Rangsarit Chaiyakun

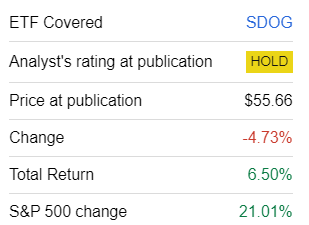

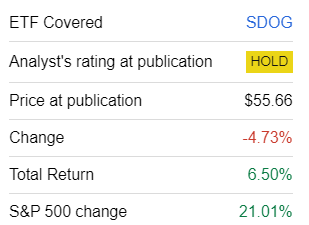

The earlier time I reviewed the ALPS Sector Dividend Canines ETF (NYSEARCA:SDOG), a smart-beta minimalist dividend-focused exchange-traded fund, was in June 2021, and it goes with out saying that an replace is lengthy overdue. At present’s reassessment is meant to reply a couple of questions, together with these associated to its previous efficiency, present portfolio holdings, and important type issue traits, all of that are essential to determine whether or not the Maintain ranking needs to be revised greater or decrease.

What Is SDOG’s Technique?

To recap, SDOG has a slightly minimalist and unsophisticated strategy to inventory choice. In accordance with its website, its foundation is the S-Community Sector Dividend Canines Index. To qualify for inclusion, as described within the abstract prospectus, a inventory have to be within the group of the 5 names with the best dividend yields within the sector, with the exception being solely actual property, which is solely ignored. 50 equities that certified are weighted equally, and so are the GICS sectors. The index is reconstituted simply every year in December, whereas rebalancing follows a quarterly schedule.

How Has SDOG Fared Since The Earlier Protection?

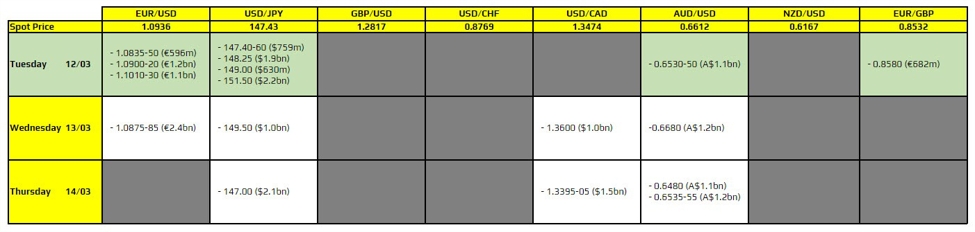

Briefly, it has not been a hit for the reason that article was revealed on June 6, 2021, underperforming the S&P 500 index grossly, even with the pretty sizable dividends factored in, partly proving my unenthusiastic Maintain ranking was justified.

In search of Alpha

In addition to, I must also point out that among the many dividend funds I cowl, together with these targeted on worldwide equities, SDOG delivered one of many weakest outcomes over the 3-year interval. The median worth return within the group is 10.18% (as of March 11), with the World X SuperDividend ETF (SDIV) having the worst results of unfavourable 47.23% and the First Belief NASDAQ Expertise Dividend Index Fund ETF (TDIV) being the champion with about 36.94%; SDOG delivered simply 3%. The full returns are proven under. Once more, the Dividend Canines ETF was removed from the most effective.

| 3Y Median Whole Return within the Group | 21.52% |

| 3Y Finest Whole Return within the Group | TDIV, 45.72% |

| 3Y Worst Whole Return within the Group | SDIV, -26.84% |

| SDOG’s 3Y Whole Return | 16.21% |

Calculated by the creator utilizing information from In search of Alpha. Returns as of March 11

However, there are nonetheless a couple of nuances illustrating that SDOG’s efficiency was not as dismal as traders may recommend from the metrics above. First, it’s price noting that through the July 2021-February 2024 interval, SDOG had a a lot decrease draw back seize ratio than the iShares Core S&P 500 ETF (IVV), as proven under:

| Metric | SDOG | IVV |

| Upside Seize | 64.29% | 103.62% |

| Draw back Seize | 75.73% | 96.78% |

Information from Portfolio Visualizer

Subsequent, the truth that is instantly linked to those information is that it carried out a lot better than the bellwether fund through the bear market of 2022, declining by simply 21 bps whereas IVV was down by 18.16% for the yr. And its most drawdown over the interval involved was simply 17.72% vs. IVV’s 23.93%. Nonetheless, through the March 2020 market carnage, SDOG underperformed IVV, taking place by roughly 21.4% whereas the S&P 500 ETF declined by solely 12.1%, which signifies that it may possibly present a bit more healthy outcomes when despair engulfs the markets, due to the margin of security its undervalued holdings ought to have, however not at all times.

In addition to, SDOG drastically lags when the S&P 500 rebounds. So it’s no coincidence that its annualized return over the August 2012-February 2024 interval (it was incepted in June 2012) was simply 10%, greater than 4% decrease than the end result delivered by IVV.

What Is SDOG Providing Relating to Dividends At This Juncture?

As of March 9, SDOG had 50 equities within the portfolio, with Viatris (VTRS) being the important thing holding with a 2.34% weight. Unsurprisingly, the present model is providing a slightly sturdy weighted-average ahead dividend yield of 4.4%, with the foremost contributors being the tobacco and diversified telecommunication providers industries. Relating to sectors, it’s vitality and supplies which are added most.

| Sector | Weight | Median Fwd DY |

| Communication Companies | 9.79% | 4.09% |

| Shopper Discretionary | 10.41% | 3.05% |

| Shopper Staples | 9.11% | 4.98% |

| Power | 9.91% | 5.13% |

| Financials | 10.53% | 4.88% |

| Well being Care | 10.17% | 4.1% |

| Industrials | 9.70% | 3.54% |

| Info Expertise | 10.56% | 3.39% |

| Supplies | 9.68% | 5% |

| Utilities | 9.48% | 4.76% |

Calculated by the creator utilizing information from In search of Alpha and the ETF

The ahead dividend yield isn’t the one metric illustrating that worth traits are pretty sturdy portfolio-wise. For instance, nearly 59% of the holdings have a Quant Valuation ranking of B- or greater, whereas the weighted-average earnings yield stands at 4.6%. With the impression of loss-making corporations eliminated (11.6% of the web belongings), it goes as much as 5.3%.

So in the case of delivering interesting yields from underappreciated corporations, its technique clearly works. However what about dividend progress? I might not say so. The WA dividend CAGRs of the portfolio illustrate that:

| 3Y CAGR | 5Y CAGR |

| 6.46% | 5.15% |

Calculated by the creator utilizing information from In search of Alpha and the ETF

An important comment is that the 3-year determine is skewed by Darden Eating places (DRI), which had an over 97% CAGR for the interval. Actually, the determine is pushed primarily by the dividend suspension amid the pandemic after which its reinstatement and gradual DPS increases because the coronavirus loosened its grip on the resorts, eating places, and leisure business.

Why Are SDOG’s Development Traits So Lackluster?

Regardless that I anticipated a usually subdued progress profile as a direct consequence of the ETF’s value-centered funding philosophy, I used to be nonetheless negatively stunned by how poor the expansion traits turned out to be. In reality, neither ahead income nor earnings per share progress charges are constructive, as proven within the desk under:

| Metric | EPS Fwd | Income Fwd | EBITDA Fwd |

| SDOG | -0.51% | -0.05% | 0.65% |

Calculated by the creator utilizing information from In search of Alpha and the ETF

The weighted-average EBITDA progress fee (the impression of the monetary sector was stripped off) is simply marginally higher, however nonetheless even under 1%. What are the culprits behind it? It’s price remembering that high-yield dividend shares characterize predominantly old-economy industries, so it’s counterintuitive to anticipate outsized progress charges from them. On this explicit case, the impression of corporations which are forecast to see their gross sales and/or EPS, and/or EBITDA declining is the primary offender:

| Metric | SDOG |

| % of holdings with unfavourable ahead income progress charges | 41.8% |

| % of holdings with unfavourable ahead EBITDA progress charges | 41.7% |

| % of holdings with unfavourable ahead EPS progress charges | 52.3% |

Calculated by the creator utilizing information from In search of Alpha and the ETF

Additionally, that is the flip aspect of smart-beta methods, as equal weighting allowed detractors to have such a considerable impression on the portfolio-wise figures.

Does SDOG Compromise On High quality?

Regardless of not concentrating on probably the most worthwhile and financially sound corporations by means of a scrupulous screening course of, SDOG does have principally sturdy high quality traits, with the foremost reality supporting this suggestion being a big share of the holdings with at least a B- Quant Profitability ranking or greater (nearly 92%, 46 holdings). In addition to, there are not any cash-burning or EBITDA-negative corporations on this combine. Clearly, there are vulnerabilities nonetheless. I ought to word that my calculations confirmed a weighted-average Return on Belongings of simply 4.1%. This can be a clearly weak end result for a large-cap combine (there are not any mid-caps in SDOG, and the WA market cap is at $80.8 billion). Alas, the median Return on Whole Capital for non-financial corporations at simply 6.8% can be properly under the fascinating stage of 10%.

Investor Takeaway

Focusing on shares with excessive dividend yields, SDOG finally ends up accumulating principally slowly rising old-economy gamers. Whereas useful amid downturns just like the one the markets went by means of in 2022, it’s something however opportune when enthusiasm returns, as value-heavy portfolios have materially smaller potential to take part within the bull run, not to mention outperform their dearer counterparts amid omnipresent ebullience. On this regard, assuming a outstanding worth tilt, SDOG is perhaps a top-class contrarian wager at this juncture because the market is in euphoria mode, which is perhaps reset at any time. Nonetheless, I might abstain from defending a contrarian view right here, sustaining a Maintain ranking.