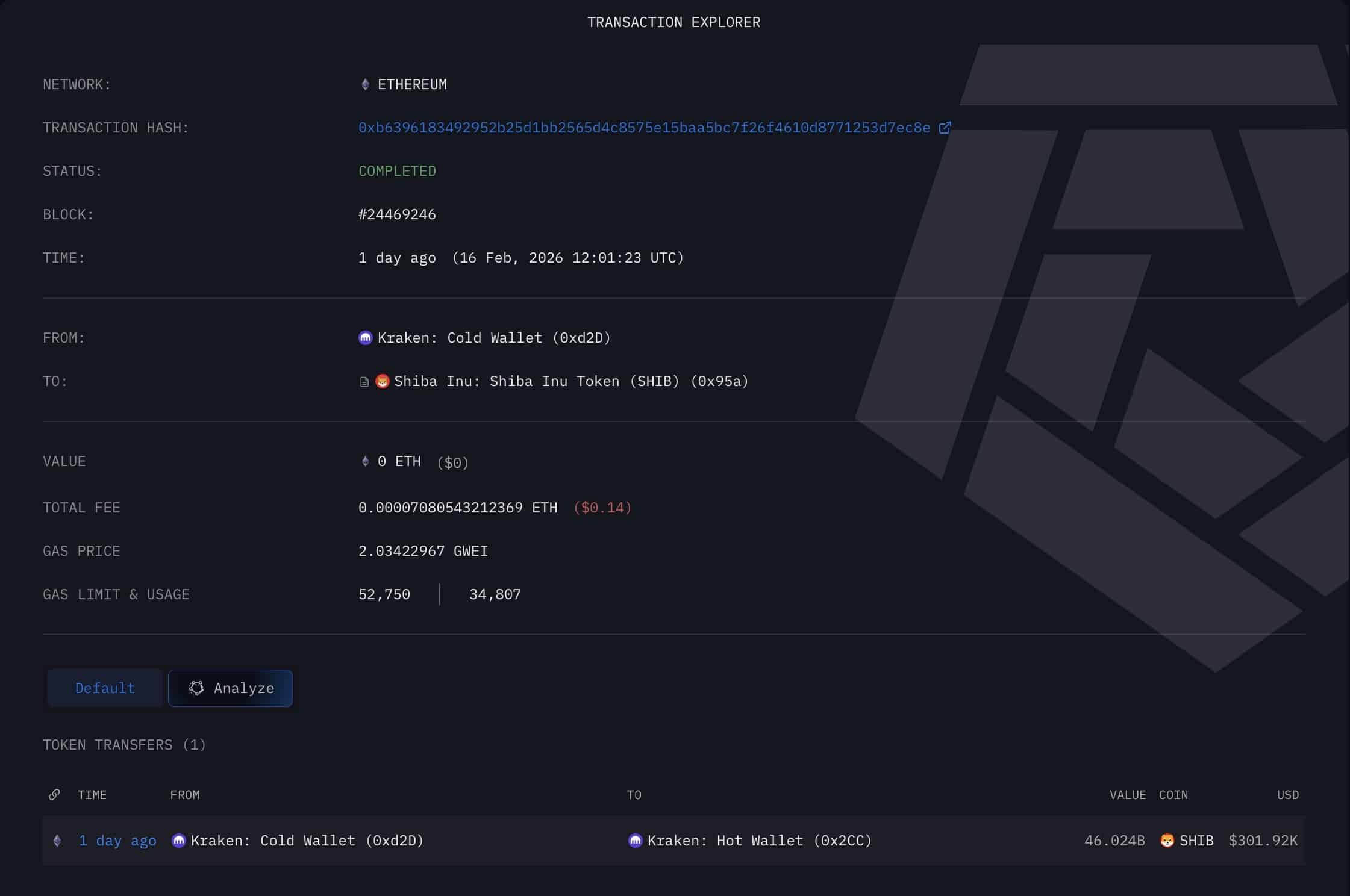

On-chain analytics have detected a significant transfer of 46 billion Shiba Inu (SHIB) tokens involving wallets associated with the Kraken exchange. This liquidity adjustment coincides with the Shiba Inu price testing a distinct support floor at the $0.000006 level. Where is the SHIB price prediction pointing?

The timing of the transfer is notable given the current state of momentum indicators. The RSI, a momentum oscillator used to measure the speed and change of price movements, has dipped near the 30 threshold on daily charts. Could be an indication that SHIB is way oversold?

As Kraken continues to expand its institutional infrastructure and capabilities, these routine rebalancing acts can sometimes serve as leading indicators for anticipated volatility in specific assets.

Kraken Cold Wallet Source Arkham

DISCOVER: Best Solana Meme Coins By Market Cap 2026

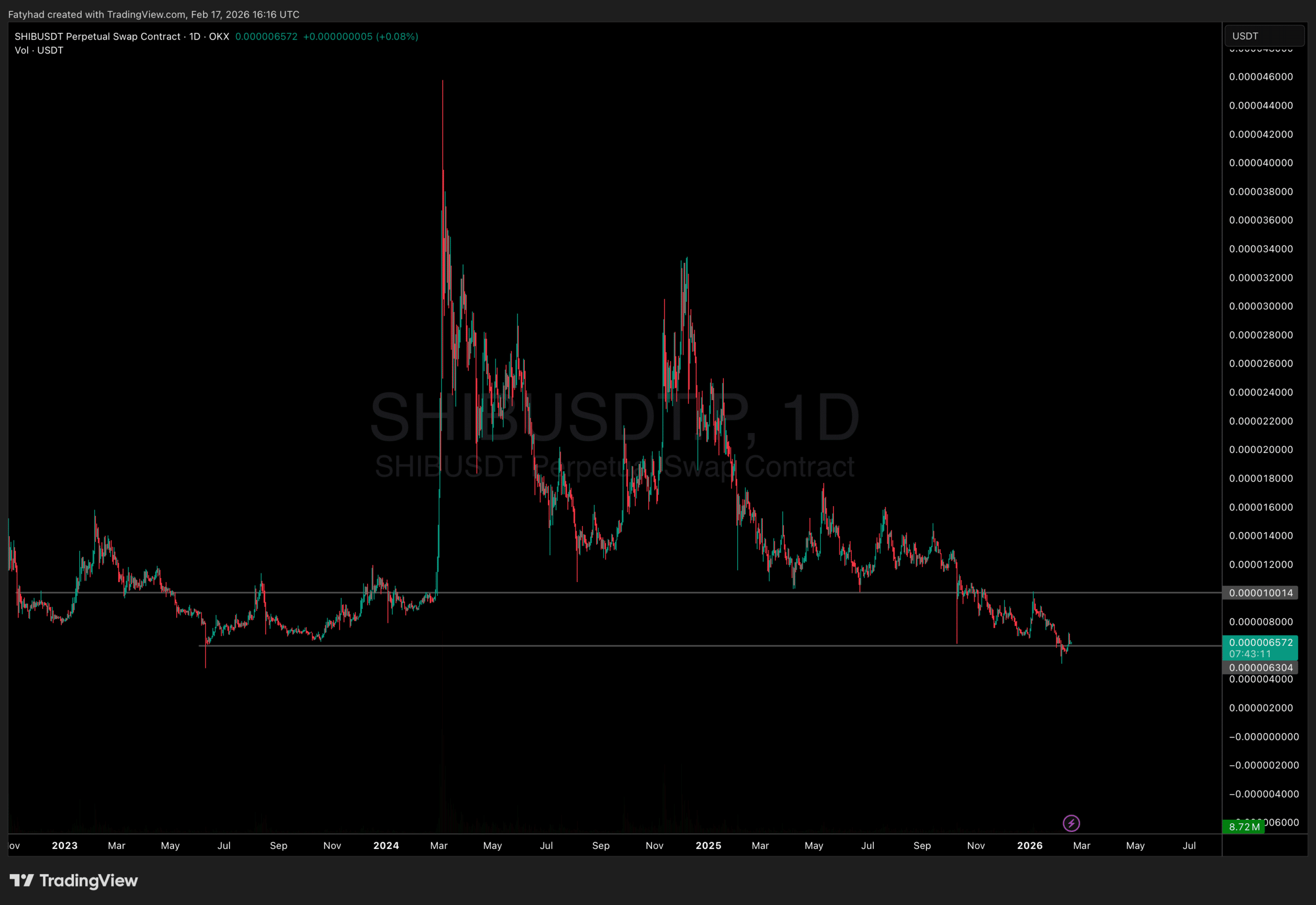

SHIB Price Prediction: Shiba Inu is Testing a Delicate Support

Shib Price Analysis Source: TradingView

Technical analysis of the daily chart suggests that SHIB is currently navigating a precarious range. SHIB is testing the $0.0000066, a delicate support zone. Breaking this area could send SHIB to new ATLs.

Resistance levels are currently forming near the $0.00001 mark. A decisive close above this level would be required to validate any short-term bullish thesis.

The movement of funds by a major entity like Kraken adds a layer of operational context. The exchange moved approximately $1.15 million worth of SHIB from cold storage to a hot wallet. Such transfers typically signal an exchange preparing for increased trading activity or ensuring sufficient liquidity for client operations.

If the market sentiment deteriorates, the increased liquidity on Kraken could alternatively facilitate selling pressure rather than buying demand. Watch for confirmation signals, such as a breakout above immediate resistance or an uptick in daily trading volume, before assuming a definite trend reversal is underway.

EXPLORE: What is the Next Crypto to Explode in 2026?

SHIB Hits Oversold Territory And MAXI Presale Just Beginning Its Run

While SHIB tests support near $0.000006, with the daily RSI nearing 30 and signaling oversold conditions, institutional rebalancing may increase short-term volatility in established meme assets.

For newer projects, however, the picture looks very different. MAXI DOGE (MAXI), an Ethereum-based meme token that leans into high-leverage trading culture, remains in its early presale stage, where pricing is driven by fundraising milestones rather than open-market demand.

The presale has raised roughly $4.6 million, progressing toward a current stage target near $4.9 million within a broader 50-stage model and a total hard cap of near $15 million. The token is priced near $0.0002804, with scheduled price increases after each stage ends, encouraging early participation.

MAXI DOGE also promotes a staking model with a dynamic APY of around 68%, though rewards decrease as more tokens enter the pool. The team positions staking as a way to reduce immediate sell pressure once trading begins. Additional planned features include futures-style trading integrations and weekly trading competitions that distribute rewards in MAXI and USDT, reinforcing its trader-focused identity.

Unlike SHIB, which reacts to market structure and broader liquidity flows, MAXI DOGE’s valuation currently depends on narrative momentum and presale participation. That creates higher upside potential but also significantly higher risk, especially since listing timelines and long-term demand remain uncertain.

DISCOVER: 10 New Upcoming Binance Listings to Watch in February 2026

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Daniel Frances is a technical writer and Web3 educator specializing in macroeconomics and DeFi mechanics. A crypto native since 2017, Daniel leverages his background in on-chain analytics to author evidence-based reports and deep-dive guides. He holds certifications from The Blockchain Council, and is dedicated to providing “information gain” that cuts through market hype to find real-world blockchain utility.