JulPo/E+ via Getty Images

Real estate-focused closed-end funds are a hot topic of discussion for real estate investors. From a variety of perspectives, these investments warrant debate and speculation from discerning investors who are looking to place capital efficiently. First and foremost, these actively managed REIT funds are generally expensive, charging expense ratios above typical REIT funds and incurring leverage expenses. Consequently, some investors opt to invest in REITs directly, avoiding the management fees altogether by accepting the burden of stock picking.

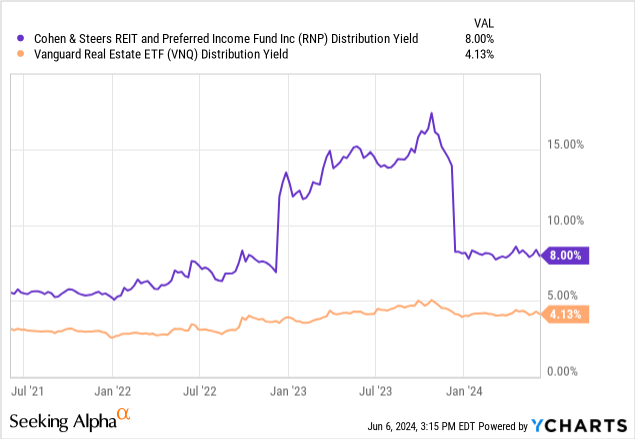

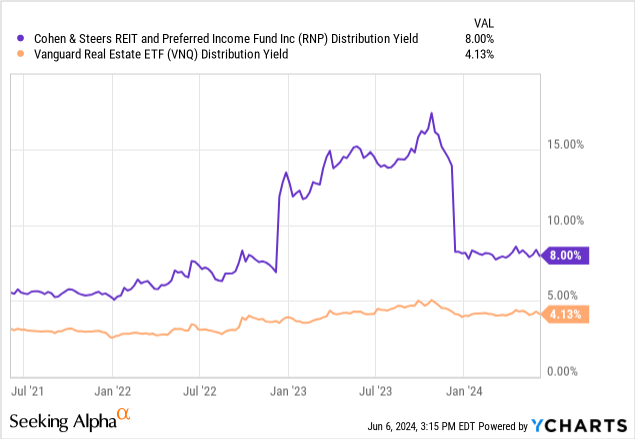

At any rate, the primary value proposition of real estate closed-end funds is consistent monthly income at a higher yield than other comparable vehicles. Today, we revisit a top-performing REIT closed-end fund following our coverage last year.

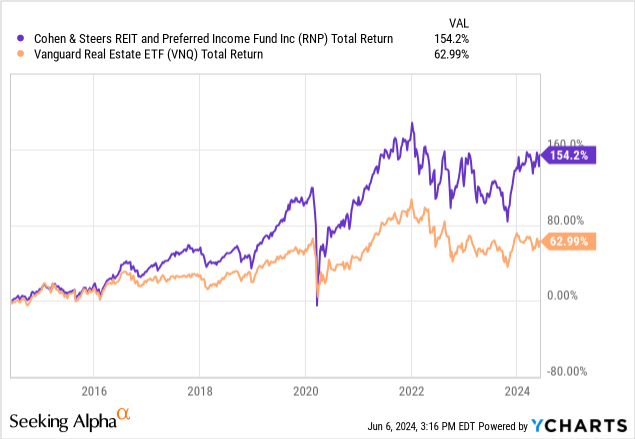

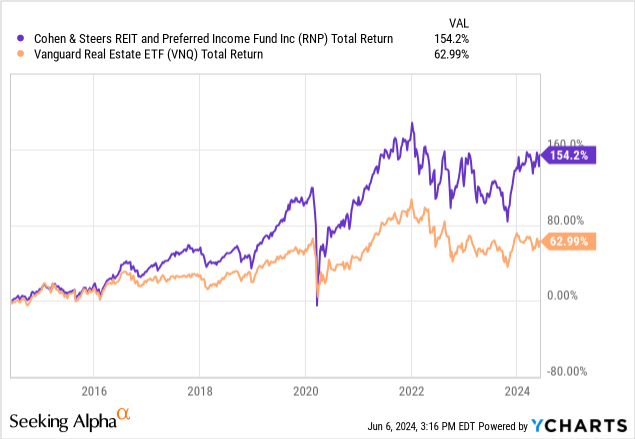

The Cohen & Steers REIT & Preferred Income Fund (NYSE:RNP) is one of the largest real estate closed-end funds by assets under management. The fund combines shares of REIT common and preferred stock. More recently, the manager has begun to incorporate more derivatives into the leveraged portfolio, including cash secured put options against high quality REITs. RNP’s portfolio is diversified across a variety of REITs by sector and geography. The fund has performed well over long time periods, outperforming real estate (VNQ) over the past decade.

The fund is managed by Cohen & Steers (CNS), a New York-based manager, specializing in publicly traded real estate and infrastructure investments. CNS is known for its growing platform of mutual funds, closed-end funds, and separately managed accounts. More recently, CNS announced a venture into private real estate with a new asset management platform.

RNP was tested as interest rates increased, putting significant valuation pressure on the fund’s portfolio. Bear in mind, that a portfolio of REITs and preferred stock is inevitably exposed to movements in interest rates. Despite the challenges, the fund has maintained its dividend and began to rebound as investor optimism surrounds potential rate cuts in 2024.

RNP’s real estate portfolio is a split of REIT equity with some additional smaller pieces of derivatives and private real estate investments. The derivative section includes cash secured put options sold against high quality REITs like Equinix (EQIX) and covered call options to generate additional yield.

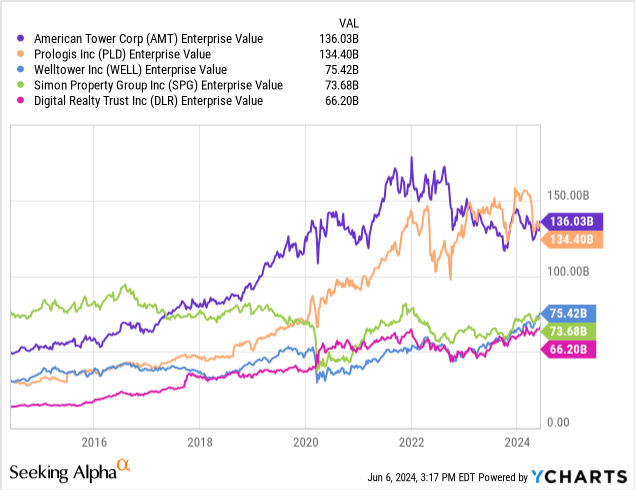

Under the fund’s hood are some of the largest publicly traded REITs. The top five holdings in RNP’s portfolio are American Tower Corporation (AMT) at 5.9%, Prologis (PLD) at 4.2%, Welltower (WELL) at 4.0%, Simon Property Group (SPG) at 3.3%, and Digital Realty Trust (DLR) at 3.0%. These landlords operate in unique sectors including telecommunications, industrial, and senior housing. Each is a blue chip with an enormous enterprise value, making them some of the largest landlords in the world.

RNP’s preferred allocation is more diverse, investing beyond publicly traded REITs. The preferred stock allocation is broadly invested across financials, utilities, insurance, and a variety of other preferreds, building a diverse portfolio beyond the real estate sector. RNP’s investments outside of real estate add diversification and other sources of yield, differentiating the fund from competitors such as the Cohen & Steers Quality Income Realty Fund (RQI). With a multicylinder approach, RNP has performed well over various time frames, including the rising interest rate era.

Assuming dividends have been reinvested, RNP has outperformed its index on one-, three-, five-, and ten-year time horizons. Clearly, the active management approach is working with consistent outperformance of the fund’s benchmark. In fact, RNP is one of few funds in the real estate sector to do so.

Certain asset classes, including REITs, offer a better opportunity to outperform the market. Availability of information, market research, and other important contributing factors allow specialist firms like CNS to apply their expertise in a productive way. While few managers can earn their salt, the CNS lineup has continuously outperformed in the real estate sector.

The Dividend

Most investors pursue closed-end funds with the goal of generating portfolio yield. Closed-end funds are generally tax inefficient, distributing income and gains to investors annually. However, consistent income can be valuable to certain demographics, such as retirees.

For any investor seeking predictable income, level distribution policies closely replicate the most important tenets of a perfect real estate investment. RNP will pay shareholders a consistent monthly distribution like what a real estate investor imagines rent checks could be. To sweeten the deal, RNP removes layers of involvement from the investor with no management responsibilities whatsoever.

For over ten years, RNP has maintained its monthly distribution, with the last reduction being after the Great Financial Crisis. Note the dip in distribution in 2016 was caused by the switch from quarterly to monthly dividends. Since then, the fund has even increased the monthly distribution following strong performance from the REIT sector.

Based on current share prices, RNP’s monthly distribution corresponds to a yield of approximately 8%. Again, RNP’s dividend is sourced from a combination of income, capital gain, and possibly return of capital from assets inside of the portfolio. As such, the income comes irrespective of the performance of the underlying assets. This means during a strong real estate market, the fund’s net asset value, or NAV, will appreciate. On the other hand, if the fund underearns the distribution, it must eat into NAV to maintain the dividend payments. This leads to additional risk factors around RNP’s distribution as compared to a typical REIT dividend.

Additionally, RNP’s dividend does not grow, which some shareholders could find unattractive. Without an appreciating income stream, RNP’s dividend shrinks relative to inflation. The lack of growth is the trade-off for an elevated yield.

Valuation

Closed-end funds and similar investments have a variety of valuation methodologies for gauging relative value. One example of a barometer for an income-producing asset is comparing the yield against the current ten-year treasury and historical trends. Investors generally look to the ten-year treasury as a bellwether of market risk, hence the namesake of the risk-free rate. A secondary methodology for valuing closed-end funds is share price relative to net asset value. As shares trade independently, the market can push shares above or below their book value, adding or detracting from the attractiveness of a fund’s current pricing.

Methodology #1: Ten-Year Spread

RNP’s yield has historically followed the movements of the ten-year treasury yield. When yields rise due to systemic risk factors, RNP’s share price declines to compensate for opportunity cost. In essence, RNP’s yield carries a risk premium over the risk-free rate of return.

Comparing the historical yield of a ten-year treasury to the dividend yield of RNP provides a point of comparison to build an appropriate spread. Over the past decade, RNP’s yield has been an average of 5.32% over the ten-year treasury at year end. The minimum spread was 2022 at 3.23% and the maximum spread was 2020 at 6.55%. If we assume 5.32% is the fair spread for RNP over the ten-year’s yield, we can build a fair value matrix.

REITer’s Digest, Data from Seeking Alpha

Currently, the ten-year treasury rate is just below 4.25%. If we add the historical spread of 5.32% to the current ten-year treasury rate, the process implies a fair yield of 9.57% for RNP’s distribution. Based on this distribution yield and RNP’s current monthly dividend of $0.136 per share, the implied fair value of RNP is $17.06 per share.

This methodology implies that RNP shares could be up to 17% overvalued compared to historical yields. The implication mostly stems from exuberance surrounding potential rate cuts over the next several years, which would boost REIT performance. Investors are looking to lock in high yields in anticipation of declining treasury yields. Optimism driving RNP’s outperformance of the index has led to another valuation factor sitting above historical precedent.

Methodology #2: Discount/Premium to NAV

A common point of discussion for closed-end funds like RNP is share price relative to net asset value. Trading independently of NAV is a major upside for funds like RNP, offering attractive opportunities to add new capital or cash out overvalued shares. Over time, premiums and discounts can vary widely and significantly impact investor returns.

Historically, shares of RNP have traded at a discount to net asset value. This means that investors have an opportunity to purchase a portfolio of assets below their liquidation value. Part of the pricing discount has been driven by skepticism and a degree of pessimism about the outlook of commercial real estate. Specifically, the likelihood that the Federal Reserve will cut interest rates. As investor outlook begins to improve, pricing for RNP has tightened. Over the past several months, RNP shares have appreciated, now trading slightly above net asset value.

Some investors see no issue buying shares at a premium to net asset value. The idea behind this is that the whole of RNP or a similar fund is greater than the sum of its individual pieces. In other words, RNP’s yield offers an opportunity greater than its individual pieces in the eyes of a prospective buyer. Other investors may see shares as overpriced in this scenario.

It’s critical to compare current pricing relative to net asset value against historical trends. In the case of RNP, the fund rarely trades at a premium to net asset value.

As shares now trade at a small premium, this serves as a leading indicator that shares of RNP have been caught up in the enthusiasm of the REIT rally. As hopes and expectations surrounding rate cuts begin to emerge, investors are buying up shares of RNP above their book value, pushing yields lower in the process.

Conclusion

Investors wait patiently as the Federal Reserve continues to monitor inflation data to determine the next steps in monetary policy. As enthusiasm begins to build once again surrounding rate cuts, real estate has trended upwards. For funds like RNP, this means a degree of investor fervor has rooted, pushing shares above net asset value and historical yield spreads relative to the ten-year treasury.

RNP is a stellar closed-end fund managed by one of the best asset managers in the real estate sector. However, after reviewing two valuation methodologies, RNP appears to be expensive relative to historical precedent. As investor expectations drive performance, this warrants caution. As a result, we reaffirm a “Hold” rating on RNP.