In an interview with FOX Enterprise, Ripple CEO Brad Garlinghouse detailed the corporate’s formidable plans for progress over the subsequent three years, highlighted by the launch of a US dollar-backed stablecoin and a strategic growth in worldwide markets amidst ongoing regulatory challenges in america.

Ripple CEO Unveils 3-Yr Progress Plan

When inquired in regards to the firm’s progress story for the subsequent three years, Garlinghouse started by underscoring Ripple’s vital worldwide presence, with roughly 95% of its buyer base situated outdoors the US. “95% of our customers are non US financial institutions,” he acknowledged.

Moreover, Garlinghouse defined that Ripple is promoting cost options and custody options round blockchain and crypto. He emphasised the corporate’s core choices and conveyed a robust dedication to additional growth.

“We’re going to keep expanding, even though the US market, as we were talking about earlier, partly from a regulatory point of view, has been slow to adopt, the non-US market has been really, really strong for us. And we’re going to be the infrastructure around all of that. That is our goal, and we think that opportunity is huge. We think that’s going to be great for Ripple,” Garlinghouse famous.

Along with infrastructure, Ripple plans to boost the utility of XRP, the digital asset central to its cost protocol. Garlinghouse expressed a constructive outlook for XRP, linking its success to Ripple’s growth and the broader adoption of its applied sciences. “We think that’s going to be great for Ripple. We think it’s going to be great for XRP,” he mentioned, reinforcing the symbiotic relationship between Ripple’s progress and the adoption of its related cryptocurrency.

Garlinghouse then delved into the specifics of the upcoming US dollar-backed stablecoin, a pivotal growth in Ripple’s technique to bridge conventional finance with the burgeoning sector of cryptocurrencies. He described the stablecoin as a response to the escalating demand throughout the stablecoin market, at present valued at $150 billion and probably rising to over $2 trillion. “Ripple has always been about how do we bridge this new world with a traditional kind of, people call it TradFi, traditional finance,” he defined.

This stablecoin goals to supply a dependable and regulatory-compliant possibility in distinction to opponents like Tether, which relies outdoors of the US and faces totally different regulatory scrutiny. The initiative represents a strategic transfer to place Ripple as a frontrunner in compliant, safe, and user-friendly crypto-finance options. “I think that market is going to grow a lot. I think a US-based player who is compliance first has a great role to play,” Garlinghouse added.

Regulatory Surroundings And Advocacy For Clear Tips

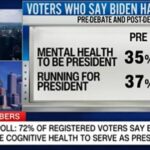

Garlinghouse additionally delved into the regulatory surroundings within the US, critiquing the gradual tempo of legislative progress which he believes hampers market progress. “Washington is still trying to understand this market,” he commented, expressing concern over potential laws which may place undue boundaries on the burgeoning crypto market.

He was notably crucial of the present administration and regulatory figures, stating, “This administration, I think, has taken a pretty anti-crypto stance led by the SEC Gary Gensler as the chair has really doesn’t understand it.” He additionally challenged the narrative put forth by sure politicians, like Senator Elizabeth Warren, who he quoted as saying, “The only people using crypto are bad actors.”

Garlinghouse concluded with a name to motion for extra knowledgeable, pro-innovation insurance policies that align with fostering job creation and financial progress, paying homage to the early days of the web growth in Silicon Valley. “This is about leading the next wave of innovation,” he affirmed, urging US policymakers to embrace and facilitate the expansion of blockchain and cryptocurrency by way of clear and supportive laws. By way of X, he added:

How pro-innovation insurance policies within the US will prevail. Step 1 – exchange the SEC management and step 2 – Elizabeth Warren’s employees ought to learn some precise information on crypto as a substitute of spewing fixed misinformation.

At press time, XRP traded at $0.486.

Featured picture from CNBC, chart from TradingView.com