Robinhood announced on Tuesday evening that a developers’ version of its custom built blockchain, known as Robinhood Chain, is now live. The move, announced at the Consensus event in Hong Kong, comes as the company accelerates its push into crypto-based financial services, including tokenized versions of popular stocks.

Robinhood Chain, which the company teased last June, is currently in the so-called testnet phase. That means it is publicly visible but restricted to a limited number of partners and participants who can test its infrastructure, and introduce experimental features. In coming months, the “mainnet” version of Robinhood Chain will go live and be used to process customer transactions.

“We now have Alchemy, LayerZero, Chainlink, and other big crypto players. But moving forward, when the mainnet is live, customers will be able to interact directly with it,” Robinhood’s SVP of Crypto, Johann Kerbrat, told Fortune.

Kerbrat added that Robinhood Chain will support transactions both in its self-custody crypto wallet, and also in the main Robinhood app. He noted that, on a customer level, the blockchain will be a seamless experience and many people will be unaware they are even using it.

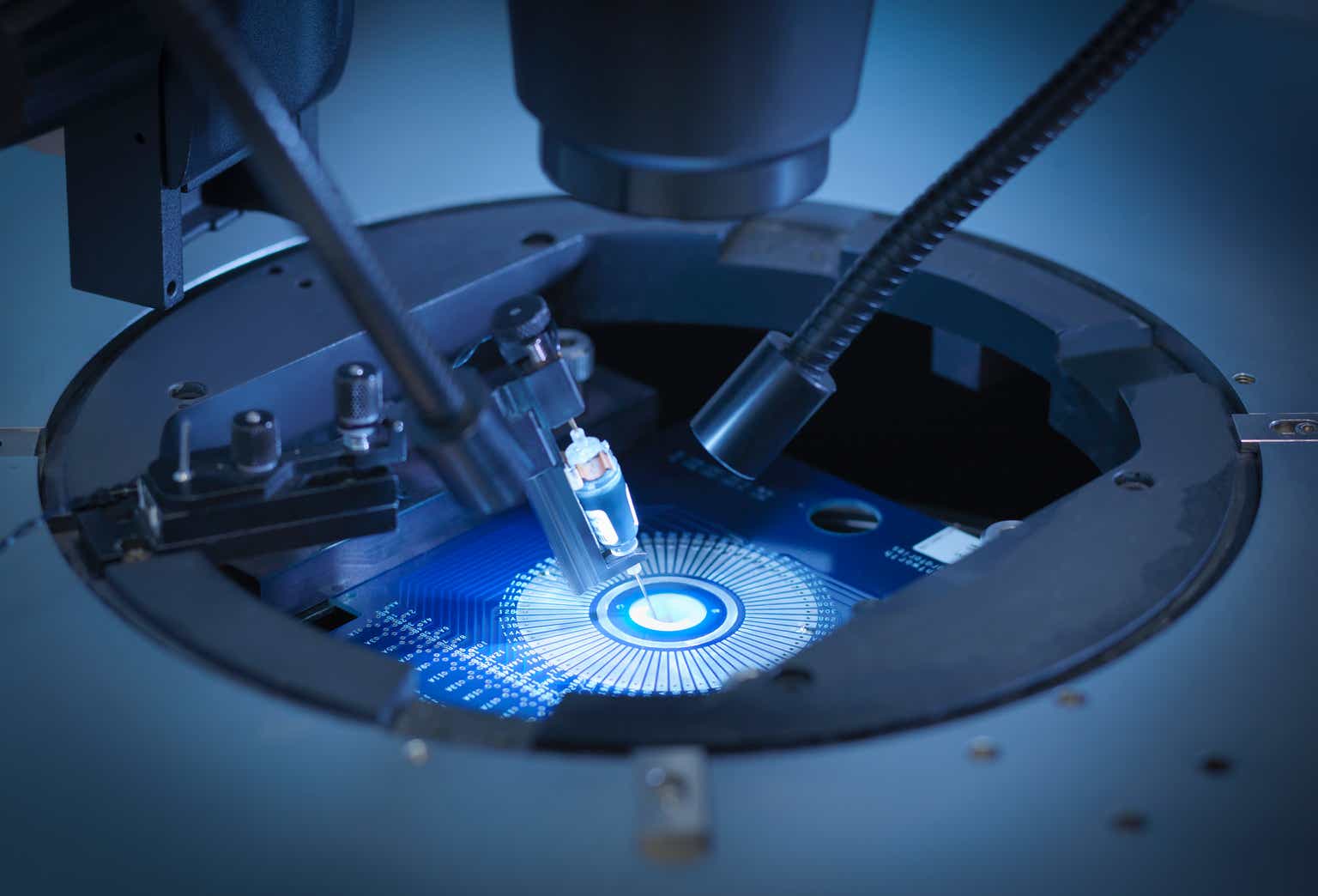

Robinhood Chain itself is built on a technology called Arbitrum, a so-called Layer 2 blockchain that sits atop Ethereum, and is designed to process transactions in batches in order to make them cheaper and more efficient. Arbitrum is one of two dominant Layer 2 technologies in the Ethereum world. The other is called Optimism, and is used by Robinhood rival Coinbase, which has adapted it for its own popular Base blockchain.

The launch of Robinhood Chain comes as the company is in a push to embrace tokenization, which CEO Vlad Tenev last year described as a freight train coming to financial markets. The term describes turning various assets into digital tokens, including stocks, that can be traded on a blockchain in the same way as Ethereum.

Robinhood’s blockchain announcement came the same day the company reported fourth quarter earnings for 2025. The earnings showed a fourth-quarter profit of $605 million, or 66 cents a share, which beat analysts’ estimate of 63 cents. Robinhood posted weaker than expected revenue, however, leading shares to fall in after-hours trading.