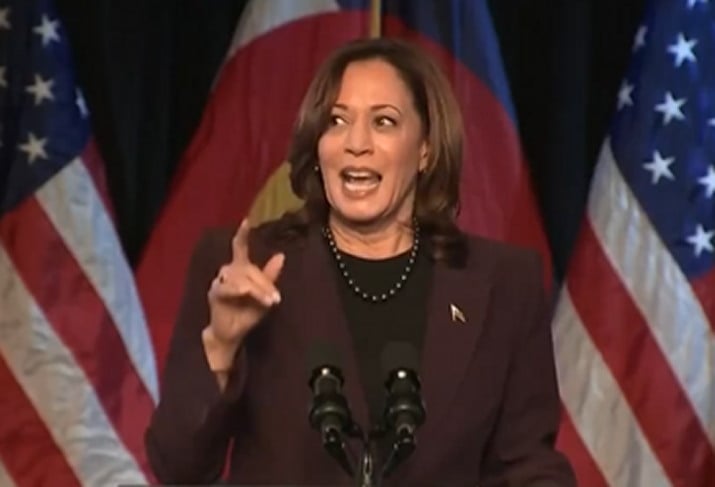

With President Joe Biden stepping out of the race for the White House, attention now turns to Vice President Kamala Harris as a potential Democratic nominee and her stance on supporting innovation within the crypto industry.

Nonetheless, the market is divided on whether her ascendancy will bring forth a more favorable environment for cryptocurrencies or if the regulatory crackdown experienced over the past years under Biden’s administration will continue.

Billionaire investor Mark Cuban has weighed in on the matter, suggesting a potential shift in policy under a Harris administration. Meanwhile, analysts speculate that a return of Donald Trump to the White House could lead to a weaker dollar, which some believe could benefit Bitcoin and other crypto assets.

Potential Support For AI And Crypto

Based on Harris’ record as a US senator and attorney general in California and her positions during her brief presidential campaign in 2019, a Politico report suggests that industry leaders perceive Harris as likely to take a more progressive approach to innovation than President Biden.

However, Harris’ rapid rise has left many industry insiders uncertain about her stance on crypto regulation or related matters surrounding the emerging industry.

Mark Cuban, a well-known crypto supporter, has expressed optimism, suggesting that Harris may be “more open to business” regarding artificial intelligence (AI), crypto assets, and government services. In an email to Politico, Cuban said:

The feedback I’m getting, but certainly not confirmed by the VP, is that she will be far more open to business, [artificial intelligence], crypto and government as a service. Changing the policies changes the message and lets everyone know she is in charge and open, literally, for business.

Trump Trade Effect

On the other hand, if Donald Trump were to return to the White House, some analysts speculate that his policies may lead to a weaker dollar, ultimately benefiting “riskier assets” such as crypto and gold, a phenomenon known as the Trump Trade.

Market expectations of a weaker dollar under a Republican administration, combined with the debut of crypto-focused exchange-traded funds earlier this year, such as the successful Bitcoin ETF market, have contributed to the rally in BTC prices and are expected to do so again in the scenario where Trump wins the seat in the Oval Office.

Fadi Aboualfa, head of research at Copper Technologies, claimed that the recent rise in Bitcoin’s price is primarily due to economic factors rather than Trump’s explicit support for the crypto industry.

However, Noelle Acheson, author of the Crypto Is Macro newsletter, believes that many other assets will outperform shortly and that it is always the short-term traders and investors that determine the current price of BTC.

Furthermore, Acheson claims that large-scale selling by the German government has caused major volatility for Bitcoin in recent weeks, and similar “bumps in the road” could be difficult for the asset to overcome – regardless of which side Washington is on. Acheson concluded by stating:

This matters for Bitcoin because there are few assets that have such a diversity of narratives,” said Acheson. If history were to repeat itself and the result of the election was not respected, “that would be pretty disastrous

When writing, the largest cryptocurrency on the market is trading at $65,970, down over 2% in the 24-hour time frame.

Featured image from DALL-E, chart from TradingView.com