Luis Alvarez

Typically, giant custodians/brokers like Schwab need to personal the product. They hope to maintain their purchasers in their very own funds versus in different issuers’ merchandise. So what do they do? They create their very own branded exchange-traded funds, or ETFs, which do not actually differentiate a lot besides within the title of the fund. That is very a lot the story of the Schwab U.S. Broad Market ETF™ (NYSEARCA:SCHB),

SCHB is a product of Charles Schwab Asset Administration. Launched in 2009, the SCHB seeks to trace the full return of the Dow Jones U.S. Broad Inventory Market Index. Designed to provide traders a low-cost technique to acquire publicity to U.S. equities, SCHB presents diversified publicity to round 2,500 of the biggest publicly traded U.S. firms, spanning throughout large-, mid-, and small-cap shares.

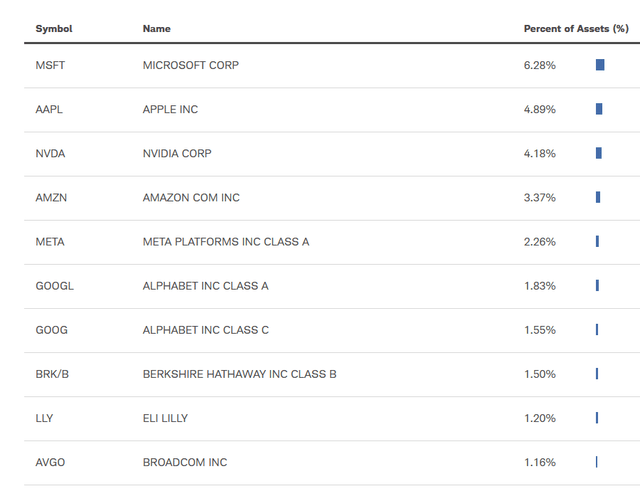

Unpacking the Holdings: Digging Deeper into SCHB’s Portfolio

A more in-depth take a look at SCHB’s holdings reveals a diversified portfolio, unfold throughout a number of sectors, with the highest 10 holdings being all of the hits you have come to like momentum-wise that dominate giant market-cap weighted averages.

These high ten holdings represent roughly 28% of SCHB’s whole portfolio, in step with different well-liked whole market ETFs on the market.

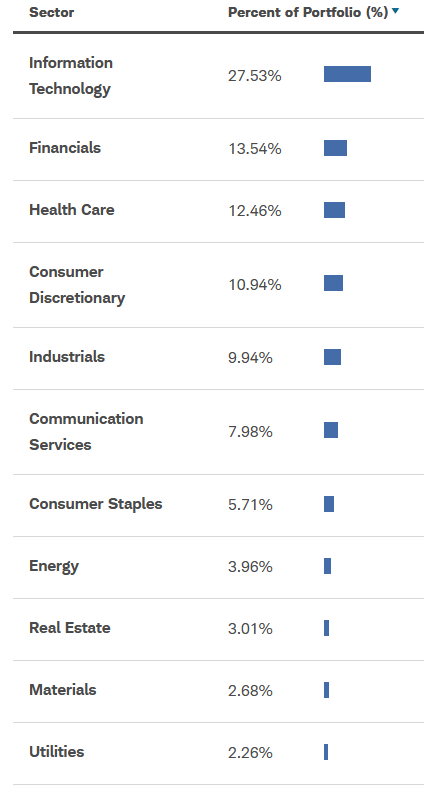

Sector Composition: The place Does SCHB Place Its Bets?

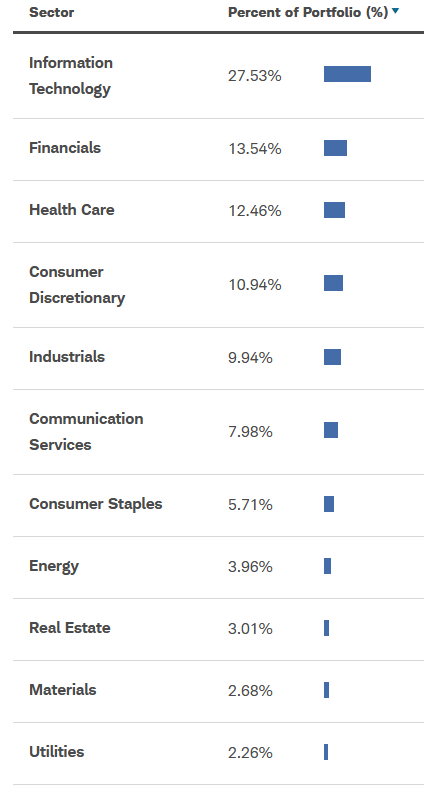

SCHB’s sector allocation is well-diversified, with its largest allocation within the Info Know-how sector, adopted by Financials and Healthcare.

schwabassetmanagement.com

My solely actual criticism is that Know-how is such a big portion of the fund. I do know that is to be anticipated, however I fear about there being some imply reversion there, simply given how outsized efficiency has been over the previous yr.

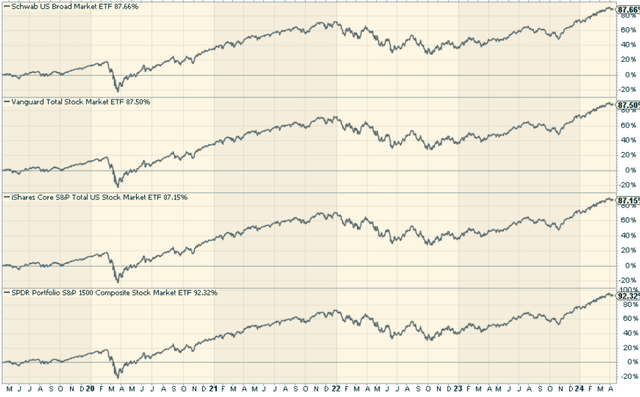

Peer Comparability: SCHB vs. Different Broad Market ETFs

When evaluating SCHB to different broad market ETFs, it is good to contemplate related funds just like the Vanguard Complete Inventory Market Index Fund ETF (VTI), the iShares Core S&P Complete U.S. Inventory Market ETF (ITOT), and the SPDR Portfolio S&P 1500 Composite Inventory Market ETF (SPTM).

By way of expense ratio, all these ETFs include an ultra-low expense ratio of 0.03%. The efficiency of all three funds has nearly been in line for the final a number of years. No large surprises right here in any way, and additional provides to the purpose that there actually is not a lot differentiation total.

Execs and Cons: The Good, The Unhealthy, and The Ugly

As with every funding, SCHB has its personal set of execs and cons. On the constructive aspect, SCHB presents an affordable and easy technique to acquire publicity to U.S. equities. With its diversified portfolio and low expense ratio, it may function a core holding in an investor’s portfolio.

Nevertheless, the ETF does have some drawbacks. For one, it could underperform the S&P 500 Index (SP500) because of its broad publicity to the full inventory market, which incorporates small-cap and mid-cap firms. Furthermore, in comparison with different ETFs like VTI and SPTM, SCHB does not look all that a lot completely different. In different phrases, there is not any discernible edge in selecting SCHB over another whole inventory market proxy.

To Make investments or To not Make investments: The Closing Verdict

Schwab U.S. Broad Market ETF™, with its broad diversification and low expense ratio, is a viable possibility for traders in search of publicity to the U.S. inventory market. Nevertheless, there’s not way more to it than that.

There’s nothing inherently mistaken with the fund in any respect, and it does its job nicely as a complete inventory market proxy. However there’s nothing particular about it towards almost each different main core fairness fund out there. If you happen to love Schwab, then actually go along with this fund versus going with one other issuer. I simply do not assume it is fascinating sufficient to get anybody excited right here.