Lighthouse Films

Defense wins championships. It also potentially saves societies. Regrettably, that’s the world we live in. Military strength, advanced weaponry, a decades-long nuclear arms race, and the advent of innovative and life-shielding systems like iron dome all remind us that the Cold War didn’t end. It just became more sophisticated and faster to understand, thanks to instant communication methods.

In my ETF research work, I aim to follow what I would potentially own. A “watchlist” if you will. The $530 million Global X Defense Tech ETF (NYSEARCA:SHLD) debuted just over a year ago, ironically (or not) on 9/11/2023. As I see it, the industrials sector of the S&P sector classifications are a good starting point. There are 11 of them.

But within each sector are “subsets” including aerospace and defense. And as ETF issuers like Global X often do, overlapping or subsidiary themes can be identified from there. SHLD is one, and I want to follow it. I do so in part because there may be times when owning the whole industrial sector makes less sense than targeting a smaller set of industrial companies that stand to benefit from higher stock prices.

So in my ETF watchlist, which I recently freshened up to include a very diverse set of 90 US equity funds, SHLD made the “roster.” Over time, I’ll determine when it merits a spot in the “starting lineup” that is my ETF portfolio, which I’ve run in various forms since the 1990s, including a couple of times as a mutual fund, and for 20+ years when I was managing “other people’s money.”

SHLD: background

This ETF invests in companies that the index manager believes can benefit from increasing use of “Defense Tech”. What is that? Firms that build and operate cybersecurity systems, use artificial intelligence and big data, and build modern military systems and hardware. Here, think robotics, fuel systems, and defense aircraft (not commercial airplanes).

Global X does a nice job of summarizing the attraction of this market segment on their website:

Industry trends

Predictive maintenance has emerged as a game changer for the aerospace and defense industry, particularly in enhancing fuel efficiency and the reliability of aerospace systems. By leveraging data analytics and IoT devices, aerospace and defense technology companies can now anticipate maintenance needs, significantly reducing downtime and operational costs.

Defense News recently reported that defense organizations worldwide are accelerating their plans to incorporate drone wingmen alongside piloted fighter jets. AI has also significantly enhanced soldiers’ roles in the field, especially in using unmanned aerial vehicles (UAVs). Militaries now employ AI in virtually every drone mission, achieving greater precision in target planning and mission completion.

The need for EMP (electromagnetic pulse) solutions is gaining traction. This technology safeguards civilian spaces, government facilities, and even nuclear sites, addressing emerging threats like illicit drone drops over prisons.

SHLD: why it made my watchlist

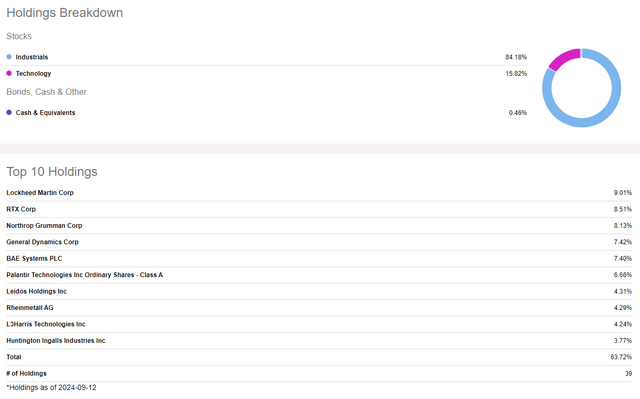

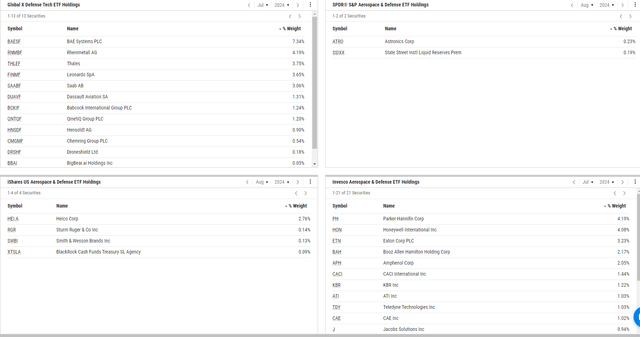

Depending on the economic sector, I typically go a bit deeper than just considering the sector ETF itself (XLI and XLK in the case of this industry, since it touches mostly on the former and a bit on the latter, as shown here). Or, in cases like this, where simply owning and aerospace/defense ETF might suffice, if I see a “tilt” within that, I want to give myself the chance to plug it right into the portfolio if the basket of stocks makes more sense than a wider ETF.

Indeed, while SHLD has a decent amount of overlap with those types of ETFs, we see here a large number of holdings unique to SHLD. That is, not owned by any of the 3 big Aerospace/Defense ETFs. More important than the number of unique stocks is that they add up to nearly 30% of the ETF’s assets. So while it is not night-and-day, I can anticipate times when I’ll see SHLD looking better chart-wise and fundamentally than the more traditional mixes in this sector. SHLD is 1/3 non-US stocks, while the other 3 shown here are 100% US stocks, or nearly so.

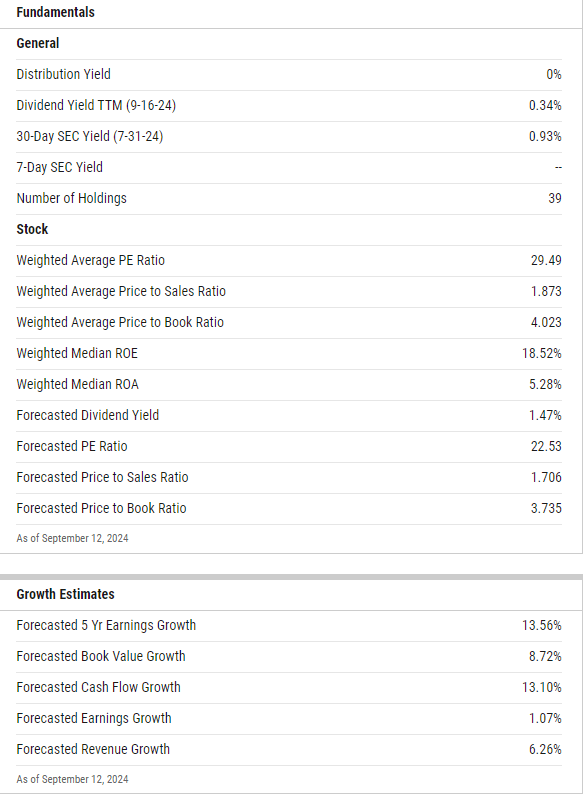

SHLD is not cheap at nearly 30x trailing earnings, though the price to sales at under 2.0 is at least in the ballpark for me. There’s not much dividend to serve as an attraction point either. But if earnings growth can come close to that 13%+ 5-year projection, I assume there will be a point at which I will assign a portfolio slot to SHLD, at least for a period of time.

But that’s why I keep a watchlist. To me, one of the biggest mistakes investors make with both ETFs and stocks is they do little or no research, then jump right in to buy it in haste.

YCharts

My process has 2 distinct steps within it:

1. What would I be willing to own “at some point in the foreseeable future?”

2. When will I own it and with what risk-management and position size parameters attached? That’s a “game time decision,” in that I can’t predict now when SHLD will be both attractive in its own right, and a good enough reward/risk tradeoff to merit a spot in my portfolio.

For instance, my ETF portfolio only has one equity ETF in it, a dividend-focused fund. Most of the portfolio is Treasuries of different maturity ranges. That’s a product of an equity market that doesn’t scream “long-term value” to me in the aggregate. There will be a time when it does, but I can’t tell the market what to do.

What might prompt me to use SHLD in my ETF portfolio?

Global conflict has been rising significantly the past several years. The defense industry for each country is as important as ever with the abilities of nuclear power constantly growing. Technology and AI companies involved in defense logistics, such as Lockheed Martin and RTX Corporation, SHLD’s largest holdings, have uncapped space to offer services and systems of protection. Especially important in a time of spreading global turmoil. If we see the globe move from potential danger to danger in progress, and the equity market is not selling off across the board, that might be a tipping point for this ETF.

Spending on the defense industry is expanding quickly. Specifically, spending on innovation with technology to keep pace with other countries. Falling behind in the defense industry is a dangerous sign and the companies in SHLD have great opportunity to be the asset governments seek in volatile geopolitical times. So ironically, this “defense” sector ETF could ultimately become a more growth-oriented way to play “offense” in my portfolio.

Risks

Other than the obvious one: this is a basket of stocks, and stocks are volatile, defense technologies are prime targets for cyberattacks. As advancements in tech are made, chance at cyber threats only increases. Rapid technological advancements mean that defense technologies or companies can become obsolete quickly if they fall behind their competition.

And, the defense sector is heavily regulated. Companies must navigate complex compliance requirements, export controls, and security clearances.

Government spending is a big indicator for the direction of the defense industry. A huge clue in the industry is following along on which funding programs are getting approval by congress. These massive deals lead to extensive research and development, driving defense stocks higher.

Global conflict is truly what drives SHLD. But it’s not the current state of global conflict, what matters is the long-term outlook and how that is changing. Nightly headlines can help, but it’s the prospect of long-lasting global unrest that is a true sign.

So SHLD makes my watchlist. That’s the top 90 US equity-focused ETFs I’ll consider. And thus, my rating in the Seeking Alpha format is hold, not because I currently own it (I don’t) but because I would not sell it right now if I owned, it, and I am not yet buying it.