pcess609

Investment Thesis

I last reviewed the Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD) on March 18, 2024, when I provided in-depth coverage of its much-anticipated annual reconstitution. I invite you to read the details if you have 15 minutes to spare, but in the interest of your time, here is a quick summary:

1. The Index made 23 substitutions. Bristol-Myers Squibb (BMY) was the main addition, while Broadcom (AVGO) was deleted due to its low dividend yield.

2. The changes prioritized dividend safety over dividend growth, backed by improvements in metrics like free cash flow to total debt, return on equity, and dividend payout ratios.

3. The expected dividend yield improved by approximately 0.30%.

4. Sales and earnings per share growth rates did not improve, leaving SCHD vulnerable to underperformance should the growth-favored market continue.

5. Profitability remained strong, and the portfolio’s 0.91 five-year beta did not change, providing some protection in down markets.

Today’s article reviews SCHD’s performance since this reconstitution and evaluates its changing fundamentals compared to three high-dividend ETFs. I will also evaluate SCHD against the SPDR S&P 500 ETF (SPY) in recognition that although the two funds have entirely different investment objectives, it’s still a good benchmark from a total returns perspective. I hope you enjoy the read, and as always, I look forward to your comments afterward.

SCHD Overview

Strategy Discussion

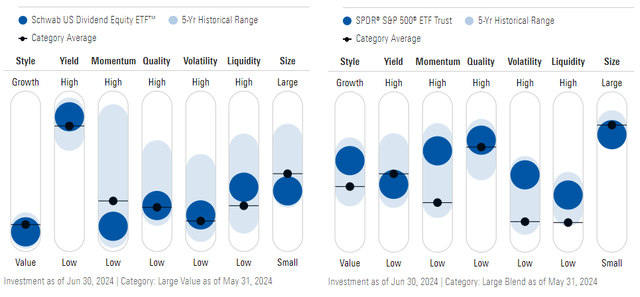

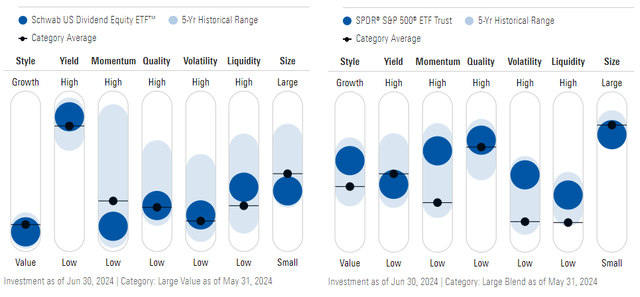

SCHD tracks the Dow Jones U.S. Dividend 100 Index, selecting 100 U.S. securities (excluding REITs) that have paid dividends for ten consecutive years, have a float-adjusted market cap of at least $500 million, and a three-month average daily trading volume of at least $2 million. Securities meeting these criteria are sorted in descending order by dividend yield, with the bottom 50% eliminated. This step is crucial, as it guarantees an above-average dividend yield by periodically removing low-yielding companies like Broadcom. Furthermore, since yield increases are driven primarily by price decreases and not dividend growth, the step promotes value investing. This finding is well-supported by Morningstar, as SCHD has leaned strongly toward the “value” style over the last five years.

Morningstar

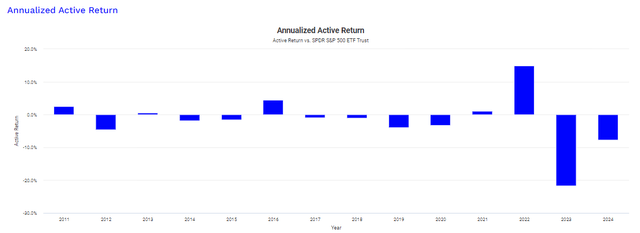

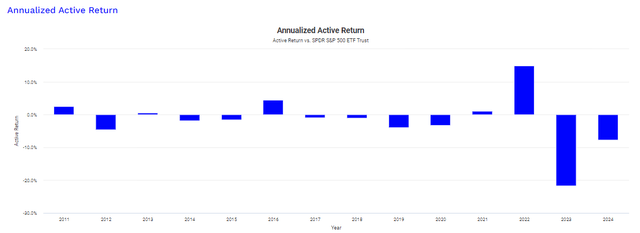

In contrast, SPY’s style range between value and growth has been much wider over the last five years, and it currently leans slightly toward growth due to the dominance of tech stocks like Apple (AAPL), Microsoft (MSFT), and Nvidia (NVDA). This summary from Morningstar is the best evidence I can provide that demonstrates why you should not directly compare SCHD and SPY. Not only are they different styles, but there are substantial differences in yield, momentum, volatility, and size. As I mentioned, I will still compare SCHD’s fundamentals with SPY, but that’s mainly for the benefit of total return investors interested in an alternative approach. Remember, SCHD had minimal performance differences with SPY up until 2022, and this long-term track record is commendable, given how SCHD is a large-cap value fund operating in what’s mostly been a growth-favored market.

Portfolio Visualizer

Turning back to SCHD’s strategy, the Index narrows down the list of stocks to 100 by screening for four fundamental factors, as follows:

- free cash flow to total debt

- return on equity

- indicated dividend yield

- five-year dividend growth.

The free cash flow to total debt and return on equity screens directly promote quality, which is one of the key things I look for in any fund. The five-year dividend growth screen is more of an indirect quality screen, as companies with strong dividend growth track records are more likely than not to be able to afford dividend increases. Lastly, I view the dividend yield screen as a value screen for the reasons discussed earlier. All of this adds up to a fund that should consistently emphasize the quality and value factors. Lastly, its modified market-cap-weighting scheme (4% max weight per security, 25% max weight per sector) means the fund will lean toward large-cap stocks.

These are the features I’ve come to expect and appreciate about SCHD. However, it’s also essential to analyze the fund for any weaknesses, as an ETF is only as strong as its Index and, by extension, the screens noted above. In recent years, I’ve written several times on the disconnect between the fund’s historical dividend growth rates and expected earnings growth rates. With virtually no earnings growth, it wasn’t reasonable to expect the double-digit growth of the past.

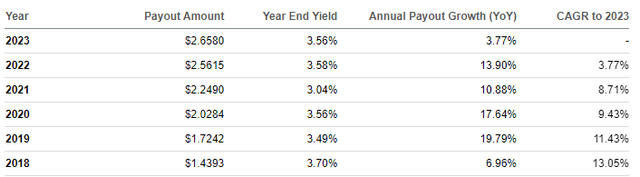

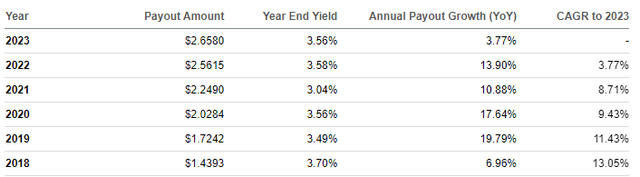

Seeking Alpha

As shown above, dividend growth slowed to 3.77% last year, part of which I consider “synthetic.” This means that the Index’s reconstitution process, which typically increases the yield, is a source of dividend growth as opposed to “organic” dividend growth that comes directly from the securities. It’s wise for DGI investors to use the ETF’s structure to boost dividends while avoiding the tax consequences they’d face by buying/selling the individual securities themselves. However, it’s crucial they don’t fool themselves into thinking SCHD’s holdings have increased dividends by 13.05% over the last five years. As I’ll show shortly, the actual number is 8.27%, with the prospect of double-digit dividend growth looking increasingly unlikely.

SCHD Performance Analysis

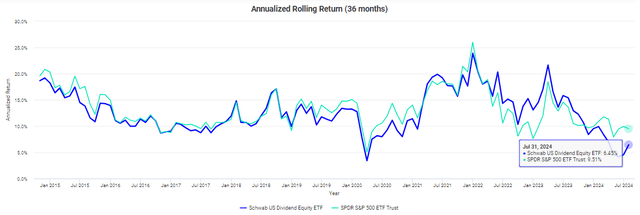

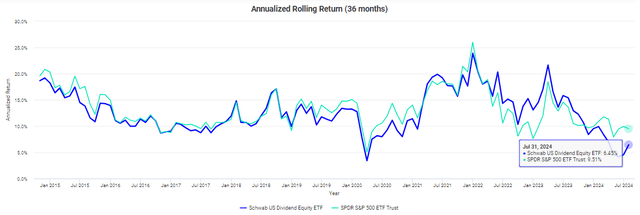

Earlier, we saw how SCHD closely matched SPY’s returns up until 2022. That year, it provided excellent downside protection and outperformed by 14.94%, only to lag by 21.62% the following year. YTD through August 16, 2024, it’s behind a further 7.72%. Here’s a link to that analysis, and I encourage you to browse through the different metrics located in the columns on the left side. One that stood out to me was how the three-year annualized rolling return gap (6.45% vs. 9.51%) is about as wide as it’s ever been as of July 31, 2024. The opposite was true in December 2022, but the strong performance of Magnificent Seven stocks the following year quickly closed that gap. It’s not unreasonable to expect SCHD to bounce back soon, as that’s generally what high-quality stocks eventually do.

Portfolio Visualizer

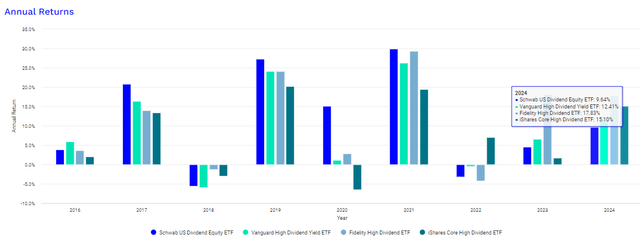

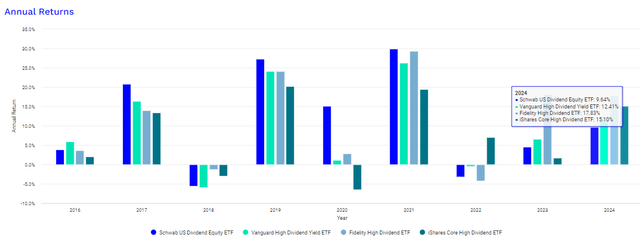

The three other dividend ETFs I’ve selected as comparators today are the Vanguard High Dividend Yield ETF (VYM), the Fidelity High Dividend ETF (FDVV), and the iShares Core High Dividend ETF (HDV). HDV was an excellent play as inflation increased due to its high exposure to Energy stocks, while FDVV and VYM provided some much-needed growth potential that was absent in most high-yield funds.

Portfolio Visualizer

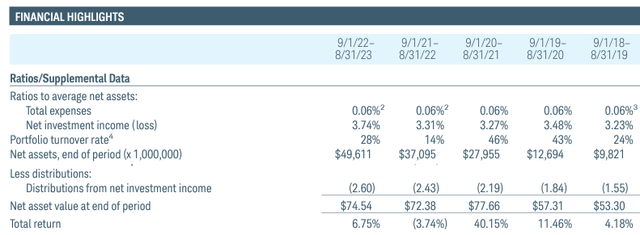

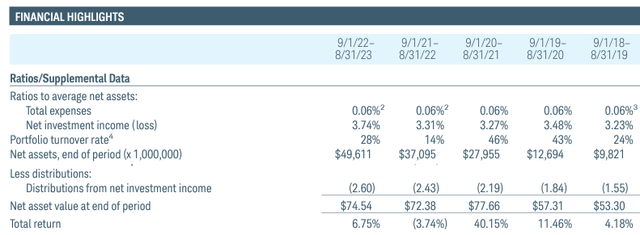

I’ll leave it to you how you want to interpret these results, but my view is that they offer little insight into what will happen next. I documented the lack of forecasting power historical returns provide here, but in addition, historical ETF performance analysis does not account for portfolio turnover, which is often high in rules-based funds. In the last five fiscal years, it’s averaged 31%, meaning that about one-third of the portfolio’s holdings by weight changes annually. As a result, any technical analysis analysts might perform is not very helpful, as it relies on price movements of stocks no longer held by the fund.

Schwab

SCHD Performance Since March Reconstitution

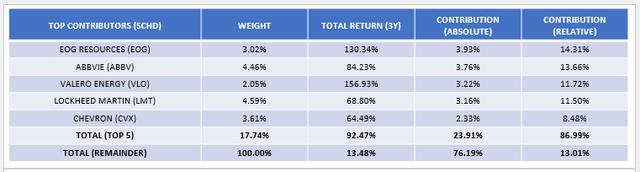

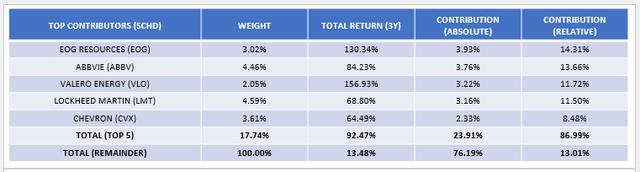

On March 18, 2024, SCHD closed at $78.72 per share. The ETF closed at $81.96 per share on Friday, meaning its return (excluding dividends) was 4.12%. Here are the top five contributors and detractors to performance, which I calculated based on weights as of March 18, 2024.

- Lockheed Martin (LMT): +28.52% (+1.03%)

- Amgen Inc. (AMGN): +19.55% (+0.68%)

- Texas Instruments (TXN): +16.24% (+0.62%)

- Coca-Cola (KO): +15.53% (+0.55%)

- Altria Group (MO): +16.98% (+0.50%)

- Valero Energy (VLO): -8.48% (-0.18%)

- Chevron (CVX): -5.32% (-0.20%)

- Bristol-Myers Squibb (BMY): -5.69% (-0.21%)

- Ford Motor (F): -12.85% (-0.23%)

- United Parcel Service (UPS): -15.47% (-0.58%)

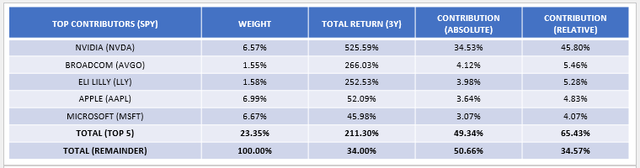

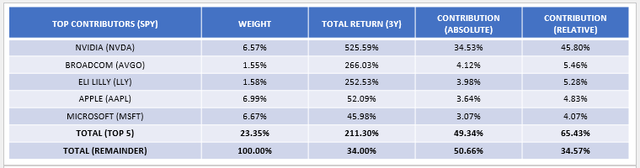

Lockheed Martin was the top contributor at 1.03% due to its relatively high initial weight (3.95%) and 28.52% price return. However, there weren’t any other significant contributors or detractors, and I point this out because this is not the case with SPY. Many investors are nervous about how only a handful of stocks have driven the returns of broad-market funds like SPY. Analyzing growth rates and valuations is one thing, but it’s shocking to see how, based on current weightings, five stocks have contributed to 49.34% of the fund’s returns compared to 50.66% for the remaining 495 holdings.

The Sunday Investor

In contrast, SCHD is far less reliant on only a handful of stocks. As shown below, its top five stocks contributed to just 23.91% of the fund’s returns compared to 76.19% for the remaining 95. It’s this better “breadth” of returns that often goes unappreciated.

The Sunday Investor

SCHD Analysis

Sector Allocations and Top Holdings

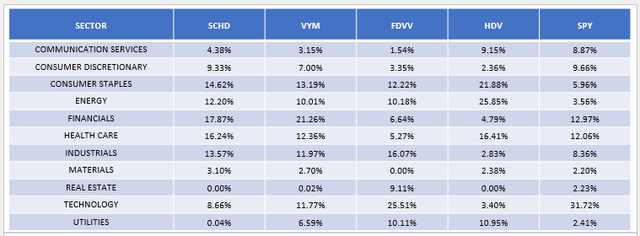

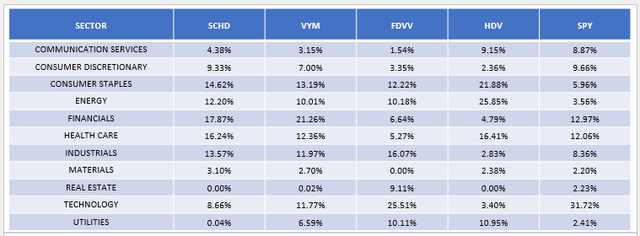

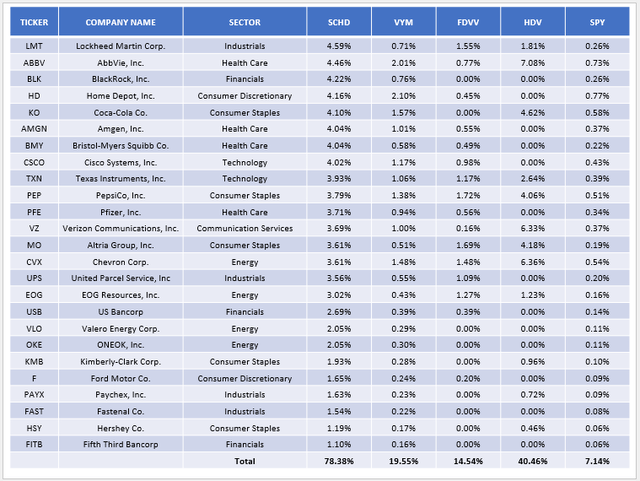

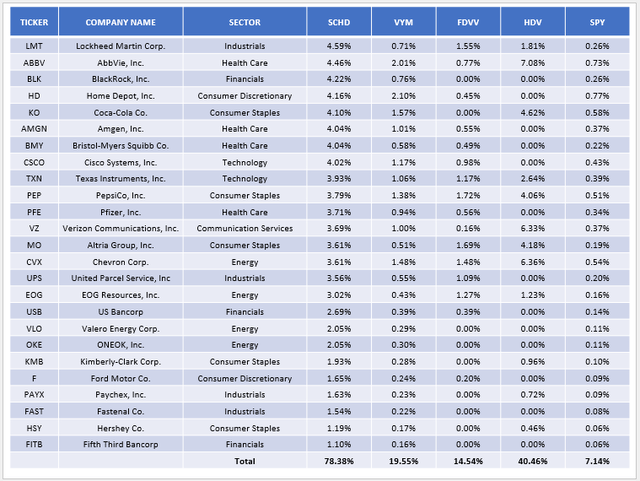

The following table highlights the sector allocation differences between SCHD, VYM, FDVV, HDV, and SPY. Note the zero exposure to Real Estate securities, which is why all the fund’s dividends are considered qualified income for tax purposes. You can view the 2023 QDI’s for all Schwab ETFs at this link.

The Sunday Investor

Based on these sector exposures, the four dividend ETFs take different approaches. FDVV overweights Technology at 25.51% and has Nvidia, Apple, and Microsoft as its top three holdings, so it’s not the best solution if you’re looking for efficient diversification from the mega-caps. HDV is interesting, as it balances volatile Energy stocks with lower-risk selections in the Consumer Staples, Health Care, and Utilities sectors. Meanwhile, VYM looks most similar to SCHD. Except for Real Estate, it has exposure to all sectors, with the most in Financials at 21%.

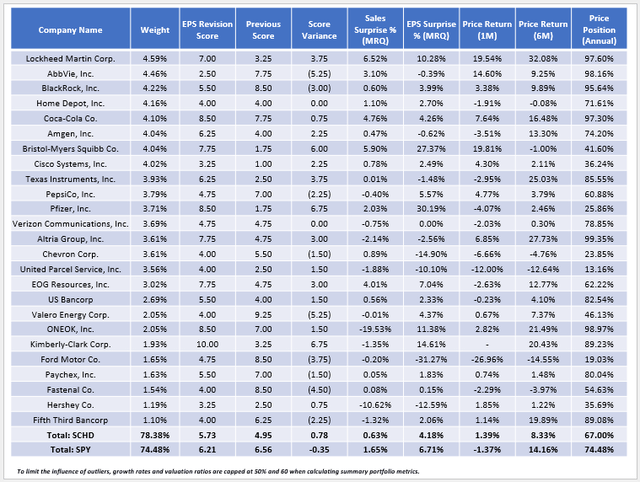

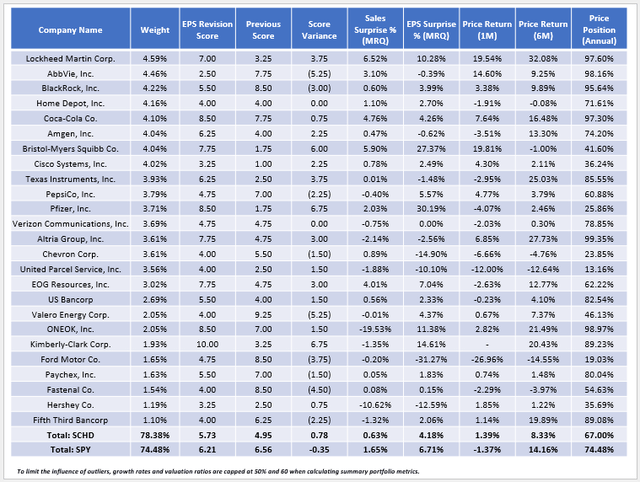

SCHD’s top 25 holdings are listed below, which total 78.38% of the portfolio. For the most part, this portfolio is unique. However, HDV has large allocations to top holdings like AbbVie (ABBV), Coca-Cola (KO), Verizon Communications (VZ), and Chevron (CVX), and its total allocation to these 25 holdings is relatively high at 40.46%.

The Sunday Investor

Total overlap is calculated by taking the minimum allocation between two funds per stock and then adding them together. For example, SCHD and VYM have 4.59% and 0.71% allocations to Lockheed Martin, so the figure used is 0.71%. After repeating this calculation, I calculated these figures and confirmed them using the free tool available at the ETF Research Center:

- SCHD vs. VYM: 22.53%

- SCHD vs. FDVV: 15.27%

- SCHD vs. HDV: 34.79%

- SCHD vs. SPY: 7.84%

Therefore, SCHD is currently most similar to HDV and least similar to SPY, but these figures are arguably low enough to justify owning more than one.

SCHD Fundamental Analysis

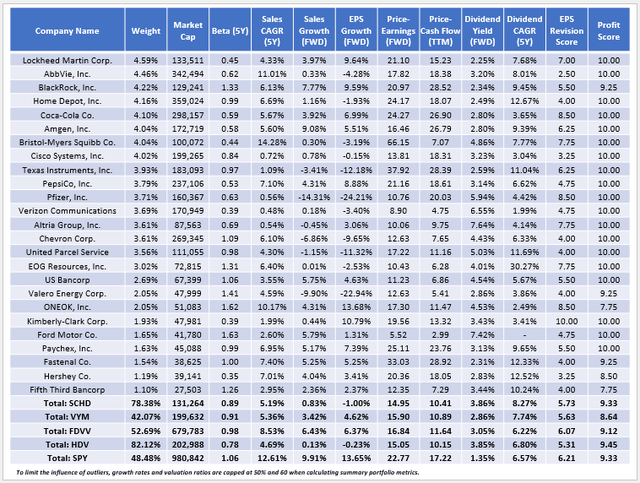

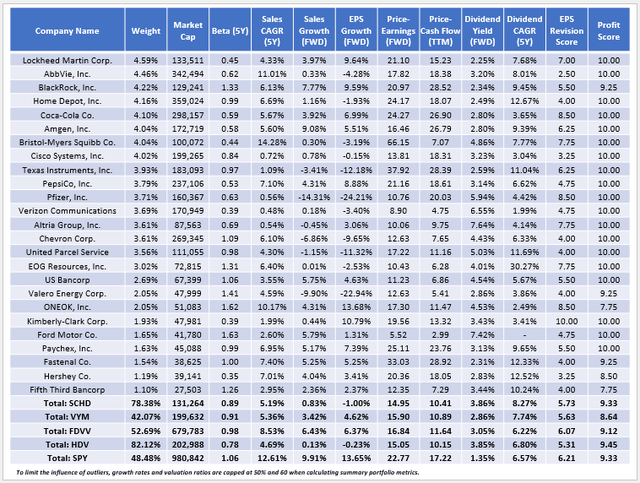

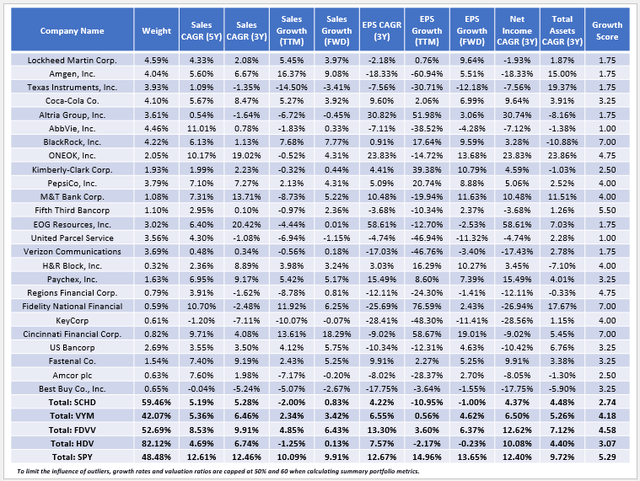

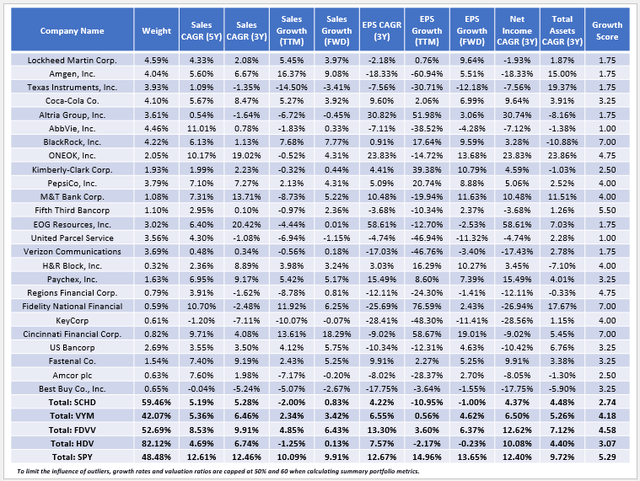

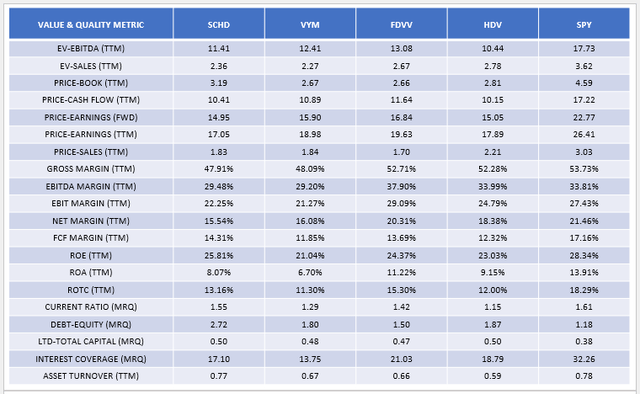

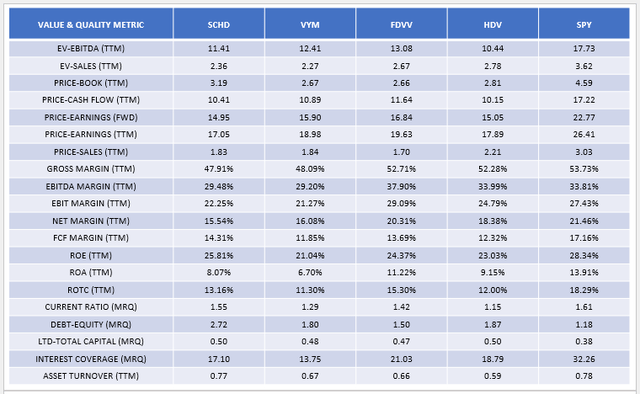

The following table highlights selected fundamental metrics for SCHD’s top 25 holdings. Please have a quick scan of the results, and I’ll provide commentary afterward for you to consider.

The Sunday Investor

Before we get into the details, here are some high-level observations:

1. SCHD is more concentrated than most. With 78.38% allocated to 25 stocks, it’s more susceptible to single-stock risk, as I think many shareholders can attest to now. The same is true for HDV, but VYM spreads that risk out a bit more with 547 holdings and only 52.69% concentrated in its top 25. Notably, it has an identical 0.91 five-year beta, so it’s also a good option if risk control is one of your objectives.

2. SCHD’s one-year estimated sales and earnings per share growth rates are virtually flat (0.83% / -1.00%). It’s disappointing that little has changed since March, and remains a primary concern of mine.

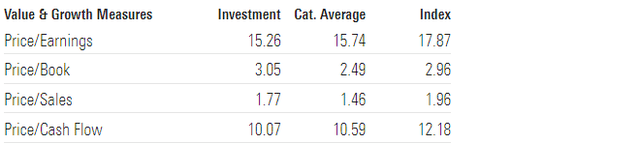

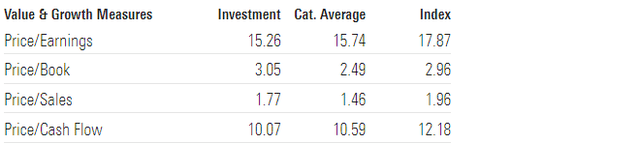

3. SCHD trades at 14.95x forward earnings and 10.41x trailing cash flow, figures I calculated myself and align well with Morningstar’s calculations. These valuations are more attractive than VYM, FDVV, and HDV and represent about a 35-40% discount compared to SPY.

Morningstar

4. The Index’s weighted average dividend yield is 3.86%. After adjusting for the fund’s 0.06% expense ratio, shareholders should net 3.80% at current prices, which is more than the fund’s 3.46% trailing dividend yield. As the year progresses, I expect the two figures to converge more.

5. SCHD’s constituents have grown dividends by an annualized 8.27% over the last five years, which is the best in this peer group. However, it’s a backward-looking metric. Later, I’ll assess SCHD’s sector-adjusted dividend consistency, growth, safety, and yield scores using Seeking Alpha Factor Grades to provide more color.

6. SCHD’s EPS Revision Score is 5.73/10, a significant improvement over the 4.95/10 score from March. This statistic tells me Wall Street has turned more bullish over its holdings recently, and I’m encouraged at how the gap with SPY has closed from 1.61 points in March to just 0.48 points today.

7. SCHD has an excellent sector-adjusted 9.33/10 profit score, which is identical to SPY and competitive with its dividend peers. High quality is a constant with SCHD, and this score consistently ranks near the top of the large-cap value category. Currently, it ranks #6/109, and if you are looking for other high-quality options, here are the top ten:

- iShares Core High Dividend ETF (HDV): 9.45/10

- O’Shares FTSE U.S. Quality Dividend ETF (OUSA): 9.43/10

- John Hancock U.S. High Dividend ETF (JHDV): 9.39/10

- VanEck Morningstar Durable Dividend ETF (DURA): 9.39/10

- Columbia U.S. ESG Equity Income ETF (EQIN): 9.36/10

- Schwab U.S. Dividend Equity ETF (SCHD): 9.33/10

- Capital Group Dividend Value ETF (CGDV): 9.32/10

- WisdomTree U.S. Dividend Growth ETF (DGRW): 9.31/10

- Fidelity Value Factor ETF (FVAL): 9.29/10

- Bahl & Gaynor Income Growth ETF (BGIG): 9.25/10

Side note: if you are looking for fundamental research on these or any other U.S. Equity ETF, please let me know in the comments section. I try to refresh my database at least twice per month.

To summarize, SCHD is a high-quality fund with a 3.80% expected dividend yield and an attractive 14.95x forward P/E. It has good earnings momentum and solid historical dividend growth metrics but still has weak estimated sales and earnings per share growth rates. Let’s look at a few of these metrics in more detail, starting with dividends.

SCHD Dividend Fundamentals

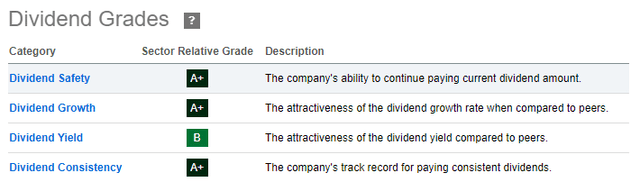

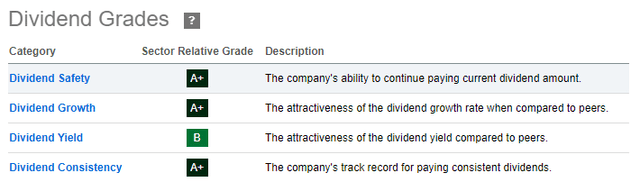

Seeking Alpha assigns dividend grades to thousands of U.S. Equity ETFs. They’re sector-adjusted, which promotes apples-to-apples comparisons. Just as it’s not appropriate to compare SCHD with SPY, it’s also not appropriate to compare the dividend features of stocks in regulated sectors like Utilities with those in more volatile sectors like Energy. For example, consider Lockheed Martin’s dividend grades below. Compared to others in the Industrials sector, it has excellent dividend safety, growth, and consistency grades, but its 2.25% dividend yield is below average. Other stocks in the same sector, like UPS, have better dividend yield grades but don’t rank as well on the other factors.

Seeking Alpha

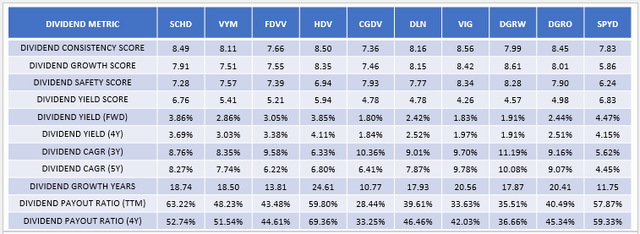

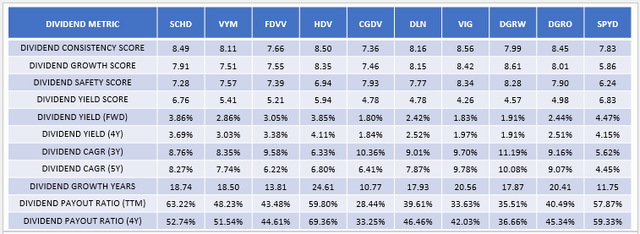

ETF grades are not available. However, I calculate scores for nearly 1,000 U.S. Equity ETFs based on current weightings and grades. This process allows me to compare funds based on their current composition rather than rely on past ETF metrics, which is less relevant due to portfolio turnover. To get a feel of what other dividend ETFs offer, consider comparing SCHD’s dividend statistics with nine other popular funds below, including VYM, FDVV, and HDV.

The Sunday Investor

Here are three of my observations:

1. SCHD has a solid 8.49/10 dividend consistency score supported by constituents who, on average, have increased payments by 18.74 years.

2. SCHD’s 3.86% gross dividend yield (3.80% net) and a 6.76/10 dividend yield score are only lagging behind the SPDR S&P 500 High Dividend ETF (SPYD). Its constituents’ 8.27% three-year dividend growth rate is also good, but DGI investors might be better off owning lower-yielding funds like the Vanguard Dividend Appreciation ETF (VIG) or the WisdomTree U.S. Quality Dividend Growth Fund (DGRW).

3. SCHD’s weakness is dividend safety, evidenced by a relatively low 7.28/10 dividend growth score and a 63.22% weighted average dividend payout ratio. Notably, SCHD is the only ETF in this sample with a trailing dividend payout ratio higher than its four-year average (63.22% vs. 52.74%). While I was pleased to see the March reconstitution reduced the payout ratio from 66.15% to 54.43%, it seems history is repeating itself. For reference, SCHD’s payout ratio was 49.09% in June 2022, when it was performing relatively well, but I’d prefer not to wait for a reconstitution each year to get things “fixed.” It would be much better if SCHD’s holdings could raise dividends without impacting the payout ratio. However, the only way to do that is through growth, and on that note, let’s check out how its top 25 holdings fare on that factor.

SCHD Growth Fundamentals

The following table builds on the earlier summary table and evaluates growth in several ways. As a starting point, I want to highlight SCHD’s 2.74/10 sector-adjusted growth score, which ranks an abysmal #107/109 in the large-cap growth category.

The Sunday Investor

It wasn’t always this way. Using the historical earnings growth rates provided over the last one and three years, we can derive the average growth rate for the first two years as follows:

- SCHD: 12.75% / 12.75% / -10.95%

- VYM: 9.68% / 9.68% / 0.56%

- FDVV: 18.49% / 18.49% / 3.60%

- HDV: 12.80% / 12.80% / -2.17%

- SPY: 11.54% / 11.54% / 14.96%

SCHD experienced the steepest drop of the five ETFs, with earnings growth declining from 12.75% in the first two years to -10.95% over the last year. This is a red flag, and it isn’t very reassuring to see how earnings growth is still forecasted to be -1.00% over the next twelve months. Meanwhile, VYM and FDVV feature earnings growth in the mid-single-digits and SPY’s growth rate remains pretty steady in the double-digits. For those interested in the math behind these numbers, here’s a worksheet showing the calculations for all of SCHD’s holdings.

Returning to the summary table above, it’s mostly bad news. For example, SCHD’s three-year net income and total assets growth rates are only about 4.50%, and its estimated sales growth rate is virtually nil. If these estimates hold true, SCHD’s holdings can only increase dividends by pushing the dividend payout ratio even higher.

SCHD Valuation and Quality Analysis

SCHD compensates for its weak growth features with an attractive 14.95x forward P/E and 9.33/10 sector-adjusted profit score, which ranks #43/109 and #6/109 in the large-cap value category, respectively. Its dividend yield, value, and quality combination are unmatched, so it’s a solid fund for income investors to hold for the long term. To illustrate, I screened earlier this month for large-cap value ETFs with dividend yields above 3% and above-average value and profit scores. I found six others, but SCHD was the only one that ranked in the top quartile on both factors.

- First Trust Morningstar Dividend Leaders Index ETF (FDL)

- iShares Core High Dividend ETF (HDV)

- Invesco Dow Jones Industrial Average Dividend ETF (DJD)

- Morgan Dempsey Large Cap Value ETF (MDLV)

- VanEck Morningstar Durable Dividend ETF (DURA)

- Global X S&P 500 Quality Dividend ETF (QDIV)

FDL has a higher dividend yield than SCHD but also suffers from weak growth (#108/109 growth score), is less diversified, and has a much higher 0.45% expense ratio. I can’t convince income investors to sell SCHD knowing there aren’t other good options. However, if income is not your priority, a few more doors open. The iShares Core High Dividend ETF (DIVB) is one choice, attractive for its strong diversification and low 0.05% expense ratio. It yields 2.69% but still ranks above average on value and quality. ETFs like FDVV and the Vanguard Dividend Appreciation ETF (VIG) are lower down on the value spectrum, and then there are broad-based funds like SPY, which is an excellent core holding. As a reader once put it, treat SCHD like one corner of the sandbox. It’s very good at what it does (dividend yield, value, quality), but you should still pay attention to the rest of the sandbox (growth, momentum).

To supplement these value and quality features, consider these statistics compared to VYM, FDVV, HDV, and SPY. You can also download this workbook if you’d like to dive deeper into the individual holdings.

The Sunday Investor

These statistics highlight how SCHD is attractive on other value metrics like EV-EBITDA (11.41x) and Price-Sales (1.83x). Its 14.31% free cash flow margin figure, which excludes stocks in the Financials sector, is competitive, as is the fund’s 15.81% ROE figure. We should expect this, given how free cash flow and return on equity are part of the selection process. Lastly, it’s worth noting how most quality metrics are worse than SPY’s, but that’s mainly because SPY overweights Technology stocks that tend to have higher margins. I’ve done my best to control for outliers by capping profitability metrics like ROE, ROA, and ROTC at 50% when calculating portfolio statistics, but even so, investors should recognize the exceptional quality of the mega-cap stocks SCHD avoids. For example, Apple’s ROE, ROA, and ROTC figures are 160.58%, 30.75%, and 44.66%, respectively, which are well above average. Avoiding these high-quality stocks doesn’t make much sense, and low-cost Index funds like SPY make owning them easy.

Seeking Alpha

SCHD Earnings Momentum

Lastly, I want to highlight SCHD’s improved EPS Revisions Grade, a statistic I use to measure market sentiment. The score has improved from 4.95/10 in March to 5.73/10 today, while SPY’s has declined from 6.56/10 to 6.21/10. In plain language, this indicates Wall Street has pared back earnings expectations for the broader market while increasing earnings expectations for the high-quality but beaten-down securities SCHD holds. The gap has yet to fully close, but if you believe sentiment is all about momentum, this is excellent news.

The Sunday Investor

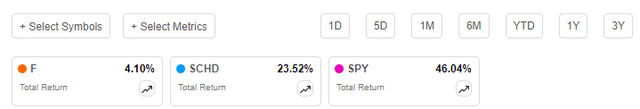

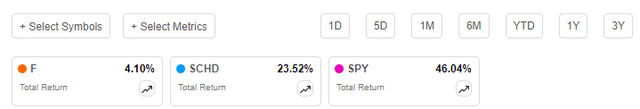

For the most part, stocks with improved EPS revision scores delivered above-average returns in the last six months. Examples include Lockheed Martin and Texas Instruments, while Bristol-Myers Squibb is close to breaking even after the company beat earnings expectations by 27.37% last quarter. The stock is up 19.81% in the last month. In contrast, Energy stocks with negative earnings revisions, like Chevron and Valero Energy, struggled, as did Ford Motor Company. Ford entered SCHD in March 2023 as the #24 top holding, and although it started out strong, it’s gained only 4.10% (including dividends) since and proved to be a net negative for SCHD, which is up 23.52%.

Seeking Alpha

Summary and Conclusion

Thank you for taking the time to read this lengthy analysis. I appreciate your time commitment, and while there are many takeaways to consider, I offer these simple closing notes:

1. SCHD is an excellent large-cap value ETF because it offers a relatively high 3.80% dividend yield and ranks in the top quartile in its category on value and quality. No other ETF can make that claim, so past performance aside, SCHD is fundamentally unique and likely a good long-term hold for income investors.

2. SCHD’s growth metrics have substantially deteriorated in the last couple of years, likely explaining why returns diverged so much from SPY. Readers should pay careful attention to this trend, as it directly impacts dividend safety and dividend growth. The payout ratio is steadily rising since its selections don’t have sufficient earnings growth to support dividend growth. It’s already up 9% since March and, notably, was the only one in a ten-fund sample with a dividend payout ratio higher than its four-year average.

3. SCHD can be used to increase the breadth of your portfolio. Unlike SPY, it has not been overly reliant on only a handful of stocks to drive its returns over the last three years, and its 0.91 five-year beta suggests it will offer some downside protection in case markets decline shortly. Owning both funds is an option, too. SCHD and SPY have only 7.84% overlap by weight, so you can mix and match them in any combination you like to get your desired yield.

4. SCHD has quickly closed the gap with SPY on earnings revisions. SPY still has the advantage, but SCHD has the momentum, and this might be an early sign of a rotation to value. The timing is challenging to get right, but this data supports keeping a position. SCHD trades at an attractive 14.95x forward earnings and 10.41x trailing cash flow, and its sector-adjusted value score ranks a solid #18/109 in the large-cap value category. For this corner of the sandbox, that’s good enough for me.

Overall, the changes since my last review were a net positive but not enough to justify a rating upgrade. The payout ratio trend worries me, and although I’m encouraged by SCHD’s earnings revision changes, waiting for earnings growth to turn positive again is only prudent. Therefore, I’ve assigned a “hold” rating to SCHD, and I look forward to answering any questions in the comments section below. Thank you for reading.