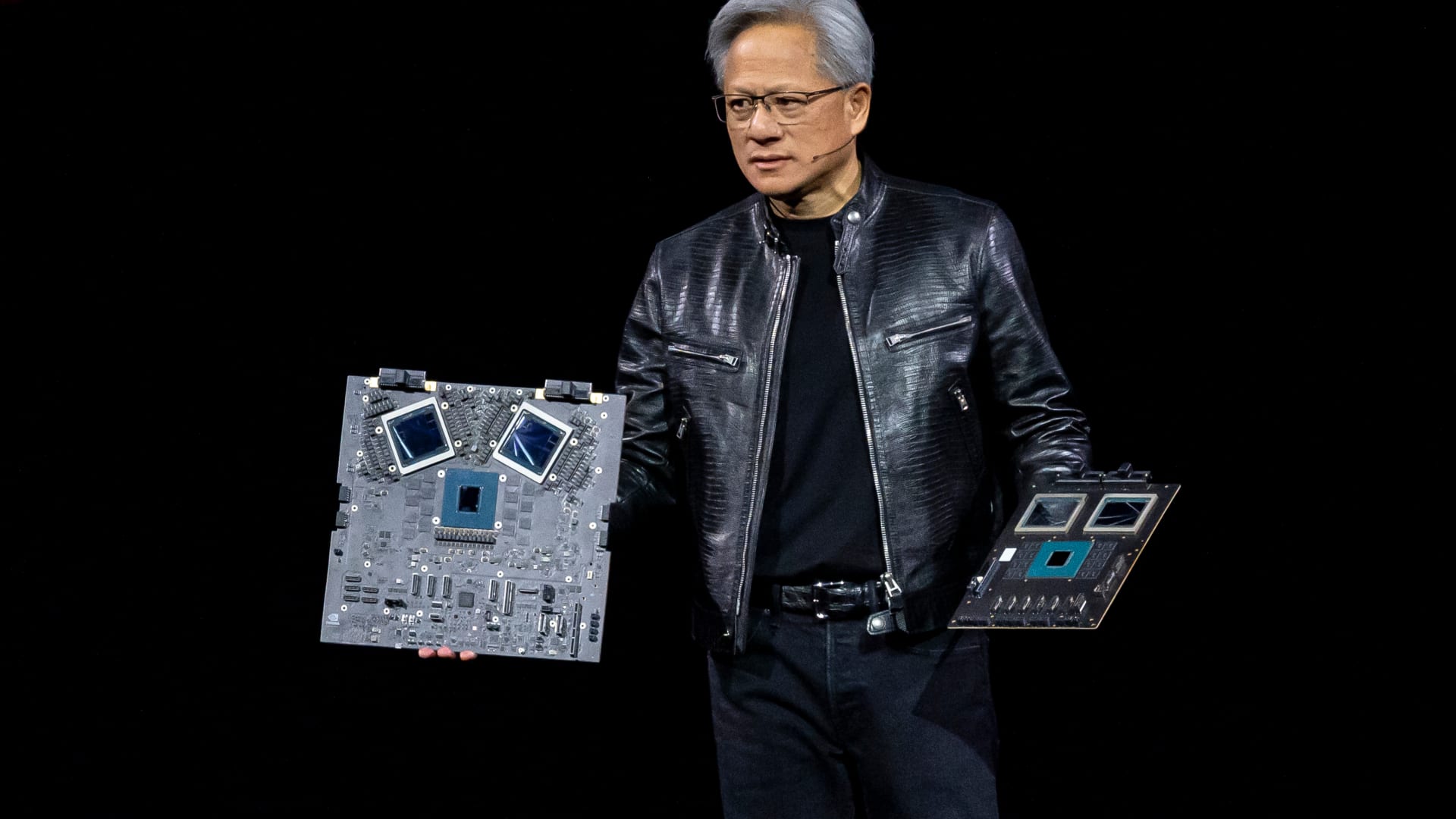

The big day is finally here, and retail traders are excited. Nvidia is set to report fiscal second-quarter results after the bell Wednesday. The company’s earnings and revenue are forecast to have more than doubled from the year-earlier period, LSEG data shows. It’s also forecast to issue strong fiscal third-quarter guidance. Despite these lofty expectations, small investors feel good about Nvidia heading into the report. JPMorgan strategist Nikolaos Panigirtzoglou noted that flows into thematic exchange-traded funds with lots of Nvidia shares are up sharply. Specifically, he said cumulative flows this month into the VanEck Semiconductor ETF (SMH) as a percent of assets are above 30%. Cumulative flows into the NVDL, a levered single-stock Nvidia ETF, also topped $4 billion this month. “The picture we get is one of a bullish retail impulse ahead of the Nvidia earnings report,” Panigirtzoglou wrote. NVDA YTD mountain NVDA year to date Bigger investors, however, have been doing the opposite. Goldman Sachs pointed out recently that both mutual and hedge funds are on average the most underweight they’ve been on tech in the past decade . This, according to the bank, was driven by selling in megacap tech names such as Apple and Nvidia. Bottom line: this report could send ripples through the market — impacting both retail and more sophisticated investors. Elsewhere on Wall Street this morning, Morgan Stanley raised its price target on Ambarella after the chipmaker posted better-than-expected quarterly results. “Ambarella posted a strong quarter with an exceptionally bullish outlook,” wrote analyst Joseph Moore. “The inventory correction is now mostly behind them, and 2H revenues will reflect actual end market demand.” “While the current economic environment will be a headwind – global auto production will be down this year and enterprise/consumer markets are mixed – the strength of Ambarella’s technology and rising demand for their new inference chips should more than offset those,” he added.

Subscribe to Updates

Get the latest tech, social media, politics, business, sports and many more news directly to your inbox.