Dan Kitwood

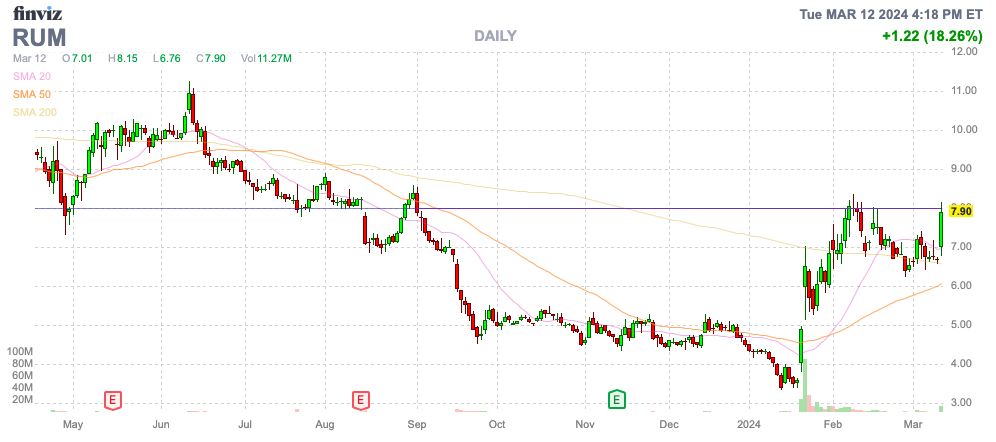

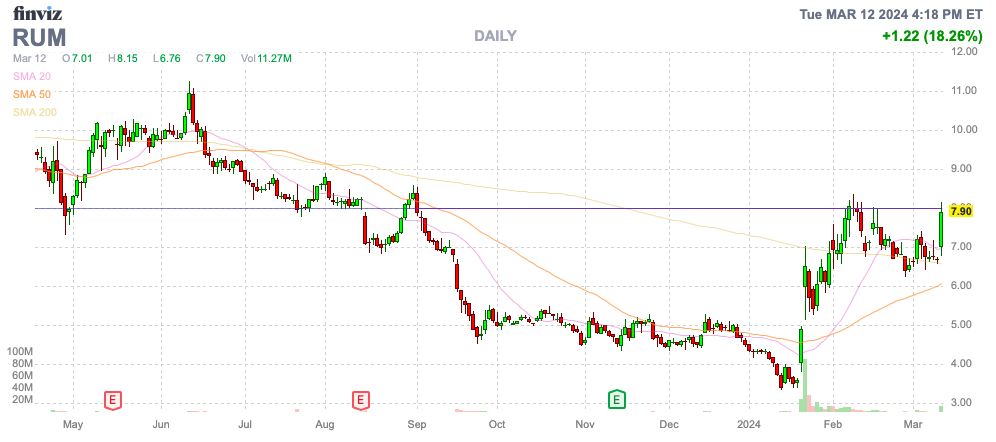

Rumble Inc. (NASDAQ:RUM) has been on a tear since asserting a partnership with Barstool Sports activities again in January. The video platform has longed introduced huge content material partnerships, however the firm has paid aggressively to amass expertise, resulting in combined monetary outcomes. My investment thesis is extra Impartial on the inventory after the surge to $8 primarily based on some hype surrounding a possible TikTok pressured divestment.

Supply: Finviz

Extra Hype On Rumble

Over a 12 months in the past, Rumble surged on the corporate reportedly providing a $100 million contract for Joe Rogan to hitch the platform. The inventory finally hit a low of practically $3 practically 2 years later when no deal materialized and the present remained on Spotify (SPOT)

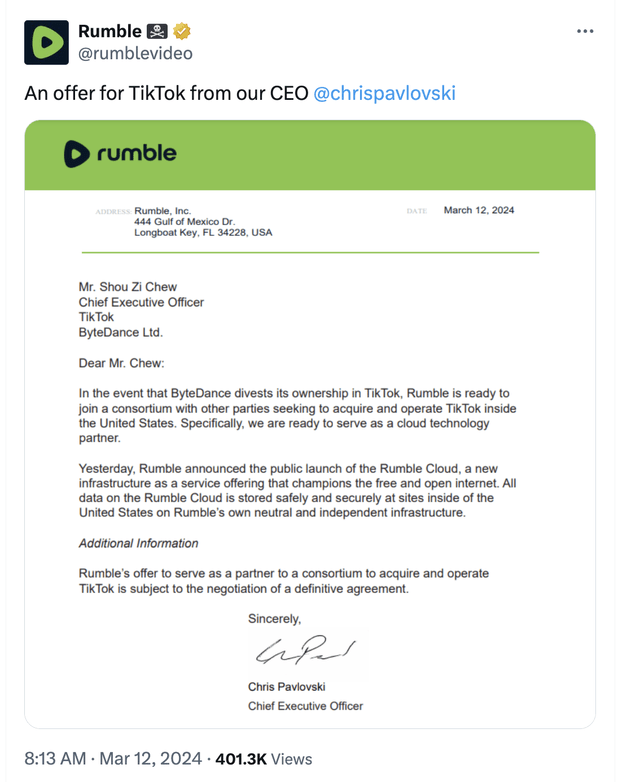

Rumble surged 20% yesterday on information of the corporate posting on Twitter/X a proposal to work with ByteDance (BDNCE) on a divestment plan. The corporate simply launched Rumble Cloud, providing a safe cloud service with information saved safely and securely at websites within the U.S. to eradicate the U.S. authorities issues with the CCP having visibility to consumer information within the U.S.

Rumble wasn’t even value $2 billion earlier than the provide was introduced, and ByteDance is valued at practically $90 billion, questioning the probability of such a partnership. Rumble Cloud is extremely unlikely to seize such a big enterprise for a cloud service that simply launched.

In addition to, Oracle (ORCL) had a deal to grow to be the cloud supplier and management the enterprise together with Walmart (WMT) for the home model of TikTok. The corporate simply reported cloud companies progress of 25% YoY to succeed in $5.1 billion in quarterly gross sales.

Keep in mind, this original deal with Oracle occurred again when President Trump was working to dam U.S. information from being despatched to China for the CCP to overview. The probability of the U.S. authorities forcing ByteDance to divest TikTok appears low, and the chances of Rumble changing into a companion in such a deal is much more minute.

Contemplating Fact Social remains to be listed because the prime buyer for Rumble Cloud, the enterprise has an extended option to go to ramp as much as the dimensions wanted to accommodate the large site visitors wants of TikTok.

Barstool Sports activities

Rumble is ready to lastly report Q4 ’23 results post-market on March 27. The market focus ought to be on the Barstool Sports partnership way over any out-of-the-blue potential take care of TikTok.

The video platform introduced the partnership with Barstool Sports activities again on January 22. The favored sports activities model was listed as having 1.6 billion podcast downloads.

As of right this moment, Barstool Sports activities solely has 23K followers on Rumble. The sports activities model has 5.7 million followers on Twitter/X, with one other 1.7 million subscribers on YouTube with sports activities persona and CEO Dave Portnoy having 3.1 million followers on Twitter alone.

In essence, the partnership is optimistic, however Rumble hasn’t precisely offered the main points on the deal. Different content material creators included income ensures for an preliminary interval till income monetization ramps up.

Dave Portnoy posted a video on Rumble on March 12 (Davey Day Dealer) with 75 likes presently. The movies had been spliced on Twitter with as much as 1 million impressions and hundreds of likes, making the engagement ranges so minimal on Rumble in comparison with different platforms.

The one analyst estimate predicts This autumn ’23 revenues of $28 million for over 40% progress. With Q1 practically over already, the pure focus will probably be on the commentary surrounding these numbers and any enhance from the addition of Barstool Sports activities to the platform, although the engagement numbers up to now are unlikely to warrant a lot of a lift to revenues.

Together with Rumble Cloud, the launch of Rumble Studio and Rumble Promoting Middle, or RAC, the corporate ought to see a lift in content material with creators now in a position to make use of Rumble to distribute livestreams to different platforms and monetize advertisements on the identical time. Sadly, a lot of the content material creators on Rumble have small consumer bases attributable to content material nonetheless being distributed on different platforms, decreasing any want for viewers to go to Rumble.

The corporate ended the final quarter with a cash balance of $267 million, and traders will clearly watch the outlined path in the direction of decreasing money burn from additional monetizing present content material creators to scale back the assured fee ranges. Rumble has all the techniques in place to totally monetize content material with the brand new sponsorship alternatives and pre-roll advertisements on movies together with subscription choices, highlighted by the $7.5 million earned on subscriptions by Steven Crowder.

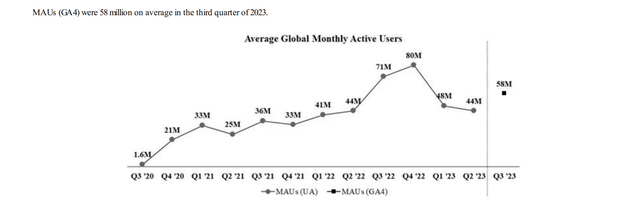

Rumble ought to see a giant 2024, with a excessive deal with political content material and the 2024 Presidential election in November contributing to progress. The video platform noticed document month-to-month energetic customers, or MAUs, of 80 million throughout This autumn ’22 because of the mid-term elections.

The market cap jumped to $2.2 billion on the TikTok information. Rumble will not even method $100 million in revenues for 2023, making the inventory valuation in all probability considerably stretched right here.

All the new content material offers and up to date techniques ought to result in important progress in 2024. An investor in all probability should not leap into the inventory following this double off the lows, although Rumble has each cause for achievement this 12 months.

The key lingering difficulty is whether or not the corporate can absolutely monetize all the new content material offers. As Rumble highlighted again through the SPAC presentation, the corporate solely must monetize the present consumer base at ~$1 monthly, a fraction of the $5+ ARPU of YouTube, with a view to produce revenues within the $700+ million vary.

Takeaway

The important thing investor takeaway is that Rumble Inc. is extremely unlikely to be concerned in a take care of TikTok. Buyers should not chase RUM inventory right here at $8, however the on-line video platform seems aligned for a giant 2024.