, the rupee is likely to remain under pressure. Without such shifts, a test of fresh record lows cannot be ruled out in the near term despite today’s intervention efforts.