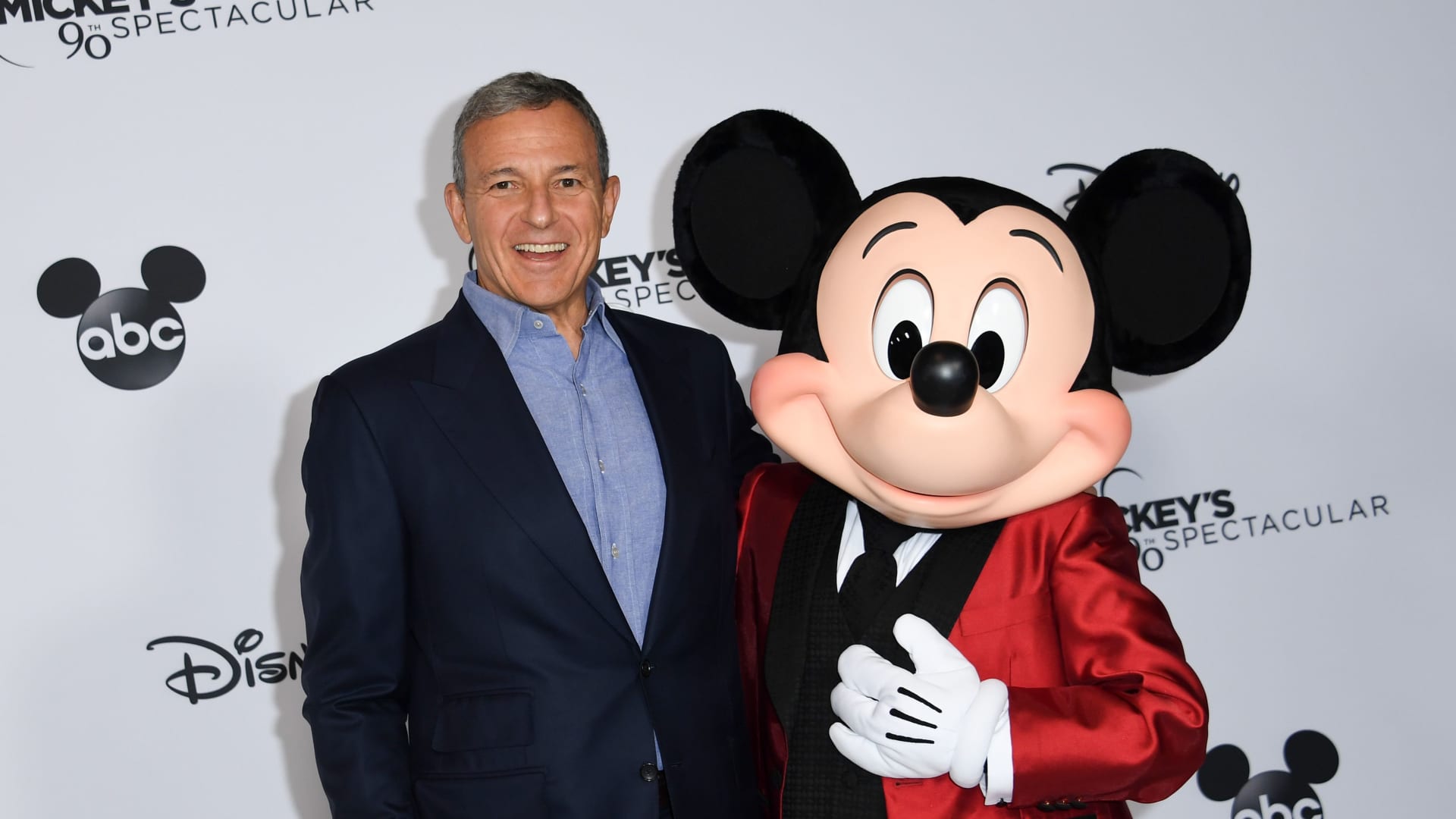

Bob Iger poses with Mickey Mouse attends Mickey’s ninetieth Spectacular at The Shrine Auditorium on October 6, 2018 in Los Angeles.

Valerie Macon | AFP | Getty Photographs

Disney shareholders on Wednesday will settle a long-simmering proxy battle led by billionaire investor Nelson Peltz.

Voters will resolve whether or not the corporate’s board deserves one other 12 months collectively, or if candidates nominated by activist buyers, together with Trian Companions’ Peltz, ought to change sure administrators.

Disney’s 2024 annual assembly will start at 1 p.m. ET on Wednesday. Disney will air a live webcast of the occasion, which generally lasts about two hours.

The 81-year-old Peltz, together with former Disney Chief Monetary Officer Jay Rasulo, have waged a quest to land two board seats. They’ve requested shareholders to call them as new administrators rather than Maria Elena Lagomasino and Michael Froman.

Peltz, who dislikes being known as an activist however has orchestrated profitable campaigns at iconic corporations like PepsiCo, P&G and Wendy’s, controls a $3.98 billion stake in Disney, or about 2% of complete shares excellent. Most of these shares are owned by former Disney govt and Marvel CEO Ike Perlmutter, who has supported Peltz and is paying a portion of the bills referring to soliciting proxies, in response to an SEC submitting.

Trian claims Disney’s board has did not generate adequate returns lately as subscription streaming losses have mounted and conventional TV subscribers have declined. Trian has additionally argued Disney’s board has struggled to plan succession, noting Iger has renewed his contract as CEO 5 instances and needed to return to the put up in late 2022 after his handoff to Bob Chapek failed.

Jay Rasulo and Nelson Peltz.

Patrick T. Fallon | Bloomberg | Getty Photographs | Adam Jeffery | CNBC

Disney has countered that Iger has been righting the ship since his return as CEO, and the corporate must be left to get better with out distraction. The corporate additionally mentioned Iger and the board are finishing up a sturdy succession vetting course of, which must be left uninterrupted.

“The whole board is leaning into this forward-looking, forward-leaning, incredibly disciplined [succession] process,” mentioned Morgan Stanley govt chairman James Gorman, who joined the Disney board in February, in an interview with CNBC’s “Squawk on the Street” final week.

Disney shares closed Tuesday at $122.82, up 55% from a low of about $79 on Oct. 27 however down 38% from $197 three years in the past. The inventory has jumped 36% 12 months thus far, in comparison with a 9% acquire for the S&P 500.

Early vote rely

Each Disney and Trian acquired assist from influential shareholders forward of Wednesday’s assembly. Disney is main Trian with greater than 60% of shareholder votes already solid, Bloomberg reported Tuesday.

One prime shareholder, who didn’t have entry to personal info and was talking on the situation of anonymity, advised CNBC they anticipated the vote could be extraordinarily shut.

Roughly one-third of Disney’s shareholders are retail shareholders, who historically vote in small numbers in annual meetings. However some particular person stakeholders, together with Star Wars creator George Lucas and Laurene Powell Jobs, have vital Disney stakes that give them heft akin to establishments. Each Lucas and Powell Jobs, who maintain Disney shares by way of the acquisitions of LucasArts and Pixar, respectively, have supported Iger and the present board.

“Turnout in contested elections tends to be higher, because both sides are soliciting votes” from massive and small shareholders, mentioned 13D Monitor founder and president Ken Squire.

Institutional buyers personal the opposite two-thirds of Disney’s inventory. BlackRock, Disney’s second-largest shareholder, plans to again the corporate, the Journal reported Monday. CNBC has confirmed T. Rowe Price, which owns about 9.3 million Disney shares, in response to FactSet, can be backing Disney. Institutional shareholders can change their vote up till Wednesday’s assembly.

“We are comfortable that management has a viable plan to address the important matters facing the company,” a T. Rowe spokesperson advised CNBC.

Iger additionally has the assist of Mason Morfit’s ValueAct Capital, which has a historical past of pushing for strategic change. The 2 sides signed an “information-sharing agreement” in January, permitting Morfit entry to nonpublic info. ValueAct owns simply 0.28% of excellent Disney shares, however its worth to the corporate extends past voting. Disney has been in a position to faucet ValueAct’s community and experience when it has pitched institutional buyers.

The California Public Workers’ Retirement System (CalPERS), Yacktman Asset Administration, and Neuberger Berman have expressed their support for Peltz and Rasulo.

Even for seasoned advisors, it is tough to foretell how main establishments will vote. The high-profile nature of the battle and the blended suggestions from proxy advisory companies could make it even trickier.

“As the stakes grow higher, so does shareholder independence,” mentioned Saratoga Proxy senior companion John Ferguson, who is just not concerned within the Disney-Trian scenario. “At Disney, more than most fights, you’re going to see shareholder independence.”

Trian might have signaled it has develop into involved Rasulo — who was trailing Peltz in early vote tallying, in response to the Journal — will not get sufficient assist to land a seat. The activist fund filed a doc Monday particularly centered on eradicating Lagomasino.

“She has overseen years of poor shareholder returns and deteriorating financial performance,” Trian wrote in its supplies to shareholders. “Her background in wealth management is not relevant to Disney’s business and she does not have any skills that are central to Disney’s strategy that others directors do not also possess.”

Voting for retail shareholders closed Tuesday night time. Disney estimated it would spend $40 million soliciting assist from shareholders. That determine would not account for the time and power that Iger and his prime administration staff have put into assembly with prime shareholders.

Trian estimated it could spend $25 million on the battle. Peltz, his prime lieutenants and their advisors met with buyers all through March.

Advisory suggestions break up

Shareholder advisory companies Glass Lewis and ISS break up their suggestions to shareholders. Glass Lewis sided with Disney and asserted Iger’s return, paired with this 12 months’s nominations of Gorman and former Sky CEO Jeremy Darroch to the board, have given the corporate “adequate opportunity to launch a more credible succession program and develop, communicate and execute on several key initiatives which appear to reasonably target acknowledged operational and financial weaknesses at Disney.”

ISS countered that board oversight failures, significantly round succession, triggered the agency to suggest Peltz’s nomination — although not Rasulo’s.

“Incremental change is needed at the company due to multi-year underperformance of the company’s peers and chosen benchmark, operational challenges, and most critically, a repeated failure on the part of the board to oversee the cultivation of a successor to Iger,” ISS wrote.

Nelson Peltz, founding companion and CEO of Trian Fund Administration, speaks with CNBC’s Andrew Ross Sorkin on July 17, 2013 in New York.

Heidi Gutman | CNBC, NBCU Picture Financial institution, NBCUniversal by way of Getty Photographs

The highest shareholder who spoke to CNBC mentioned ISS’ choice to assist Peltz over Lagomasino was a big shock.

Whereas it supported Peltz, ISS mentioned shareholders should not again Rasulo, citing his earlier positioning as a possible successor to Iger.

“Though we do not have any concerns about his ability to serve as an objective director, we recognize that Rasulo’s potential presence might create added friction on the board,” ISS wrote.

Blackwells might play spoiler

Peltz and Rasulo aren’t the one two new board members for whom shareholders can vote. Activist investor Blackwells, run by Canadian inheritor Jason Aintabi, can be operating a slate of latest potential administrators.

Finest identified for its successful 2022 campaign to take away Peloton CEO John Foley, Blackwells has nominated media govt Jessica Schnell, SL Green director Craig Hatkoff and TaskRabbit founder Leah Solivan as its three Disney board alternative candidates.

Blackwells is not supporting Trian’s marketing campaign and has totally different suggestions for Disney than Peltz and Rasulo, together with a attainable break up of the corporate by separating its owned actual property right into a publicly traded actual property funding belief.

Nonetheless, Blackwells has additionally been a thorn in Disney’s facet. The funding agency released a presentation final month detailing a previous relationship between ValueAct and Disney, which mentioned the investor made tens of hundreds of thousands of {dollars} in charges managing Disney pension funds.

ValueAct hasn’t managed Disney belongings because it started constructing a stake in late 2023, an individual conversant in the matter beforehand advised CNBC. The association nonetheless raised questions on ValueAct’s assist for the corporate and whether or not Disney’s board ought to have disclosed the prior relationship.

Disclosure: Sky is owned by Comcast, the mother or father firm of CNBC.

WATCH: Disney board battle reaches last moments