BlackJack3D/iStock via Getty Images

Dear Co-investor

The SaltLight Worldwide Flexible Fund is off to a good start this year, with a +9.2% return in the first quarter of 2024. We had contributions from our ‘Distressed 5’ SA portfolio, AppLovin (APP) and our Offshore Oil exposure.

In this letter, we discuss general portfolio updates, pontificate on ‘self-healing’ as a thesis, delve into the offshore oil supplier opportunity, and review a few members of our ‘Distressed 5’ South African businesses.

Portfolio Update

Over the past six months, we’ve observed increasing divergences within our portfolio. Our investments in AI Infrastructure from three to four years ago have performed admirably for us; however, we became concerned with their high valuations and have pruned them significantly. The remaining portfolio is demonstrating solid underlying momentum, which is a reason for optimism for future returns.

Back to the AI Infrastructure investments. Why Sell? Our initial thesis was that AI infrastructure was the optimal path to participate in the early phase of this new technology epoch. We think this idea has been largely validated, and these previously ‘unknown’ companies are now widely admired and exalted in the general zeitgeist. Nvidia (NVDA) earnings now have a two-day countdown on CNBC, and even 60 Minutes has released an Nvidia story.

We caveat that such situations are fraught with the risk of being temporarily accurate but wrong long-term. For one, we don’t know how significant this opportunity could be, and second, we don’t know who the businesses that will capture the long-term value are. But history has taught us that the early predicted ‘winners’ rarely take the final trophy. The quantum of capital being deployed into AI venture capital is staggering.

These reasons alone don’t make a good reason to sell, but high valuation multiples force us to make very narrow predictions about the prospects of these few companies. We’re nervous about being in this position when we think the distribution of outcomes in the AI opportunity is wider than the market implies.

As market participants start to focus on the roll-up-the-sleeves matters to achieving broad-based AI adoption, they might become despairing about several hurdles to be overcome, namely rising energy constraints, the arduous task of AI adoption in enterprises (to use their domain data), and the step-change in AI unit economics compared to general computing.

Financial markets often mercilessly puncture a hole in the dreams of even the most exhilarating economic visions. Present valuations do not allow for even the slightest bump in the road; consequently, we’re taking our chips off the table until a better opportunity comes.

Meanwhile, the other areas of our portfolio are beginning to validate our original investment theses. In our 2023 year-end letter, we had a hunch that 2024 was shaping up to be a fruitful year for many of our investments, notably our ‘Distressed 5’ South African companies.

With South Africa on the cusp of crucial elections in May, the air is thick with uncertainty. Despite navigating significant macro and political uncertainties, our portfolio companies are showing promising signs of ‘self-healing’, a dynamic we will delve into more deeply within this letter. If two or three execute well on their path, we should earn respectable returns on our capital.

The last notable modification is that we’ve increased our investment in China. We’ve been wrong on the macroeconomic outlook for a long time. In 2021, it was our largest detractor, and we paid dearly. Despite this, our investment in Pinduoduo (PDD) over the years has generated sufficient returns to exceed the capital loss from the rest of our Chinese companies. We’ll highlight our investment in Tencent (OTCPK:TCEHY) (and Prosus) later.

Self-Healing as a Thesis

There has been increasingly hushed chatter in investing circles about how passive investing has altered the investment landscape in public markets. Prominent value investor David Einhorn recently confronted what many have been thinking – provocatively declaring: “The market is broken”.

In a nutshell, his view is that the number of active managers is dwindling, and those that have remained are sticking to the safe waters of passive index constituents (i.e., well-followed large caps). This leaves a swath of the public markets (namely, small and mid-caps) capital-starved with the prospect that these companies could be in a state of perpetual undervaluation. As a result, Einhorn contends that the ‘game of investing’ has been radically altered.

We tend to sympathise with Einhorn’s views. Yet, we’ve still found compelling opportunities in this financially dystopian world. We’ve adapted our approach because of some hard-won lessons. Valuation discounts can remain persistent until there is a countervailing force to overcome ingrained inertia.

We’ve adapted by focussing on two critical investment criteria:

As humble investment managers, we must play the ball where it lies rather than become romantic about how the world should be. But we do have a personal gripe with current conditions. Suppose you have a promising emerging company that can earn high incremental returns on capital. In that case, it should invest more in these opportunities to grow(!!) rather than repurchasing its undervalued shares.

For the brave few who opt for growth and require external funding, accessing growth capital without resorting to costly dilutive equity is often a struggle. This capital constraint starves oxygen from their growth trajectory, preventing them from evolving into the next generation’s large caps.

Einhorn makes another critical point. Passive investors don’t engage with management teams about lax corporate governance and ill-thought-out strategy. In a way, large caps operate in an unchecked existence. What remains are bloated incumbents, free from predators, living off abundant and inexpensive capital. This is not capitalism!

For many smaller companies, this situation becomes untenable – the vexing reality of obscurity crushes their original public company dreams of broad-based notoriety and generous valuations. In despair, they turn to the consoling and welcoming arms of private equity (PE) buyers with large institutional capital backers.

The PE proposition is indeed alluring. Large alternative managers can offer jilted prospects with ample long-duration equity capital, a gateway to covenant-light private credit and deep operational expertise. It’s a tough siren song to ignore.

Einhorn is right. Active managers in these sectors used to play a vital role in fostering entrepreneurial growth. We shouldn’t let this essential function die.

Now, let’s go back to how we are finding opportunities. We wanted to walk you through a few companies in our portfolio engaged in ‘self-healing’: Tencent (Prosus), Offshore Oil Services, and ‘Distressed’ 5.

During the quarter, we reinvested back in Tencent (and proxy Prosus) primarily because we’re observing another pattern from our playbook that we cited in our last letter: the idea that advertising is a helpful ‘switch’ that can be ‘turned on’ to enhance margins when they’re required.

Tencent’s WeChat is used daily by 1 billion people in China. Still, Tencent has historically under-monetised the advertising potential of its vast social network, relying on in-game purchases and fintech take rates. Then came TikTok (Douyin in China), where engagement was determined not by what your friends were doing but through an omnipotent algorithm delivering personalised short-form video content. Social network effects became less relevant, and eyeballs moved elsewhere.

Seeing this as a competitive threat, Tencent launched its own short-form video—much as META had done through Reels. Similarly to Facebook and Instagram, with Tencent’s daily ubiquity and existing network effects, video took off rapidly as a complement to engagement time. Once they reached a sufficient scale, management started monetising the content[1].

Our thesis is that AI is likely to enhance the opportunity by 1) improving video engagement through surfacing more personal content to users (providing more monetisable ad inventory) and 2) improving ad targeting (more relevant ads that lead to higher click-through rates) in the same way it has benefited AppLovin and Meta Platforms.

Independent of AI. If Tencent gets these elements right, each is combinatorial to growing profitability, but AI is a force multiplier.

Despite this positive backdrop, Tencent’s promising narrative is somewhat overshadowed by broader negative sentiment towards Chinese investments, which has pressed Tencent’s valuation multiples to historically low levels. In this environment, Tencent is compelled to self-heal. In response, Tencent is deploying its increasing profitability by returning capital to shareholders by boosting dividends by 42% and doubling its share repurchases over the coming year.

There is a financial link to its shareholder Prosus here. In the past, Tencent’s repurchases had little impact on their share price and were primarily a mechanism to ‘sterilise’ share sales from Prosus in its own value unlock programme[2]. We think there is a good chance that Prosus will also step up its own repurchases.

To give some sense of the scale of the repurchases, Prosus’ market cap is $75bn, and Tencent has announced $12bn in repurchases over the next year.

You’ll notice that our thesis does not rely on Chinese macroeconomic conditions. We think a combination of ‘self-healing’ and low valuations should generate a favourable return for us.

Offshore Oil Suppliers

Over the years, some of our most rewarding opportunities have come from asymmetric opportunities, where the price-inferred odds and outcomes are in a lopsided distribution divorced from reality.

Early last year, our friend Shai Dardashti shared an instantly compelling idea in offshore oil suppliers that presented asymmetric payoffs without requiring substantial capital at risk. However, there was an ideological challenge: we typically avoid commodity-based businesses due to their poor track record in creating shareholder value. Yet, this offshore oil opportunity was unique for commodity companies—it boasted a transitory moat that, we believe, could last five years.

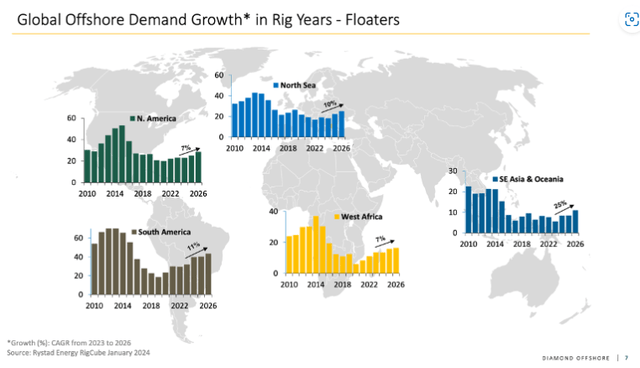

Offshore oil suppliers are in a temporary goldilocks period. Typically, a large oil company will be contracted to handle the project in offshore oil exploration and production. They require the help of support vessels in the back to handle much of the lugging of materials and personnel. During the contracting process, they are stereotypically an afterthought in the economic equation because they represent a small part of the contract value. Vessels are paid a day-rate, and the chief contractor does not take the risk of idleness or geographic repositioning – unless there is a shortage of vessels and capex is rapidly picking up.

We initially invested in a basket of offshore oil supply companies—including oil jack-ups, platforms, drill ships, and offshore service vehicles (OSV)—that were trading at a fraction of replacement value in a market that has been in terminal decline for nearly a decade.

These offshore support businesses do not have a robust history of shareholder returns and are subject to the boom and busts of the oil sector. The last offshore oil bull market ended around 2014 – primarily due to the rise of the US shale industry. From 2014 to 2021, offshore oil investment fell by 60% and consequently, almost every public oil services company went through some form of bankruptcy or reorganisation in the subsequent years (ouch!).

During COVID, with little travel happening, the oil industry was brought to its knees (you might recall that oil futures went negative at one point, meaning they were paying investors to take the oil).

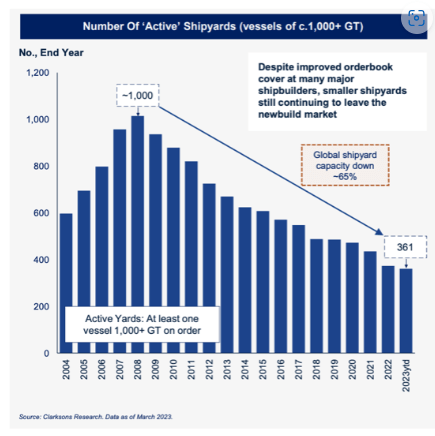

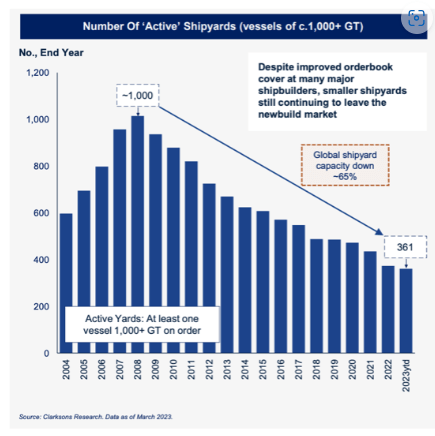

When we began researching the opportunity set, we found that these companies had all been restructured, some carrying minimal debt. The scars from bankruptcy were front of mind; therefore, leashes were being kept tight on management taking any financial risk. Moreover, the supply of new offshore oil assets was significantly curtailed due to the shutdown of global shipyard capacity during COVID-19. Although oil prices had recovered somewhat due to the war in Ukraine, ESG policies had curtailed funding for oil projects, and inflation had jacked up the cost of building a new ship.

In summary, we were looking at an ageing fleet of specialised assets (not every vessel can be repurposed for offshore oil operations), conservative balance sheets, and decade-low investment in oil.

We acquired our stakes at 3-4 times cyclically low EBITDA, with the businesses valued at only 25%- 35% of the replacement cost of constructing a new ship or rig. The opportunity was as asymmetric as they come, and our thesis was that should there be an uptick in oil exploration demand, these companies would temporarily become price makers rather than price takers.

Historically, the seeds of these companies’ downfall are sown when offshore oil capex booms. The industry responds by heavily investing in contracting new vessel builds. This scenario played out in 2013-2014. There was a lead time to build a vessel, and by the time US fracking became dominant, many of these new builds were no longer economically viable.

This situation is different today. At this early stage in the cycle, legacy debt investors are still prominent on the shareholder register. Management has been incentivised to prioritise free cash flow over investing in new assets, and we are perfectly content with this.

Whilst debt is manageable (our remaining holding has little net debt), the stronger players are starting to consolidate the fragmented, sub-scale operators. Additionally, offshore oil capex is expected to rise in the coming years, and day rates are still below levels that economically justify new builds.

While initially buying a basket, we have consolidated our capital into one company that we believe will generate substantial returns due to its management team, industry position and scale. Since our investment, free cash flow has increased substantially, and despite this growth, its valuation remains depressed. Thus far, we have realised extremely satisfactory returns on our capital.

Distressed 5

Transaction Capital (TCP) completed its spin-off of WeBuyCars (WBC) during the quarter – an event we’ve written about many times. We’ve previously expressed our belief that WBC has ample room to grow over the next few years. The market often misunderstands the dynamics of “aggregators” and, as a result, underestimates WBC’s potential value. Through economies of scale, aggregators tend to capture significant portions of the “industry pools of profit.” Our research of other aggregators across various industries bolsters our confidence in maintaining our position in WBC.

The forthcoming year presents a particularly intriguing opportunity with the remaining TCP ‘rump’, which includes Nutun and the troubled SA Taxi. In our fourth-quarter 2023 letter, we posed a critical question post-unbundling:

“What becomes of the remaining TCP business? Lenders no longer have leverage over the holding company through HoldCo debt cross-default clauses. Theoretically, if SA Taxi lenders choose not to support debt-rollover relief, TCP could simply put SA Taxi into business rescue in an orderly process rather than the voluntary workout process they’re following at the date of writing. We’ll know in two months how things will look post-unbundling.”

We hypothesised that a contingent of investors (retail and wealth managers) would likely want to own the ‘clean’ and ‘exhilarating’ WeBuyCars business over TCP’s complex, troubled remains (likely to avoid the complications of explaining a potential credit event to their clients). True to expectations, we observed a rapid sell-off of TCP shares post-spin-off.

This is a classic spin-off special situation, so we increased our holdings. Over the years, engaging in such spin-off opportunities has yielded excellent, non-correlated returns for us. While the timing of these developments can vary, often taking 6-12 months to unfold, each situation is unique. The next significant catalyst will be clarity around the SA Taxi debt situation[4].

Blue Label Telecoms (BLU) continues its path of self-healing. BLU announced that it received approval from the Competition Commission to take control of Cell C. This is a subtle but essential development to unlock shareholder value. The remaining impediment is the telecoms regulator.

Despite BLU trading at single-digit multiples of its core business earnings, investor interest has been subdued. A significant reason for this hesitancy is the complexity associated with Cell C—an overhang that has muddled BLU’s financials and made the business difficult for investors to understand. For many, this places BLU in the ‘too hard’ pile, leading to its neglect.

Gaining “control” of Cell C should simplify matters considerably. Once Cell C is consolidated into BLU’s accounts, the financial statements will become less complex and feature a manageable external debt balance.

The transformation under the new management at Cell C cannot be understated. They have shifted the business from a seemingly hopeless situation to one where merely achieving a break-even point would be sufficient for BLU to prosper.

Additionally, Cell C’s management has renegotiated their roaming agreement with MTN on very favourable terms, reducing cash burn and positioning Cell C for growth as a wholesaler of mobile communications.

The consolidated external debt position is the last remaining piece of the puzzle that must fall into place. During the Cell C recapitalisation, lenders leveraged BLU’s robust core business as credit enhancement to offset their risk. This strategy, while necessary, imposed a substantial debt load on BLU, a point that continues to be a significant concern in the market. However, what seems underappreciated by the market is the expected repayment of this debt by the third quarter of this year. This repayment milestone is crucial as it would improve BLU’s balance sheet and restore management’s capacity to undertake shareholder-friendly actions, such as share buybacks or dividend distributions.

Assuming Cell C reaches a point where it no longer has a negative operating cash flow, BLU stands to generate significant excess free cash flow (FCF). Given the current stock valuation multiples, BLU could aggressively repurchase shares, potentially reducing its share count by a substantial margin within 3-4 years. This scenario would demonstrate a solid financial turnaround and enhance future profitability, making BLU an increasingly attractive investment for current and potential new investors. Such an event could recalibrate market perceptions and spotlight BLU as a compelling comeback story in the telecom sector.

As we always remind investors, most of our liquid wealth is in the same fund as yours. We share in the inevitable ups and downs right with you. Please feel free to reach out if you have any questions.David EborallPortfolio Manager

|

Disclaimer Collective investment schemes are generally medium to long-term investments. The value of participatory interest (units) or the investment may go down and up. Past performance is not necessarily a guide to future performance. Collective investment schemes are traded at ruling prices and can engage in borrowing and scrip lending. A schedule of fees, charges, minimum fees, and maximum commissions, as well as a detailed description of how performance fees are calculated and applied, is available on request from FundRock Management Company (RF) (PTY) Ltd (“Manager”). The Manager does not guarantee the capital or the portfolio’s return. The Manager may close the portfolio to new investors to manage it efficiently according to its mandate. The Manager ensures fair treatment of investors by not offering preferential fees or liquidity terms to any investor within the same strategy. The Manager is registered and approved by the Financial Sector Conduct Authority under CISCA. The Manager retains full legal responsibility for the portfolio. FirstRand Bank Limited is the appointed trustee. SaltLight Capital Management (PTY) Ltd, FSP No. 48286, is authorised under the Financial Advisory and Intermediary Services Act 37 of 2002 to render investment management services. Footnotes [1]Currently, Ad load on Tencent’s platform remains at a measly 3% whereas Western counterparts sit at ~10%. [2]Prosus is selling down its 33% investment in Tencent and using the proceeds to buy back Prosus shares trading at a hefty discount. [3]Source: link [4]As long as the TCP holdco has no further obligations other than the Santaco BEE Deal equity cure (~R285m) we think some certainty – good or bad – would unlock value. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.