Justin Sullivan

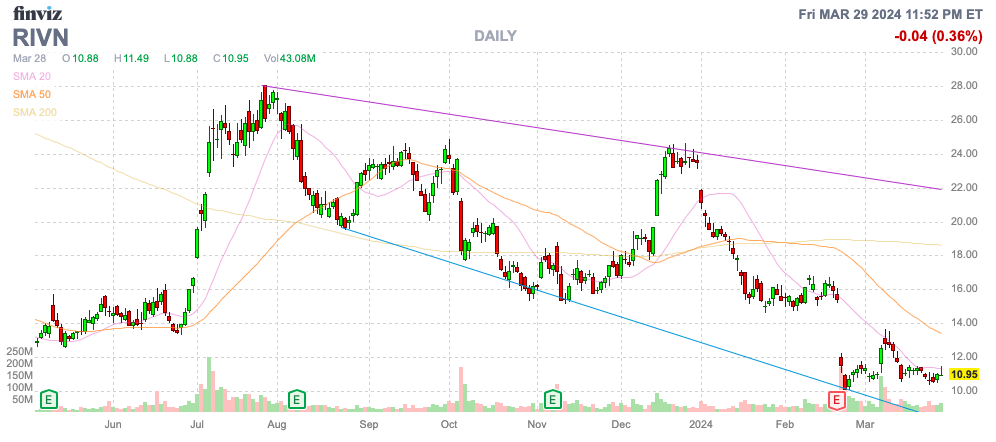

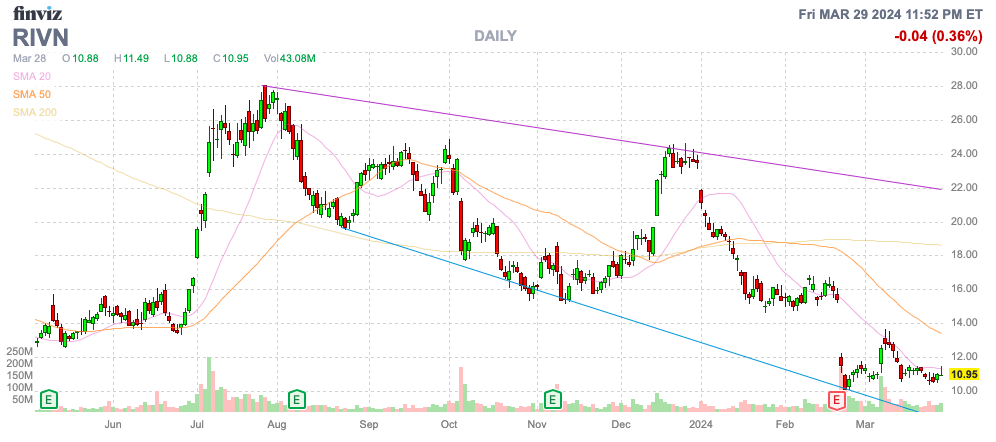

The EV sector has had a troublesome yr with waning demand. The EV producers surviving the stoop like Rivian Automotive, Inc. (NASDAQ:RIVN) are poised to learn from the following up cycle in EV demand with out opponents like Apple (AAPL) available in the market. My investment thesis is extremely Bullish on Rivian with the corporate transferring full-speed forward with new automobile fashions whereas the competitors disappears.

Supply: Finviz

Apple Automotive Terminated

As Rivian strikes full velocity forward with the brand new R2 fashions, opponents proceed to reduce within the EV market. The newest firm to exit the EV market by no means formally entered the market.

Apple was lengthy rumored to be engaged on a self-driving EV happening the way in which again to 2014 in “Project Titan”. The tech big introduced final month the intention to terminate the development of an EV in favor of pushing generative AI work. The Apple Automotive undertaking included 2,000 workers reassigned to AI or laid off.

The corporate spent years and billions of {dollars} engaged on the Automotive undertaking. The worry of any EV entrant was that Apple would use billions in working money flows to fund a dominant entrant into the house with an infotainment system built-in with iPhones and different Apple {hardware} and software program.

Now, the tech big has already exited the house, probably resulting from points with discovering a producing companion and troubles with scaling EVs set to high $100K every. Apple turned a cellular phone into a pc in your pocket warranting larger and better ASPs for the smartphones, however most customers don’t have any monetary capability to afford a high-end automobile.

As mentioned within the earlier article, Ford (F) pulling again on EV growth is a bullish growth for Rivian. Now Apple has exited the market earlier than beginning to arrange a grand state of affairs the place Rivian has far much less competitors when the EV market absolutely develops down the highway.

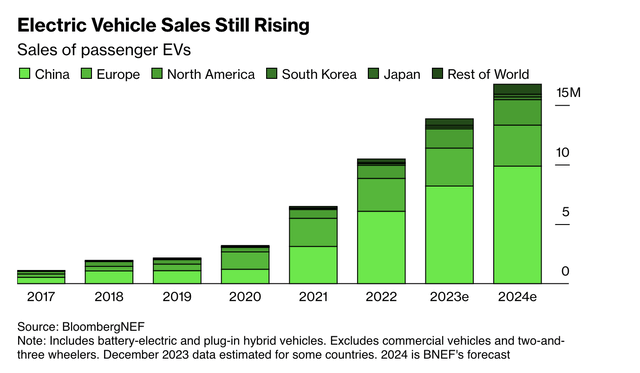

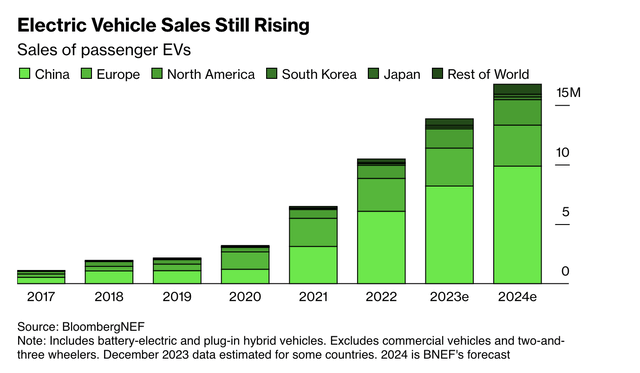

U.S. EV gross sales topped 1 million models for the primary time in 2023 for ~7% of the market. EV gross sales are even forecast to succeed in 1.9 million units this yr to succeed in 13% of whole automobile gross sales whereas world EV gross sales are set to high 15 million resulting from China having a thriving EV market with decrease finish choices.

Supply: Bloomberg

Rivian is on path for reaching optimistic automobile gross margins this yr whereas feared high opponents are exiting the market.

Full Pace Forward

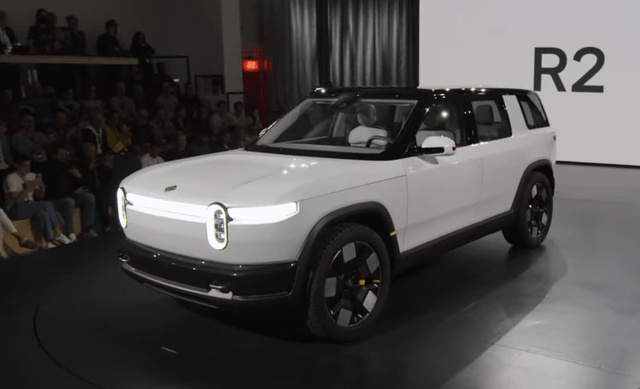

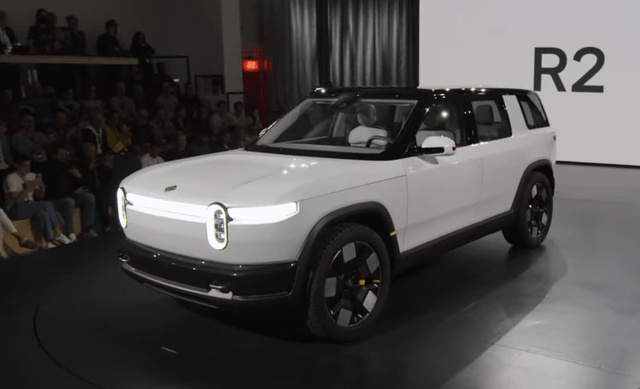

Just some weeks again, Rivian unveiled each the R2 and R3 automobiles. As a result of slowdown within the EV market and the diminished competitors, the corporate has been capable of delay the huge price of a brand new manufacturing facility in Georgia in favor of constructing the decrease price R2 fashions on the present plant with a beginning value of $45,000, pulling ahead the discharge date.

Supply: R2 Reveal presentation

Rivian predicts the R2 will launch in 1H’26. The corporate could have the R1S, R1T, EDV and the R2 offering a strong lineup of SUVs, vans, and work vans.

The R3 crossover EV and the premium R3X model will shortly observe the R2 manufacturing begin. The corporate initiatives saving $2.25 billion in capex and product growth prices through beginning R2 manufacturing within the Regular plant.

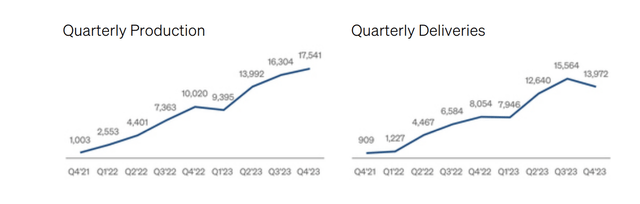

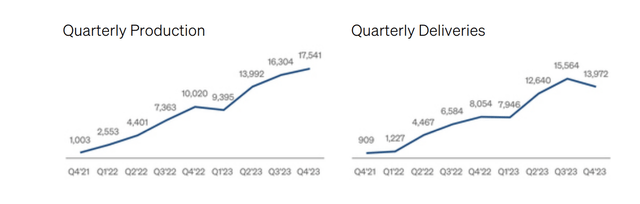

The corporate has already been capable of ramp up quarterly manufacturing to over 17K automobiles earlier than plant modification throughout Q2 will assist velocity up manufacturing and drastically lower out mounted prices. The present plant has the capability to supply 150K automobiles yearly offering Rivian with loads of progress behind the 2023 manufacturing ranges earlier than needing the brand new manufacturing plant costing a number of billion to construct. The brand new plans is for manufacturing on the Regular, Illinois plant to broaden to 215K models.

Supply: Rivian This fall’23 shareholder letter

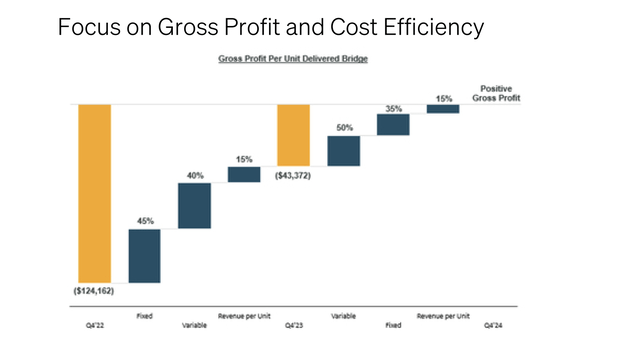

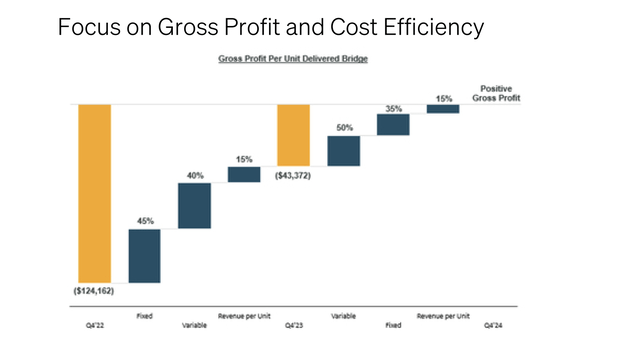

The inventory has slipped resulting from a mix of EV demand dynamics and fears Rivian will not ever generate a revenue with the decrease demand atmosphere. The corporate misplaced $43K per automobile in This fall, although an enormous enchancment above the prior yr ranges.

Supply: Rivian This fall’23 shareholder letter

The losses are nonetheless large contemplating Rivian is in essence promoting automobiles at round $80K and the prices are above $120K every. The corporate expects to chop 50% of these losses through a discount in variable prices from R1 engineering design modifications, business provider negotiations, and decrease uncooked materials prices. The plant shutdown throughout Q2 will lower mounted prices lowering 35% of the automobile losses and bridge the hole in the direction of optimistic automobile gross income.

Rivian ended 2023 with a money steadiness of $9.4 billion offering the funding to make materials development to succeed in optimistic gross income. Because the EV firm builds a full suite of EV fashions and a producing base, different opponents are pulling again on electrification plans.

The corporate has undoubtedly hit some velocity bumps with demand for R1s hitting a wall contemplating their common value of ~$80K. The information of pulling ahead the R2 with a beginning price of $45K and increasing the manufacturing capability in Illinois was an enormous optimistic, however the inventory trades on the lows.

Rivian is on the tempo of an almost $5 billion gross sales fee for 2024. The corporate has enormous upside with the R2 launch in 2026 the place the Regular plant capability alone would produce practically $10 billion price of gross sales based mostly on simply promoting $45K automobiles whereas the R1 gross sales are at far larger costs.

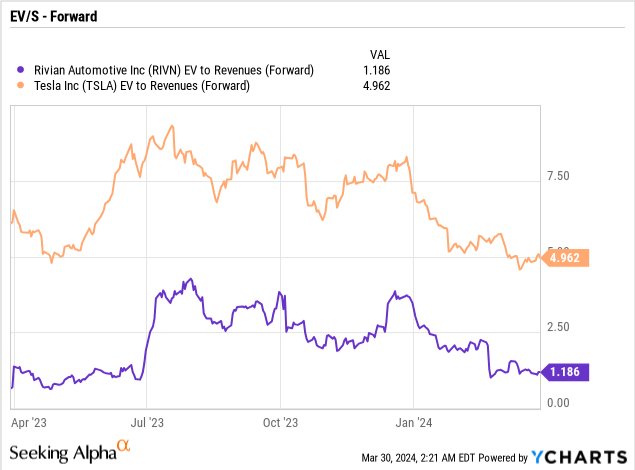

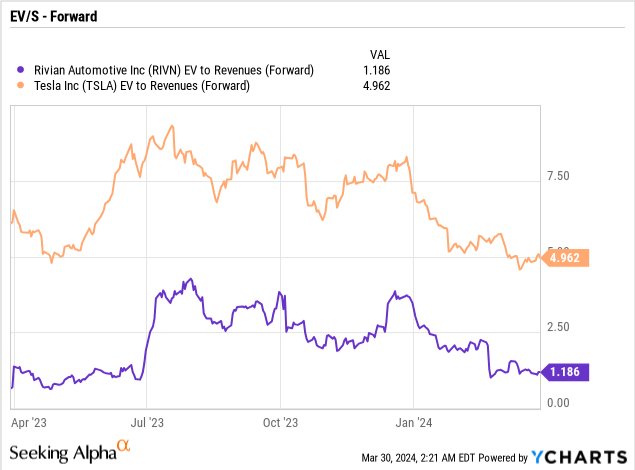

The inventory solely has a market cap of simply above $10 billion now. Even with the latest weak point of Tesla (TSLA), the inventory is much cheaper buying and selling at a serious low cost with EV/S a number of of 1x whereas Tesla nonetheless trades up at 5x.

Traders should watch out with the upcoming Q2 numbers because of the plant shutdown. Any unwarranted weak point would supply an incredible alternative to personal Rivian contemplating the plant shutdown will enhance R1 line fee manufacturing by 30% whereas lowering prices per automobile. The corporate is on tempo to succeed in a optimistic gross revenue throughout This fall whereas different EV producers are quitting the sport or pushing out plans organising Rivian as a survivor.

Takeaway

The important thing investor takeaway is that Rivian is ready to outlive and thrive the EV downturn. The corporate is transferring full velocity forward whereas the business is pulling again regardless of the long-term tendencies shifting in the direction of EVs.

The inventory is affordable right here buying and selling at a serious low cost to Tesla whereas any weak point in Rivian over the course of the Q2 plant shutdowns and decrease output would supply an enormous alternative to purchase the inventory on weak point.