Santander Personal Banking Worldwide has lately announced its foray into the crypto market. Catering to its prosperous purchasers in Switzerland, the financial institution now supplies companies for buying and selling and investing in main digital currencies, particularly Bitcoin (BTC) and Ethereum (ETH).

This growth marks a pivotal shift within the financial institution’s method to digital belongings, aligning with the rising demand for digital currency services amongst institutional and personal buyers.

Increasing Cryptocurrency Providers

The choice by Santander, a famend monetary establishment with over 160 years of historical past and an enormous buyer base of 166 million, signifies a broader acceptance of digital currencies in mainstream banking.

The report disclosed Santander has deliberate to progressively increase its crypto choices over the approaching months, including extra digital belongings that meet its “stringent” screening commonplace.

The financial institution emphasizes that these digital foreign money companies shall be out there completely at purchasers’ request and facilitated by way of their designated relationship managers.

To safety and compliance, Santander additionally claims to make sure that the digital belongings are held in a “regulated custody model.” This mannequin includes the safe storage of “private cryptographic keys,” important for accessing and managing these digital currencies.

John Whelan, Head of Crypto and Digital Property at Santander, highlighted the progressive nature of Swiss rules associated to digital belongings. Whelan added:

As holding of crypto as a substitute asset class continues to increase, we anticipate that our purchasers want to depend on their present monetary establishments to be liable for their belongings.

International Banking Establishments Embracing Crypto?

Santander’s enterprise into digital foreign money companies is a rising pattern amongst main international banks. Commerzbank AG, a distinguished full-service financial institution in Germany, lately received a crypto asset custody license, marking a big step within the German banking sector below the German Banking Act.

Commerzbank’s acquisition of this license permits it to supply a variety of digital asset companies, specializing in cryptocurrencies. This determination positions Commerzbank to cater to the rising curiosity in digital currencies amongst its shopper base.

Jörg Oliveri del Castillo-Schulz, Chief Working Officer of Commerzbank, expressed the financial institution’s dedication to leveraging the newest applied sciences and improvements. Castillo-Schulz acknowledged:

Now that we have now been granted the license, we have now achieved an necessary milestone. This highlights our ongoing dedication to making use of the newest applied sciences and improvements, and it varieties the inspiration for supporting our clients within the areas of digital belongings.

Moreover, these developments throughout main monetary establishments point out a notable shift within the conventional banking sector’s approach to digital currencies.

As digital belongings proceed to achieve mainstream acceptance, banks corresponding to Santander and Commerzbank seem strategically positioning themselves to supply digital foreign money companies, reflecting the evolving panorama of worldwide finance.

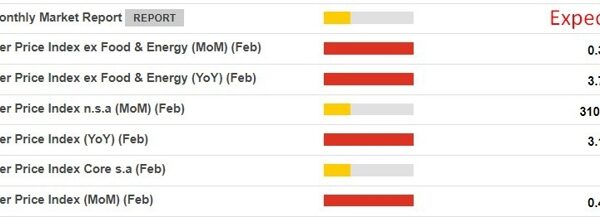

Featured picture from Unsplash, Chart from TradingView