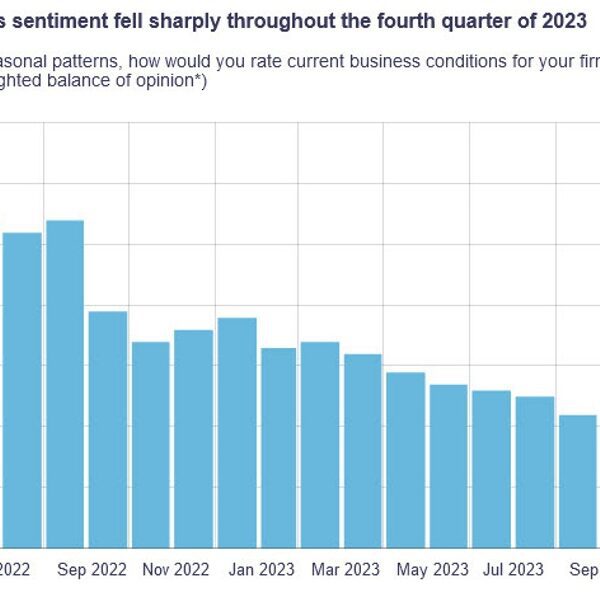

The Reserve Financial institution of New Zealand’s determination to take care of rates of interest at 5.5% was anticipated, however their stance leaned in direction of the hawkish facet. They did not dismiss the potential of future charge hikes to handle inflation. This sentiment drove the NZDUSD worth up, surpassing the 61.8% Fibonacci retracement degree of the July to October downward motion, which was at 0.61674. The pair reached a peak of 0.6207 earlier than encountering promoting stress and retreating.

This pullback under the 61.8% retracement degree has turned it right into a resistance level, disappointing those that had wager on the break. A sustained transfer above the 0.6167 degree is required to bolster a bullish outlook. In the meantime, on the draw back, the realm between 0.6104 and 0.6117 is more likely to appeal to help patrons, with a stop-loss order recommended under it. Nonetheless, a vital help degree is on the 50% midpoint of the July 2023 excessive and the 200-day shifting common, each converging round 0.6092.

If sellers fail to drive the value under this twin technical degree, the bias would nonetheless favor patrons. Thus, the market is presently in a state of flux, with patrons and sellers jostling for dominance. The following important market transfer may very well be triggered both by a breakout above the 61.8% retracement degree (0.6167) or a breakdown under the mixed help of the 200-day shifting common and the 50% retracement degree (0.6092).