hapabapa

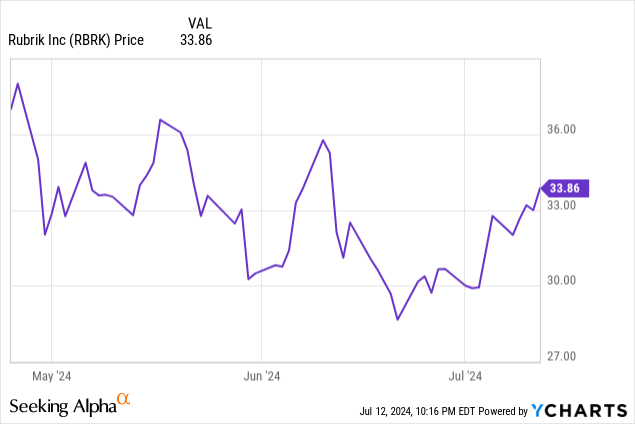

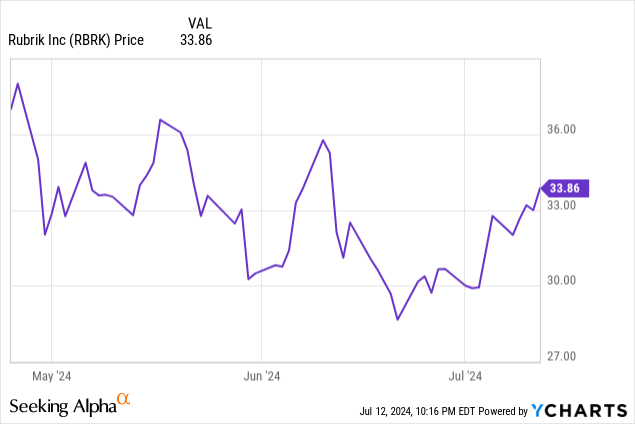

Oftentimes the phrases “great value” and “recent IPO” are not two terms that can describe the same company, least of all in the stock market of 2024. But that’s the conclusion I’ve come to on Rubrik (NYSE:RBRK), the data cybersecurity company that went public in April at $32 per share.

Rubrik popped in early trading as most IPOs do, but since then the stock has floundered, even while the rest of the market has continued to rally. It’s in this stagnant trading that I view a tremendous buying opportunity.

Rubrik is the rare stock that combines a plethora of attractive fundamental qualities: rapid growth, a path to profitability, multi-year secular growth tailwinds, alongside a reasonable valuation. Amid record-breaking market highs, I’ve been rotating more and more of my portfolio toward these names, and adding a few new, more volatile issuances to the mix can certainly help reduce my portfolio’s correlation to the broader market.

In a nutshell, here are the core reasons to be bullish on Rubrik:

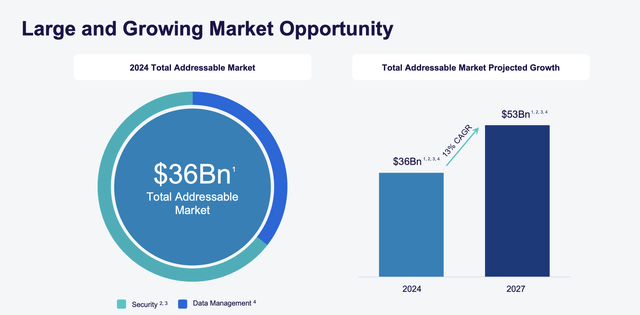

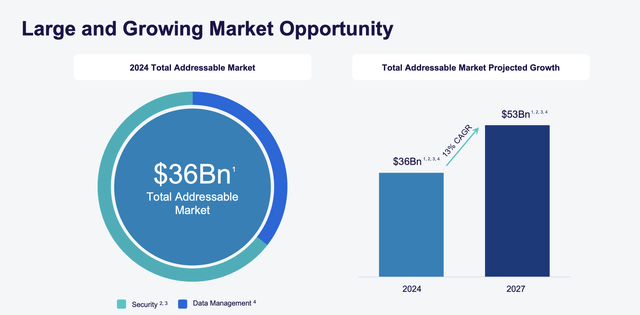

- Rubrik addresses a large and growing TAM. One of the most important rules in investing in emerging tech stocks is to ensure they’re addressing a big enough market; Rubrik amply checks this box with an expected $53 billion TAM by 2027.

- Differentiated security approach versus more recognizable security vendors today. While competitors like Palo Alto Networks (PANW) and Zscaler (ZS) focus on cyberattack prevention, Rubrik’s products are more geared toward backing up enterprise data and planning for resiliency in the case of an attack.

- Growth at scale. Despite hitting nearly $1 billion in ARR, the company is continuing to grow subscription revenue at a >40% y/y pace, a clear signal of a company that is both executing well and has a large market to attack.

- AI growth tailwinds. The foundation of AI and LLMs is large troves of data, which Rubrik’s critical competency is to back up in the case of an unexpected failure.

Take advantage of the weakness in this stock to buy.

Rubrik: a cloud-native security platform to ensure data is failsafe

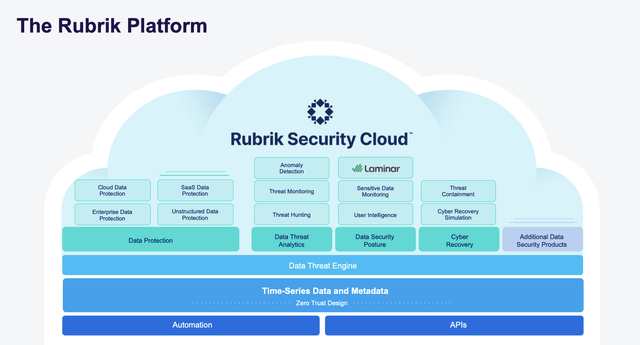

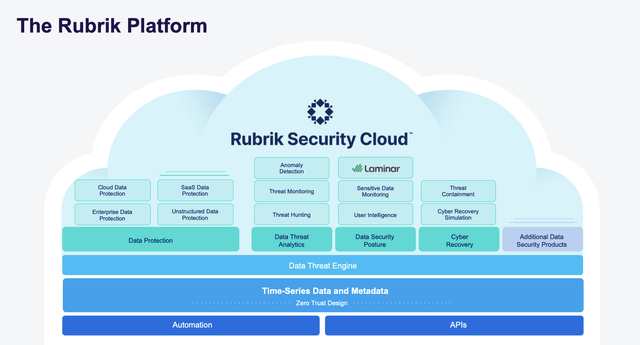

Since its founding ten years ago in 2014, Rubrik has always specialized in cybersecurity. The Rubrik security platform, as shown in the snapshot below, consists of a varied set of features and functions, but the core objective of Rubrik is encapsulated into three main categories: data resilience (ensuring data can survive an attack), data observability (monitoring the health of internal systems), and data remediation (ensuring data is clear of errors and inconsistencies).

Rubrik platform (Rubrik June investor presentation)

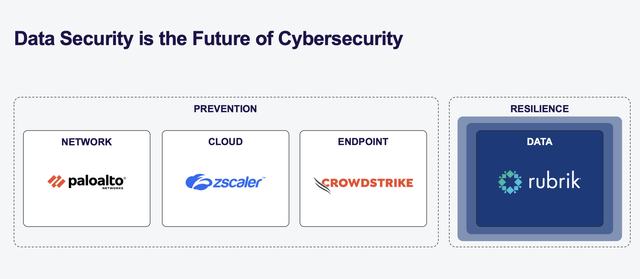

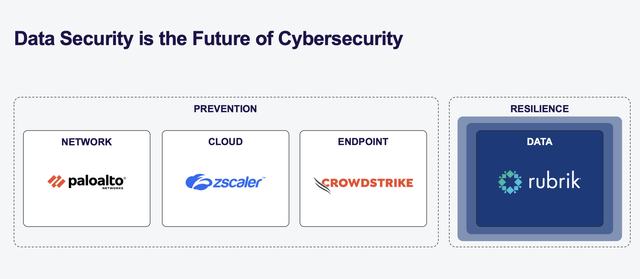

As mentioned above, though cybersecurity is a very broad field with many incumbents, Rubrik differentiates itself from its myriad competitors by focusing on resilience instead of prevention.

The chart below shows some of the most prominent names in cybersecurity. Palo Alto Networks (PANW) is perhaps the most recognizable and the oldest of cybersecurity titans, having made a name for itself in providing strong firewalls (security measures against enterprise network breaches). Relatively newer to the game is Zscaler (ZS), which provides the equivalent of firewalls but for enterprise data and assets that are housed in the cloud and in SaaS applications instead of on premises. CrowdStrike (CRWD), meanwhile, focuses on endpoint security: which is making sure that devices that house data, such as employees’ mobile phones, are protected from an attack.

Rubrik vs. peers (Rubrik June investor presentation)

The common thread across most of these names is that their products are designed to wall off enterprise assets from an attack. And while Rubrik certainly does compete with other cybersecurity vendors, its ethos of ensuring survivability and that all data is backed up is its unique selling point. Imagine if a large multinational corporation went dark for a day after a cyberattack occurred that was never supposed to happen: Rubrik is the “plan B” route.

AI is a major force in expanding this market

Needless to say, our growing reliance on the cloud and on data for every piece of the enterprise has made this a large market, which Rubrik estimates at $36 billion today and growing at a 13% CAGR annually to $53 billion by 2027.

Rubrik TAM (Rubrik June investor presentation)

It’s important to note as well that AI is a meaningful growth driver in this space for the simple reason that large language models ingest vast amounts of data. Again, in the event of an attack, AI applications would be paralyzed if the underlying data lakes were compromised.

Rubrik and Gen AI (Rubrik June investor presentation)

And as shown in the chart above, not only is Gen AI a secular growth tailwind for Rubrik, but the company has also adopted OpenAI models to build its own AI-powered product, Ruby, to automate the process of cyber resilience and recovery.

Rapid growth and a path toward closing the profitability gap

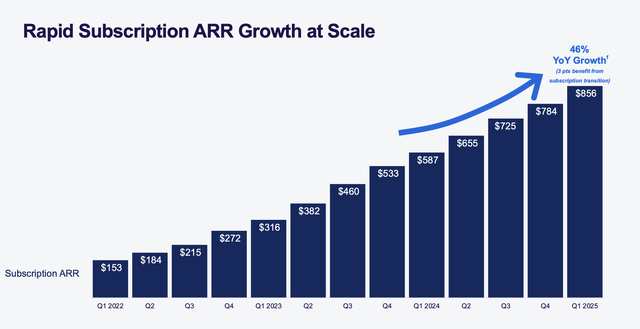

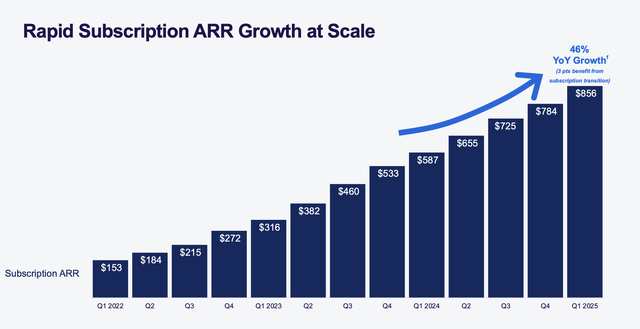

Rubrik’s financials also speak for themselves in demonstrating the company’s unique potential. Over the past several years, the company has shifted its sales model to focus on subscription licenses. The company prices like many of its competitors on a usage basis, which means that as data volumes grow, so does Rubrik’s revenue.

Rubrik ARR growth (Rubrik June investor presentation)

In Rubrik’s most recent quarter (Q1 or the April quarter, which was the company’s first earnings release since going public), the company reported 46% y/y growth in subscription ARR to $856 million. Total revenue in the quarter, meanwhile, jumped 38% y/y to $187.3 million. This came in well ahead of Street expectations of $171.4 million (+26% y/y).

Large beats on a quarterly earnings right after an IPO is usually a tremendously positive signal, as consensus has little to no guidance to work with in modeling results – and a big beat suggests that the company has a lot more potential than the markets are giving it credit for. And yet despite a successful Q1 earnings print, Rubrik’s stock still has done little but hover around its original IPO price.

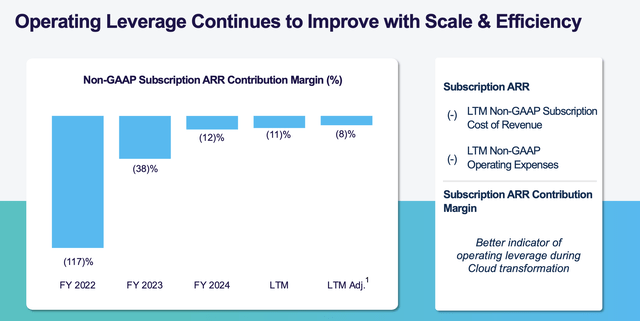

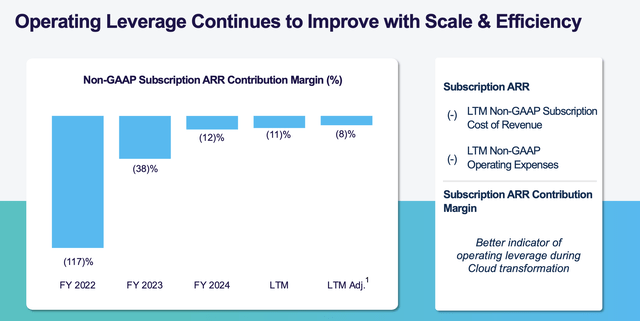

We note as well that while Rubrik is still very much a hyper-growth stock, the company is pushing comfortably toward breakeven. It measures its profitability using a more customized metric that it calls “Subscription ARR contribution margin”, which is defined as its quarter-end ARR, reduced by pro forma cost of revenue and opex (excluding stock comp and depreciation, which all software companies do in reporting pro forma metrics).

By this measure, and after netting out expenses that were specific to the IPO, the company’s subscription contribution margin hit -8% in the trailing twelve months, a vast improvement versus -38% in FY23.

Rubrik operating leverage (Rubrik June investor presentation)

We do note that likely the biggest risk investors are watching are Rubrik’s more conventional loss metrics. Pro forma operating loss in the first quarter was $93.6 million, which amounted to a -50% pro forma operating margin.

Still, in Rubrik’s defense I’d argue two points:

- At its rapid growth rates, Rubrik should be focusing on landing more subscription customers, and given the company enjoys pro forma gross margins of ~75%, a high-margin recurring revenue stream should help close the profitability gap over time

- The company has ample liquidity after its IPO to support its cash burn

Valuation and key takeaways

At current share prices near $34, Rubrik trades at a market cap of $6.10 billion. After we net off the $606.3 million of cash and $297.1 million of debt on Rubrik’s latest balance sheet (which includes IPO proceeds), the company’s resulting enterprise value is $5.79 billion.

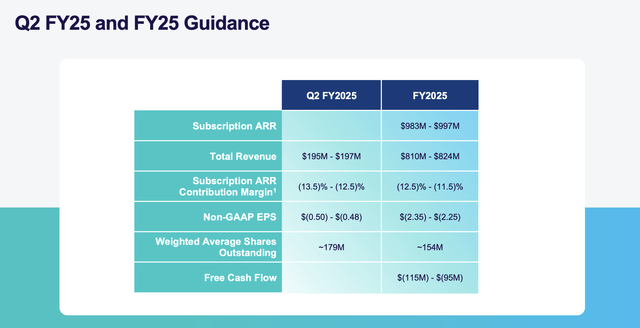

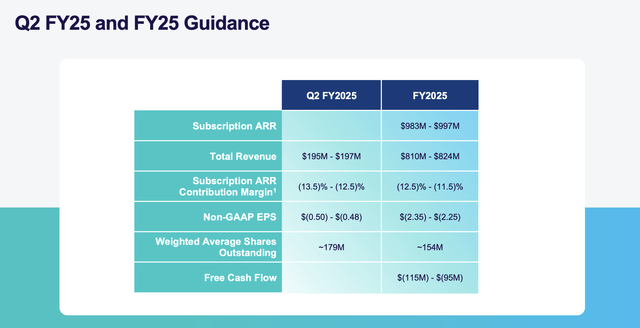

As an aside: Rubrik’s operating cash burn in Q1 was -$31.4 million; and including $3.6 million of capex, free cash flow burn was -$35.0 million. At this burn rate, Rubrik has enough cash on its books to last at least four years even without improving loss margins (or roughly two years if we net debt off against its cash). We note that Rubrik’s guidance for the current year calls for a burn range of -$95 million to -$115 million, which is slightly better than its most recent -x$35 million in quarterly burn.

For the current fiscal year, from a revenue standpoint Rubrik has guided to $810-$824 million, which represents 29-31% y/y growth. Meanwhile, consensus is calling for $1.05 billion in revenue by FY26 (the year ending in January 2026), or 29% y/y growth against the midpoint of Rubrik’s current-year guidance.

Rubrik outlook (Rubrik June investor presentation)

This puts Rubrik’s valuation multiples at:

- 7.1x EV/FY25 revenue

- 5.5x EV/FY26 revenue

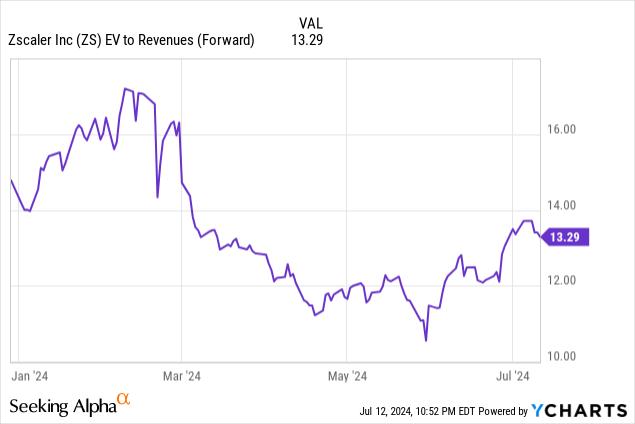

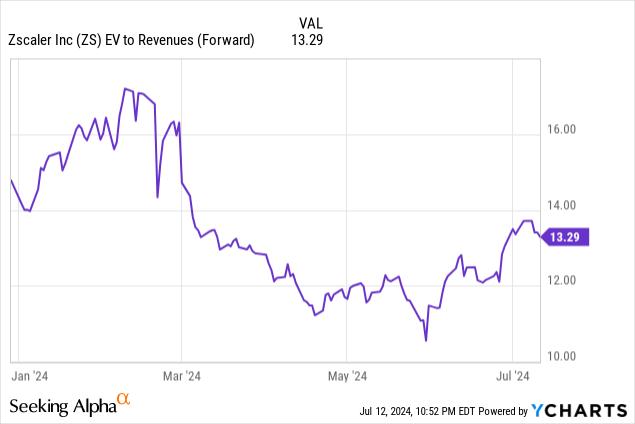

We note, meanwhile, that direct peer Zscaler, which is also growing revenue at a ~30% y/y clip, trades at a low-teens revenue multiple:

While we have to give credit for the fact that Zscaler is profitable whereas Rubrik is currently generating bigger losses, it’s difficult to believe that this is worth ~double the valuation for Zscaler.

We should carefully monitor that Rubrik continues to make progress on reducing its operating losses, but its tremendous subscription ARR growth at high margins should naturally drive improvements over time. This is a tremendous buying opportunity in this recent IPO.