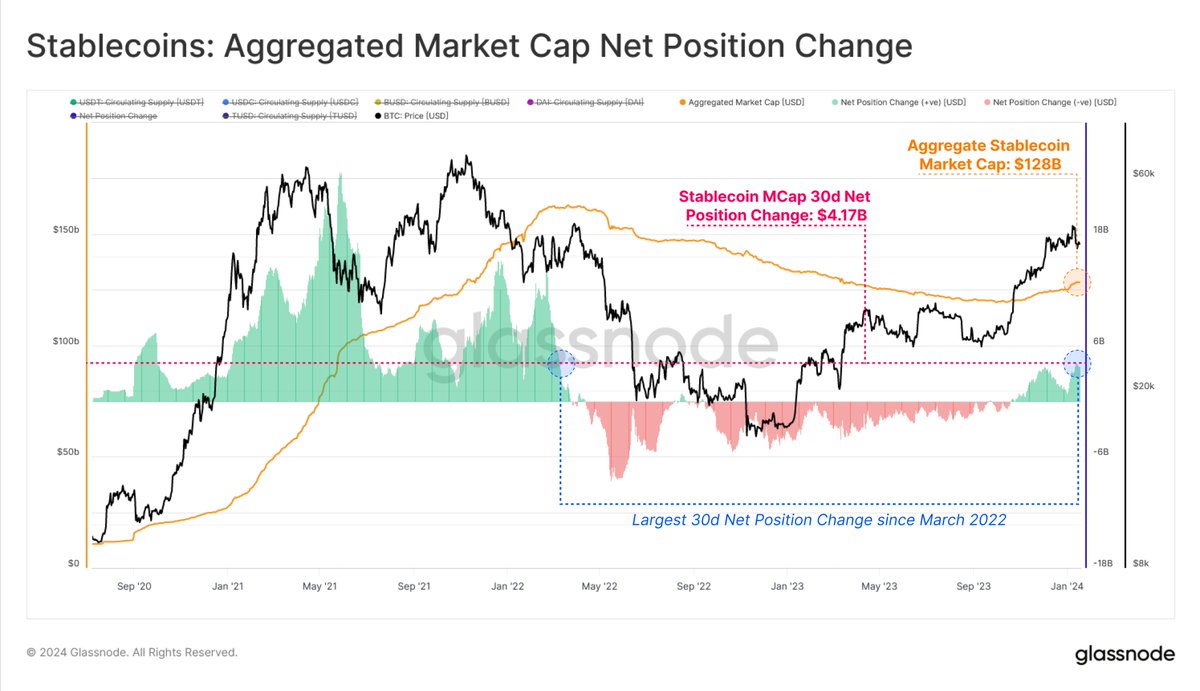

Stablecoins are actually rising as a pivotal drive, notably influencing Bitcoin’s current value actions. Data from the on-chain analytics agency Glassnode reveals a notable shift within the stablecoin provide ratio (SSR) oscillator, signaling a rise in stablecoin “buying power.”

This pattern has turn out to be a significant factor contributing to Bitcoin’s value efficiency.

Stablecoin Provide Strikes 3.5% Increased

The SSR oscillator, a essential software in understanding provide and demand dynamics between “BTC and USD,” has exhibited a marked decline. This lower signifies that stablecoins presently possess enhanced buying energy to accumulate Bitcoin, in response to Glassnode.

From a peak of 4.13 in October, the SSR oscillator has dropped sharply to simply 0.74 as of January 22. This shift aligns with Bitcoin’s ascent to two-year highs above $48,000 this month, suggesting a direct correlation between stablecoin provide tendencies and Bitcoin’s bullish trajectory.

James Van Straten, a analysis and knowledge analyst at CryptoSlate, has highlighted a big improve in stablecoin provide ranging from This fall of 2023, a pattern that has continued into the brand new yr.

As we noticed final week with the rotation of stablecoins shifting into #Bitcoin, that despatched BTC above 42k.

Stablecoin provide is now 10B greater from the low,

and three.5% greater up to now 30 days. https://t.co/QIq2sEA9yg pic.twitter.com/YFcSzZhan8— James Van Straten (@jvs_btc) January 31, 2024

Notably, in response to the information, this growth contrasts with the pullback in stablecoin provide noticed from Might 2022 till October 2023.

Bitcoin’s Restoration Amid Stablecoin Inflow

In the meantime, current stories point out that stablecoins have amassed greater than $4 billion in inflows over the previous month. The Glassnode data underscores this growth, with the combination provide of main stablecoins like Tether (USDT), USD Coin (USDC), Dai (DAI), and TrueUSD (TUSD) experiencing substantial progress since final October.

The “aggregated market cap net position change” metric, which tracks the month-to-month modifications within the complete stablecoin provide, has proven optimistic values, indicating this improve.

The latest knowledge level to a $4.17 billion improve within the 30-day web place change, marking the biggest rise within the stablecoin market cap since March 2022. With these inflows, the mixed market cap of those fiat-tied tokens stands at roughly $128 billion.

Amid this inflow of stablecoin capital, Bitcoin has shown resilience and restoration from its current value dips. Whereas the asset’s every day buying and selling quantity has ranged under $25 billion up to now week, over this identical interval, the main crypto has rebounded by almost 10% in value, buying and selling above $42,500 on the time of writing.

This restoration, albeit with a minor dip within the final 24 hours, underlines Bitcoin’s responsiveness to the shifting panorama within the stablecoin market.

Featured picture from Unsplash, Chart from TradingView