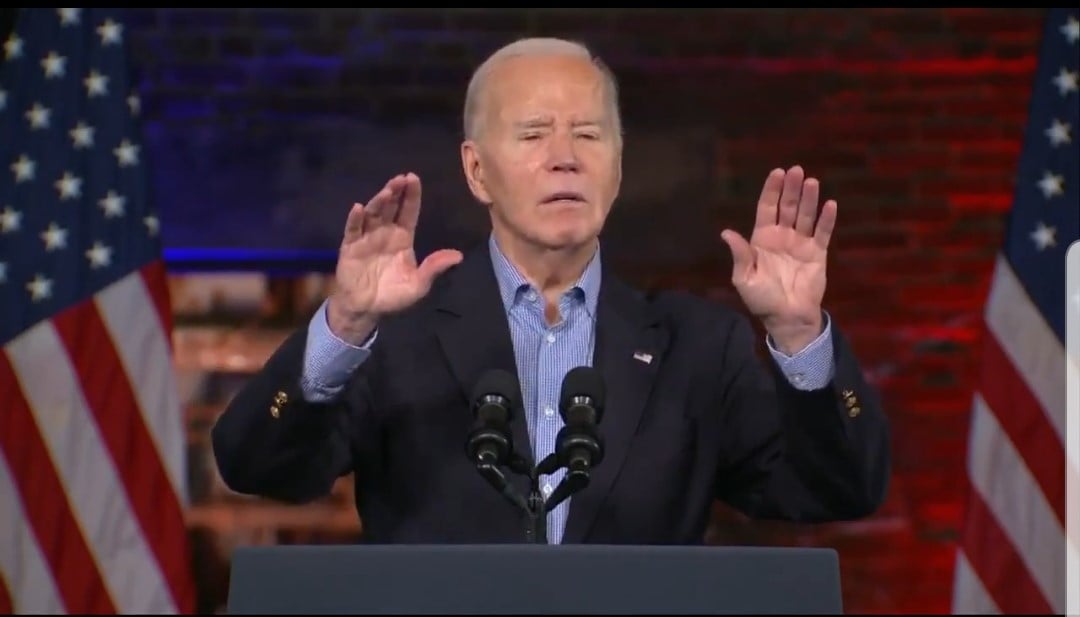

Emblem of Aramco, formally the Saudi Arabian Oil Group, Saudi petroleum and pure gasoline firm, seen on the second day of the twenty fourth World Petroleum Congress on the Massive 4 Constructing at Stampede Park, on September 18, 2023, in Calgary, Canada.

Artur Widak | Nurphoto | Getty Photos

Saudi Arabia’s state oil big Aramco reported a 25% decline in revenue to $121.3 billion in 2023, down from $161.1 billion in 2022.

“The year-on-year decrease can be attributed to lower crude oil prices and volumes sold, as well as reduced refining and chemicals margins, partially offset by a decrease in production royalties during the year and lower income taxes and zakat,” Aramco stated in a press release.

Aramco stated complete income additionally fell 17% to $440.88 billion, down from $535.19 billion final 12 months.

The consequence nonetheless represents Aramco’s second-highest ever internet earnings. Free money stream additionally fell to $101.2 billion in 2023, in comparison with $148.5 billion in 2022.

“Our resilience and agility contributed to healthy cash flows and high levels of profitability, despite a backdrop of economic headwinds,” Aramco CEO Amin Nasser stated.

Altering Fingers

The earnings come after the Saudi authorities transferred an extra 8% of Aramco shares, value $164 billion, to Saudi Arabia’s Public Funding Fund (PIF). Yasir Al-Rumayyan is each the Chairman of Aramco’s Board of Administrators and the Governor of the PIF.

The share switch to PIF is among the largest transactions Aramco has undertaken since itemizing, and can permit the PIF to learn from Aramco’s mega dividend payout coverage. PIF already owned 4% of Aramco, and controls Sanabil, a monetary funding agency, which owns 4% of Aramco as effectively.

Aramco stated complete dividends of $97.8 billion had been paid in 2023, up 30% from 2022. It declared a base dividend of $20.3 billion for the fourth quarter, to be paid within the first quarter of 2024. Aramco additionally pays performance-linked dividends, value $10.8 billion this 12 months. The complete 12 months performance-linked dividend to be paid in 2024 is anticipated to be $43.1 billion.

The PIF’s 16% state in Aramco, value an estimated $328 billion, is about to strengthen its monetary place and enhance its means to deploy capital to speculate on behalf of the Saudi state. The brand new stake additionally pushes PIF nearer to attaining its end-2025 goal of $1 trillion in belongings below administration.

Extra Funding

Aramco confirmed it could halt plans to raise its oil production capacity from 12 million barrels per day to 13 million barrels per day — a transfer anticipated to cut back capital funding by roughly $40 billion between 2024 and 2028.

“The recent directive from the government to maintain our Maximum Sustainable Capacity at 12 million barrels per day provides increased flexibility, as well as an opportunity to focus on increasing gas production and growing our liquids-to-chemicals business,” Nasser stated.

Aramco’s common hydrocarbon manufacturing was 12.8 million barrels of oil equal per day in 2023, together with 10.7 million barrels per day of complete liquids.

Aramco goals to ramp up its investments in gasoline, and has a goal to extend gasoline manufacturing by greater than 60% by 2030, in comparison with 2021 ranges. Its flagship funding is the Jaffoura project — the most important gasoline play within the Center East — with an estimated 200 trillion commonplace cubic toes of pure gasoline.