Key Notes

- Bulls concentrate $55 million in leveraged positions near $2.7, representing 58% of all active long contracts to prevent further decline.

- XRP liquidations totaled only $17 million compared to Bitcoin’s $188 million, showing traders covered positions rather than facing forced exits.

- Technical analysis reveals a double-bottom pattern forming between $2.6-$2.8 with potential rally to $3.6 if $3.1 resistance breaks.

Ripple

XRP

$2.80

24h volatility:

3.5%

Market cap:

$167.36 B

Vol. 24h:

$5.39 B

price tumbled 3%, trading as low as $2.78 on October 9, mirroring the broader market downturn as Bitcoin’s pullback from all-time highs sparked cascading liquidations. The correction dragged XRP below the $3 psychological support, but trading data from derivatives exchanges indicates that bulls are aggressively covering positions to prevent deeper losses.

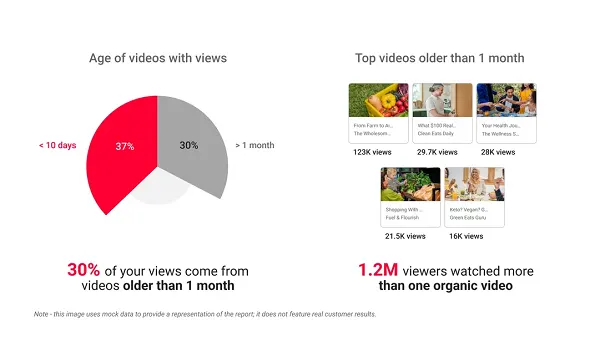

Ripple (XRP) Liquidation Map as of October 9, 2025 | Source: Coinglass

According to Coinglass’ Liquidation map, which tracks active leverage positions deployed at key price levels, short traders dominated XRP activity on Thursday, with $146 million in open short contracts compared to $95 million in longs. However, around $55 million in leveraged long contracts are clustered near $2.7, accounting for 58% of all active bullish leverage. Such a large leverage cluster signals intent to defend key price levels below it.

Total Crypto market liquidation, Oct 9, 2025 | Source: Coinglass

Aggregate market flows also emphasize XRP relative resilience. Market-wide liquidations topped $679 million, with Bitcoin

BTC

$121 436

24h volatility:

1.4%

Market cap:

$2.42 T

Vol. 24h:

$68.00 B

and Ethereum

ETH

$4 355

24h volatility:

3.7%

Market cap:

$525.59 B

Vol. 24h:

$41.92 B

bulls taking the biggest losses with $188 million and $181 million in liquidated long contracts respectively.

Despite being the fifth largest cryptocurrency by market cap, XRP bulls lost only $17 million in the last 24 hours, while lower cap assets like Dogecoin

DOGE

$0.25

24h volatility:

3.6%

Market cap:

$37.56 B

Vol. 24h:

$2.99 B

and Plasma (XPL) saw larger losses. This reflects XRP traders opting to cover their positions on Thursday, rather than keeping up with the pace of the broader market sell-off.

Ripple (XRP) Price Forecast: Can Bulls Confirm the Double-Bottom Reversal?

From a technical standpoint, XRP’s current price setup reflects a developing double-bottom formation between $2.6 and $2.8, often interpreted as a bullish reversal pattern. The neckline sits around $3.1, which also aligns with the mid-line of the Bollinger Bands (BB) and the 20-day simple moving average (SMA).

A decisive breakout above this level would validate the double-bottom signal and potentially trigger an upside continuation toward the projected bullish XRP price target at $3.6.

Ripple (XRP) Price Forecast | TradingView

Momentum indicators also provide a cautiously bullish backdrop. The Relative Strength Index (RSI) currently hovers at 41, suggesting near-oversold conditions. This positioning typically favors a short-term bounce, particularly when coupled with compression on Bollinger Bands signaling potential volatility expansion.

If bullish leverage around $2.7 continues to hold, XRP may rebound toward $3.1 in the near-term, followed by a breakout attempt toward $3.6.

Conversely, failure to sustain the $2.7 support could invalidate the pattern, raising the risk of a breakdown toward the lower Bollinger Band at $2.50.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Ibrahim Ajibade is a seasoned research analyst with a background in supporting various Web3 startups and financial organizations. He earned his undergraduate degree in Economics and is currently studying for a Master’s in Blockchain and Distributed Ledger Technologies at the University of Malta.