Ladan Stewart, a outstanding determine within the US Securities and Change Fee’s (SEC) crypto division, has left her place to hitch White & Case, a famend legislation agency primarily based in america.

Stewart, who has led the SEC’s crypto and cyber litigation unit since September 2022, performed a pivotal position in overseeing important litigation involving main gamers within the cryptocurrency trade, as reported by Bloomberg Regulation.

Nonetheless, Stewart’s newest profession transfer signifies a shift in her skilled focus away from hostile engagements with the nascent crypto trade.

Stewart’s Key Position In Authorized Battle In opposition to Ripple And Coinbase

In response to the report, considered one of Stewart’s notable circumstances concerned main the lawsuit in opposition to Coinbase, the most important cryptocurrency trade in america by buying and selling quantity, in June 2023. As Bitcoinist reported, the lawsuit accused Coinbase of working as an unregistered securities trade, dealer, and clearing company.

As well as, Stewart was a part of the SEC workforce that engaged in a multi-sided legal battle with blockchain funds firm Ripple over whether or not the XRP token needs to be categorised as an unregistered safety beneath the Howey take a look at.

Stewart’s departure from the SEC comes when the company is appealing a New York federal choose’s ruling that Ripple’s XRP token is just not a safety when bought to most of the people, contradicting the SEC’s stance that the majority digital tokens are securities.

From SEC Enforcement To Crypto Authorized Protection?

In response to Bloomberg Regulation’s report, becoming a member of White & Case as a associate within the agency’s white-collar protection group, Stewart goals to develop a “robust practice” specializing in crypto and cyber defense.

Stewart emphasised the significance of the crypto trade’s endurance, particularly with the current launch of a number of Bitcoin Change Traded Funds (ETFs) on January 12.

Given the trade’s complexity and turbulent enforcement panorama, Stewart believes that authorized questions surrounding digital property will proceed to be on the forefront. Stewart acknowledged:

Crypto is right here to remain—that’s turn into very clear with the launch of a slew of Bitcoin exchange-traded funds. Given the complexity and the turbulent enforcement area, authorized questions surrounding crypto are going to be on the forefront for a while.

White & Case, however, has a worldwide presence spanning over 40 places of work and a workforce of greater than 2,600 attorneys and is acknowledged as one of many largest legislation companies in america. The agency’s main purchasers embody trade giants equivalent to Microsoft, Abbvie Inc., and GoldenTree Asset Administration.

Stewart’s expertise and experience in navigating the regulatory landscape surrounding cryptocurrencies will likely be a priceless asset to White & Case, particularly given the heightened regulatory scrutiny the digital asset trade has confronted in recent times, stated Joel Cohen, head of White & Case’s White Collar Group, in an announcement.

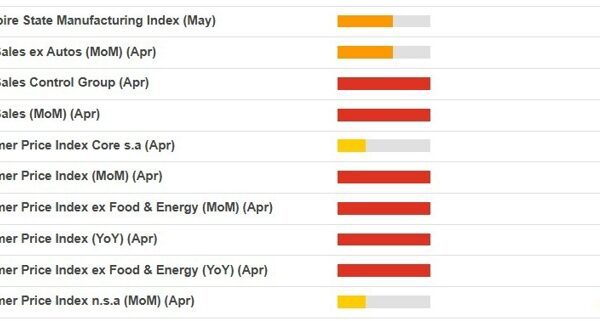

Featured picture from Shutterstock, chart from TradingView.com