The Chief Govt Officer (CEO) of the cost agency Ripple Labs, Brad Garlinghouse, has revealed the game-changing position of XRP in revolutionizing the banking sector on the planet.

Ripple CEO Says XRP Can Be Used To Settle Liquidity

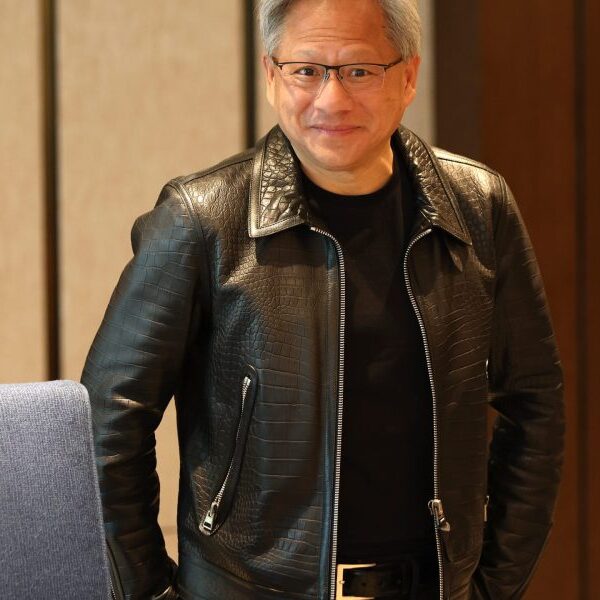

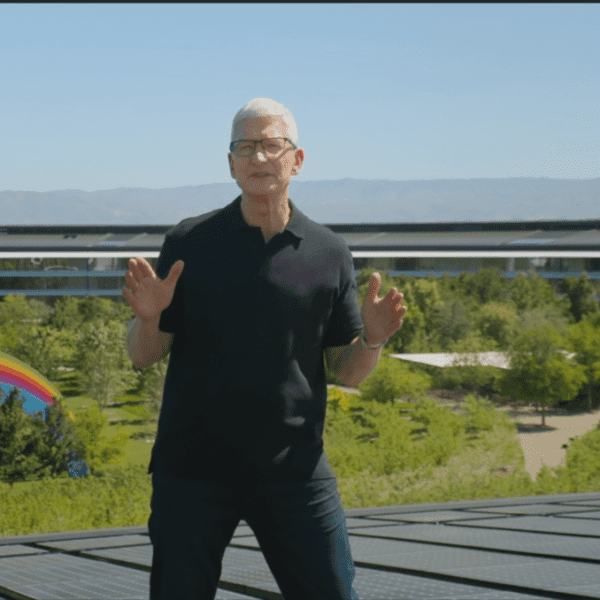

Jack The Ripper, a group influencer and determine, shared the knowledge with the cryptocurrency group on the social media platform X (previously Twitter) on Monday. Ripper’s X publish was accompanied by a brief clip of Brad Garlinghouse in a latest interview with CNBC, the place the CEO highlighted the position of crypto property in reworking the banking sector all over the world.

Talking on revolutionalizing the banking sector, based on the Ripple CEO, Ripple at present “utilizes the digital asset (XRP) as a tool to settle liquidity needs between financial institutions (Bank).” As well as, Garlinghouse famous that there’s a whole of “$27 trillion presently held by different banks in the world to carry out payments between each other.”

Because of this, Garlinghouse believes utilizing XRP to carry out these transactions between banks in actual time presents a greater sector. It is because XRP could be very “efficient” in finishing up these transactions, because it takes lower than “3 seconds” to get it carried out compared to the standard technique, which takes as much as an hour.

Banks should preserve sizeable reserves beneath the standard system that Garlinghouse outlines so as to facilitate seamless worldwide transactions. XRP makes this process straightforward and cuts settlement delays from days to seconds, offering a potential consequence.

Garlinghouse has reminded the group that the worth of a digital asset in the long run is triggered by the utility it covers. He then highlighted a number of components to think about, which embody the issue the token is fixing as a utility, how huge the issue is, and what number of prospects it has.

Moreover, the Ripple CEO asserted that there’s a lot of hype current within the system at this time; nevertheless, he can’t resolve if that may be a good factor for the sector or not.

The Fee Agency Locks 800 Million XRP In Escrow

Reviews have revealed that Ripple locked away 800 million XRP tokens in its escrow account after its month-to-month launch of 1 billion XRP from its reserve. Information from Whale Alert reveals that the corporate locked away the aforementioned XRP in three distinct transactions.

Whale Alert reported that the primary transaction saw 200 million valued at $118.94 million locked away within the escrow reserve. A couple of minutes later, the agency locked away one other 100 million XRP valued at $59.48 million within the account.

In the meantime, the final transaction witnessed a whopping 500 million XRP tokens value roughly $297.65 million being locked away. It’s noteworthy that the cost agency often releases 1 billion XRP each first day of the month.

Nevertheless, this month noticed a shift within the routine, with Ripple releasing 500 million XRP as an alternative of the preliminary 1 billion. This technique which started in December 2017 is anticipated to stabilize the XRP market and doubtlessly enhance the token’s worth.

Featured picture from iStock, chart from Tradingview.com