The Chief Know-how Officer (CTO) of Ripple Labs, David Schwartz, delivered a nuanced perspective on the complexities surrounding the classification of tokens as securities yesterday. Though he didn’t point out XRP, it appears clear that he’s speaking about Ripple’s battle with the US Securities and Change Fee (SEC). His evaluation delves deep into the intricacies of the Howey take a look at and its utility on cryptocurrencies, like XRP.

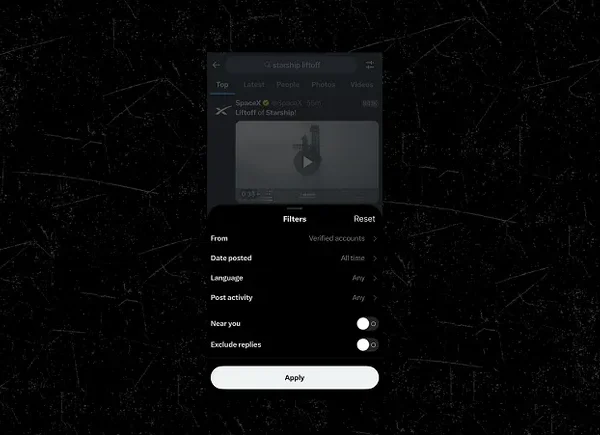

Schwartz opened his post on X by stating, “I’ve talked a little bit about US securities law, and I’m going to do that a little bit more. As most of you know, the primary argument that some tokens are securities comes from the inclusion of ‘investment contracts’ in the list of things that are securities.”

Ripple CTO Analyzes The Howey Take a look at

First, Schwartz addressed the versatile nature of the Howey take a look at, a vital device utilized in figuring out whether or not an asset is a safety. He said, “What [court cases] have shown is that Howey is a flexible test that can’t just be applied robotically.” He argued that the unique Howey requirement for earnings to come back “solely” from the efforts of others has been tailored in subsequent instances to incorporate influences from market forces and different exterior elements.

Increasing on this, the Ripple CTO highlighted the ambiguous nature of every requirement within the Howey take a look at. He identified, “Howey says you need an ‘investment of money’ but there are cases that say sometimes something given for free can be an investment contract.” This interpretation means that the normal understanding of an funding can prolong past financial contributions, complicating the classification of digital belongings.

Schwartz then addressed the broader goal of securities legal guidelines, underscoring their position in stopping fraud. He questioned the need of those legal guidelines given the present illegality of fraud, stating, “It’s primarily because securities fraud can be hard to detect and punish.”

He emphasised that securities legal guidelines are designed to make securities fraud more difficult to commit, notably by imposing disclosure necessities on these in search of public funding.

Additional, Schwartz explored the authorized precedents and their implications for digital belongings. He examined the distinction between funding contracts in instances like Howey and the therapy of different belongings, reminiscent of collectibles and artworks. Schwartz contemplated, “Why orange groves were an investment contract in Howey but works of art from early in someone’s career aren’t… Collectibles aren’t securities — but why? Every Howey element is there.”

Courts Alone Can’t Repair It

In discussing the position of Congress, Schwartz expressed skepticism concerning the courts attaining an applicable stability with out legislative intervention. He responded to a question from pro-XRP lawyer Jeremy Hogan, and referred to as for an motion by US Congress, “I think it’s possible, but unlikely, that courts will strike an appropriate balance without help from Congress.”

He added, “About the only thing that would drive Congress to prompt action might be courts swinging far in the direction of not deeming tokens securities.” He implied {that a} drastic shift in judicial attitudes in direction of not deeming crypto tokens as securities is perhaps the one catalyst for Congressional motion.

It’s vital to notice that Schwartz made it clear that his insights have been private and presumably not reflective of Ripple’s place. “I am not a lawyer… I have no idea if this does or doesn’t reflect the position of my employer,” he clarified, highlighting the independence of his evaluation.

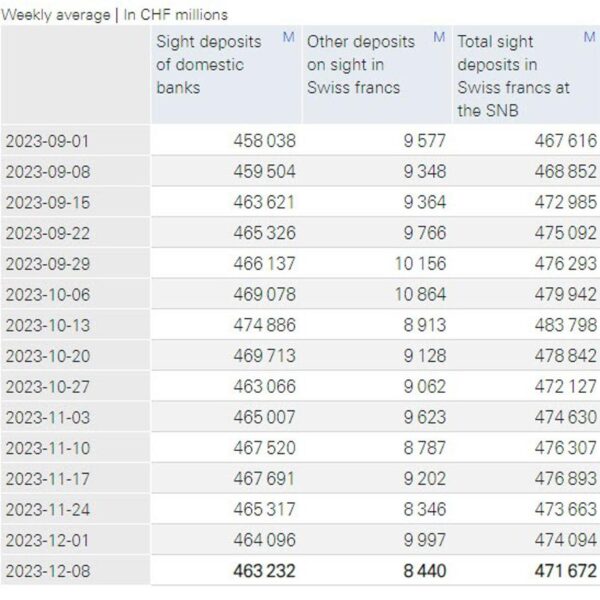

At press time, XRP traded at $0.61686.

Featured picture from YouTube / CB Insights, chart from TradingView.com