SouthWorks/iStock via Getty Images

Investment Thesis

In my last coverage of Shift4 Payments (NYSE:FOUR) I mentioned as relevant information that the CEO had been aggressively buying shares after the announcement of Q1 results. Since then, the stock has risen just 7% compared to the S&P500 remaining flat and also presented the results for Q2 2024.

After analyzing the results, I can understand why the CEO was so interested in buying the shares and despite the great fundamental improvement the company still look cheap, so I maintain my buy rating.

Q2 2024 Earnings

During the second quarter FOUR reported revenue of $827M which was slightly less than analysts expected but represented a strong 30% year-over-year growth. Additionally, free cash flow increased almost 40% year-over-year, reaching a margin of 11%. So, it seems that the company continues on its positive growth path despite how complicated the economic environment has been, which can be seen in the 50% growth in payment volume, a key metric to evaluate that the payment network has demand, regardless of whether this ends up translating into revenue to a greater or lesser extent.

| Estimate | Actual | Beat/Miss | |

|

Revenue |

$857M | $827M | -3.5% |

| EBIT | $155M | $162M | +4.7% |

| EPS | $0.87 | $0.96 | +10.6% |

In addition, during the quarter closed on the acquisitions of Revel and Vectron for almost $300M total (acquiring 100% of Revel and 41.43% of Vectron). Also there was recently announced the acquisition of Givex for just under $150M USD, continuing with small complementary acquisitions without overpaying, which ends up being reflected in the ROIC.

Excluding the acquisition of Givex, the company would have allocated around $2.3 billion between acquisitions and product investment since 2020. In this same period the EBIT has been $357M, therefore the return on investment would be approximately 15.5%, a fairly solid figure that demonstrates the good capital allocation of management.

International Expansion

But what stands out is that the company also continues to grow organically through international expansion and gaining partnerships with restaurants, hotels and other leisure venues. Among them, Xperience Restaurant Group stands out, which operates 11 different Mexican restaurant concepts, making it an important group to add to the client portfolio. There were also partnerships with several college teams, the New England Patriots’ Gillette Stadium and many others that demonstrate how relevant Shift4’s service is getting.

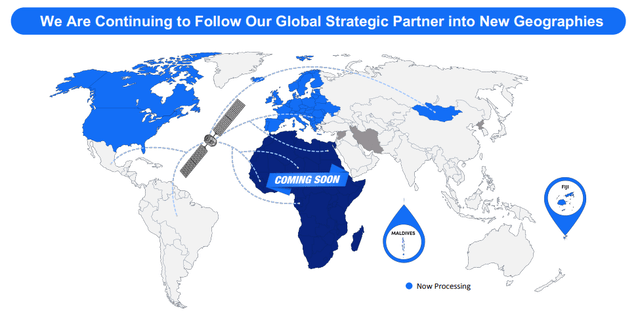

International expansion (Shift4 Payments Investor Letter)

It also seems that the company is entering heavily into Africa and Asia Pacific, international markets that I didn’t expect to be growth opportunities, if I’m completely honest. The new markets were Fiji, a tourist destination, and Sierra Leone, the first African country that FOUR reached. In the near future management hopes to reach into 8 to 12 additional countries in Africa and a few countries in Asia, which would be extremely positive for organic growth.

Stock Structure and Debt

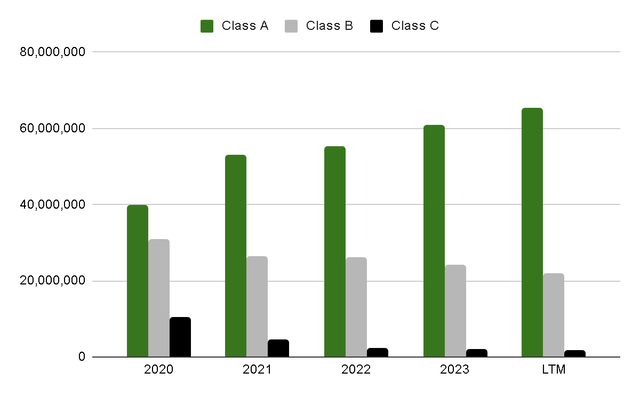

One aspect that I really liked to see was that the shareholder structure continues to be simplified, since currently the company has type A, B and C shares, which can make it somewhat complex when analyzing. During Q2 2024, type A shares increased 7% compared to FY 2023, but type B shares decreased 9% and type C shares another 2%. It can be noted that there’s a clear tendency to decrease type B and C shares, something that I personally value and many investment funds and institutional investors do as well.

Shares outstanding (Author compilation)

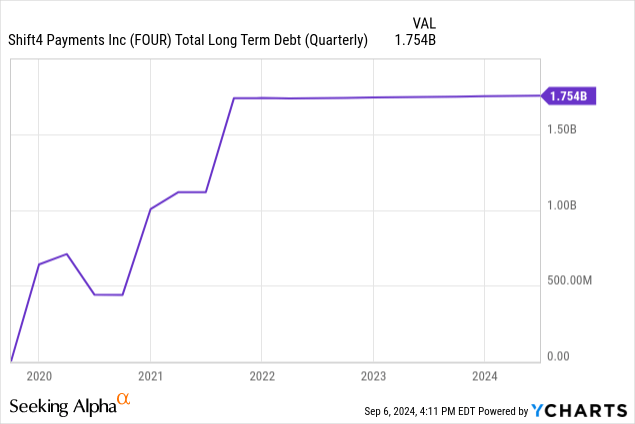

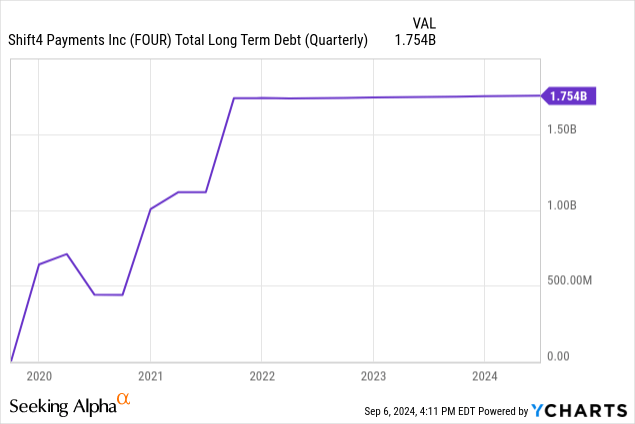

It is also worth mentioning that the total debt did not increase and with this it has already accumulated almost 2 years of no debt issuance, an aspect that made many investors quite nervous. From here, deleveraging will depend on what the company decides to pay, but so far it seems that management sees no reason to do so.

Our total indebtedness has a weighted average cost of 1.35% and we do not have any maturities until December 2025. Our net leverage at quarter end was approximately 2.7x. The deleveraging profile has been quite extraordinary.

CFO Nancy Disman on Q2 2024 Earnings Call

The cost of debt is quite low and there’re no maturities until the end of 2025, therefore it seems reasonable to me to invest in acquisitions and organic growth, so leverage will be reduced as EBITDA grows and the company accumulates cash.

Valuation

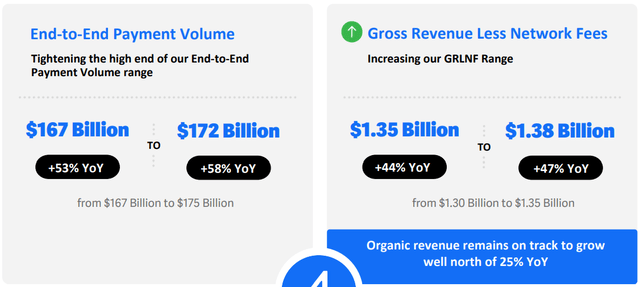

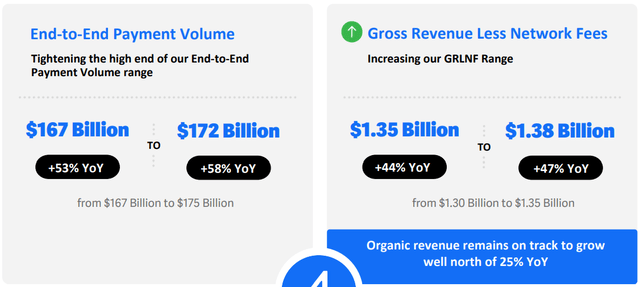

As the icing on the cake we have that the guidance was raised, which makes perfect sense given the latest positive news regarding acquisitions and international expansion. Gross revenue is now expected to grow 44% to 47% vs. previous guidance of 38% to 44%, although free cash flow is expected to tighten even though adjusted EBITDA guidance also increased.

FY 2024 guidance (Shift4 Payments Investor Letter)

According to the guidance, the adjusted EBITDA would be between $662M and $689M and the conversion to free cash flow would be around 60%, representing a FCF of $397 to $413M. As always, I’ll be more conservative and my estimate is $366M in case something goes wrong.

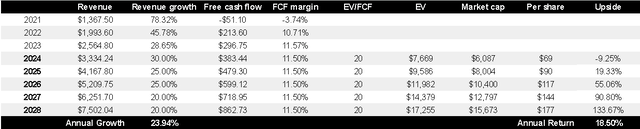

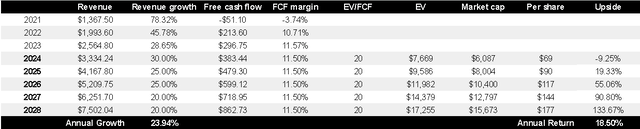

And for FY2028 my estimate would be that they generate just over $850M in FCF, with a multiple of 20 times EV/FCF it would represent an Enterprise Value of $17 billion. Minus the $1.58 billion in net debt and divided by the 89M shares outstanding would mean a share price of $180 USD. This is more than doubling the current share price of $75 with a reasonable estimate since it assumes growth of 25% annually (practically the current organic growth)

Valuation model (Author compilation)

The Bottom Line

I understand why the CEO was buying shares after Q1. The results were very good and the valuation continues to look favorable with a TTM EV/EBTIDA of 17 and TTM P/FCF of 13. Considering that the company grew almost 30% year-over-year YTD, it seems more than fair and even cheap to me.

The risks remain the same as I mentioned in my previous coverage, those are competition and cyclicality of the service mainly. However, I maintain my buy rating even though the shares have risen nearly 7% since my last analysis vs the S&P500 being almost flat.