Torsten Asmus

Dear Co-Investor

Fund Return1

| 2020 | +3.42% |

| 2021 | +18.09% |

| 2022 | -34.25% |

| 2023 | +30.82% |

| 2024 | +63.24% |

| 2025-1st Quarter | +2.70% |

The SaltLight FR Worldwide Flexible returned +2.70% in 1Q25. While short-term market. volatility often grabs headlines, our focus has always been set firmly on the horizon, specifically, what the world could look like in 2030. Volatility can be unsettling, but it also presents opportunities to invest in exceptional businesses at attractive prices.

Our primary approach to investing in the unknown is to apply Bayesian thinking to a set of hypotheses. These hypotheses are continually updated as new information becomes available. With each new piece of evidence, one must ask: Does it confirm or disconfirm our initial thinking? Our letters often follow a similar approach. We wrote some hypotheses a while ago and are updating co-investors on whether the events are confirming or disconfirming them.

In this letter, we’ll cover recent investment activities, update you on our long-term Al thesis, revisit our ever-evolving e-commerce margin theme, and provide a significant update on Blue Label Telecoms. We aim to keep things both insightful and refreshingly jargon-free. Frequent readers accustomed to our lengthy tomes may be surprised by the brevity of this letter.

Investment Activity

To set the stage, before the recent “tariff tantrum,” our U.S. exposure was approximately 32% (as of 4Q 2024). Part of the reason was that we identified some excellent opportunities in China, Southeast Asia, and Europe. However, Mr Market, in all his capricious wisdom, occasionally tosses bargains our way. Nvidia’s (NVDA) once-lofty valuation dropped back into compelling territory, prompting a cautious but determined rebuild of our position.

This recalibration was deliberate. While we’ve remained cautious about Al infrastructure, preferring Al software instead, opportunities like these remind us why patience is an investment manager’s favourite virtue (though admittedly, a good sense of humour runs a close second).

Al Opportunity, Agents and Nvidia

Our conviction remains that artificial intelligence is not just a product–it’s a transformative, multi-decade opportunity. Why such confidence? While evidential data matters, our most successful theses often start as a clear, simple insight about how an idea reshapes the status quo. In the case of Al, the shift is straightforward yet profound: traditional software, limited by its deterministic human-written code, is inherently “dumb.” However, with a few lines of code, a good prompt, and useful data, Large-language models (LLMs) unlock the ability for software to plan, reason, and self-correct..

Think of your coffee machine, traditionally limited to two binary actions: on or off. Today, with a good wi-fi connection and a small microprocessor, it can become smart enough to anticipate your morning routine, and lazy enough to give you extra sleep on Sundays.

Now, we’re making a deadly simple case here. Where we are heading is that we think “intelligence” will be embedded in all software applications, much like web connectivity was two decades ago. *Everything*–appliances, devices, and PCs – will likely be upgraded. From our perspective, the investable opportunity is not the devices (although perhaps another Apple moat is born), but rather the application and infrastructure layer that serves this intelligence.

Things are advancing quickly: the latest generation of Al platforms takes this even further; now you merely specify the task, and the agent dynamically writes the necessary code on the fly. Looking ahead, this sets the stage for low-cost Robotics -a topic for another day.

One emerging thesis that we reflected on in our last letter was the concept of Al Agents. We believe there are good odds that agentic Al will initiate the productivity gains necessary to sustain this Al Epoch. Reasoning Large Language Models (LLMs) coupled with multi-step agents will likely assist cloud providers, who have spent billions on capital expenditures to build out Al infrastructure, in finding a viable pathway to monetise their substantial investments.

So far, the thesis appears to be playing out: This quarter, all cloud providers have released their own versions of Al-agent software development kits (SDKs)-a logical move, as these agents drive significantly higher API usage than traditional chatbots.

Our internal experience has shaped our thinking: integrating Al agents into our research process, alongside our internal data, has undoubtedly enhanced productivity and yielded a high return on investment once implemented. While our Al variable costs have increased substantially, they remain remarkably lower than the cost of human talent for equivalent tasks.

If our own experience is anything to go by, we anticipate strong enterprise adoption of AI agents. Yet, the journey won’t be straightforward. A significant hurdle is that many enterprises still operate their own on-premises data centres rather than using cloud infrastructure. For AI agents to deliver their full value, they must access internal company data. Enterprises, therefore, face a grave decision: either migrate their IT infrastructure to the cloud or invest heavily in building dedicated Al-optimised data centres (that, today, will likely be powered by Nvidia products). Now, even if they could obtain servers, only mega-size companies have the resources to pursue this latter route.

Over the coming months, we anticipate a new wave of advanced Al product launches, driven partly by the widespread rollout of Nvidia’s latest hardware generation. Nvidia’s Blackwell series offers a 30-fold improvement in inference performance compared to the earlier Hopper series. Such a leap forward will likely reignite widespread enthusiasm and excitement, reinforcing AI’s prominence in the broader Zeitgeist.

Another area that continues to drive returns is our thesis on e-commerce margin expansion.

E-Commerce Margin Expansion

Two years ago, in our 3Q23 letter, we made the case that we thought our e-commerce investments would start to show higher margins. At the time, we hypothesised that advertising would be the tool to do that. Back then, we wrote:

“In many cases, a business with a sufficiently large customer base can have a low margin core product and then monetise it with high-margin advertising. Digital advertising generates high incremental margins (as high as the ∼80% level). The low. margin product can almost become the customer acquisition cost, and the ‘real’ business becomes advertising. This strategy has proven effective across a broad spectrum of industries, from e-commerce at Amazon, MercadoLibre, and Shopee”

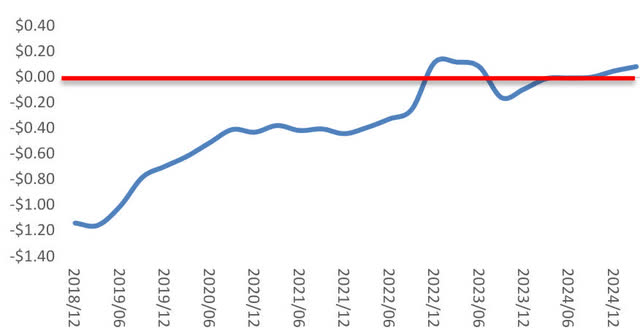

Sea Limited (SE) continues to demonstrate excellent top-line revenue growth and expanding margins. Their e-commerce business is now EBITDA profitable across all regions. Sea has gone from losing $1.20 EBITDA per order to making $0.09 per order.

Now, a 9c profit per order doesn’t sound like much, but in 2018, Shopee processed 200 million orders per quarter, and last quarter, they reached 3.1 billion orders. They’re arguably the dominant player in the region, with a relatively benign competitive environment.

Shopee – EBITDA per order $

We were somewhat correct that advertising and logistics scaling up contributed to this result. However, credit and payment services have also become a meaningful driver of margin expansion.

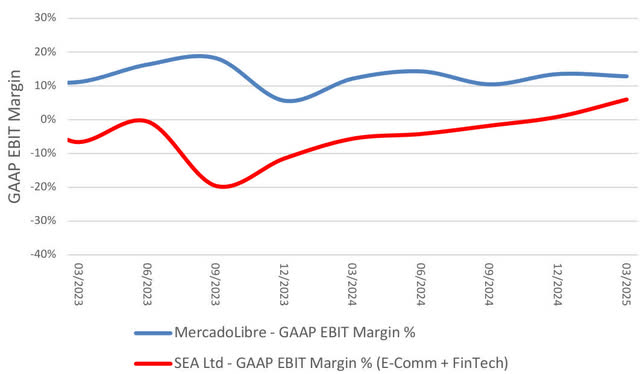

Sea’s fintech business (recently rebranded as Monee) echoes MercadoLibre’s playbook in Latin America. The e-commerce business is used as a low-cost ‘customer acquisition’ funnel. From there, they have introduced a mobile wallet, deposits through their banking licenses, and credit (as well as buy-now-pay-later) lending. MercadoLibre has established a robust merchant acquiring business and offers low-cost payment terminals throughout the Latin American region. We believe this presents a potential opportunity for Sea to replicate this success in the years to come.

MercadoLibre’s margins expanded rapidly after introducing its fintech business, offering a glimpse of what SEA’s trajectory could look like.

MercadoLibre vs Sea Ltd E-Commerce And Fintech EBIT Margins (GAAP)

Apart from the healthy e-commerce and fintech businesses, Sea has also successfully reinvigorated its gaming business as the Free Fire franchise is showing steady growth again. We were quite surprised by management’s recent announcement of “Free City,” an ambitious mobile game inspired by Grand Theft Auto?. We suspect that announcing the game at this early stage to investors is indicative that they think this game could be a “hit”

Value Unlock at Blue Label Telecoms.

Our investment in Blue Label Telecoms (BLU) has significantly advanced since 2023. Back then, sentiment was excessively pessimistic; today, management’s steady execution in turning around Cell C is finally being recognised by the market (a lessening of the persistently negative press articles has contributed to the effort).

Our view is that three factors drive the current valuation discount: 1) accounting complexity, 2) a common perception that Cell C is overburdened with debt, unviable, and loss-making, and 3) BLU’s poor capital allocation track record over the last decade. All are fair, but many of these dynamics are changing rapidly.

Our perspective has been that once Blue Label consolidates Cell C, much of the noise surrounding debt will be eliminated through accounting consolidation, as most of Cell C’s debt is owned by Blue Label.

The recently announced decision to potentially separately list Cell c, forcing the market to value the business, is encouraging. The most valuable aspect is the Mobile Virtual Network Operator (MvNO) business, which holds a 90% market share in the MvNO sector. Capitec, their largest MVNO partner, announced that it already has 1.6 million active subscribers and intends to launch a post-paid product by the end of the year. MvNO partners bring their distribution channels, and Cell C provides the technical infrastructure. Wholesaler service does not cannibalise direct Cell C business, as management has indicated that the net margins on MvNO customers are comparable to those on direct retail customers.

The other meaningful news for Cell C is the government’s decision to drop the Ad Valorem tax on low-end smartphones. Cell C will be the primary beneficiary, given its low average revenue per user (ARPU) customer base.

It will be interesting to see how the market responds to this sensible restructuring.

We continue to find excellent opportunities. Our flexibility, relatively small size and unrepentant opportunism will, hopefully, continue to make your partnership in our fund worthwhile.

As we always remind our co-investors, a significant portion of your manager’s personal capital is invested in your fund, and we share the ups and inevitable downs alongside you.

Please don’t hesitate to contact us if you have any questions.

David Eborall | Portfolio Manager.

|

“Collective investment schemes are generally medium to long-term investments. The value of participatory interest (units) or the investment may go down and up. Past performance is not necessarily a guide to future performance. Collective investment schemes are traded at ruling prices and can engage in borrowing and scrip lending. A schedule of fees, charges, minimum fees, and maximum commissions, as well as a detailed description of how performance fees are calculated and applied, is available on request from FundRock Management Company (RF) (PTY) Ltd (”Manager”). The Manager does not guarantee the capital or the portfolio’s return. The Manager may close the portfolio to new investors to manage it efficiently according to its mandate. The Manager ensures fair treatment of investors by not offering preferential fees or liquidity terms to any investor within the same strategy. The Manager is registered and approved by the Financial Sector Conduct Authority under CiscA. The Manager retains full legal responsibility for the portfolio. FirstRand Bank Limited is the appointed trustee. SaltLight Capital Management (PTY) Ltd, FSP No. 48286, is authorised under the Financial Advisory and Intermediary Services Act 37 of 2002 to render investment management services.” |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.