Nasdaq-listed medical device manufacturer Semler Scientific has expanded its Bitcoin (BTC) holdings, acquiring an additional 303 BTC for $29.3 million. The company continues to double down on its MicroStrategy-inspired corporate treasury strategy.

High Bitcoin Price Not A Barrier To Purchase

Bitcoin made history this week by surpassing the $100,000 price level for the first time, pushing its total market capitalization past $2 trillion. Despite BTC’s record high price, corporate buyers like Semler Scientific remain undeterred and continue accumulating the flagship cryptocurrency.

According to a recent announcement, Semler Scientific has added another 303 BTC to its holdings. Notably, the latest purchase was made from November 25 through December 4, at an average price of $96,779, inclusive of fees and expenses.

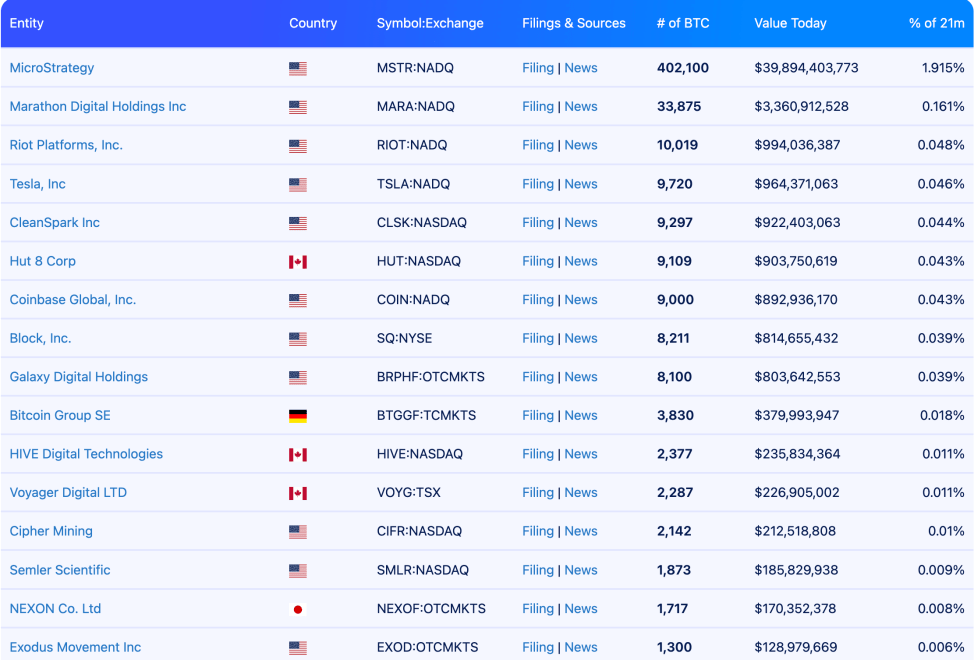

This brings the company’s total Bitcoin holdings to 1,873 BTC, acquired at a combined cost of $147.1 million and an average purchase price of $78,553 per BTC. These substantial holdings place Semler Scientific among the top publicly-listed companies holding BTC as part of a corporate treasury strategy.

Semler’s BTC yield from October 1 through December 4 stood at 54.7%. This is lower compared to the yield from July 1 – when it adopted BTC as a corporate asset – through December 4, which was at 78.7%. Commenting, Eric Semler, chairman of Semler Scientific, said:

We are very pleased to report a BTC Yield of 78.7%. In addition, we have requested approval from the options exchanges to allow options trading in our stock as we believe we satisfy their eligibility requirements.

For clarity, BTC yield is a key performance metric Semler uses to evaluate the effectiveness of its Bitcoin investment strategy, which aims to maximize shareholder value. The company also uses this metric to help investors understand its decision to finance BTC purchases by issuing additional common stock.

How Do Semler Scientific’s BTC Holdings Stack Against Other Companies?

Semler Scientific first unveiled its BTC acquisition strategy earlier this year in May with a purchase of 581 BTC for $40 million. Since then, the company has gone on multiple BTC buying sprees, ballooning its total BTC holdings to 1,873 as of today.

The firm’s latest BTC purchase has pushed it to 14th position – overtaking Japanese firm Nexon with 1,717 BTC – on the list of publicly-traded companies to hold BTC as part of corporate treasury strategy.

The leader in this space remains US-based business intelligence firm MicroStrategy, which continues to make significant Bitcoin purchases worth billions of dollars. MicroStrategy currently holds nearly 2% of Bitcoin’s total 21 million supply.

Following MicroStrategy are crypto mining firms MARA with 33,875 BTC, Riot Platforms holding 10,019 BTC, and Elon Musk’s Tesla with 9,720 BTC. At press time, BTC trades at $99,355, down 3.8% in the past 24 hours.

Featured Image from Unsplash.com, Charts from Bitcoin Treasuries and TradingView.com