The US Securities and Alternate Fee (SEC) has intensified its regulatory efforts concentrating on the rising crypto market and Decentralized Finance (DeFi) sectors.

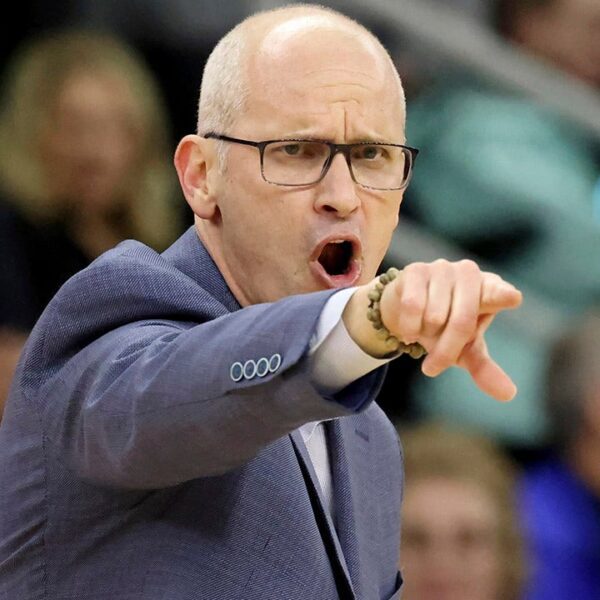

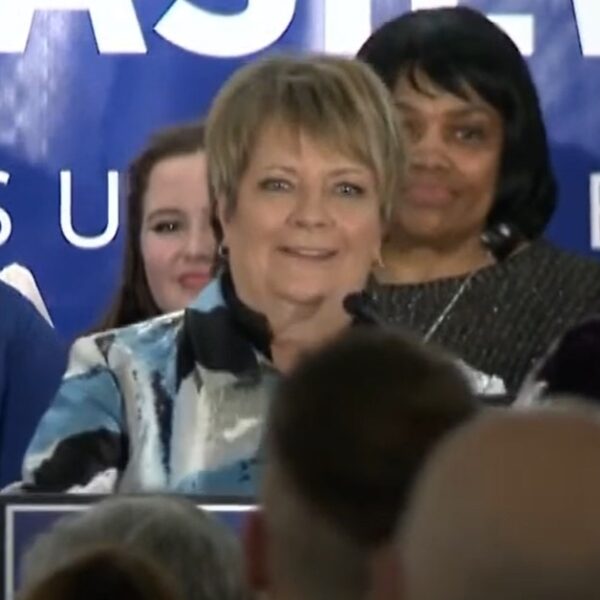

The regulatory watchdog has just lately adopted new rules imposing registration necessities on “dealers” and “government securities dealers.” Whereas the SEC Chair, Gary Gensler, believes these measures shield buyers and improve market integrity, the transfer has confronted staunch opposition from Commissioner Hester Pierce.

SEC Crypto Laws Could Stifle Competitors?

The newly adopted guidelines, Alternate Act Guidelines 3a5-4 and 3a44-2, refine the definition of “as a part of a regular business” in Sections 3(a)(5) and three(a)(44) of the Securities Alternate Act of 1934.

These guidelines intention to determine particular actions that will classify people partaking in them as “dealers” or “government securities dealers.” Consequently, these falling underneath these classes should register with the SEC, change into a self-regulatory organization (SRO) member, and adjust to federal securities legal guidelines and regulatory obligations.

Commissioner Hester Pierce expressed her robust dissent in response to adopting these guidelines. Pierce argued that the definition of a “dealer” outlined within the guidelines deviates from the present statutory framework, resulting in distorted market habits and diminished market high quality.

The Commissioner, who has taken a broadly pro-innovation and pro-adoption stance on the DeFi sectors and crypto belongings, criticized the broad scope of the principles, categorizing market individuals that have interaction in funding and buying and selling actions as sellers solely based mostly on their liquidity-providing actions.

Pierce emphasised that the excellence between sellers and merchants is “vital” and has been persistently acknowledged by the Fee and market individuals for many years.

By conflating the 2 classes, Pierce believes that the principles create uncertainty and impose “unnecessary regulatory burdens” on entities that don’t function as sellers.

Furthermore, Pierce means that this regulatory shift penalizes liquidity provision, probably decreasing market liquidity and discouraging corporations from partaking in actions that contribute to optimistic liquidity externalities.

The Commissioner criticized the rule’s unfavorable impression on competitors inside the market. The “excessive regulatory requirements” and related prices will seemingly drive smaller gamers out of the market, resulting in focus and homogeneity amongst liquidity suppliers. This consolidation could exacerbate market fragility relatively than foster wholesome competitors, Pierce acknowledged.

Pierce Calls For Revised Crypto Laws

Whereas the SEC argues that the principles present complete regulatory oversight, Pierce contends that efficient regulation doesn’t necessitate a prescriptive regime governing each market participant.

The Commissioner highlights present information sources and surveillance mechanisms, such because the Consolidated Audit Path, Type PF, TRACE, and enormous dealer reporting, that already facilitate regulatory oversight with out imposing burdensome laws on liquidity suppliers.

Pierce additional acknowledged that along with these “fundamental flaws,” the brand new guidelines pose implementation challenges and lack readability relating to their utility to the crypto markets.

The scope of the principles stays unclear, probably subjecting unanticipated corporations to registration necessities. Pierce mentioned that the quick implementation interval, the involvement of a number of regulators corresponding to FINRA and SIPC, and potential interactions with different guidelines additional complicate the state of affairs.

Given the considerations raised and the arbitrary nature of the rule’s classification, Commissioner Pierce requested that the rule be repurposed to permit stakeholders to supply suggestions on a considerably revised model. Finally, Pierce emphasised the necessity for a extra rigorous and predictable course of that avoids “arbitrary” outcomes based mostly on probability and the Fee’s whims.

Featured picture from Shutterstock, chart from TradingView.com