EschCollection

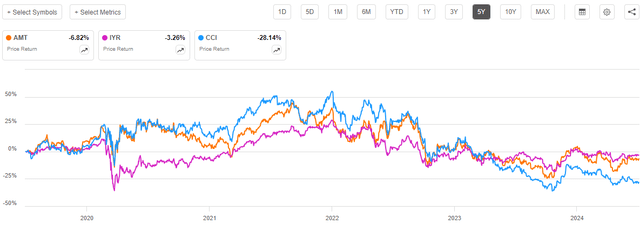

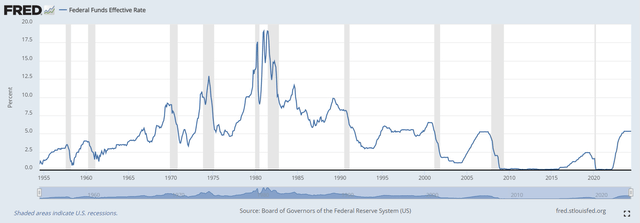

The Cohen & Steers Total Return Realty Fund (NYSE:RFI) is a closed-end fund that investors can use as a method of getting exposure to the real estate sector of the American economy while earning a very attractive yield at the same time. The real estate sector might not be the first one that investors flock to right now. After all, numerous media outlets have been talking about the troubles that the sector has been facing due to “high interest rates.” However, the truth is that today’s interest rates are not particularly high by historical standards. In fact, today’s rate would have been considered average or even low prior to 2000:

Federal Reserve Bank of St. Louis

The problem, of course, is that nearly two decades of ultra-low interest rates have caused massive asset appreciation in just about every sector. In addition, many sectors of the economy have become addicted to incredibly low interest rates that their business models do not work properly when it actually costs something to obtain financing. This is a drag on some sectors of the real estate market because today’s higher mortgage rates compared to a few years ago result in lower investment returns unless rents can increase sufficiently to cover the more expensive mortgage rates (or property prices decline). That has not been the case in all real estate sectors, and it is the factor that is responsible for all of the negative press coverage that real estate investments have been getting.

Real estate is sometimes considered as an option for investors who are looking to earn a high level of income from the assets in their portfolios. This is because rental properties generate cash flow. Real estate investment trusts, which are basically just investment companies that own rental properties, are required by law to pass a significant portion of these cash flows through to their own investors as dividends. This has resulted in these companies having substantially higher yields than most common stocks. As of the time of writing, the iShares U.S. Real Estate ETF (IYR) has a trailing twelve-month yield of 2.92%. This is substantially above the 1.33% current yield of the S&P 500 Index (SP500):

While the higher yield of real estate investment trusts compared to common stocks is nice, by itself it is not sufficient to provide income for most investors. After all, the yield of the iShares U.S. Real Estate ETF is only sufficient to provide an annual income of $29,200 for every $1 million invested. That is pretty terrible, and it is certainly not enough for a reasonable lifestyle in any area of the United States.

This is where the Cohen & Steers Total Return Realty Fund comes in, as its 8.37% yield is much more attractive. That yield would provide an annual income of $83,700 for every $1 million invested. That is higher than the average salary of an American worker, and it is enough for a modest life in many areas of the nation. This is especially true for retirees, who likely have Social Security or pension income as well. Here is how the fund’s yield compares to that of its peers:

|

Fund Name |

Morningstar Classification |

Current Yield |

|

Cohen & Steers Total Return Realty Fund |

Equity-Real Estate |

8.37% |

|

Neuberger Berman Real Estate Securities Income Fund (NRO) |

Equity-Real Estate |

11.14% |

|

Nuveen Real Estate Income Fund (JRS) |

Equity-Real Estate |

8.91% |

|

Principal Real Estate Income Fund (PGZ) |

Equity-Real Estate |

12.34% |

|

abrdn Global Premier Properties Fund (AWP) |

Equity-Real Estate |

12.83% |

|

CBRE Global Real Estate Income Fund (IGR) |

Equity-Real Estate |

14.20% |

The final two funds shown on the list invest in both American and foreign real estate companies, and so might not be directly comparable. The iShares International Developed Real Estate ETF (IFGL) has a trailing twelve-month yield of 3.54% right now, which tells us quite clearly that foreign real estate has higher yields than domestic real estate equities. As such, funds that invest in foreign real estate can generate higher levels of income to support their yields than domestic real estate funds.

As we can see, the Cohen & Steers Total Return Realty Fund generally has a lower yield than most of its peers. This could certainly reduce the fund’s attractiveness for any investor who is trying to maximize the level of income that they receive from the assets in their portfolios. However, at the same time, it suggests that the distribution is more likely to be sustainable than those of some of the higher-yielding funds shown in the table above. That is obviously a very good thing.

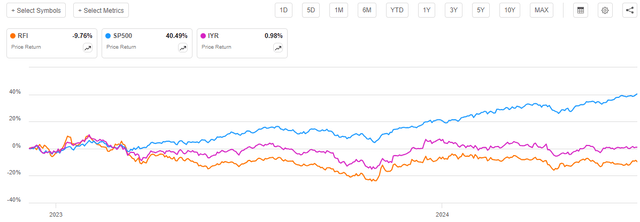

As regular readers might remember, we previously discussed the Cohen & Steers Total Return Realty Fund in December of 2022. The capital markets in general have generally been pretty strong since that time. However, real estate equities have lagged the rest of the capital market due to the already-discussed issues that many market participants have with purchasing real estate-related assets in today’s monetary environment. As such, the fund cannot really be expected to have delivered a jaw-dropping performance since the previous article was published:

As we can see here, our assumption was very much correct. The Cohen & Steers Total Return Realty Fund delivered a 9.76% share price decline since the prior article was published. This is substantially worse than the 40.49% gain of the S&P 500 Index. It is also worse than the 0.98% gain of the U.S. Real Estate Index. As we can see, though, real estate itself struggled to deliver a reasonable performance over the period.

However, shareholders in this fund have done much better than this chart would suggest. As I explained in a previous article:

A simple look at a closed-end fund’s price performance does not necessarily provide an accurate picture of how investors in the fund did during a given period. This is because these funds tend to pay out all of their net investment profits to the shareholders, rather than relying on the capital appreciation of their share price to provide a return. This is the reason why the yields of these funds tend to be much higher than the yield of index funds or most other market assets.

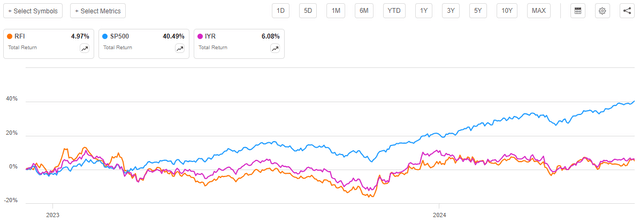

When we include the distributions that the Cohen & Steers Total Return Realty Fund has paid out since the December 6, 2022 publication date of the previous article, we get this alternative chart:

This performance will almost certainly improve the fund’s overall appeal, as we can immediately see that investors in it received a 4.97% total return over the period. Basically, the fund’s large distributions more than wiped out all of the losses that shareholders suffered from the declining price over the period. However, the fund still unfortunately underperformed both the U.S. Real Estate Index and domestic large-cap common stocks. Thus, the fund’s performance still leaves a great deal to be desired, and many investors may not be interested in purchasing it as its performance was not good enough compared to alternatives over the past few years. However, poor performance in the past does not guarantee poor performance in the future, so we should still look at the fund’s portfolio and positioning today to determine if things could improve for it.

About The Fund

According to the fund’s website, the Cohen & Steers Total Return Realty Fund has the primary objective of providing its investors with a high level of total return. This is not particularly surprising considering the fund’s strategy. The website does not do a particularly good job of explaining the strategy, merely stating:

The investment objective of the Fund is to achieve a high total return through investment in real estate securities.

This description does not specify whether the fund will be investing in common equities, preferred stock, debt, or a mix of such securities issued by real estate companies. The fact that it is targeting total return as an objective suggests that the fund is primarily investing in common equities. This is by no means certain, though, as some fixed-income funds also claim that total return is their primary objective.

Fortunately, the fund’s 2023 annual report provides a very in-depth description of the fund’s strategy. Here is what this document states:

Under normal circumstances, the Fund will invest at least 75% of its total assets in equity securities of real estate companies. Such equity securities will consist of (i) common shares (including shares and units of beneficial interest of real estate investment trusts), (ii) rights and warrants to purchase common shares, (iii) securities convertible into common shares where the conversion feature represents, in the investment adviser’s view, a significant element of the securities’ value, and (iv) preferred shares. For purposes of the Fund’s investment policies, a “real estate company” is one that derives at least 50% of its revenues from the ownership, construction, financing, management or sale of commercial, industrial, and residential real estate or that has at least 50% of its assets in such real estate.

The major thing that we see here is that the fund explicitly states that it can invest in both common and preferred equity. Technically, the above quote states that the fund can invest 75% of its assets into preferred equity issued by real estate companies and then invest nothing into the common equity of such companies. It would be quite rare for the fund to do this, but this would still be technically allowable under the mandate provided in the fund’s annual report.

As I have pointed out in various previous articles, any fund that invests in both common stock and preferred equity can reasonably have total return as its primary objective. Common stocks, after all, deliver their returns in the form of capital gains and current income (via dividends), which is the very definition of total return. The fact that this fund invests in both common and preferred stock does not change the fact that it is pursuing both things, as the addition of preferred stock simply weights its investment returns towards income rather than capital gains. The reverse is also true, as a higher allocation to common stocks will result in the fund’s investment returns being weighted more towards capital gains than current income.

The fund’s first quarter 2024 holdings report states that the Cohen & Steers Total Return Realty Fund is holding the following asset allocation:

|

Asset Type |

% of Total Assets |

|

Common Stocks – Real Estate |

79.1% |

|

Preferred Securities – Exchange-Traded |

8.1% |

|

Preferred Securities – Over-The-Counter |

8.4% |

|

Corporate Bonds |

2.6% |

|

Private Real Estate – Office |

1.0% |

|

Money Market Funds |

0.3% |

We can clearly see that the fund’s portfolio is heavily weighted towards the common equities of real estate companies. Unlike a certain fund that we discussed a few days ago, the Cohen & Steers Total Return Realty Fund is not in violation of its investment mandate. The fund’s annual report states that only 75% of the fund’s portfolio needs to be invested in either common or preferred stocks issued by real estate companies. The fund is fulfilling that mandate right now solely with the common stock allocation in the portfolio. It technically does not matter what the rest of the fund is invested in.

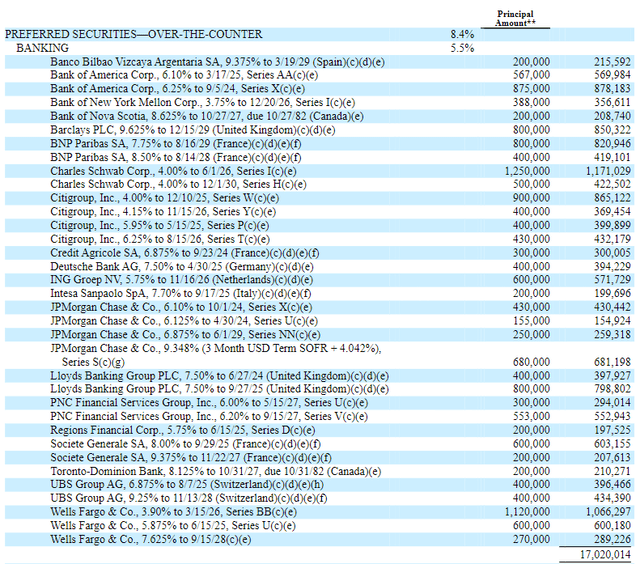

This is a good thing because the fund’s preferred stock and corporate bond allocations do not consist entirely of investments in real estate companies. For example, the fund explicitly states that 5.5% of its total assets are currently invested in preferred stocks issued by banks and traded over-the-counter:

While it is certainly true that some of these banks lend money to real estate developers and investors, it is difficult to make the case that any of them are “real estate companies” per the fund’s definition. However, a 5.5% weighting is only a small minority position that will not typically have an outsized effect on the portfolio as a whole. Thus, the fact that the fund is holding some banking sector preferreds will boost its investment income a bit compared to a portfolio that is solely invested in real estate common equity. It should not change the fact that the fund’s shares and portfolio performance should still generally perform as we would expect from a real estate fund.

These banking sector preferred stocks are not the only things that the fund holds that are not, strictly speaking, securities that are issued by a real estate company. From the first quarter 2024 holdings report:

|

Sector Weighting |

Security Type |

% of Total Assets |

|

Banking |

Preferred Stock-Exchange-Traded |

0.8% |

|

Brokerage |

Preferred Stock-Exchange-Traded |

0.1% |

|

Insurance |

Preferred Stock-Exchange-Traded |

0.1% |

|

Utilities |

Preferred Stock-Exchange-Traded |

0.4% |

|

Banking |

Preferred Stock-Over-the-Counter |

5.5% |

|

Brokerage |

Preferred Stock-Over-the-Counter |

0.1% |

|

Energy |

Preferred Stock-Over-the-Counter |

0.1% |

|

Finance |

Preferred Stock-Over-the-Counter |

0.1% |

|

Insurance |

Preferred Stock-Over-the-Counter |

0.6% |

|

Pipelines |

Preferred Stock-Over-the-Counter |

0.5% |

|

Telecommunications |

Preferred Stock-Over-the-Counter |

0.7% |

|

Utilities |

Preferred Stock-Over-the-Counter |

0.5% |

The total of all of these positions is 9.5% of the fund’s total assets. The remainder of the securities in the portfolio (except for the money market fund) consist of securities issued by real estate investment trusts. The fund’s holdings report does list a number of sectors that are not shown above, but when we look at the actual securities, we see that they were issued by real estate investment trusts. Examples of these include the corporate bonds issued by American Tower (AMT) which are listed as telecommunication sector bonds and the bonds issued by Sabra Health Care REIT (SBRA), which are listed as healthcare sector bonds. These bonds obviously still comply with the fund’s general statements about investing primarily in securities issued by real estate investment trusts and similar entities.

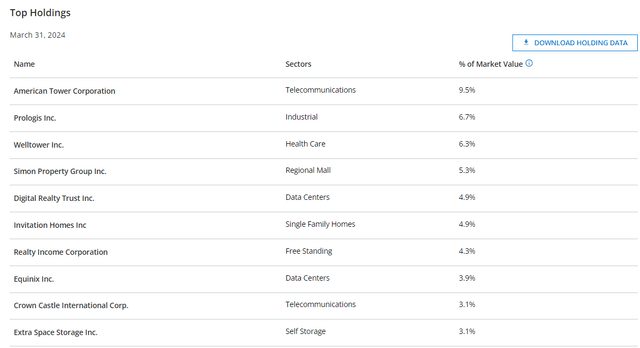

Anyone who follows domestic real estate investment trusts will likely be at least somewhat familiar with the companies that account for the largest positions in the fund. Here they are:

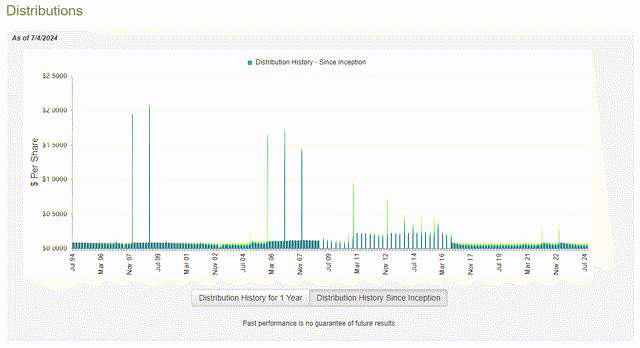

Many of these companies are among the largest and most well-known real estate investment trusts in the United States. As such, several of these companies are among the largest positions in many other real estate-focused closed-end funds. For example, American Tower Corporation and Crown Castle International (CCI) have long been among the most popular real estate stocks among fund managers. This is not necessarily a good thing, though. After all, both of these companies have substantially underperformed the iShares U.S. Real Estate ETF over the past five years:

In the case of Crown Castle International, the underperformance was incredibly severe, as the shares have declined by 28.14% since 2019. American Tower at least managed to avoid underperforming by a double-digit percentage, but it still did much worse than the index. This could mean that these stocks were one of the reasons for this fund underperforming the index, as their poor performance would have dragged down its net asset value. The extent to which these two companies were actually a drag on the fund’s portfolio depends somewhat on when it purchased the stocks, however. The fund did own securities issued by both companies the last time that we discussed it. However, the weightings have changed:

|

Company Name |

Weighting December 2022 |

Weighting July 2024 |

% Change |

|

American Tower |

7.59% |

9.50% |

+1.91% |

|

Crown Castle International |

3.87% |

3.10% |

-0.77% |

As we can see, the fund’s weighting to American Tower increased since the end of 2022. However, its weighting to Crown Castle International decreased over the same period. As both companies underperformed the U.S. Real Estate Index, this almost certainly means that the fund’s managers bought more shares of American Tower at some point. However, that might not have been the case with Crown Castle, as its weighting would have declined if the fund had simply held its position since our previous discussion. This fund only had a 24% annual turnover in 2023, so it is certainly possible that the shares that it currently owns in Crown Castle are the same ones that the fund held at the time of our previous discussion.

In a previous article, I stated that one of the problems facing the domestic real estate sector is the trend toward remote work that started during the pandemic:

The COVID-19 pandemic caused many employees to switch to a remote work environment, where employees are simply able to remain at their homes to work as opposed to commuting to the office. It is questionable whether or not there are benefits to such a work structure, as some companies suggest that in-office work is strongly preferable while others suggest that the flexibility that working from home provides their employees is worthwhile. Employees seem to prefer working at home, however. When we combine this with rising crime rates in various cities that have generally encouraged employees and employers to stay away, many companies have found that it makes more sense just to cancel their leases for office space and put the money elsewhere.

This has caused a substantial number of vacancies in some areas. A recent article suggests that 33.9% of office space in San Francisco, California is vacant. The article goes on to suggest that even higher vacancy rates could arise in the near future as some tenants have stated their intentions not to renew their leases. This has obviously pushed down commercial office space valuations in those areas. After all, real estate is, at its core, worth what someone will pay for it, and nobody is going to buy a vacant office building that is not generating income and that they do not need for their own business.

The general takeaway here is that there are some areas of the real estate market that are seemingly holding up okay. For example, house prices have not really declined in most areas of the United States (there are some coastal regions that have seen small decreases) and neither have apartment buildings. Data centers have almost been completely unaffected by the current economic conditions as generative artificial intelligence, cloud computing, and similar things are continuing to drive data center demand upward pretty rapidly. Thus, we would be best served by avoiding the office space sub-sector, but we do not necessarily need to avoid all real estate in today’s market. As we saw just a few paragraphs ago, none of the largest positions in this fund are commercial office space real estate investment trusts. In fact, only 0.6% of the fund’s holdings consist of publicly traded office real estate trusts. The fund does have 1.0% of its assets invested in a private office real estate deal, but that is a building in Plano, Texas, not San Francisco. In any case, the fund clearly has less than 2.0% of its assets invested in commercial office space. That means that this fund is largely unaffected by the troubles that are faced by this particular real estate sector.

Overall, this fund seems to be decently well-positioned for the current environment, although the large allocation to cellular tower real estate has certainly been a drag on its performance.

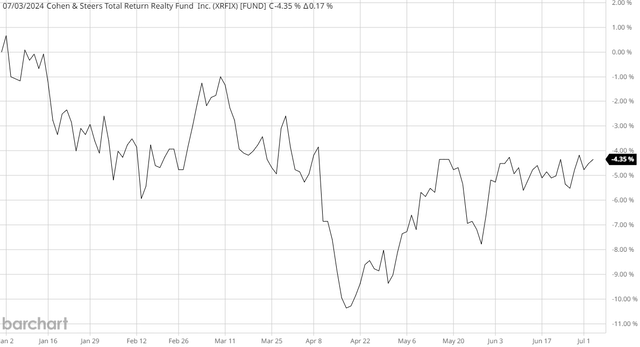

Distribution Analysis

The primary objective of the Cohen & Steers Total Return Realty Fund is to provide its investors with a high level of total return. As is the case with most closed-end funds, it aims to deliver the bulk of its total returns to its shareholders via the payment of regular distributions. To this end, the fund pays a monthly distribution of $0.08 per share ($0.96 per share annually). This gives the fund an 8.37% yield at the current price. As we saw in the introduction, this is lower than many of the fund’s peers, but it is certainly still quite reasonable.

The fund’s distribution history is quite attractive, as it has paid out the current distribution since 2014:

The above table only shows that the distribution has been stable since October 2016. However, prior to that, the fund was paying $0.24 per share quarterly, which works out to the same annual payment as it has today. Thus, the fund has nearly ten years of stable payments.

The fund’s stable payment history is due to its managed distribution policy. This is explained in the fund’s annual report:

The Fund, acting in accordance with an exemptive order received from the U.S. Securities and Exchange Commission and with approval of its Board of Directors, adopted a managed distribution policy under which the Fund intends to include long-term capital gains, where applicable, as part of the regular monthly cash distributions to its shareholders. The Plan gives the fund greater flexibility to realize long-term capital gains and to distribute those gains on a regular monthly basis. In accordance with the Plan, the Fund currently distributes $0.08 per share on a monthly basis.

The Fund may pay distributions in excess of the Fund’s investment company taxable income and net realized gains. This excess would be a return of capital distributed from the Fund’s assets. Distributions of capital decrease the Fund’s total assets and therefore could have the effect of increasing the Fund’s expense ratio. In addition, in order to make these distributions, the Fund may have to sell portfolio securities at a less than opportune time.

Shareholders should not draw any conclusions about the Fund’s investment performance from the amount of these distributions or from the terms of the Fund’s Plan.

Thus, there is a very real chance that the fund may be distributing more money than it actually earned from its investment portfolio. After all, the fund does not employ leverage so there is no realistic way that it is earning an 8%+ yield from a portfolio that primarily consists of real estate investment trust common equities. Capital gains have also been quite difficult to come by in this sector recently, so that casts further doubt on whether or not the fund is actually earning enough to cover the distributions. Let us investigate to be sure.

As stated earlier, the most recent financial report that is currently available for the Cohen & Steers Total Return Realty Fund is the annual report that corresponds to the full-year period that ended on December 31, 2023. A link to this document was provided earlier in this article. Obviously, this is a much newer report than the one that was available to us the last time that we discussed this fund, but it still will not include any information about the fund’s performance over the past six months. It should still work as an update, though.

For the full-year period that ended on December 31, 2023, the Cohen & Steers Total Return Realty Fund received $10,019,335 in dividends along with $1,825,311 in interest from the securities in its portfolio. This gives the fund a total investment income of $11,844,646 for the period. It paid its expenses out of this amount, which left it with $8,996,327 available for shareholders. That was not sufficient to cover the $25,449,637 that the fund paid out in shareholder distributions over the year.

Fortunately, the fund was able to make up the difference via capital gains. For the full-year period, the fund reported net realized gains of $15,321,854 along with $10,948,262 net unrealized gains. Overall, the fund’s net assets increased by $11,202,659 after accounting for all inflows and outflows during the period. Thus, the fund did manage to fully cover the distributions that it paid out in 2023.

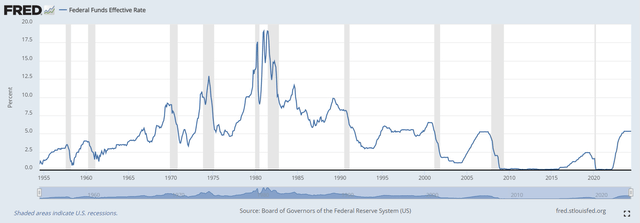

Unfortunately, the fund has not managed to cover the distributions so far this year. This chart shows the fund’s net asset value per share since December 29, 2023 (the last trading day in the reporting period):

As we can see, the fund’s net asset value has declined by 4.35% since the start of this year. This means that the fund’s investment profits year-to-date were lower than the amount that it paid out in distributions. We should keep an eye on this, as it is not sustainable long term.

Valuation

Shares of the Cohen & Steers Total Return Realty Fund are currently trading at a 1.92% premium on net asset value. This is considerably more expensive than the 0.87% discount that the shares have had on average over the past month. As such, it may be possible to get a better value by waiting a bit for the discount to decline.

Conclusion

In conclusion, the Cohen & Steers Total Return Realty Fund is one of the better real estate closed-end funds currently available in the market. The fund does not have an especially high yield compared to its peers, but it appears to be having a much easier time sustaining it than some peers. The fund also boasts a very good portfolio for the current environment. The fact that it avoids the troubled commercial office sector almost entirely is quite nice, as that particular sector is facing greater challenges than most others. The real problem here is the fund’s valuation, as it trades at a premium that could reduce the forward total return compared to peers that currently trade at steep discounts.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.