Merchants work on the ground on the New York Inventory Trade (NYSE) in New York Metropolis, U.S., January 29, 2024.

Brendan Mcdermid | Reuters

Geopolitical dangers could also be mounting, however shares are nonetheless the “asset class of choice,” in line with Beat Wittmann, accomplice at Porta Advisors, who additionally mentioned the end result of the U.S. election in November could be “pretty irrelevant” for markets.

As buyers enter an unprecedented year for elections around the world amid a number of large-scale conflicts prone to additional escalation, Wittmann acknowledged that “politics will remain difficult and confusing,” however that markets will doubtless be sanguine.

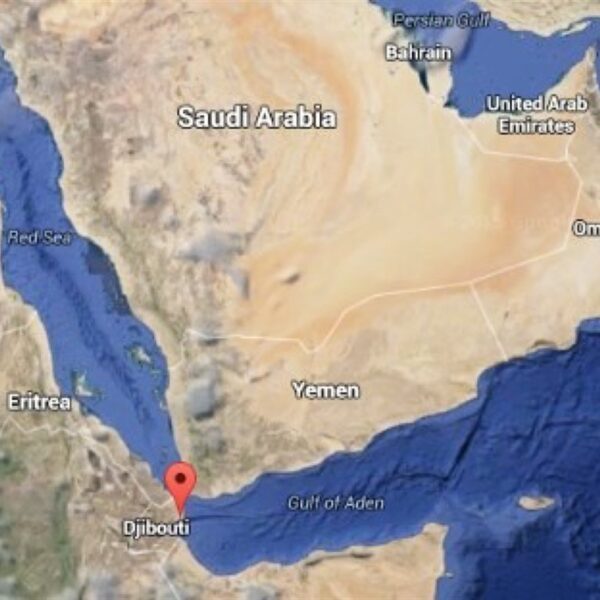

“There are two transmission mechanisms. One is energy prices — will the trouble in the Middle East be a transmission into higher energy prices, or the war in Eastern Europe? Not really, if you look at how energy prices have developed,” he instructed CNBC’s “Squawk Box Europe” on Tuesday.

“And the second thing is really international trade and trade routes. We have seen it brutally in Covid and we see a bit of it of course — traffic through Suez, insurance companies putting up costs, etc.— but that’s all digestible.”

He added that markets had “gotten used to trouble in geopolitics” during the last 5 years, so the impression on asset costs of any additional unhealthy information could be considerably restricted.

Final 12 months affords some help to this principle. Regardless of the breakout of the Israel-Hamas struggle and Russia’s invasion of Ukraine exhibiting no signal of abating, together with a number of different simmering geopolitical tensions world wide, the S&P 500 gained 24% in 2023.

Nonetheless, a lot of the momentum was pushed by the excellent efficiency of the so-called “Magnificent Seven” mega-cap tech shares, resulting in some considerations amongst buyers about focus danger. Wittmann acknowledged that danger, however stays bullish about broader upside potential in shares.

“I think it’s on track, of course expectations get ever higher, so there will be at some stage disappointments here and there, but stock-specific.”

“But technology clearly has real mania potential, and there could be even a melt-up in the market led by technology.”

Financial coverage emerged as the important thing driver of an enormous rally towards the top of the 12 months after the Federal Reserve signaled that not less than three rate of interest cuts have been on the desk in 2024, providing a selected enhance for high-growth shares. The Fed releases its subsequent financial coverage resolution and ahead steerage on Wednesday.

Wittmann advised the one danger to this momentum could be if inflation proves stickier than the Fed expects due to some unexpected geopolitical danger coming into play, leading to rates of interest being saved greater for longer.

However he believes that will be an issue just for fastened revenue and the expansion shares which have loved a lot of the current rally, and could be constructive for worth shares — these buying and selling at a reduction relative to their monetary fundamentals — which means if “in any doubt, I think equities are really the asset class of choice.”

U.S. election ‘irrelevant’ for markets

A lot of the dialog on the current World Financial Discussion board in Davos, Switzerland, centered on the possibility of Donald Trump returning to the White House, and whether or not his erratic decision-making and radical coverage proposals, reminiscent of sweeping 10% tariffs on all imports, could be materials for buyers.

Wittmann mentioned the end result of November’s election could be “pretty irrelevant for markets, quite frankly.”

“If you have such a strong position as an economy, which the U.S. has in a supreme way, controlling and basically dominating finance, dominating technology, dominating aerospace defense, having achieved strategic autonomy in energy, for example, then it’s really difficult, so no matter whether he gets elected or not, he will also not be able to surprise,” he mentioned.