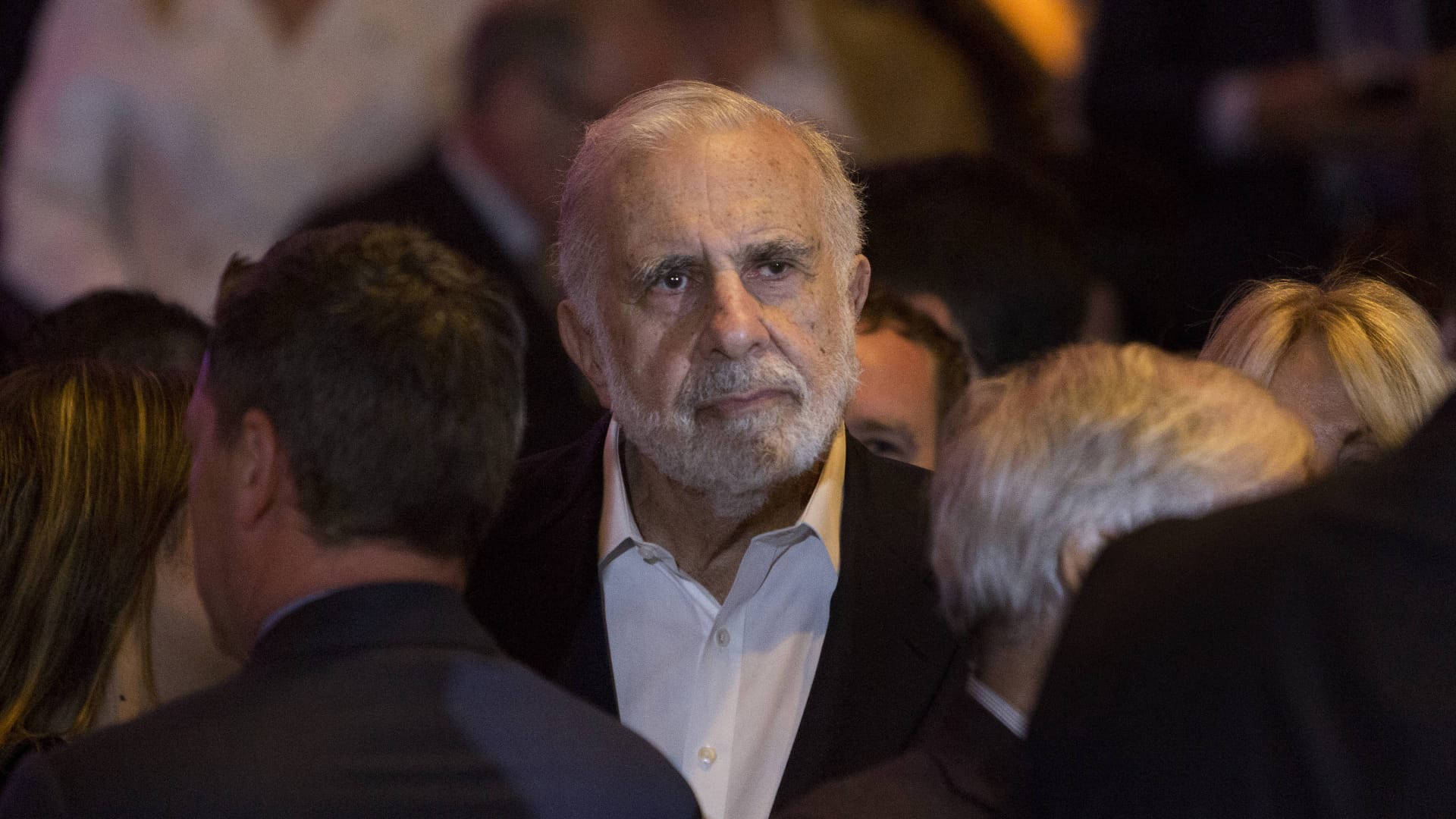

Carl Icahn, billionaire activist investor, waits for Donald Trump, president and chief executive of Trump Organization Inc. and 2016 Republican presidential candidate, not pictured, to speak at an election night event in New York, U.S., on Tuesday, April 19, 2016.

Victor J. Blue | Bloomberg | Getty Images

The Securities and Exchange Commission said on Monday that billionaire activist investor Carl Icahn illegally failed to disclose billions of dollars worth of personal margin loans pledged against the value of his Icahn Enterprises stock.

Icahn and the publicly-traded company that bears his name settled those charges without admitting or denying wrongdoing. They agreed to pay $500,000 and $1.5 million in fines, respectively, the SEC said in a press release Monday.

The SEC said that Icahn pledged anywhere from 51% to 82% of Icahn Enterprises, or IELP, shares outstanding to secure billions worth in margin loans without disclosing to shareholders or federal regulators.

Icahn’s cumulative personal borrowing was as much as $5 billion, according to an SEC consent order.

As the effective controlling shareholder of IELP, Icahn would have been expected to make what are known as Schedule 13D filings, which typically detail what a control shareholder expects to do with their influence over a company but also would have had to include information about any encumbrances, like margin loans, on a stake.

“The federal securities laws imposed independent disclosure obligations on both Icahn and IEP,” said Osman Nawaz, a senior SEC official. “These disclosures would have revealed that Icahn pledged over half of IEP’s outstanding shares at any given time.”

The SEC said Icahn did not disclose the margin borrowing via 13D until July 2023. A spokesperson for Icahn did not immediately return a request for comment.

Icahn’s margin borrowing was highlighted in a May 2023 report issued by short-seller Hindenburg Research, which put pressure on Icahn Enterprises’ stock after alleging that the holding company was, among other things, not estimating the value of its holdings correctly.

Icahn consolidated and amended his margin borrowings in July, two months after the Hindenburg report, according to the SEC’s consent order.

This is breaking news. Please refresh for updates.