The Reserve Bank of New Zealand is at 0200 GMT Wednesday, which is 2200 US Eastern time on Tuesday evening.

Earlier previews:

- RBNZ monetary policy meeting – Reuters poll is not clear cut, 19 say hold, 12 say 25bp cut

- ANZ forecast the RBNZ to remain on hold next week, signal a rate cut later in the year

- NZD traders – Westpac forecasts the RBNZ to cut by 25bps in October and November 2024

Via BNZ, forthright views:

- BNZ economists argue easing is “already overdue”

- Economy “buckling” under tight conditions, slumping migration, government cuts

- Recent data shows manufacturing/services PMIs at GFC levels, retail spending down, job ads plummeting

- Inflation now “behaving itself” – June CPI came in 0.3% below RBNZ expectations

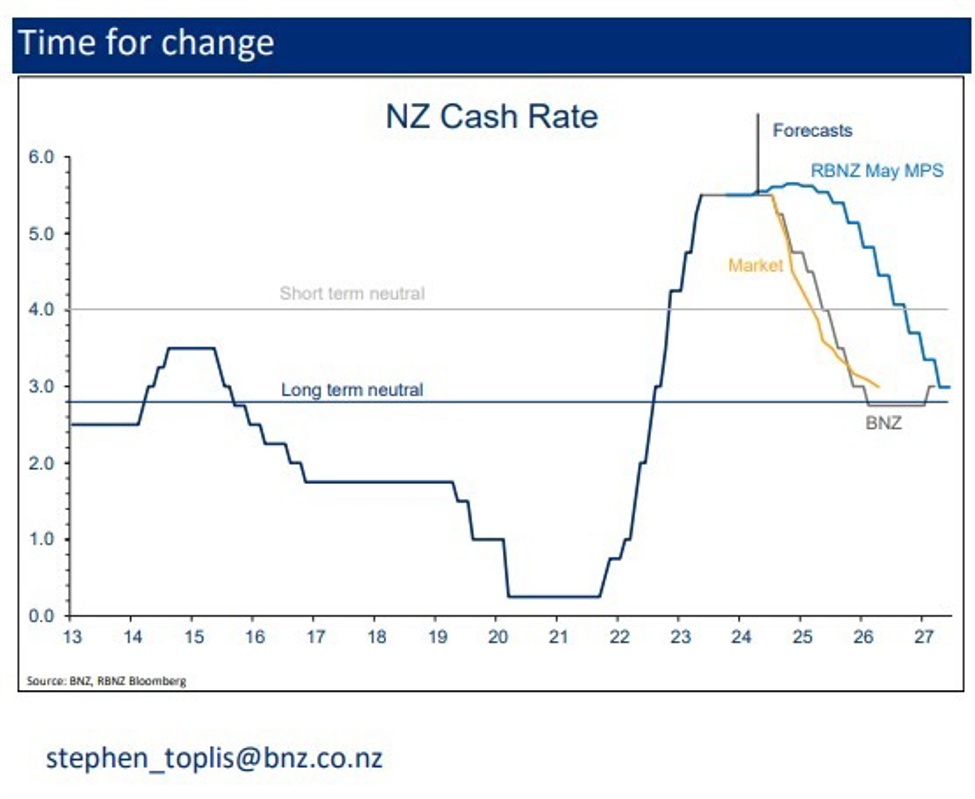

- BNZ forecasts 25bp cut in August, followed by consecutive cuts to 2.75% low

- Warns delay risks “unnecessary volatility in output and interest rates”

- Notes market pricing even more aggressive – 100bps of cuts by November

- Expects RBNZ to remove tightening bias, bring forward first cut substantially

- But cautions RBNZ’s “propensity to surprise” creates uncertainty

Key takeaway: BNZ sees risks tilted towards delay rather than earlier move. Market pricing looks overly aggressive in near-term.

This article was written by Eamonn Sheridan at www.forexlive.com.