bjdlzx

When Ring Energy, Inc. (NYSE:REI) announced that it had made the Founders acquisition, there were plenty of comments about adding debt “at a time like this” (to cleanly explain a lot of shareholder frustration with the deal). But now comes the announcement of higher-than-expected production (both total and oil) as well as an expectation of lower costs to be reported in future earnings.

The last article was focused on cash flow progress. But that progress is difficult to see when commodity prices were declining. Now that has changed, and we are at least slightly headed in the other direction. Declining costs similarly have things going in the right direction. The future is brightening for debt payments and an end to the debt situation.

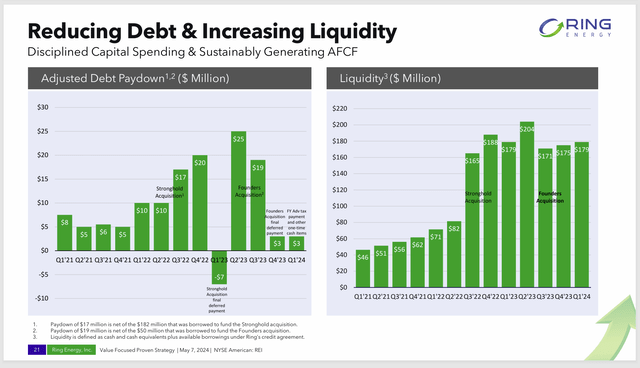

Management confirmed during the announcement that they paid down debt $15 million. This is one of the highest quarterly payments the company has made without an asset sale or stock sale to accumulate more cash to use for debt payments. That Founders acquisition, despite being all debt, may turn out to do the company far more financial good than was originally expected.

Review Of Founders Acquisition

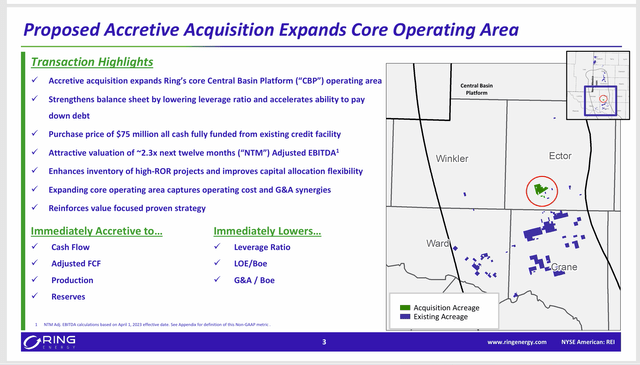

Management originally proposed to pay $75 million for the business. Already $48 million has been repaid according to management. This gets the company back to where it was “debt-wise” while retaining the Founders leases and additional production going forward to service the debt. It very much looks as though this purchase will be repaid within one year.

Ring Energy Founders Acquisition Cost And Benefits Summary (Ring Energy Founders Acquisition Presentation July 11, 2023)

Now, admittedly, all production went to repaying the debt incurred on this transaction. Still, it is significant that free cash flow increased despite the deal being 100% debt. All of us have been through deals that are “accretive” and will “lower costs” only to see little to no difference in the future. That does not appear to be the case this time around.

If in a worst-case scenario, management can pay $10 million on that debt with a climbing free cash flow now that oil prices appear to be drifting upward, then things have materially improved from a few years ago. Most of us remember when a lower debt amount was a real financial straijacket. Things are still tight. But nothing like they were.

The whole idea is to be more profitable at the same commodity price compared with the past. Unlike many managements I follow, that may actually have happened here. It is happening by raising the production mix and by grabbing lower cost acreage that becomes available to the company on reasonable terms.

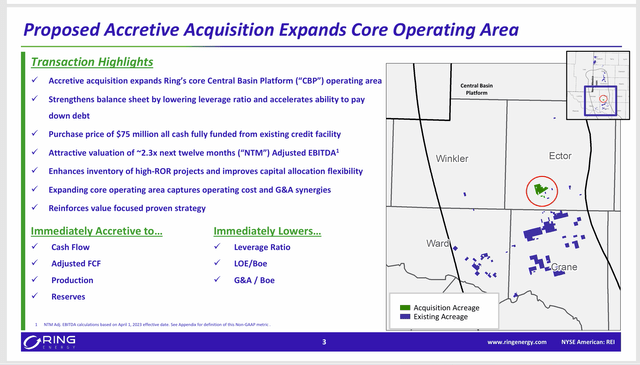

Production Mix

The reason this is happening is because the Founders acreage is similar to the Northwest Shelf acreage acquisition made years ago in that the percentage of oil produced is higher. In fact, the goal of the percentage of oil production has been raised by management due to this acquisition.

Many of the small companies, have mentioned that they have to pay to take away natural gas production. This unfortunately often has included Ring Energy. They cannot flare it anymore. Therefore, there is a big swing in cash flow as the percentage of oil production climbs in the production mix reported.

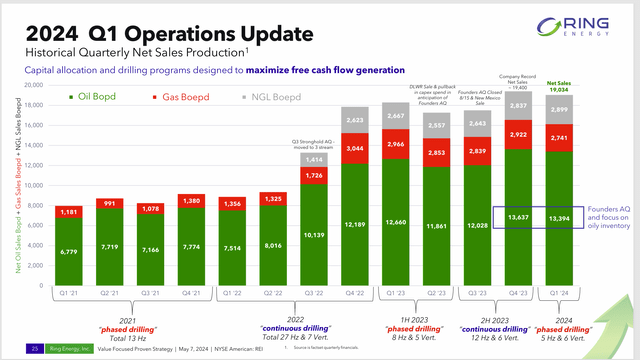

Ring Energy Production Mix History (Ring Energy Corporate Presentation First Quarter Earnings May 2024)

Notice that when the Founders acquisition was made, the oil production increased while the other products produced remained in the same range. What this acquisition did was add more inventory that would likely produce a higher oil percentage of production. That would increase free cash flow even on a maintenance budget because management has considerable incentive to drill the higher oil percentage of production wells first.

This acquired acreage actually continues the trend of the Northwest Shelf acquisition made years ago. It turns out that acreage in both areas tends to be more profitable. Naturally, management is exploiting this to increase free cash flow.

This means that free cash flow will increase as more profitable wells are drilled to replace declining established production. Production may not have to grow for free cash flow to increase. But a production increase would definitely aid the cause if management can do it with the budget they have.

Drilling Strategy

The drilling strategy had already shifted towards the oil weighted acreage. All this acquisition did was, give the company more oil weighted options.

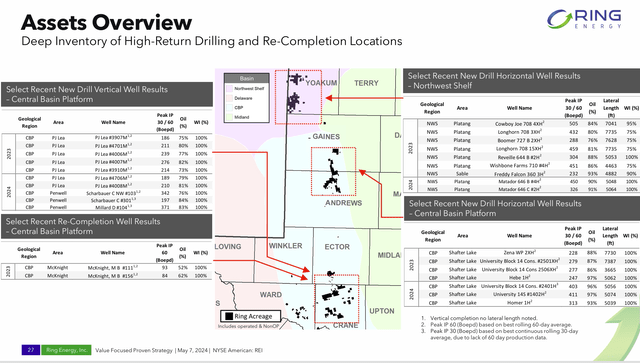

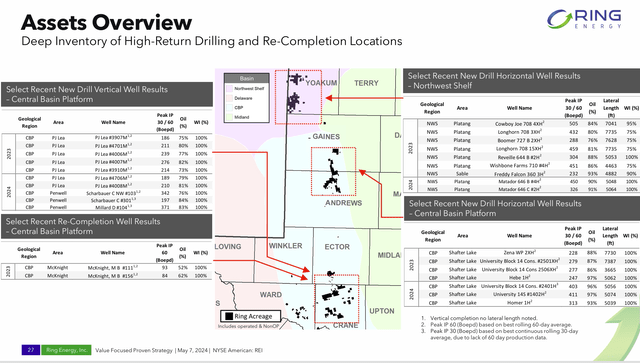

Ring Energy Latest Drilling Results (Ring Energy Corporate Presentation First Quarter Earnings May 2024)

Clearly, the latest results demonstrate that the oil percentage of the production mix will continue to grow. It would appear that the further North management goes, the better the results (as a very rough idea) on average. Therefore, it makes sense to acquire properties up North.

The first Stronghold acquisition was made to get the production up to a point where the volume of production would allow for some savings. It did not necessarily hurt the production mix. But it also did not help it. Now, management is in a position to drill more profitable acreage for the foreseeable future.

This could change as the ability of North America to export gas increases dramatically over the next two years. For this company, there is a good chance that instead of having to pay to take away natural gas production, the company may actually earn some money on that natural gas production. That would be an extra boost to free cash flow that really no one is counting on at the current time.

Outlook Change

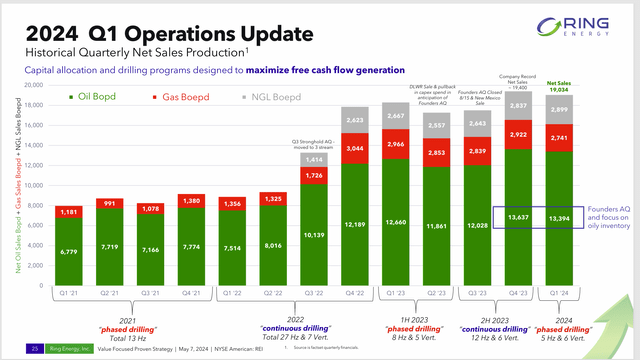

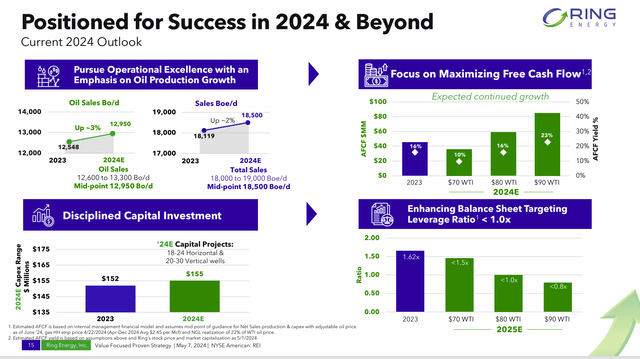

Because of the outperformance of guidance, the original guidance for the second quarter will change, as will the full fiscal year outlook. Currently, strong oil prices are “icing on the cake” that will speed debt repayment along.

Left out of the announcement was the use of “modern completion techniques,” which is gobbledygook for the latest technology. This use is expected to surprise management with a bit of not-guided growth. Since Mr. Market is big on debt payments and shareholder returns; this is about the only way to slide in some growth when it is needed.

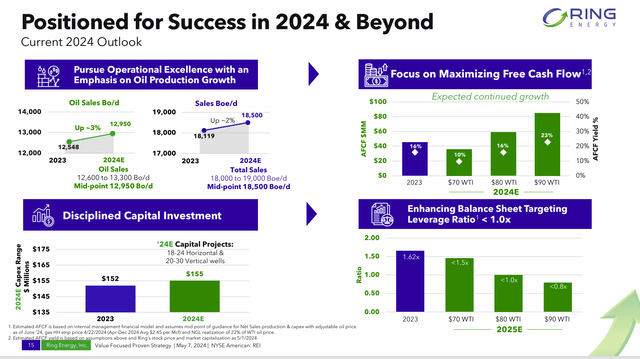

Ring Energy First Quarter 2024 Earnings Guidance For 2024 (Ring Energy Corporate Presentation First Quarter Earnings May 2024)

One of the things that happened with the Stronghold acquisition was that oil prices came down, and yet, the debt ratio remained about the same. That kind of masked huge operational cost progress that was the reason for that acquisition in the first place.

The whole Ring Energy acreage has very low breakeven points compared to many in the industry. The problem has always been that COVID-19 struck before the company could convert to an operating model from a “story stock.” Therefore, all that was ever needed was more production. But neither the debt market nor the stock market was open to that idea. So, the only way to get to where management needs to be is through accretive acquisitions. Fortunately, the cost of acquisitions still seems to be aiding this idea.

Now, rising oil prices may make management look like geniuses. After the last few years, that would be a relief. Currently, the oil price is past $80 WTI. The chart on the lower right-hand-side strongly implies significant debt ratio progress if prices remain at the current level for a decent amount of time.

That is what lenders want to see, no matter the commodity price environment. It is one of the big reasons for getting that debt ratio down and keeping it down.

Senior Management Change

Investors may well remember that previous key managers had begun and sold several companies before the entrance of Mr. Paul McKinney, CEO. Therefore, it is not surprising that there is yet another retirement from that team. Mr. Steven D Brooks, Executive Vice President of Land, Legal, Human Resources, and Marketing, will retire. This turns out to be a key position, given the acquisition strategy of the company. Therefore, whoever replaces this retiring person will need considerable experience. A search for a replacement is underway. Meanwhile, existing personnel will fill in these duties as needed.

The Executive Vice President of Operations, Mr. Marinos Baghdati, is leaving to pursue other interests. Here, there is a replacement that will be promoted into the position. That enhances the chances of a smooth transition. Mr. Shawn Young will become the Vice President of Operations through promotion.

Summary

Investors basically have been notified that the first quarter of the fiscal year will have a fair number of one-time cash-out items. Therefore, the first quarter is likely to be the lowest of the fiscal year (the key here is likely). All that is needed is for oil prices to remain in the range where they currently are or to continue to rise. Currently, that looks like a good bet.

Ring Energy Free Cash Flow Debt Payments And Resulting Liquidity (Ring Energy Corporate Presentation First Quarter Earnings May 2024)

It now seems clear, with the guidance revision, that the days of less than $10 million contributions to debt reduction are over with (except possibly the first quarter).

The borrowing base was reaffirmed. That implies at least some lender confidence in the plans of management. Finances may be on the tight side. But there is clear improvement since this management took over.

The third quarter, in particular, is off to a start with WTI $80 and higher prices. Should prices zoom ahead as they did in fiscal year 2022, then there could be a lot of debt reduction to put this issue behind once and for all. Meanwhile, the current environment is likely more than satisfactory.

Management is likely to look for more higher quality inventory to keep costs down or even reduce those costs. The Founders acquisition was clearly a good move for the company if for no other reason it was made before oil prices began strengthening. That is the one thing that allows shareholders to see benefits. All the other “pluses” about low costs and more profitability are something management has to be very diligent about because long-term it will affect stock price performance.

Commodity price volatility makes verifying profitability progress extremely difficult. However, competitor Riley Exploration (REPX) has also raised debt levels considerably with a large acquisition and some small ones. Sometimes insiders will leverage up slightly (so that they do not bet the company) with the idea of taking advantage of a period of strong commodity prices that they see ahead.

Insider timing is far from perfect. But they often know when commodity prices should roughly bottom, and it is therefore a good time to make acquisitions for the right price. They then pay off that debt and usually more, when prices recover.

Overall, the current situation could bode well for Ring Energy. Therefore, Ring Energy remains a strong buy with the additional supposition that debt payments likely increased at various pricing points.

Risks

A severe and sustained downturn in commodity prices can materially change the company outlook, or even prove to be fatal. That is unlikely for now because oil prices are strengthening. But it is always a threat in an industry where commodity prices are volatile and future visibility of prices is low.

This company, like many in the industry, is benefitting from technology improvements that periodically sweep the industry. Those improvements can stop at any time, which would slow the company’s climb out of its debt situation.

The loss of key personnel, including the retirement of one Executive Vice President, can set back company plans materially in the future. Seamless succession is a very high priority for small companies.