NewSaetiew/iStock via Getty Images

Summary

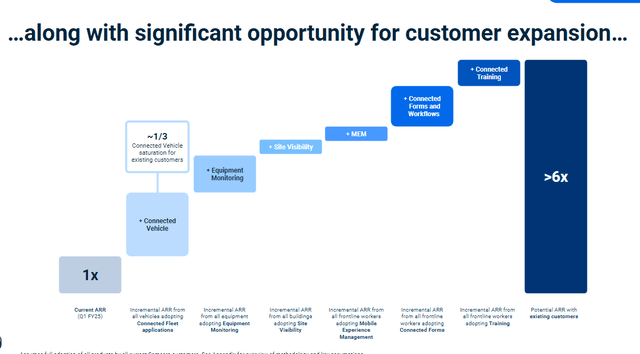

Following my coverage on Samsara (NYSE:IOT) in Mar’24, which I recommended a buy rating as execution had been excellent, and I expected the market to value IOT at a higher multiple than its historical average, this post is to provide an update on my thoughts on the business and stock. I have gotten a lot more bullish on IOT after reviewing the new product launches. I believe IOT value proposition to customers has greatly improved with these new products, and IOT should see strong adoption, which further improves its stickiness and competitive advantage. The growth runway remains attractive as a bunch of customers have yet to meet their renewal cycles, and IOT is still underpenetrated in terms of customers acquired.

Investment thesis

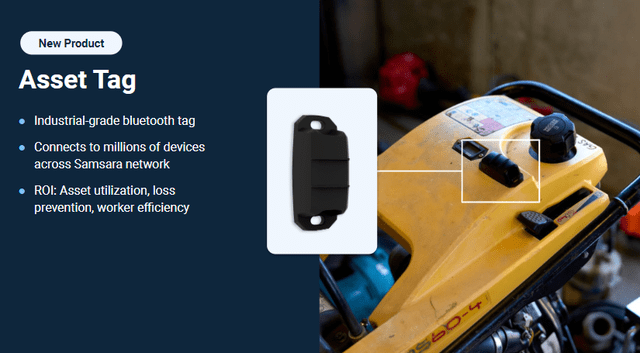

I believe the growth outlook for IOT just got a whole lot better with the recent product launches: Asset Tag, Connected Workflows, and Connected Training.

IOT’s new Asset Tag product is something that I am extremely excited about, and I view this as a game changer for customers. A key distinctive feature is the smaller size. The main reason why IOT is able to reduce the size of the product is because it leverages an entire new architecture vs. the legacy method of connecting via cellular network. This product leverages IOT’s extensive network of IOT devices to connect to nearby gateways and IOT hardware. In addition, because these Asset Tags can communicate with gateways in the network, they are able to communicate over a wider range than RFIDs, which rely on nearby reading devices. Ultimately, it improves clients’ ability to recover assets, improves asset utilization rates, and makes sure the right tools are on the right job at the right time.

This product basically increases the stickiness of IOT and makes it a lot harder for competitors to compete. Because of how the architecture works, the client needs to have a lot of IOT hardware in the area, and by that definition, it means that the client is already adopting IOT’s hardware and devices. For them to switch to another vendor, they would have to replace all of these devices, which is going to cause operational hiccups along the way.

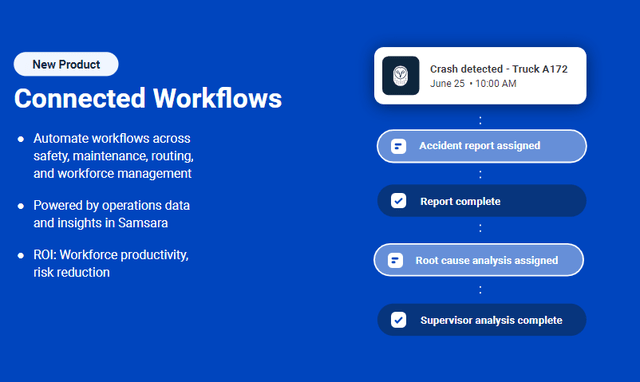

The second product that I am positive about is Connected Workflows [CW]. CW is a platform that integrates Connected Forms with data and automation. Specifically, there are two key features that stand out. Firstly, it is the ability for an event to be automatically triggered upon another event occurring. For example, once a supervisor enters a geofence (event 1), he will be automatically triggered to conduct a safety check (event 2, which is caused by event 1). Second, it’s the ability to pre-populate different CW-dependent forms using the data that IOT has already gathered (i.e., the safety checklist can be prefilled with the location, the date, what are the key things to check, etc.), which speeds up the overall process.

You can imagine how powerful this automation process is, as it allows for the automation of tasks with contextual data to trigger multi-step workflows. In other words, there is less need for a team to constantly monitor for any faults, be ready to notify the respective personnel, and plan out what should be done in the event of any triggers. This entire human process is inefficient and costly. Hence, I believe the automation and streamlining of historically manual tasks will be a major driver for adoption.

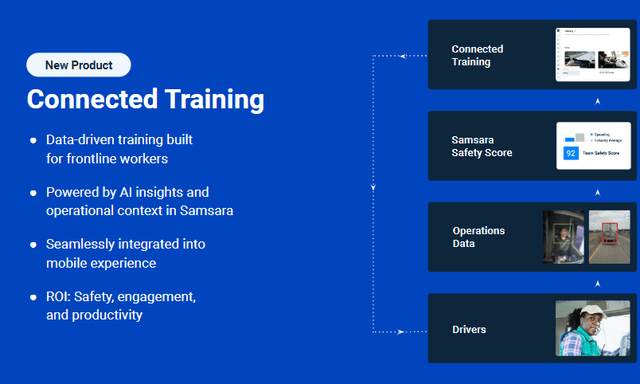

The third product is Connected Training [CT]. With CT, clients can proactively provide required training in response to events. A driver whose attention is diverted by their phone, for instance, can be given an automated training session to finish at their next rest stop. In addition, customers have the option to design their very own educational programs (some customers have more niche requirements, so this certainly helps). Given that safety is one of the most important elements that underlying customers pay attention to, I am expecting strong adoption for CT.

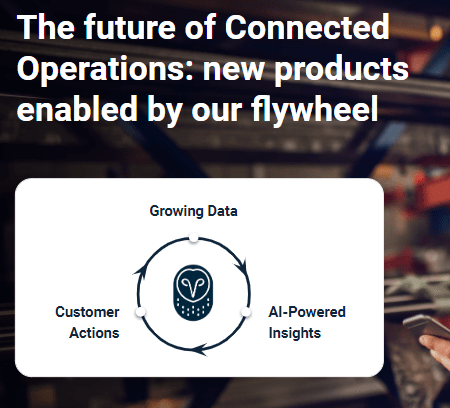

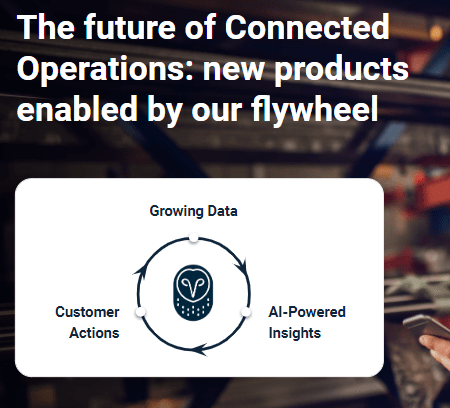

IOT

With these products being rolled out, which I expect to receive strong adoption, IOT competitive advantage should get a lot stronger. The byproduct of the adoption of these products is that IOT is able to gather significantly more data than in the past, and this becomes a data flywheel: more data leads to more insights, which enable IOT to improve customer productivity and innovative products. All of these enable IOT to improve its value proposition to customers (improve productivity, safety, and ultimately cost.

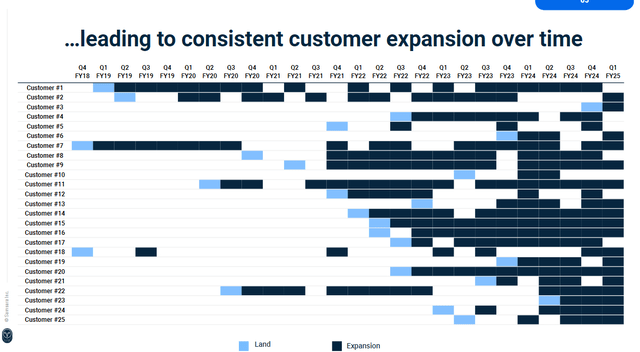

Therefore, I remain very convicted of IOT’s ability to consistently deliver very strong growth over the foreseeable future, with expanding margins as it scales. In fact, after reviewing the investor day presentation, I got even more bullish as management noted during the investor day that they are seeing plenty of opportunities to upsell or cross-sell in the current base. I point this out because there is a significant chunk of IOT’s customer base that has not met their renewal cycle yet, which means there is still plenty of room for IOT to up-sell or cross-sell all these new products.

Now, remember, we’ve only been selling for a little more than eight years and we sell three- to five-year contracts. So still less than 50% of our overall ARR has gone through a renewal cycle. As more and more of that ARR renews over time, that will drive more leverage in sales and marketing. Investor day transcript

Valuation

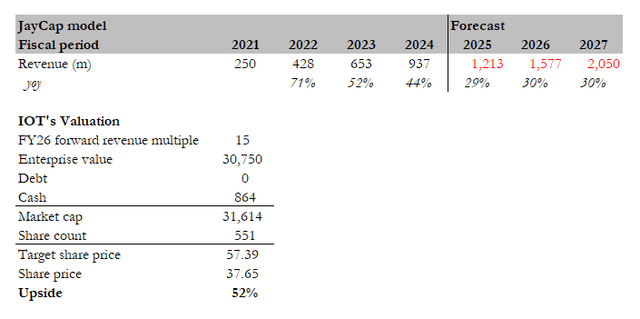

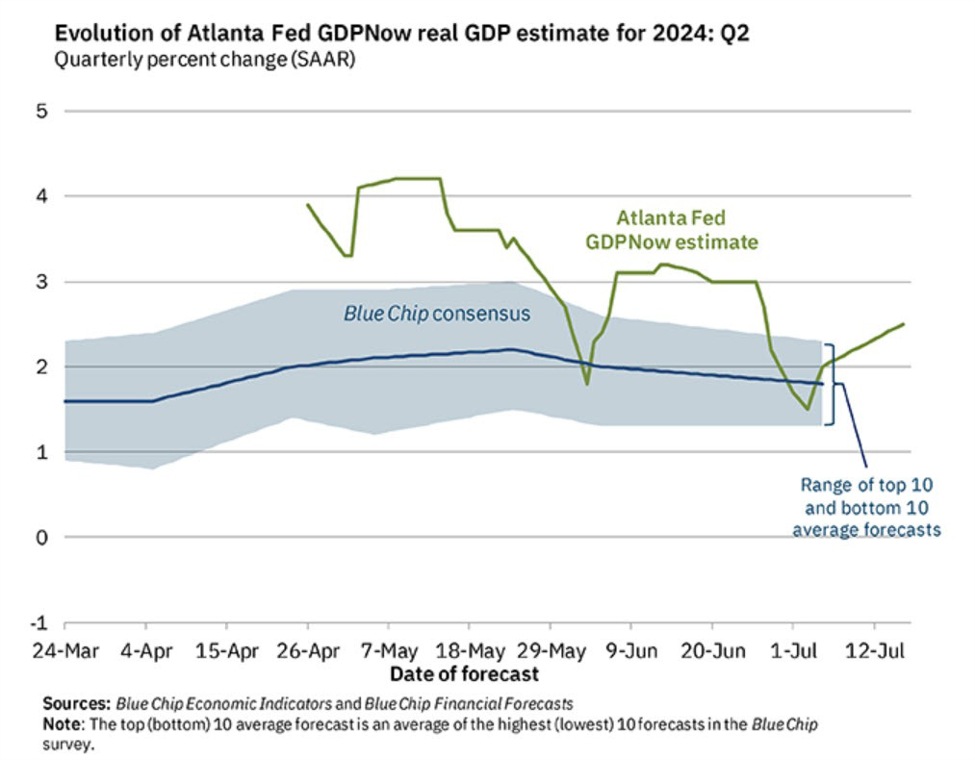

My target price for IOT based on my model is ~$57. My model is now based on FY27 numbers, as I model 2 years forward from the current fiscal period. I am now a lot more bullish about IOT growth than I was a few months ago, and thankfully, the market doesn’t seem to have fully priced this yet. My latest model assumes IOT to achieve $1.213 billion in revenue in FY25 (high end of management’s guidance), which implies 29% growth and growth to inch towards 30% for the next two years. I must point out that IOT could very well achieve growth much higher than this, given the new products launched (IOT growth was 44% in FY24, for reference). The catalyst for growth to go higher could be when rates get cut, which reduces the cost of capital for IOT’s customers, allowing them to invest more in new digital solutions.

I have also increased my valuation multiple assumption from 13x to 15x, as I am more bullish on the growth potential today. The market willingness to attach a higher multiple post-investor day (from ~12x to 15x today) also suggests that investors have a positive view of the new products.

Risk

IOT gross margin may become volatile in the near term as IOT sales devices, which are used to collect data from customers, If the new products (Asset Tag) see a huge spike in adoption, it could pressure gross margin, and the market may extrapolate this weakness forward in their models. Any breach in data privacy will greatly hurt IOT’s reputation. Given that customers value privacy and data security (they don’t want people to know where their assets are), this could reduce customer confidence in the reliability of IOT’s products.

Conclusion

In conclusion, my rating for IOT is a buy rating. I believe IOT recent product launches significantly enhance its value proposition and solidifies its competitive advantage. This made me a lot more bullish on its growth potential. All these new products drive a data flywheel effect for IOT, which will help to further refine IOT offerings. Looking ahead, there is still a substantial growth runway and untapped upselling potential.