Diane Labombarbe/iStock Unreleased via Getty Images

What I Saw in Q1 2024

Before we begin to unpack Q2 2024 developments for Restaurant Brands (NYSE:QSR), I believe it is important to put into perspective some developments we observed in Q1 2024, as well as outlook for the current quarter:

- RBI is strategically positioning itself to succeed in its ‘Expand Project 2028’. The company expects to open approximately 1,800 restaurants per year by 2028, reaching $60 billion in global sales and more than 40,000 locations. Similar to Wendy’s (WEN) ‘Expansion Project 70/30’ and Chick-fil-A’s ‘Expansion Project 2030’, RBI is targeting the international market in particular;

- Like most QSRs, RBI has introduced value promotions to recapture low-income guest traffic. At Burger King, for example, the latest promotion was the ‘Your Way Meal‘, which consists of $5 meals that include three sandwich options (Chicken Jr., Whopper Jr. or Bacon Cheeseburger), fries, nuggets and a drink. RBI’s CEO initially stated that this promotion will continue throughout 2024, as I pointed out in my last analysis. Furthermore, even before July (which was the month in which most brands deepened their positioning in terms of value) Burger King was already shouting about value with the ‘Whopper Jr. Duo’ promotion for $5. Popeyes also took this approach by reintroducing its ‘Big Box‘ for $6.99 ($0.99 more expensive than on previous occasions). Tim Hortons, while establishing promotions here and there, such as the LTO Summer Menu (with cold drinks at up to 50% off) and the $3 breakfast sandwich with the purchase of any coffee, doesn’t need to shout as much as other brands precisely because the company is already one of the leaders in the segment in terms of perceived value. Firehouse Subs, on the other hand, is establishing a thriving environment for promotions focused on digital channels, since this is its differentiator and the simplest way to reach its guests;

- Among the developments involving lean models and remodeling we saw Burger King carrying out its ‘Royal Reset’ project, with the goal of remodeling 90% of its units by the year 2028, in line with the openings of its ‘Expansion Project 2028‘. For Burger King, the company is expected to invest around $300 million across 3,800 different restaurants (around $65,000 per restaurant) tied to commitments of increases in royalty rates to franchisees, which will fund the rest of these remodelings. At Popeyes, the focus will be on remodeling the kitchens, integrating them with a new KVS system that allows for greater operational efficiency in the back of the house. These kitchens are called ‘Easy to Run’ by management and they will also focus more on digital sales;

- Since Q1 2024, the company has been committed to reducing its leverage. In my first follow-up with the company, I identified the reduction of financial risk through the measurement of the Degree of Financial Leverage (which is essentially how many times ROE exceeds ROA), which is helping to reduce the variability of profitability on equity and interest charges. Management made it clear during Q1 that in addition to maintaining dividends, it is interested in deleveraging its balance sheet before increasing buybacks;

- Operating cash flow remains stagnant due to problems in receivables management. However, the company still has a negative cash cycle, which is tremendously positive in the restaurant business.

The result of RBI’s positioning with its conglomerate of brands has seen the company outperform the industry and QSRs overall in comparable sales. Consolidating across all brands and segments shows that comparable sales grew 4.6% despite challenging comparisons. In the broader context, it was in Q1 2024 that the strategy of increasing the average check per guest by increasing menu prices began to become unsustainable for restaurants overall. Declining traffic was not offset, and several QSRs showed negative SSS.

I went into more depth on this situation with a focus on QSRs in my article “Inflation Forces Quick Service Restaurants To Innovate Amid Less Foot Traffic” and I can assure you that it is worth checking out.

RBI competitors such as Jack in the Box (JACK), Wendy’s and McDonald’s (MCD) reported historically weak comparable sales, somewhat out of step with Burger King, which had already implemented the ‘$5 Whopper Jr. Duo’ at the time. Tim Horton’s continued to outperform the market and showed no signs of weakness in this challenging environment, increasing comparable sales by almost 7%. Popeyes, driven by easier comps, outperformed its direct competitors such as KFC (YUM) which reported a 2% decline in comparable sales. Firehouse Subs remained stable with a SSS of 0.3%.

This outlook for resiliency in terms of comparable sales, whether it was the success of growing the average check more strongly than the industry or the ability to lose fewer guests than the industry average, has me quite excited about RBI’s developments for the rest of the year. In addition, the international diversification of its portfolio allows the company to avoid being held hostage by the American consumer.

This proved to be a successful strategy during Q2, specifically in the case of Tim Hortons, which I will discuss later. During Q2, approximately 45% of its total revenue came from its operations in Canada and approximately 43% came from the United States. Operations in other countries such as Brazil, India, the United Kingdom, France and the like are part of the international reportable segment and comprise 12% of the company’s total revenue.

That said, I believe it would be more beneficial for the reader to subdivide this analysis into parts that cover each brand specifically. Other important topics, such as the acquisition of Carrols and Popeyes China, will be covered within the respective chapters of the brands.

Tim Hortons: The Daily Coffee and the Daily Value

It comes as no surprise to me that Tim Hortons has been successful in maintaining consistent traffic in a challenging environment. I discussed this in both my last analysis of RBI and my article on Dutch Bros (BROS). After all, both companies are winning where Starbucks (SBUX) is losing: Value and Customer Experience.

This becomes clear when we see the development of initiatives on Starbucks’ part that aim to plug these two gaps and bridge the gap. For example, in relation to Value, Starbucks has adopted promotional strategies such as ‘Menu Pairings‘ and a 50% discount on Friday for a limited time exclusively for users of the app. These strategies are aimed at both non-occasional guests and recurring guests and Starbucks Reward users. Clearly the company wants more non-occasional guests to join Rewards, since this is the group that attends the least and comprises about 40% of the business.

According to a Technomic survey, Starbucks is losing share in the snack and non-meal segment. The drop was from 65% in 2021 to 58% in 2024. In addition, the intention to return among regular guests (who visit at least once a month) also fell from 43% to 34% in the same period. At the end of the day, few people can pay $6 for a drink and still feel satisfied with the value. And this is where other companies like Tim Hortons gain market share.

To give you an idea, in Canada alone, Tim posted a 4.9% growth in comparable sales. That’s about 0.3% when we look at all the brand’s units. This was the highest comparable sales performance within RBI’s portfolio, and the best part is that it was driven by a healthy balance between traffic (number of transactions) and growth in the average check per guest. This shows that the company, especially in Canada, is managing to adapt to the turbulent environment based on its everyday value proposition.

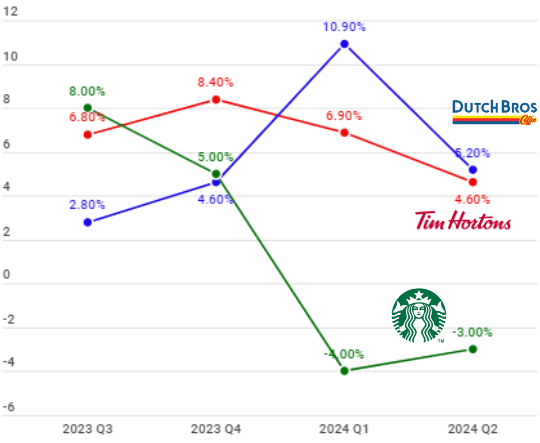

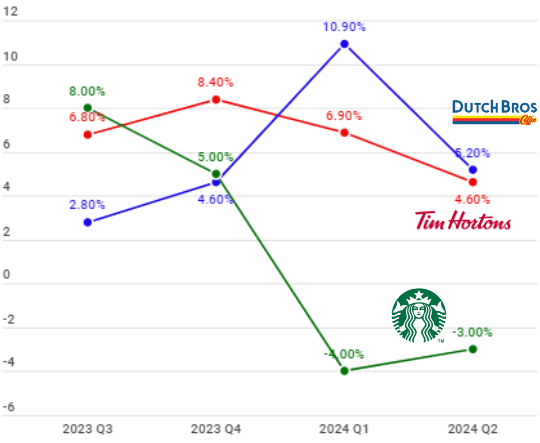

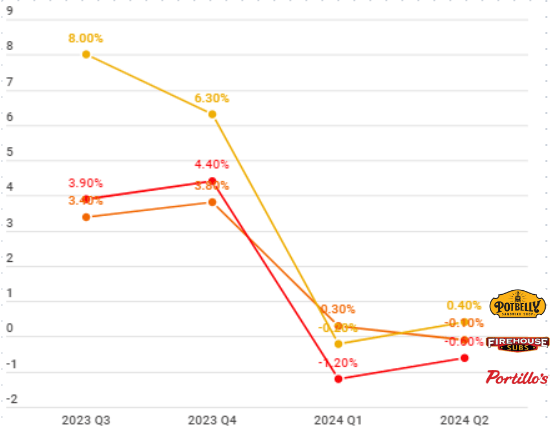

In the following graph I have compiled the SSS growth of the three companies mentioned above:

Comparable sales of Hortons and competitors (Author)

The outlook is also positive when we compare these results with the QSR segment. According to Revenue Management Solutions, during Q2 2024, QSRs showed an average growth in SSS of approximately 1.7%. This result is the result of a 2.3% decline in segment traffic and a 4.2% growth in the average check per guest. When we look at the Black Box QSR Index panorama, the results are also similar, with a 1.9% decline in traffic and 1.4% growth in sales.

If you look closely, when we exclude the data related to the increase in the average check per guest and traffic – since these are data not disclosed by the RBI sector – we see that Tim Hortons far outperformed the QSR segment average with a difference of 2.9% in comparable sales and 0.8% in system-wide sales growth.

It is also noted that the brand’s margins remained resilient when we compare the last half-year with the same half-year in 2023. That is, in reality we see that the company’s operating margin went from 24% to 25%, which despite being a little lower than brands like Burger King (with margins of 30%) is resilient in relation to traffic precisely because of its pricing targeting the daily value.

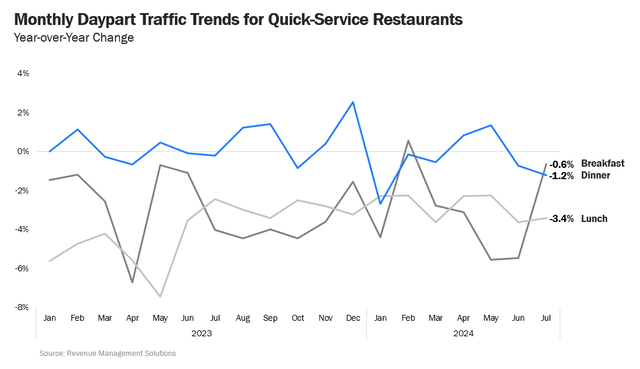

One of the periods that Tim Hortons thrives on is the morning shift. And this is in line with what we’re seeing in the QSR segment. I recently wrote an article about Denny’s (DENN) in which I contextualized the company’s decline in part to the decline of the family restaurant segment. One of the many reasons that family restaurants are failing is precisely because they’re losing their leadership in the morning shift. Limited-service restaurants are offering much cheaper and more convenient meals.

I highly recommend reading this article. There you will find a list of QSRs that are offering value options for low-income guests in the morning and how this impacts family restaurants. One of the restaurants I mentioned is Tim Hortons. Tim managed to increase revenue from this shift by 4.5% year-on-year, maintaining a share of almost 70% in the filtered coffee segment and 60% share in breakfast sandwiches and wraps, in addition to being considered the #1 brand in relation to daily value in breakfast, according to internal research by RBI.

These are impressive results, but management is also looking to position itself to gain share during the afternoon, a historically underutilized time period. To that end, the company is adding iced and energy drinks to the menu, including some summer LTOs to appeal to Gen Z guests. We’ve recently seen the addition of cold beverages like Cocoa Caramel Crunch ICED CAPP®, Butter Pecan Cold Brew, Mango Lemonade and more.

Whether it’s Starbucks, Dutch Bros, Smoothie King or even McDonald’s (MCD) (with CosMc’s), they’re focused on increasing their exposure to iced drinks. This movement is justified when we look at the data. According to Dataessential, the predicted CAGR of the iced coffee market is 22% from 2024 to 2032.

That’s why we’ve seen many locations changing their ice management manual. Starbucks, for example, due to its high number of customizable iced drinks, had to develop and include an ice management plan within the ‘Siren Craft System‘ to speed up the preparation of these drinks. About 75% of the drinks sold at Starbucks today are iced.

At Tim Hortons, about 40% of all beverages sold are iced beverages, and to keep the occasional guest coming back, the company has developed two co-branded partnerships: Caramilk and Oreo Double Stuf. In addition, the company recently introduced its new energy drink (clearly aimed at attracting Gen Z guests), called Infuser, made with natural caffeine.

In conjunction with its cold beverage strategy, Tim Hortons is also offering more appealing afternoon snacks. Today the company has around a 10% share of this market, but intends to reach 30% by at least 2026. The company has been investing in this direction since at least 2022. First came the Loaded Bowls with two options: Cilantro Lime and Habanero Chicken. In addition, the company launched the Loaded Wraps and soon expanded through specific menu innovations, such as the BBQ Crispy Chicken. Additionally, the Anytime Snackers line was available across Canada and in most locations in the United States by early 2023. These are savory, buttery pastries with a flaky exterior that are ideal for an afternoon snack with a cup of coffee.

It is clear that while convenience stores and bakeries are attracting low-income guests due to perceived value, Tim Hortons is offering classic bakery and convenience store meals at an affordable price and trying to reverse that trend. In this last quarter, the company deepened this direction of the product mix for the afternoon shift with the launch of Flatbread Pizzas.

In fact, I recently read a very interesting study by Datassential that corroborates this afternoon snack strategy adopted by Hortons. The first piece of data we have is that 55% of these snacks are taken with a beverage other than water (reaching up to 60% with Gen Z and 65% with Gen Y).

This is great for two simple reasons. First, the underutilized afternoon shift is rotated and the assets are better monetized. At the end of the day, this is a higher ROI for RBI and for the franchisee. Second, the average check per guest will tend to increase through cross-selling. That is when something like bundling is not offered along the same lines as the breakfast value promotion.

So when we put the pieces together, we see that Tim Hortons’ performance is justified by the consistency of its value proposition with what its guests want and the strategic positions it is taking in both frozen beverages and snacks. At the end of the day, these are two markets that will see rapid growth in the coming years, and Hortons is positioned to capture a substantial share if it holds its ground.

Burger King: Remodel to Win!

Burger King followed the contractionary traffic trend we saw at most limited-service restaurants during Q2 2024. Does this mean that ‘Your Way Meal’ was not successful in bringing back the low-income guest? No. The ‘Your Way Meal’ was only implemented during the month of July, a period of the year when most limited-service restaurants were deepening their value promotions.

This means that the financial impacts of the ‘Your Way Meal’ will have to be assessed from the third quarter of 2024. But we can say that according to research by Technomic, QSRs like McDonald’s were able to increase traffic from the ‘$5 Meal Deal’.

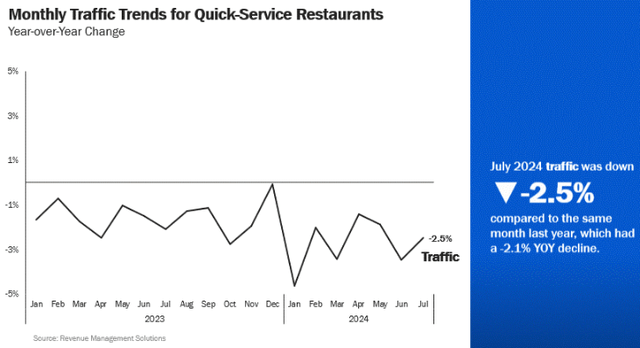

Furthermore, according to RMS, July was marked by a rapid increase in traffic when compared to June. To give you an idea, in June QSRs had 3.5% less traffic than in the same month last year, and in July the year-over-year difference was -2.1%. Clearly, neither month was worse than January of this year, indicating a trend of improvement in the very short term driven by value promotions.

Note that after April, with the increase in the minimum wage for fast-food workers, and the consequent increase in prices in California, the segment has been losing strength until July. See the graph below:

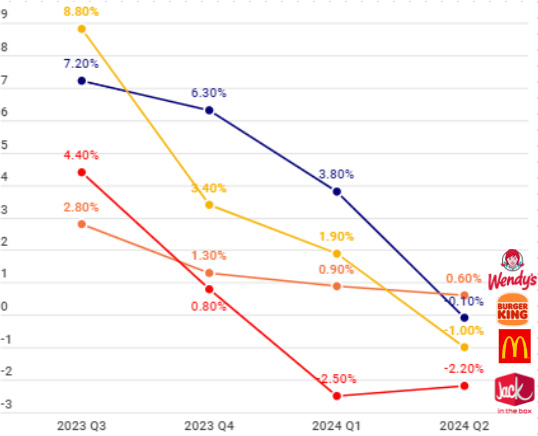

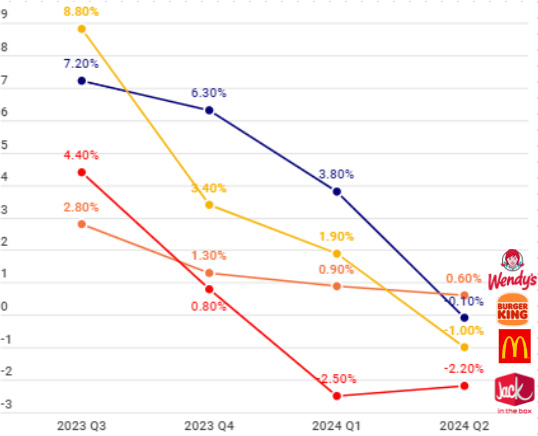

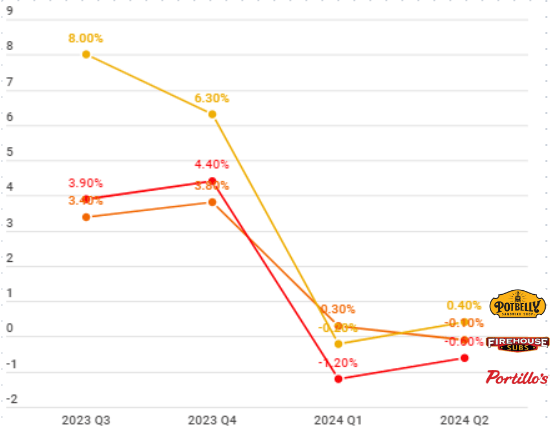

However, at the end of Q2 2024, Burger King showed a slight decline in comparable sales of approximately 0.1%. This result outperformed the comparable sales growth of companies such as Jack In The Box and McDonald’s, avid competitors in the burger segment. In the following graph you can see this difference:

Comparable sales of Burger King and competitors (Author)

Burger King’s own management has admitted that both traffic and sales have been below expectations. But the truth is that the entire segment is suffering. As I said earlier, I suspect that because of promotions like the $5 ‘Whopper Jr. Duo’ and more recent breakfast efforts have managed to maintain lower traffic than their direct competitors.

This seems to be a point of convergence between Wendy’s and Burger King. Both companies are successfully positioning themselves in the breakfast segment. This revenue stream helps a lot with transaction numbers when the busiest times start to fade and guests are redirected to c-stores. Note that in the last month, breakfast was the fastest-growing meal among QSRs year-over-year:

In addition to value, on the other end, Burger King plans to increase profitability at the unit level through remodeling. As I mentioned earlier, these efforts are part of the ‘Royal Reset’ program. The objectives, explained during Q1, are set out in the third item of the first chapter of this analysis. During the first quarter, Burger King is on track to complete 400 remodels, which is approximately 10.5% of the total number of restaurants planned through 2028 (3,800 restaurants).

But why are these remodels important? I explained this in detail in my article “Inflation Forces Quick Service Restaurants To Innovate Amid Less Foot Traffic” on how remodels are important for QSR restaurants, especially in an environment where ROI must be stretched at all costs, or risk mass closures.

Intrinsically to Burger King, where the company intends to reformulate these units to the ‘Sizzle‘ model, it is expected that in addition to the evident cost savings there will also be an increase in sales at the unit level. According to the company, the first remodelings of the ‘Royal Reset’ program contributed to an average increase of 12% in unit level sales.

In fact, once the company acquired Carrols, Burger King’s largest franchisee, the company planned to expand the ‘Royal Reset’ to encompass remodeling and refranchising as well. This became the ‘Royal Reset 2.0’. This means that most of the restaurants acquired from Carrols will be refranchised, and are not expected to remain under RBI’s control in the long term.

Speaking of the consequences of the Carrols acquisition, in addition to the operational factor of RBI now temporarily being the largest operator of Burger King, there was also an increase in the company’s debt after the acquisition, reaching approximately $13 billion.

In the end, the amount representing the Carrols acquisition (which was also increased by the Popeyes China transaction, which we will discuss in the next chapter) exceeded both the operating cash flow and the amount raised in debt, which reduced the company’s cash position by $107 million.

However, the company still has $942 million in cash, similar to what we saw at the end of 2021, when the company completed the acquisition of Firehouse Subs for $1 billion. In other words, since the company is a good cash generator, I see no problem in carrying out specific acquisition operations like the ones we are seeing.

In the meantime, the RBI managed to renegotiate the interest rate on a term loan of nearly $5.9 billion, which comprises almost half of its total debt. The rate was reduced from SOFR + 2.25% to SOFR + 1.75%. It also repaid about $1.15 billion, reducing part of the Term Loan B and issued $1.2 billion in senior notes with an interest rate of 6.125% due in 2029. According to management, these transactions are aimed at generating $30 million in annualized net interest savings.

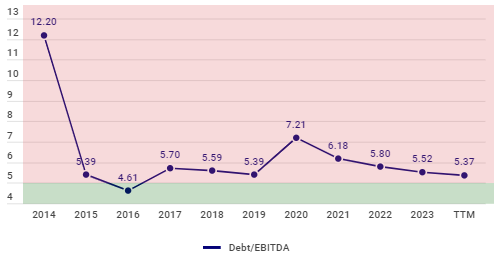

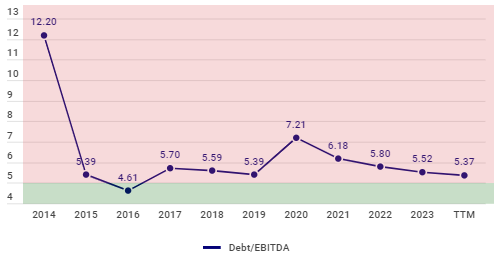

The next step is deleveraging. This has been the process the company has been undertaking since its last acquisition in late 2021. The company’s net leverage ratio is 5.37. This is how many times its total debt exceeds its EBITDA. RBI recently announced that it intends to reduce this ratio to around 4. This means that if EBITDA grows by 8% as expected, the company intends to maintain a debt load of approximately $10.5 billion by the end of the year. This would represent a reduction of $2.5 billion in net debt.

The chart below explores this relationship between debt and EBITDA at RBI over the years:

Debt/EBITDA ratio (Author)

Note that in the last ten years the company has not reduced its debt/EBITDA ratio to 4. This means that RBI probably projects that the ratio will remain somewhere between 4.5 or 5. In this case, the debt reduction would be approximately $1.2 billion, which would be much more credible if we take into account the half-yearly operating cash flow and cash availability.

In short, what we are seeing at Burger King are developments that are designed to protect franchisee economics during a period of especially slow traffic. While quite different from Hortons, it is equally interesting because of the unit-level economics provided by the Sizzle model. Furthermore, I believe that Burger King will continue to be under pressure as it tries to monetize its value promotion.

The key point here is that the brand is well-positioned to maintain promotions like the Your Way Meal at least through the end of the year. This gives it an advantage over companies like McDonald’s, which will need to offset the end of its $5 Meal Deal with LTOs and launches like the ‘Big Arch’. Just look at the consistency in comparable sales and relate them to the value proposition. Wendy’s is a company that also takes into account the daily value of its Biggie Bag, and while its comparable sales are down, they have stabilized over the last few quarters.

Popeyes: Fried Chicken Around the World

Among the most interesting developments regarding Popeyes in the long term, the one that attracted the most attention was the acquisition of Popeyes China for approximately $1.5 million. RBI now controls around 14 Popeyes restaurants in Shanghai, a market in which the company has expanded through an operator since August 2023. In total, there are 14 units in operation.

Popeyes’ initial plan in China is to expand the business through its own investments before looking for local operators. We know that the Chinese market has not been the most appetizing in recent times. The stagflation it is facing seems irreversible in the face of the stimulus perpetrated by the PBOC.

However, if Popeyes proves profitable in China and is based on the operational efficiency initiatives tried by Burger King and Popeyes’ own US kitchen remodeling, known as ‘Easy To Run’, I believe that there will be no shortage of operators. But, in the short/medium term it will be a risky investment IMO.

In fact, Popeyes’ international operations have grown significantly since RBI acquired the company in 2017 for approximately $1.6 billion. Since 2019, the company has expanded into several continents and growing markets such as India, New Zealand, China and Brazil. In addition, it is increasing its penetration in more mature markets such as Spain, in partnership with RB Iberia (with approximately 138 units) and the United Kingdom (with at least 50 units).

To give you an idea, RBI’s plan with Popeyes is to achieve 4% international growth in the number of units per year. This would mean a net growth of 50 units per year.

Within the United States and Canada, the goal is to reach the target of 4,000 stores by the long-awaited year of 2028. This would represent a mark of 180 openings per year in these markets.

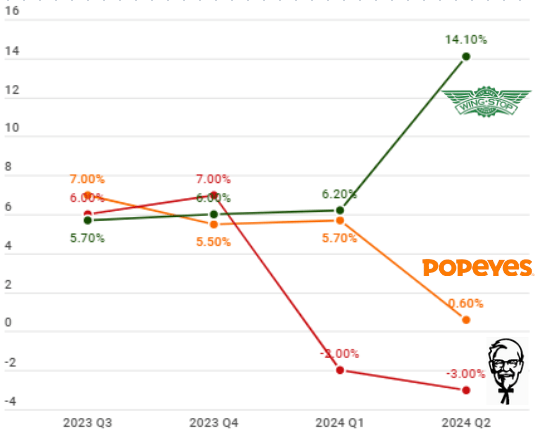

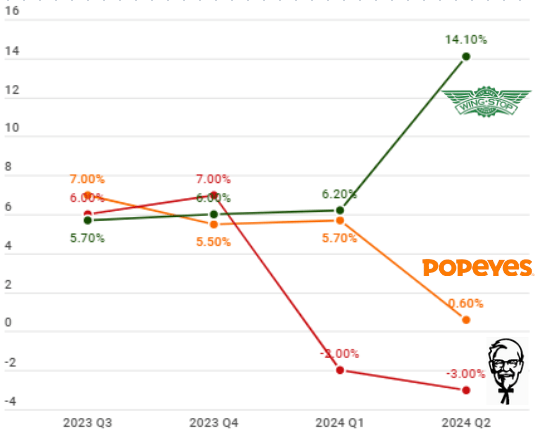

On the value side, late in Q2 we saw the reintroduction of Popeyes’ value promotion, the Big Box for $6.99. This promotion was first introduced in 2014 and was priced at $5. Like Burger King’s Your Way Meal, we have yet to see the full impact of the Big Box. However, management has said that the promotion is not performing as well as it should (for non-occasional guests). Despite this, the boneless wings continue to be successful in maintaining a strong base of occasional guests. Here’s a look at the company’s comparable sales compared to its competitors:

Comparable sales of Popeyes and competitors (Author)

Note that even though Popeyes did not show accelerated growth in SSS, it continued to show sustainable growth even when facing difficult comps.

This chart also explains why KFC (YUM) has been deepening its promotional mix so much in recent months. KFC is trying to bring back non-occasional guests, but it is also slowly losing part of its occasional customer base. This is a different dynamic than Popeyes. We recently saw the announcement of two new value meals for the $5 Taste Of KFC menu (KFC’s Famous Bowl with Chicken Nuggets and KFC Chicken Nuggets). In addition, the company is offering its special Tuesday promotion of a bucket with eight pieces of thighs and drumsticks for $10.

The Taste of KFC offers were introduced in April. This means that the company did not wait until July when most restaurants realized that what happened in Q1 was a declining traffic trend that was here to stay. So KFC’s lower comparable sales in Q2 already include the initial impacts of the deepening of the promotional mix.

Wingstop (WING) is successfully building a healthy hook and build strategy for hyper-personalization of orders through ‘MyWingstop‘ that is generating impressive results. In addition to its database of 45 million active customers, the company has successfully increased the average check by 20% in digital orders. And all this within a 68% digital sales mix.

Note that Popeyes’ approach is a mix of these two sides of the industry. While on the one hand she beckons to the non-occasional guest (or at least tries to do so) through the ‘Big Box’ for $6.99, she still takes care to remodel her kitchens to the ‘Easy To Run’ format to meet the demands of growing digital orders. Although it does not represent astronomical levels in the sales mix as at Wingstop, at Popeyes this modality corresponds to 27% of the total sales mix. This is a growth of 32% in Q2 year over year.

Like Burger King, Popeyes is working to improve the franchisee’s economics above all else. This is a key point in its expansion project, which is the fastest in RBI’s portfolio. I don’t expect astronomical sales from here, after all the company is not looking for the non-occasional guest at any cost. With moderate promotional activity and stable comparable sales, the company is proving itself competent in maintaining its customer base and expanding into key markets.

Firehouse Subs: Trying to Increase the Footprint Without Losing the Essence

RBI’s fast-casual sandwich brand reported stable comparable sales during Q2 2024, in line with its direct competitors. Note the chart below to see how this dynamic has played out over the past few quarters:

Comparable sales of Firehouse Subs and competitors (Author)

The digital-first sales strategy is driving loyalty apps as a key sales and hook-and-build tool. If you’ve read my latest Potbelly (PBPB) reviews, you’ll know how the company is leveraging ‘Perks’ to keep its occasional guests coming back to its restaurants, even if it’s just to redeem a cookie. In the case of Firehouse, around 40% of the sales mix comes from digital channels. This number has been accelerating quarter by quarter.

To that end, the company already uses its Firehouse Rewards app, where guests can redeem meal upgrades, free subs, and other extras. The Firehouse app may not be as gamified as IHOP’s (DIN) ‘IBOP’ and Chick-fil-A’s ‘Code Moo’, or as easy to earn quick and addictive rewards as ‘Perks’, but it seems to be an interesting digital sales channel at the moment. Eventually, I believe RBI will need to revamp it along the lines of what Potbelly did a few years ago.

Regarding the expansion of the brand acquired at the end of 2021, RBI is betting on monetary incentives for franchisees. These incentives are mostly for veterans/rescuers and are intended to encourage agreements with operators that are consistent with the company’s values, preserving its organizational culture. These monetary incentives can range from $20,000 to $100,000 per unit agreed.

With these incentives and the new lean unit models developed by RBI, the new Firehouse units, as well as Popeyes’ ‘Easy To Run’ kitchens and Burger King’s ‘Sizzle’ models, have an ROI that guarantees greater security for franchisees, and a payback period of at least one year shorter. Thus, the company aims to grow by 100 to 200 units per year.

Like all of RBI’s brands, Firehouse is looking forward to a bright future both in the United States and abroad. Since the beginning of the year, the company has been developing locations with small and large operators in countries such as Switzerland, Mexico, the United Arab Emirates and Oman. Like Wendy’s, Firehouse has a particular interest in the Southeast and Eastern European markets, with deals in Albania and Kosovo standing out.

My recommendation

As demonstrated in this analysis, RBI has been successful in maintaining a stable performance across all fronts, while also delivering growth prospects from tangible international growth and unit-level economies that drive improvements in franchisee economics. These developments have culminated in 1.9% growth in consolidated comparable sales across all segments. This performance outperforms both the RMS QSR Index and the Black Box QSR Index.

As you can imagine, I reiterate my ‘Buy‘ recommendation for RBI. I believe the company is on track to deliver accelerated sales growth from the international expansion of its brands. Furthermore, the company has managed to maintain stable comparable sales in a scenario of declining traffic.

This indicates that promotional and hook and build efforts are addressing guest dissatisfaction (especially low-income guests) with the value proposition of RBI restaurants. In this regard, I highlight the positioning of Tim Hortons as RBI’s main brand and organic growth catalysts such as snacks and frozen beverages.

I would like to revisit my valuation models incorporating current growth prospects and arrive at a target price for RBI. Let’s start with the NPVGO Model.

With an estimated EPS of $3.57 for fiscal 2024, a payout ratio of approximately 70%, and a ROA of 5.11%, we find an internal growth rate of approximately 1.53%. This means that from retaining $1.07 per share ($3.57 x 30%) RBI will produce growth of $0.05. From this, we have that the NPV of this retention would be -$0.21 (-$1.07 + $0.05 / 6.39%) considering RBI’s WACC. According to this model, the value of the stock would be the perpetual NPVGO plus the value of RBI if it were a cash cow, that is, if it distributed all of its profits. With this, we have that the value of RBI stock would be approximately $51.45 (-$4.42 + $55.87). This is approximately 28% below where the stock is trading today.

Now looking at the DDM Models, let’s run the Gordon Model and Single Period DDM. For the Gordon Model we need to make the assumptions that dividends will continue to flow to shareholders in perpetuity and at a certain constant rate. Accepting this assumption, when we place the 2024 dividend ($2.32) under the perpetual growth of 4.3% and discount to present value from the cost of equity of 7.33%, we find the stock price at $76.57. But I am being very conservative here, since I am considering the expected growth for only fiscal year 2025 and modulating it to perpetuity. If we use the average growth of the last 5 years (5.36%) I find the value of $117.77.

In Single Period DDM we have two cash flows that need to be discounted to present value using the cost of equity I mentioned earlier. The first is the annual dividend of $2.32, and the second is the selling price of the stock. In my model we will assume that RBI is selling at a P/E of 23.04 (just like the 5-year average). This would give us a target price of $78.80.

In my last analysis, I modeled a DCF that gave me a target price of $89.37. I don’t think I need to model another DCF because the assumptions I used remain the same. Let’s do something different this time.

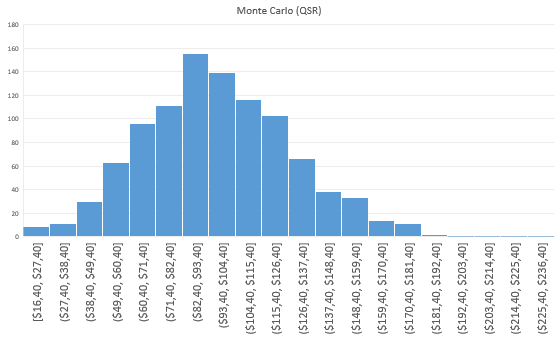

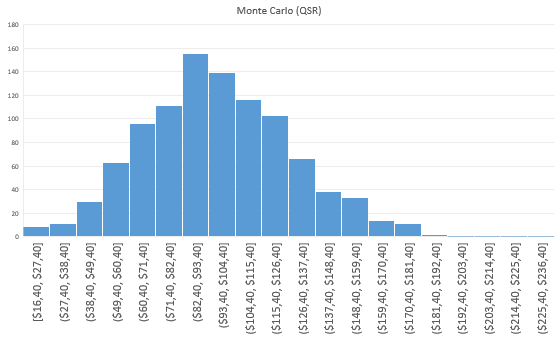

To wrap things up, let’s run a Monte Carlo simulation using historical data on revenue growth, EBIT growth, and WACC. I ran 1,000 random iterations based on the historical data and its variances and found the following distribution of results in the simulated DCFs:

Monte Carlo simulation (DCF) (Author)

Note that my last target price for RBI ($85) is within the range with the largest number of samples collected ($82.40-$93.40). This indicates that my target price fits most of the scenarios predicted for the company. Furthermore, the number of iterations that surpassed my target price was greater than those that missed it. This may indicate undervaluation in most scenarios modeled according to historical assumptions.