Rockwool A/S (OTCPK:RKWBF) Q2 2024 Earnings Conference Call August 22, 2024 8:00 AM ET

Company Participants

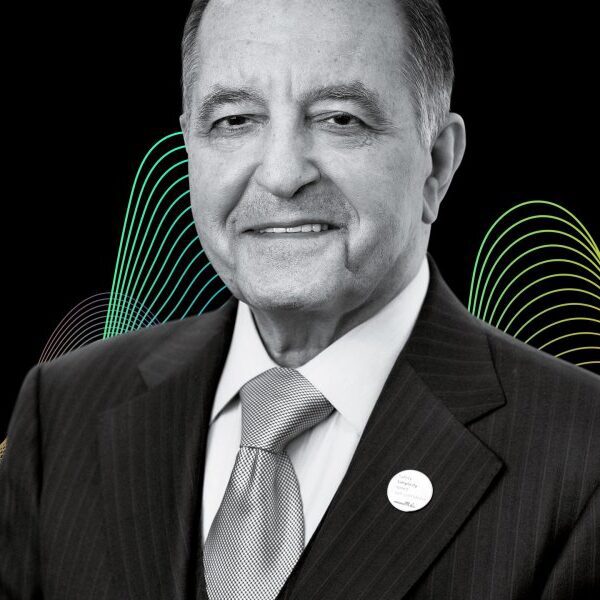

Kim Andersen – Chief Financial Officer

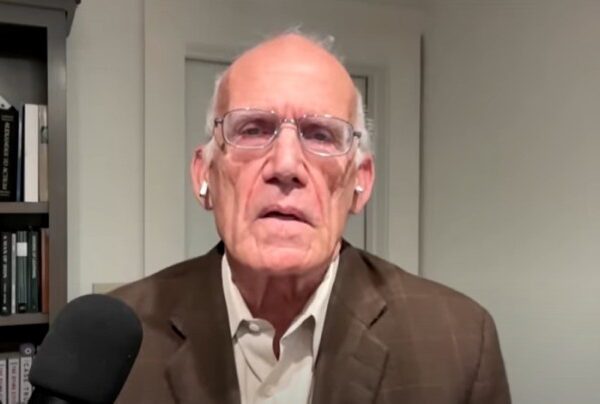

Jens Birgersson – President & Chief Executive Officer

Conference Call Participants

Claus Almer – Nordea

Arnaud Lehmann – Bank of America

Yassine Touahri – On Field Investment Research

Brijesh Siya – HSBC

Harry Goad – Berenberg

Zaim Beekawa – JPMorgan

Marcus Cole – UBS

Axel Stasse – MS

Operator

Ladies and gentlemen, welcome to the ROCKWOOL Report on the First half year of 2024. Today, I’m pleased to present CEO, Jens Birgersson; and CFO, Tim Anderson, for the first part of this call. All participants will be in a listen-only mode. And afterwards there will be a question-and-answer session. As a reminder, this conference call is being recorded.

I would now like to turn the presentation over to your host. Please begin.

Kim Andersen

Thank you very much, and good afternoon, everybody. Sorry for the delay. We had some technical challenges here in Chennai from where we’re taking the calls. Today, first of all, of course, I’m Kim Andersen, the CFO. And with me here, I have the CEO, Jens Birgersson. And today, we will present to you the first half result and then afterwards, we go into Q&A.

Before we start, I’d just like to remind you on Slide number 2, the forward-looking statement, and please be aware that this presentation contains uncertainties.

And with this, we can quickly go into the presentation on Slide number three.

Jens Birgersson

Good morning. Good day, everyone, its Jens Birgersson. Kim and I and the whole Board of Directors of ROCKWOOL including my successor, [Jesmond] (ph). We are in India, in Chennai. And the reason we are here doing a Board meeting is about 90 kilometers southwest of Chennai, which was previously called Madras. We have bought a piece of land that we have approved the factory project for our second factory in India, where we have had quite a successful last couple of years filling up our first factory. So that’s the reason we are calling from here. And I really can’t blame India for the technical problems. We — everything works here. It’s some other issue, not [indiscernible] problems here.

So if we move to Slide 3, the H1 results. As you know, I normally don’t comment the half year very much. But in the contrast between H1 and Q2 is a little bit interesting. So in H1, we saw 8% quite broad-based growth, but as we have seen in previous — probably in the last 1.5 years, is the commercial side of the business going. We don’t see much growth on residential rather the opposite. So the residential is still trouble, but we are doing fine on the commercial side of things.

If you look at the results year-to-date, EBIT margin is 17.7%. And that has been achieved on more or less neutral pricing we have a fraction of a price reduction, there’s a mix of market and some markets, the prices going up, for example, North America, parts of Asia and there are others where the prices just hold and somewhere they are down, but we’re kind of monitoring our market share. And now we get that. So overall, we are very happy with the first half year.

Moving on to Slide 4, second quarter highlights, comparable differs a little bit. So Q2 wasn’t very strong last year, Q1 was a strong either last year. So I would say we have a really broad-based growth and record growth in North America. I don’t think we ever had bigger growth number and higher sales that goes for both Canada and the U.S. Over on sales, nominal we always store budget rates, good to see that we crossed DKK 1 billion. I’m not sure if that’s the first time, but a very, very strong quarter. And then on the EBIT margin we reached 18.7% and that includes EUR7 million creating provision or donations and just to sum up, we had in Q1, Q1 plus Q2 is a little bit more than EUR30 million, but we have [indiscernible]

Let’s move to Slide 5. I just don’t — I’m not really going to comment this. But if you look at on the right system division’s growth, its minus 1%. We did divest Charles Will. So on like-for-like numbers, Systems division had 2 percentage points better growth that’s shown there.

If we now shift to Slide 6, we see Q2 and what’s pleasing here is to see that here, obviously, the insulation business is growing very, very much. It’s a super good quarter. But maybe from my perspective, even more pleasing is that the System division has gained a little bit of momentum. So if we add back the 2% last top line for Charles Ville, we have about 5% of the comparable basis. So we are looking now in the coming quarters, whether the growth will increase a little bit in the System division. The main driver for the System division growth is about panel growth and that had a very strong development.

If we turn to Slide 7, the regional sales development, starting with Europe. It’s a very scattered picture in Western Europe. We have some countries growing 20%, 30%. We have Sweden growing surprisingly quite well. Germany single-digit growth, the healthy growth back turning the corner, although we don’t see Germany on the residential side taking up at all, but that’s on the commercial side. Then we have countries like Spain, France, U.K. that are around the [indiscernible] or slightly negative. So quite a wide spread on that, move into Eastern Europe and Russia, you see several countries with very solid double-digit growth numbers and one or two of the small amounts of negative. And we have now listed at Russia. Russia had a very good quarter, but so did Poland and so did, for example, Ukraine, we are small in Ukraine, but we grew some 40% in grade.

Moving on to North America, Asia and others. A quick summary of the whole thing that is a Chinese negative. U.S. and Canada is on record growth and Southeast Asia, including Japan, very good growth. In Thailand, Malaysia, Indonesia and where we are now India on very good growth. We are getting closer to a point where we can’t sell more, but it’s nice to see that we are growing out here also in North America.

Let’s go to profitability on Slide 8. Margin has increased quite a lot if you look there on the right-hand diagram the EBITDA margin up to 25% of the EBIT margin now 18.7%, which is a lot higher than the year back. So the trend offers have been healthy. We have listed some of the factors, obviously, volume growth, stable sales, prices, import costs have got stable. We see now what the inflation coming back a little bit. We have had some favorable factors coming in, obviously, compared on the inflation, but we see also many, many materials kind of kicking up with normal inflation. [indiscernible] here that is worth noting, if you look at the headcount, we are about 10 to 100 employees also higher in the head count compared to a year back, and that is with the 10% growth.

So obviously, we have tremendous productivity improvement they almost 9%, 10% productivity improvement, and that gives us nice over absorption where we — our fixed costs on the factory overhead and on the rest. And you see that flow through to the bottom line. So it’s nice to see that, that scalability is there in the business. I’m also quite happy with this quite [indiscernible] ramp up in the factories where, for example, in North America, we have to step up capacity very quickly and also in some European countries step up Germany, for example, increased the ships, but we have been able to do that relatively quickly, and that has helped us in support of this growth.

If we move to Slide 9. Here, I only want to comment on margins in Q2 2024 and I guess I spoke about the 5% like-for-like growth of System Division here, I’m quite pleased with that. The system division is up around the 15% margin again. Of course, installation at that margin is doing very well. And I also want to maybe clarify that the whole Ukraine donation has been put on insulation so that you are aware of that.

Looking to the investment activities, no, nothing of worth to recognize most of these things. But what we have done a small acquisition in Vietnam. We have signed and we are very close to close, I think, four to six weeks. And just to underline that we are here with the Board in Asia. We have since a while, been working here in Asia to step up our efforts, it’s a very small acquisition, but yet an important bridgehead into Vietnam and many of us might don’t know that we even a country like Vietnam has 100 million people on a very great outlook at the moment. So I’m happy with that we could get that long because again, it’s clearly growth market, and it’s good to have the more or less [indiscernible] factory in the country. We’re also working on some other targets in the region. It’s not a lot around, but we are scouting.

Move on to Slide 11. Net working capital percentage, 11.5% down compared to a year back from 13.4% nothing special with that. It’s nothing we really need to focus a lot on the its inherent in the business that we don’t tie up too much net working capital. If we had one reason that number due to the volume growth, we perhaps would have liked to have a little bit more finished goods inventory. We had to sell a little bit more than we wanted to — we’re going to work now maybe to bring that inventory up in the coming quarters. And then the last one there, the net cash position around EUR200 million net cash positive, and that’s after the dividend and is after the share buyback, we are on track. We had about EUR160 million buyback plan for this year, and we are pacing relatively well on the curve of that phone. So good cash. And in spite of high investment, obviously, with the earnings level we have. Now we have a lot of cash in the company. So good to see that.

Slide 12, as we normally do in the half year report, we normally include one or two slides on sustainability. We have done that also here it’s not much drama about that. We have defined sustainability goals that with the time horizon to print, we are on track or ahead on all just pull out a couple of data points here. Okay, I take it from my memory, so if you look first on the CO2 emission intensity. This is the goal we defined before science-based target existed and as an engineer, that’s a good metric. Here, we have achieved with the index 2015 100 in terms of ton CO2 per produced [indiscernible] wool, we had the reference level 2015 of 100 and now inherently in the business we have reached the index 84, so that’s 16% down per ton produced through productivity improvements, conversions, green energy and some other actions. And we will see this number now continue down over the coming years because we are investing and we are taking actions and in the annual report and the sustainability report, you will see a number below the before.

So that’s progressing well, and you know the green investment on the CapEx side, you see what type of money we put into that. We are also working now, as we said, on our energy supplies and the contracting around that to see if we can get out of this extreme volatility in the next the next round we have an energy crisis or something like that. So that work is ongoing. And science-based target that we also have a goal for talks about CO2 equivalent emissions in absolute terms, excluding acquisitions. We have a goal for that, too. And it’s quite pleasing to see that when the business is growing, volume or top line double digit, but our Q2 emissions only increased with 6% on a more than 10% volume and sales growth.

So that’s good. That shows that, that kind of emissions [indiscernible] is working. It also shows the — underlines the challenge we have 2030 of really, really convert the whole company more or less into electrical melting driven by green energy. So we need — it’s a really challenging target, but we are working on it. But at this stage, we don’t feel that it’s impossible. We have the technologies we have the investment plan. But then, of course, the more we grow, the more challenging as goals to come. So at the moment, I would say, the long-term growth outlook is quite positive. So it’s a challenging goal, but we are working and we can see that the actions we are taking are good.

The Rockcycle’s here is referred to as the retail waste themes that we take back our own products and upcycle them — we recycle them. We have added also Poland to the countries where we offer this service, and we have now 22 countries in the scheme and the goal is 30 by 2030. So we are well ahead of that. We will be that or we will be ready much before 2013. And then on safety, the safety goal, no serious accidents and fatalities in the first half year and is what we like to see, and that’s how we need to perform all the time. But as you know, we have a big, big operational with many factories at these factories. It’s — things can happen, but we are working very seriously on that, and it’s good that we have a good first half year.

Going to the outlook, Slide 14. Going forward on sales, we haven’t seen any change or any dramatic developments in the market, but we are stepping in a couple of quarters where we have more challenging comparables. So on the top line that mid-single-digit percentage growth. It seems like a good outlook still, although we are ahead of that until now, but that’s because of comparables. But as we see now, we see the business pretty much continue. That’s good. On the EBIT margin around 17%. Also there, we are a little bit ahead. But then as you know, we have the December effect go away. We also have the summer in France, profit of business for us. impact a bit. But we feel comfortable with that outlook and on the investment, nothing need to report on that we are on track to invest much what we have planned to invest for the year.

Yes. should stay, though, on the investment side, we have one setback our new plant in France, we were surprised. I would say that we got a negative verdict on one of the lawsuits. So we are regrouping that we have not at all given up the new factory in France, but — we need to look at that and see how we keep pushing the plant in France. We thought we should be able to start building it now, but this also set back and we can expect a further deal possibly will move the resources and accelerate on other project. We have a number from the start, but we have absolutely not given up on the French keep working through that.

Over to questions.

Question-and-Answer Session

Operator

Thank you. We will now begin the question-and-answer session. [Operator Instructions] And the first question will come from Claus Almer with Nordea. Please go ahead.

Claus Almer

Thank you. Yes, two questions from my side. I’ll do them one by one. The first question goes to inflation. Jens, you mentioned that you do see a — it sounds like a small inflation. Does that mean you’re going to raise prices? Or will you have to absorb that in your P&L, so to speak? That would be the first one.

Jens Birgersson

Yes. Yes. So Claus, thanks for introducing yourself. We don’t have the normal screen that we can who asked the question and who you are so great, if you can introduce stuff like that, so we know. No, yes, I see — I mean the inflation doesn’t go away. We had the energy benefit and some other benefits but — we have several markets where we foresee that we will do a small drumbeat price increase to cover that inflation. There could be competitive dynamics in some places where we might not do that, but the overall direction is that we are ready to do a small price increase to pass on the inflationary pressures as far as we can.

Claus Almer

Okay. And then leading to the next question, which is the interest second half guidance, and you did touch upon this in your slides. But implicitly, you guide for around 16% EBIT margin in the second half, so down versus first half also if we adjust for the Ukraine donation? Is this only due to France and December sale, as you said? Or is it also the inflation impact. You have previously said it’s not easy to break prices in all markets. So you have to be more specific about these price increases?

Jens Birgersson

Yes, I saw your headline in your initial comment. And I would say we are not — you have seen some companies that have released earnings report now and that have seen decline in top line. And that is quite a mixed picture in different related sectors. So we haven’t seen any of that. So we are not pessimistic. We are not pessimistic on the prices. We think we can do most of that. Yes, we believe there is inflationary pressures, but we have the ambition to pass that on. So that’s the outlook. And then we did upgrade was at 18th of July to 17%, we felt to make an assessment now is not prudent. We feel comfortable with the 17%. We obviously have no ambition to reduce the profitability, but we acknowledge the December effect and the France effect, as we always do. So I will leave that to my successor to kind of nail that outlook in his, maybe first earnings call.

Kim Andersen

There are also — and you know that kind of we coming closer and closer to the autumn period, where many of our markets will negotiate 2025 prices. There’s always a little bit of timing there.

Jens Birgersson

Yes. So I wouldn’t do straight to mathematics and say we have concluded this on that. We’ll come back on that forecast when we a little bit deep, deeper into those discussions. And I also say, I — we feel comfortable with the 70% — the next time we will know more.

Claus Almer

Fair enough. Thank you so much for the answers.

Operator

Your next question will come from Peter [Sehested] (ph) with ABG. Please go ahead.

Unidentified Analyst

Great. It’s Peter from ABG. Thanks for taking my questions. I have two. The first one is on France, with the Maritime program has noted an increase in applications following their return to the normal application procedures. And I guess that these applications will probably not hit the market or really realized in the second half. Is this something that you have taken into account in your guidance? Because I know that in France, the renovation program has been a very important driver for [indiscernible] for the past, it’s the first question.

Jens Birgersson

Yes its accounted for, we have a good profitable business. And France is slightly in the negative territory in the quarter. And we haven’t factored in any hopes and dreams from the scheme. So we have a good conservative or realistic forecast, and that’s included.

Unidentified Analyst

Good. And just going back to the guidance because you are working on pricing is it the same as you had you did in Q1 and also with respect and we have sort of the usual thing about the December impact. That’s also something that you typically reiterate around this time of year. Is there anything that is sort of different this time that it has been, let’s say…

Jens Birgersson

No, no. It’s very much — it’s very much business as usual. We drive a very strict pricing process in the company. We stay on top of the market and we try to take that very serious. And there isn’t any dynamics out there that is different to another year. Of course, we don’t have the situation we had in the autumn 2022 with the hyperinflation about this. So I would say business as usual and there is a slight deflation and we will try to go after it. And it’s not — no drama around the whole thing. But then, of course, you have some markets, some segments, competitive pressures. We work on all that, but so far so good.

Unidentified Analyst

Thanks for taking my questions. And also, I’d like to say thanks to all your efforts and what you’ve done at ROCKWOOL. I think you’ve said you and Kim and the team at a very high let’s say, benchmark for the incoming CEO. So good luck to him as well.

Jens Birgersson

Yes. Yes. Thank you very much, Peter. We have the same team in place to get a very strong pair of hands taking over the business. So I am very optimistic about the future.

Operator

Your next question will come from Arnaud Lehmann with Bank of America. Please go ahead.

Arnaud Lehmann

Thank you very much. My name is Arnaud Lehmann from Bank of America. My first question is, I guess, related to pricing, margin and returns staying on that topic. You indeed have done very well on margins and that drove an improvement in ROIC, which you publish, I think, 23% is printed number in the H1 report over the last — I think that’s a 12-month rolling data, which compared to 15% last year. I appreciate there’s an element of let’s say, inflation in CapEx and the cost of adding new plants has gone up. But on the other hand, I don’t believe you have a broad-based plans to increase the capacity. It’s more of a selective process. So I guess my question is, beyond pricing and margin levels, do you believe that these sort of returns are sustainable going forward? Or is there a possibility for some sort of normalization over time?

Jens Birgersson

Yes. I would like to — I will give just a brief flavor on that reflection on it, and then Kim should comment it because he continues. My view on that is that we are not still — we want to have 15% or above. But the biggest job as to see or what I’ve seen is that for me, it’s not so important if it’s 23% to 16% or whatever. It’s important, but we keep supporting the volume growth. And at the end, in our industry, if you have the capacity, you can deliver the volume.

So from my perspective, I think, yes, we want to have a good cash generation with a good margin, but we would like to invest more, sometimes we get delays like now in France, the plant, we would really like to build that. And that would be a burden for quite a while, such a big plant on the return on capital employed. And quite frankly, I’d rather have a couple of percentage points lower return on capital employed and get a plant built because that’s better for the long term for this business. So that’s how we look at it. So I think that now you have a combination of that some projects are hanging.

And yes, we are building plant in India, plant in Romania, we are building on the Sweden and U.S. In the U.S. — we are building. It’s not just selected. We are building and we’ve got a step-up but it’s quite hard to build. So it’s not a goal in itself for me to keep it to 23%. But I should let Kim…

Kim Andersen

The short term at 23% — close to 24% compared to 15% last year. last year was a bit abnormally low because that was impacted by the 2022 downturn in performance. So — and maybe this year is a bit abnormally high since we have a relatively low working capital at the beginning of the year. So I think it’s a — I think a normalization would be around 20s but as Jim said, it’s not something that we steer towards necessarily on these short-term RICs. We do the 15-plus target setting internally and then we go for this, but we will step up investment in the coming years. So Jens and myself will maybe not be able to present 24% ROIC short term. In the short term, that’s where the numbers are.

Arnaud Lehmann

Very good. Thank you for that. My second question, if that’s okay, is regarding Russia, I mean no change as far as I can tell in terms of the way you’re thinking about the ownership of these assets for ROCKWOOL. Should we expect a change with the new management in the future, I guess? — maybe something…

Jens Birgersson

So we have a very — we have worked through this through in detail. My successor is still until the first of September board member. His partner with, we haven’t seen the external environment on the reasoning for not to continue what we do. We haven’t seen anything change. And we see the companies that take the other route. It impacts very negatively. So we see no reason to change and there is no intention to change the strategy because of the new CEO of the company, and we are on the line on this.

Arnaud Lehmann

Thank you very much.

Operator

The next question will come from Yassine Touahri with On Field Investment Research. Please go ahead.

Yassine Touahri

Yes. Good afternoon. So two questions on my side as well. First, could you comment a little bit about the pricing trends and the volume trends that you’ve seen in July and August? Is it fair to assume that there is no change in pricing? Or have you announced some additional price increase? I think in the U.S., there were some price increase. And on volume, have you seen any improvement or deterioration versus second quarter? And then my second question would be on the new entrants. Like in [indiscernible] margins are relatively high today. Do you see a risk for new companies to enter the European or North American mineral wool industry? Or do you think it’s too hard, like because of a regulation like — and they could face the same issues are you facing in France?

Jens Birgersson

Yes. So in France, we see some pricing pressure in the residential segment of the live walls cost activity is relatively low. We haven’t seen much of a change. I mean it’s around this year or slightly negative, slightly up, not in dramatic and I think we need some I don’t know, governmental programs taking action to get that up.

Overall, in Europe, on the GDP side of things, we probably haven’t seen a case for a broad-based upturn. It has weakened a little bit lately in Europe. So France sits around the CRO, slightly negative, nothing really dramatic comprised as some segments a bit down, but the segments, we can increase the prices. So that’s on that side. And then price increases are some markets where we — there is no issue whatsoever bid price. For example the U.S., we just launched an 8% increase, and that’s in line with what’s happening in the market on Glasswool and stone wool. So that’s moving. The last question, just to make sure I understood, you asked me how difficult it is to enter the stone wool business? Was that the question?

Yassine Touahri

Yes. Do you see a risk because the margins today are much higher than they were [indiscernible]

Jens Birgersson

Yes. Obviously, there are people that look at stone wool and think this is a fantastic business. And to this, you have 18% EBIT margin and the rest. And I think having a single plant versus our quite big machine now with a lot of economics of scale and also considering how difficult it is to start up the plant a brand really, really productive outfit. I think you will see some entrants. But I must say that there hasn’t been an entrant for a long time that come even close to our margins because it’s very, very difficult to run a small network or just 1 plant without brand and without the service level and all the rest of I’m not particularly worried about you entrust.

But yes, some people will announce new plants and will deal with that when that comes. But the trend started at the plants are announced and very much delayed because it’s also very, very difficult to build the plants. It will be very persistent in some geographies to get your plant build in today’s world. And I think there is also important because we have the means and the persistence to just keep working until we can build our plants. So it’s — it can be very challenging to get all the permits and you get the permits that you have [indiscernible] whatever as it is in many industries in Europe at the moment.

Yassine Touahri

And maybe just a very last point, which is just like not a question but more a comment about the fact that you’ve delivered such a greater growth for the company. I think it’s quite impressive what you’ve been able to do in terms of margin and productivity. So just wanted to assure the best of luck for your future endeavor. Thank you.

Jens Birgersson

Thank you very much, Yassine. And you mentioned an aspect there that this is an important 1 to us that we don’t talk about too much, and that is our productivity that economics of scale of the business. That’s an underlying big advantage of Rockwool that we have in culture and that’s a strong part. But thank you for those words.

Operator

Your next question will come from Brijesh Siya with HSBC. Please go ahead.

Brijesh Siya

So I have a couple as well. Just on the pricing, right? It’s interesting that you keep talking about pricing flat in the quarter. But looking at Eastern Europe, Eastern Europe growth is up 28% in Q2. Given some of your competitors not direct one, but a different segment a little bit, but they talk about when the volumes bounce back, they see some pricing pressure. Is that something is also impacting you? Because I recollect historically, Eastern Europe has been a different market where competition is it more intense compared to Western Europe. So any comments around that will be very helpful.

And within that, if you could just give a little more flavor into the Western Europe when everybody is talking about interest rate improvement cut coming through, do you see similar risk panning out in Western Europe as well when the volume bounce happens maybe towards end of Q4 or maybe into 2025. So that’s my first one. I’ll come back for second.

Jens Birgersson

Okay. Thank you, Brijest. So in the Eastern Europe, we have the classic country, for example, Poland, where price competition is fears, whenever volumes go down whatever is down and you see the whole EPS competition several segments, flat and in facades. So there, we really live it. But then there are also some Eastern European markets where Romania, Hungary, but we don’t see much of that, but it’s more vested in the dynamics. But for sure, that effect is there. It’s no secret that Poland is challenging but we balance volume and price. So this kind of school book, really, really a lot of competitors that want volume for any price and we do well on the really big projects where you want really our high safety you want delivery, safety, you want to logistics. Those projects, we still can take with good margins.

And on the other, we need to play it a bit more by the year. And then correct some agent upturn comes. So that’s the same path as we have discussed many times, Brijesh. But there are also quite a few Eastern European markets that doesn’t have that position on that. So then in Western Europe on the trends on the dynamics I think fundamentally in Western Europe, what you see is that sometimes, there could be there could be circumstances mean so they go three, four months and you get simply too many projects. And then someone doesn’t get enough, but then it turns into a bit of a seasonal panic all of the competitors. And that is nothing unusual of that.

And we have seen it, for example, in Germany several times where someone really, really want volumes. And our approach has traditionally been not okay. If it’s not on the sustainable level pricing, we rather we gather step away from those projects and then the market will normalize. And I must admit, I have not seen any other trend in Europe. I don’t see any change to the fundamental dynamics to the Western European pricing until now.

Brijesh Siya

Perfect. And my second question is more into the U.S. You’re talking about you are nearing full capacity. Then looking into 2025 and 2026, and I guess your new plant is not coming on [indiscernible] in 2017. So what kind of U.S. — I was talking about U.S., sorry. Yes. Asking you about – sorry. If I just finish the question is that you have near full capacity right now and looking into 2025 and 2026, what’s kind of volume headroom you have to continue to grow this number? Or you see there is a kind of a really a capacity constraint at still meeting your growth in the near to medium term until the new plant comes in 2027.

Jens Birgersson

Yes. Yes. So they are the normal two or three factors here on full capacity that can be quite confusing for our business. Because if we don’t — if we miss a few months that we have not for capacity, we have frozen capacity, and we can never catch that back in the year. And what happened here was that we had some challenges with delivery times. So in the U.S., we didn’t expect the ramp up. The business went down in 2022, early 2023 and then it step changed up. We didn’t have the ships in place, we battled to get blue collar workers in the ship dock and to train overall the rest — then we sat with this more than six months backlog of orders on delivery times. During that period, we didn’t increase prices. We just focus on 1 than to work back lead times. And then we go up on full capacity.

So this doesn’t mean we don’t have more capacity in the plant, even though we run a couple of months a fall. So going into next year, we will count to that, if you see a good next year with more seasonal stock and running more close to full the rest of the year. So we have more growth in the business, and that will take us through one or two years, I think. And then, of course, after that, we do what we normally do if we run out the used capacity from other parts of the world, supply the demand, although we don’t make a lot of money on that, our ambition and we have done a lot of that in Europe.

You remember last time we were up on very high utilization. We shipped from even Norway down to Germany. We use those type of deals because our priority, if we have that demand is to up the customers. And here, we might get into that next year or the year after, where we actually have to bring in certain grades of stone wool into the U.S., and we will be ready for that when it’s needed.

Brijesh Siya

Thank you for all your kind of effort. And I think I turned a great job as my colleagues have all told that it’s kind of probably the pricing initiative we have taken in the last nine years has been simply pretty impressive, and that’s we can see with the margins. So thank you very much, and good next innings.

Jens Birgersson

Thank you, Brijesh.

Operator

The next question will come from [Harry with Goad] (ph). Please go ahead. Harry, your line is open.

Harry Goad

Yes. Hi. Can you hear me?

Jens Birgersson

We can hear you.

Harry Goad

Okay, great. Harry at Berenberg, I got two, please. So firstly, just coming back on a couple of remarks you’ve made on the margin, I think it mainly in response to Anne’s question. But just for clarity, I appreciate your point that both margins and returns on capital can move around. But were you indicating that around 15% in terms of EBIT margin is the right way to think about the sort of through cycle average margin and obviously, obviously, having had a big increase this year.

The second question, please, is around sort of pricing and competition? And when we’re thinking about that, should we be thinking about your product relative to other stone wool providers? Or should we actually always be thinking about it relative to the broader suite of insulation products. Thank you.

Jens Birgersson

Yes. So I will hand over the 15% margin question to CFO, Kim. I’ll take the other 1 first, and then Kim will answer the average cycle margin, which I don’t feel I’m the right one to answer at this moment.

On pricing and competition, I would say that, yes, it probably attracts people to the market. Stone wool is a great product. It has a very clear cut out space in the market and to meet the climate goals our installation on other installation [indiscernible] will beneath that then obviously we think is the best. And so I think we can see some new entrants. But again, I don’t see anything happening there quickly due to the nature of the business. And in the last couple of years, the inflation of equipment, this near-shoring drive that has happened in Europe and the U.S. is just expensive and complicated to build. And there isn’t a lot — we have a lot of in-house engineers doing a lot of this work. It’s not easy. So I wouldn’t factor in that you will have big new entrants that come in five, six factories very quickly, that’s not likely to happen. But sure, we’re going to have new entrants.

Kim Andersen

Normalized margin, not necessarily exist or cost in the coming few years here in 2025 and into 2026, we have no plans to open in a new factory. So there will be no sort of major depreciation change coming. That will change, of course, once we start to get the big factories opened in Europe and in the U.S. So that will definitely impact the EBIT. We are working on margin improvements, we have told you previously about our efforts to reduce the manning in our factory. That is definitely a margin possibility. But besides that, I think we just worked what having constant focus on productivity and then hopefully to maintain or improve margins. That’s really our aim. But I said from — so these seven onwards, there will definitely be more depreciation coming from the planned investments that we’re doing over the coming years.

Harry Goad

Thank you very much.

Operator

Next question will come from Zaim Beekawa with JPMorgan. Please go ahead.

Zaim Beekawa

Good afternoon, all. Just two questions for me. The first one is, I noticed there’s a slight mix effect in the regional sales. Can you just remind us on the impact this has on the margins, particularly by region? And then secondly, on your hedging for the year to 2025.

Jens Birgersson

Okay. I don’t leave the hedging to Kim. Actually, with the recent success we have had in North America, we don’t have so much regional effects of the margins. We have always said France is a very good market, but we have a lot of other markets now that are on the same level. So when you have North America versus Europe, on average, you don’t see much mix effect and country mix effect anymore because we’re up on scale and we start to have that large profitability in North America. And then Asia is still too small to impact the picture. It doesn’t matter if they grow 20% they won’t impact overall numbers because they’re still too small. So there are some effects.

We still have more difficult markets like Poland some other markets if that really grows a lot, it dilutes. But at this stage, I won’t say a country VIX effect is big. And then in the residential segment, actually, our margins per unit is a little bit higher. That will be slow. On the other hand, we get beautiful [indiscernible] from all the commercial, heavy density products, flat foods and all, and that’s also given an effect. So I wouldn’t say we have any great mix impacts at the moment. But for sure, if we wouldn’t have had volume growth that we have now, all these big projects, heavy plate project would have diluted the margin a bit because that margin on the paper is slightly lower, but with this absorption is fine.

Kim Andersen

On the hedging side, [indiscernible], we are — we have this with the foundry [indiscernible], which is still our biggest energy source. Therefore, we can only [indiscernible] prices a quarter at a time. Right now, we don’t have a read for 2025 [indiscernible] we do have on sort of long-term contracts for the best of the consumption on the [indiscernible] and on gas, we have covered the quarter into Q2 next year, [indiscernible] about now. The [indiscernible] expected consumption.

Zaim Beekawa

Perfect. Thank you for those answers. And Jens, best of luck on your future endeavours also.

Jens Birgersson

Thank you very much.

Operator

The next question will come from Marcus Cole with UBS. Please go ahead.

Marcus Cole

Hi, Marcus Cole from UBS. I’ve got two questions as well. I was reading in a statement that you’ve recovered some share in Europe. I was just wondering if you’re willing to put some numbers to that. And then the second question is — just on the volume growth strength in H1, are there any one-offs in there that we should be aware of? You don’t think that can be repeated in the rest of the year? Thanks.

Jens Birgersson

Okay. So some market share or broad base is steering quite hard on maintaining it. And in some countries, we do down to the all because there are associations working sometimes will be done exactly. So the market share has remained pretty stable, that it could be country differences. Obviously, the U.S., where we are growing, we have a very low market share in the total margin. We have a high market share with the install, but there’s still only a couple of percentage points of the overall insulation market. We are taking market share out of the insulation market, but I don’t think anyone is no or to [indiscernible] that because everyone is lower. So our market share is stable, improving some prices slightly down than others, but we are happy with the way we manage that.

Marcus Cole

We don’t have any special one-offs.

Jens Birgersson

No 1 so we don’t — we have some big projects, but — the biggest project we have to get is like EUR4 million to EUR5 million or so in. So we have got some big projects that impact and best look for the future yes.

Marcus Cole

Great. Thanks very much and best of luck for you, Jens.

Jens Birgersson

Thank you.

Operator

Your next question will come from Axel Stasse with MS. Please go ahead.

Axel Stasse

Good afternoon, everyone. Thanks for taking my question. I just have one remaining. If I understood correctly, the commercial market drove the EBIT margins in the first half year. So how should we look at pricing in the residential market going forward? And I’m asking this question specifically based on your comments on the key focus on volume growth. So is it fair to assume we could see some pricing risk in the residential market when volumes pick up? Or did I not understand it correctly?

Jens Birgersson

We unfortunately have a very disturbance on the line. So we could not hear that question.

Kim Andersen

Could you maybe just repeat one more time and keep it very short.

Axel Stasse

Yes, sorry. So the commercial market drove the EBIT margin in the first half year of the year. And based on your comment on key focus on volume growth going forward, is it fair to assume that we could see some pricing risk in the residential market going forward to gain share?

Jens Birgersson

We’re just going to try to — just a second, we mute you and we just see if we cannot. Yes. Yes. Okay. So I think the residential market at the moment is a bit of a falling knife. So we clearly don’t have an ambition in a market. If you look at the new housing starts in Germany, it’s down to even lower level than last year. I can’t remember how much, but this is really, really low. So — so we don’t have a plan to attack in any way and take market share. We just try to stay in. And when the market is that low, it’s better to focus on where we have some volume growth and maybe have an opportunity to just ramp up and get nice business in.

So I don’t think the timing to go after market share growth in the residential is a good one at all because I think it would just result in the price — negative price viral. So we try to take care of our market share, and then we hope that at some stage is market consumer.

Axel Stasse

Okay. Thank you very much.

Operator

This concludes our question-and-answer session. I would like to turn the conference back over to our host for today for any closing remarks. Please go ahead.

Kim Andersen

Yes, from myself and Jens, we’d like to thank you very much for the call today. I’m sorry the line broke up a little bit here at the end. If you have questions afterwards, of course, you’re welcome to give me a call. And for some of you, we will see you next week. Thank you very much. Have a nice day.

Operator

The conference has now concluded. Thank you for attending today’s presentation. You may now disconnect.