Khanchit Khirisutchalual

Funding Thesis

Albert Einstein: “In the middle of difficulty lies opportunity.”

In our view, Roku (NASDAQ:ROKU) has the potential to be one of many shock success AI tales for 2024. We all know they don’t seem to be as flashy as the AI darlings or metaverse shares. However we expect Roku’s place in streaming video adverts units it up completely for an enormous 12 months.

Allow us to stroll by way of why we’re so bullish on this firm. First off, the streaming revolution remains to be in full swing. Conventional cable TV continues to lose subscribers quickly as folks change to on-demand streaming. Roku is on the epicenter of this seismic shift, with its platform and gadgets utilized in an enormous proportion of streaming households. In order the streaming pie grows, Roku stands to seize increasingly of the market.

Now mix that core power with Roku’s superior promoting capabilities. Their AI-powered advert concentrating on platform permits for extra related, personalised, and efficient video promoting. Entrepreneurs are shifting advert {dollars} to Roku as a result of their tech improves outcomes. This can be a sustainable aggressive edge that Roku is parlaying into explosive advert income progress.

In our article, we illustrate that trying on the macro image, we expect the financial system will keep away from recession in 2024 barring any black swans. That would offer a strong backdrop for Roku’s secular progress drivers to speed up.

The one knock is Roku remains to be shedding cash because it spends aggressively on progress initiatives and increasing its platform. However we foresee the corporate enhancing profitability subsequent 12 months by tightening up working bills whereas nonetheless investing neatly.

If we’re proper that Roku strikes this improved steadiness between progress and income in 2024, the inventory might go up considerably. The market will reward earnings progress, particularly in a dangerous atmosphere. Roku has all of the substances to place all of it collectively subsequent 12 months and present its full potential. This might be the breakout second buyers have been ready for.

AI’s Impression on Promoting

In a previous piece, we talked about how synthetic intelligence is beginning to shake up the promoting trade in a significant means. AI permits advertisers to focus on their messages extra exactly to the best audiences. It permits for the automated technology of personalized advert artistic content material, tailor-made to every consumer. Additional, it’s streamlining complicated backend processes that used to require intensive guide work.

Early adopters like Baidu (BIDU), Meta (META), and Spotify (SPOT) are already seeing tangible advantages from implementing AI of their advert operations. The know-how helps them minimize prices, whereas additionally enhancing the efficiency of their advert campaigns. It successfully smoothes out a number of the inherent frictions and inefficiencies which have at all times existed in promoting. This results in a greater return on funding for advert spend.

We used Baidu as a shining illustration of how AI can optimize the finer factors of connecting the suitable adverts to the suitable customers. And when Google (GOOG) (GOOGL) revealed layoffs in its promoting part in December, that improvement served as extra affirmation of this tendency. These workforce reductions stemmed straight from AI boosting operational effectivity, as Google overtly acknowledged.

So along with enabling higher advert concentrating on and response, AI additionally confers significant labor value financial savings because it takes over sure guide duties from human staff. This illustrates how the deployment of AI is already enhancing the monetary outcomes of serious industrial members. Moreover, there’s nonetheless a ton of headroom within the know-how to deal with future challenges with way more difficult promoting. This house is being utterly remodeled by AI.

Roku’s Dominance in Streaming TV Promoting

Roku stands out to us as an intriguing firm to regulate in 2024 for a few key causes.

First, they’re dominating the streaming TV promoting sport proper now. In keeping with Comscore, Roku accounts for a whopping 38% of all US family streaming hours – that is simply insane! They’re by far the chief on this house.

As consumer viewing patterns shift, advertisers want exact marketing campaign efficiency throughout all screens to optimize spend and handle frequency. Shifting {dollars} to Streaming TV requires data-driven decision-making. A lot of this consumption happens on Roku; 38% of US family streaming TV hours are spent on Roku. Wanting 12 months over 12 months, Comscore reported a 16% improve in households viewing Streaming TV on a Roku system (2022-2023).

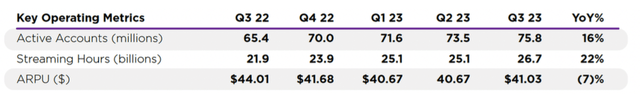

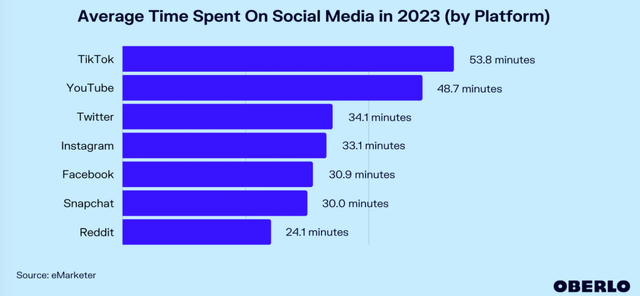

And never solely that, however Roku continues to develop at spectacular charges. In Q3 2023 alone, they grew energetic accounts by 16% and streaming hours by 22%. Individuals are clearly spending increasingly time streaming exhibits and flicks by way of Roku. The typical Roku consumer streams almost 4 hours per day now, which is extra time than folks spend on many social media apps.

Content material Partnerships and Advert Product Improvements

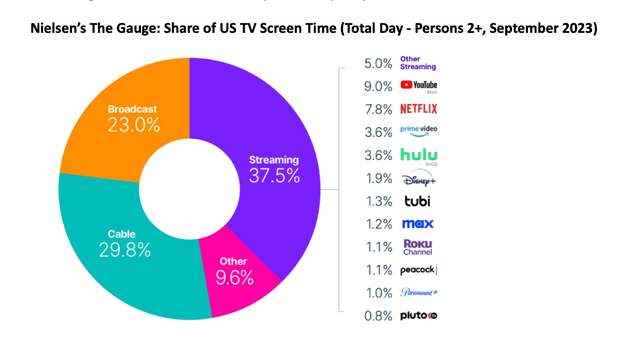

This ongoing shift from conventional TV to streaming performs proper into Roku’s strengths. Consultants estimate streaming nonetheless solely makes up about 37% of complete US TV viewing time, so there is a lengthy runway for progress forward as streaming disrupts conventional cable and broadcast TV.

One benefit Roku has is that it leverages content material from companions like YouTube, Netflix, and Prime Video, saving substantial prices on producing authentic programming. Roku additionally aggregates viewing information throughout these providers to construct a wealthy understanding of viewers behaviors from a number of angles.

The opposite key purpose we’re bullish on Roku for 2024 is their promoting merchandise. Roku has invested closely in making its advert concentrating on extraordinarily personalized and exact, utilizing superior information like location, viewing habits, and extra. As AI and machine studying tech improves, Roku is poised to take benefit and make its already stellar advert concentrating on even higher.

And whereas Roku’s advert income per consumer is at present lower than Fb’s, for instance, we expect their large engagement ranges and room for innovation with AI put them in an amazing place to drive progress in advert ARPU subsequent 12 months.

Threat

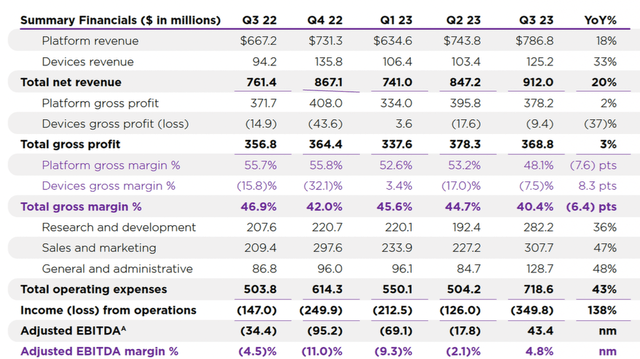

One potential concern some might have about Roku is that they’re at present shedding cash on an working foundation, pushed by excessive progress in working bills. Bills grew round 30-40% final quarter, which is admittedly fairly steep.

Nonetheless, we do not suppose this loss is simply too worrying for a couple of causes. First, Roku has already guided for a big slowdown in expense progress subsequent quarter, forecasting solely a negative mid-teens proportion improve versus 70% final 12 months. It exhibits they’re tightening the belt and changing into extra environment friendly even amidst fast growth.

Second, even with losses on the working earnings line, Roku has been money movement optimistic since 2020. So they don’t seem to be burning by way of money regardless of not being worthwhile but underneath GAAP accounting. The free money movement technology helps cut back considerations about their funds.

And lastly, it is common for high-growth tech corporations like Roku to take a position aggressively upfront to seize a management place, then concentrate on profitability later. We predict they’re nonetheless within the early phases of progress within the streaming market and have room to take a position to cement their pole place.

Valuation and Funding Potential

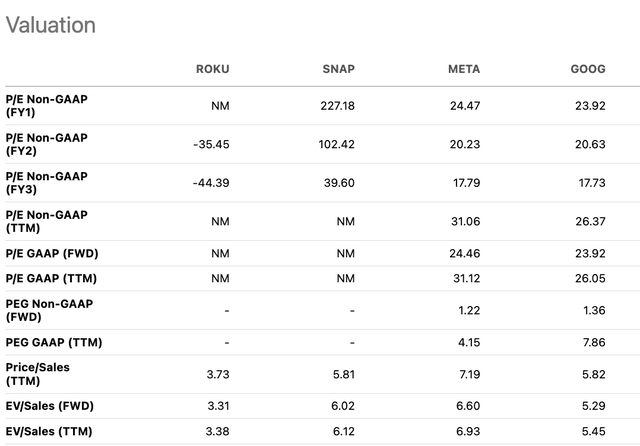

When taking a look at P/S and EV/S ratios, Roku at present trades at a reduction in comparison with different advertising-focused friends. This low cost is sensible provided that Roku is unprofitable proper now.

Nonetheless, we’re having a bet that Roku can enhance profitability in 2024 with the assistance of AI tailwinds in promoting. If Roku executes easily on utilizing AI to optimize operations and increase promoting efficiency, the corporate might begin closing the valuation hole as income materialize.

Basically, we see the potential for a number of expansions if Roku leverages AI to show the nook on profitability subsequent 12 months. Smoother execution and visual margin enchancment might rerate the inventory larger as buyers achieve confidence in Roku’s earnings progress trajectory.

The market is just not but pricing in the advantages of AI adoption. So if Roku succeeds on this entrance as we anticipate, its valuation multiples ought to elevate in response, driving upside for the inventory.

Conclusion

We view Roku favorably for a couple of key causes. First, the corporate has a dominant place within the US streaming TV market, commanding the highest view share. Second, Roku employs an asset-light enterprise mannequin, leveraging content material from companions slightly than spending closely on originals. This expands Roku’s ecosystem at minimal incremental value.

At present, Roku trades at a reduction to promoting friends due to its losses. Nonetheless, we’re assured the US financial system can proceed rising in 2024, and the promoting trade ought to profit from AI adoption tailwinds.

Given Roku’s aggressive strengths in streaming TV advert concentrating on and talent to optimize its mannequin with AI, we imagine the corporate can enhance profitability subsequent 12 months. If Roku executes properly, its discounted valuation ought to rerate larger because the market features confidence.

We like Roku’s market management, economical enterprise mannequin, and potential as an AI promoting participant. Whereas dangers exist round execution, the inventory affords a pretty upside if Roku can ship enhancing effectivity. We price Roku a Sturdy Purchase.