Nonetheless, Robinhood CEO emphasised that though the worth of cryptocurrencies like Bitcoin is rising, they’re nonetheless sophisticated and dangerous

Robinhood, a preferred app for buying and selling shares and cryptocurrencies, has introduced its plans to take swift motion in itemizing spot Bitcoin exchange-traded funds (ETFs) following the approval by the SEC. These ETFs purpose to offer diversified publicity to cryptocurrencies for retail and institutional traders.

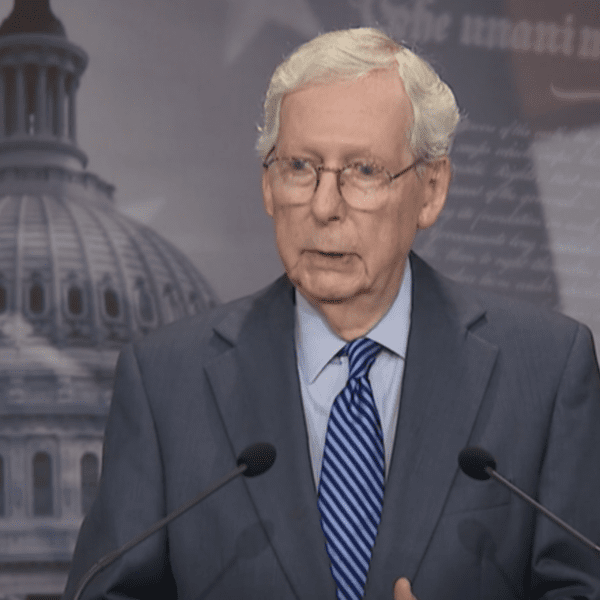

Vlad Tenev, the CEO of Robinhood, expressed his enthusiasm for the regulatory approval and said that the corporate is dedicated to itemizing these modern ETF merchandise as shortly as attainable. This choice aligns with the rising acceptance of cryptocurrencies within the mainstream monetary business.

Robinhood Assembly Surging Consumer Demand

With its massive person base and the popularity it has grown over time, Robinhood is primed to cater to person demand for these new Bitcoin (BTC) funds. The corporate witnessed firsthand BTC’s enthusiasm amongst its person base after enabling native help in 2018.

By making Bitcoin ETFs obtainable extra shortly, Robinhood is as soon as once more displaying its help for the fast-growing cryptocurrency market whereas conserving its promise to make finance accessible to everybody. Offering these funding alternatives is in step with Robinhood’s mission of inviting tens of millions extra folks to participate in monetary markets on their very own phrases.

Emphasizing Schooling and Duty

Nonetheless, the CEO of Robinhood, Tenev, additionally understands the importance of staying educated about cryptocurrencies. He emphasizes Robinhood’s dedication to offering academic assets that specify the basics of BTC, ETFs, and threat administration practices. The objective is to empower their clients with worthwhile data that may assist them make knowledgeable choices.

Thrilling replace from Washington at present! As a pioneer in providing spot crypto buying and selling, Robinhood is thrilled in regards to the @SECGov‘s choice to approve spot Bitcoin ETFs. We have been forward of the curve in crypto entry, and we plan to record these ETFs on @Robinhoodapp as quickly as…

— Vlad Tenev (@vladtenev) January 10, 2024

The CEO additionally highlighted that the platform is engaged on superior threat administration options. These improvements might help clients cope with the unpredictable modifications within the crypto market whereas permitting them to customise their publicity to cryptocurrencies in a accountable method.

Turning Level for Crypto Adoption

The approval of spot Bitcoin ETFs by the SEC is a big improvement that shouldn’t be underestimated. These ETFs maintain precise BTC as an alternative of futures, and this permits traders to have unprecedented entry to digital belongings by way of acquainted and controlled funding autos.

Prior to now, getting concerned with cryptocurrency exchanges within the US was thought-about riskier, primarily because of the challenges surrounding regulatory acceptance. Nonetheless, the introduction of ETFs simplifies the method and makes cryptocurrencies extra accessible and acceptable for each retail and institutional traders

This approval has additionally opened the floodgates for conventional suppliers with 11 ETFs from main issuers like Constancy and Grayscale already accepted this week. These merchandise purpose to reap the benefits of the rising curiosity in BTC and different digital tokens as a method to hedge towards inflation and discover promising improvements.

The approval of those ETFs additionally validates the assumption that Bitcoin is a singular asset class with diversification properties which are just like digital gold. This concept had already satisfied some retail merchants and establishments like Tesla to take a position billions in BTC earlier.