bymuratdeniz/iStock via Getty Images

Summary

Following my coverage on SAP (NYSE:SAP) in Apr’24, which I recommended a buy rating due to my expectation that SAP can sustain its premium valuation due to the strong growth momentum, as seen from its CCB growth trend and growing adoption of AI, this post is to provide an update on my thoughts on the business and stock. I reiterate my buy rating for SAP as demand remains absolutely solid, as seen from the strong CCB trends, 2Q24 top-line growth, and AI adoption. Margins are also set to improve in the coming years as the restructuring exercise is nearing its end.

Investment thesis

Yesterday, SAP released its 2Q24 earnings, which saw revenue growth of 10% on a constant currency [CC] basis to EUR8.3 billion, accelerating from 9% in 1Q24. Driving the solid growth performance were: solid cloud revenue growth of 25% CC to EUR4.2 billion, in line with 1Q24; cloud ERP Suite growth accelerating to 33% (100 bps improvement vs. 1Q24); and the extension suite grew 6% CC. License revenue continued to decline (-27% this quarter), which was as expected given the focus on cloud. Lastly, maintenance revenue came in at EUR2.8 billion. The strong top-line performance drove a huge beat at the EBIT level, which came in at EUR1.94 billion, 7% above consensus expectations. FCF performance was solid as well, coming in at EUR1.3 billion (67% conversion from EBIT).

This set of 2Q24 results gave me a lot more confidence that growth momentum remains very strong and that various metrics and indicators continue to suggest solid growth ahead. First, the 10% revenue CC growth is a major narrative game changer for SAP as it finally reaches “double-digit” growth status. Secondly, the main driver behind this growth was the robust S/4 product cycle momentum, as evident from the solid current cloud backlog [CCB] growth trend sustaining at 28% (same as 1Q24). Notably, the sales pipeline showed no signs of any impact from the macro weakness. The backlog trend is also seemingly better than last year, as management noted July was off to a good start, and pipeline coverage looks really good relative to last year. This is in line with my expectations regarding S/4HANA, as noted in my previous post:

I believe the S/4HANA migration cycle is now starting to ramp significantly (management noted S/4 HANA growth remained robust, growing in line with 4Q23) and driving accelerating growth metrics at scale. Jay Capital

While transactional cloud revenues were down by 2%, I am not entirely worried about this because of two reasons. One is that this portion of the cloud revenue is going to get smaller over time as the overall cloud revenue continues to grow at 25%. The second is that this is not a structurally declining business. It follows how the macroeconomy is performing, and given that central banks in SAP key regions have cut rates (Europe) or are going to cut rate [US] soon, I take that as a positive sign that the economy is trending in the right direction, so growth could tilt to a positive level soon. Management did guide for 2H24 to see better performance based on the current forecast, and I take that they have seen positive trends in July for them to guide this.

AI adoption continues to be solid as business AI has become a central topic in SAP sales pitches to clients, which has led to SAP increasing the pace of migration into SAP’s cloud offerings. To put things into perspective, 20% of all deals now include premium AI features, and all ERP and LoB deals had AI in the conversion, which is as evident as it can be that AI is driving growth considering that AI features were really not significantly present a few years ago.

In every ERP and LoB deal we closed, our AI strategy played a key role and AI had a direct impact on our bookings. In the second quarter, almost 20% of all deals included premium AI use cases and this is just the beginning. 2Q24 earnings results call

SAP efforts to restructure the business are bearing fruit, as can be seen from the improvement in EBIT margin, from 19.1% in 2Q23 to 23.4% in 2Q24. SAP should be nearing the end of its major restructuring exercise, as they increased their provision for restructuring to EUR3 billion (previously EUR2.2 billion). I believe this increase is more of a pull forward than a cause for alarm; it is the result of larger-than-expected staff reductions as a result of the restructuring program, a higher-than-expected acceptance rate of the early retirement program in the US, and more departures in regionally more expensive countries like Germany. Once SAP gets past this, it should set up a nice base for margin to expand over the next few years as top-line trends continue to perform.

Valuation

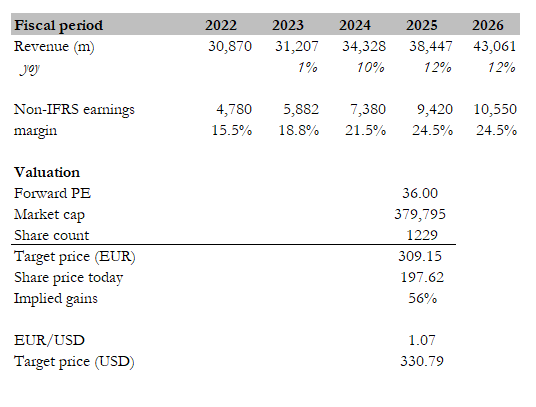

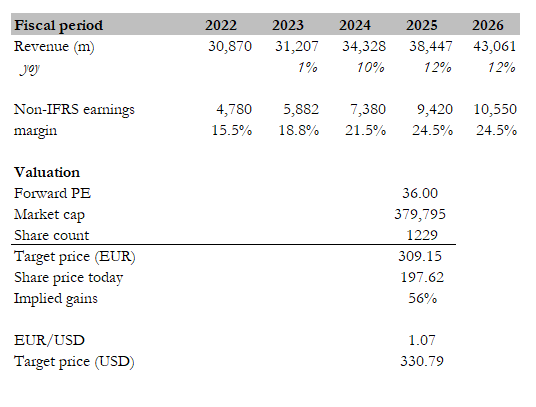

Own calculation

My target price for SAP based on my model is EUR309, based on FY26 estimates (the previous model was based on FY25 estimates). My model assumptions are that SAP can achieve low-teens growth in the next few years, fueled by solid cloud revenue momentum (CCB continues to trend at 25%, and 2Q24 touched 10% growth). Stronger than expected, AI adoption could drive growth even higher. FY24 margins should have no problem meeting my low-20% expectations, as 2Q24 is already at 22%. Once the restructuring exercise ends, margins should trend towards the mid-20s. Overall, this has been a really solid quarter that supports all my bullish views that valuation will continue to stay at this level (36x forward PE).

Risk

SAP’s cloud revenue may not grow as fast as I expected, especially if the migration of S/4HANA gets delayed. Licenses and support could also decline faster than expected, which might put pressure on margins if the cloud has also not reached full economies of scale to offset that pressure. Any delays in product development or releases could disappoint investors, particularly if they were related to S/4HANA or AI.

Conclusion

In conclusion, my rating for SAP is a buy rating as it delivered a strong 2Q24 with solid top-line growth, driven by cloud adoption and AI adoption. The restructuring plan is nearing completion, paving the way for margin expansion in the coming years. All of these should continue to support earnings growth momentum, which I expect to justify its premium valuation.