“We may be looking at the end of capitalism.” These phrases, from the pen of the loquacious Albert Edwards of Societe Generale, shocked the Wall Avenue analyst set final April and set Alberts on his option to turning into a financial press favorite for his witty turns of apocalyptic phrase. He was commenting on the phenomenon of “greedflation,” an financial bugbear beforehand beloved of progressive economists, not fairly venerable 160-year-old French funding banks.

However after falling from its blistering tempo in 2022, shopper inflation has gotten stubbornly caught within the 3% vary—rising unexpectedly for the last two months whilst wholesalers’ costs stay flat or fall. That’s greedflation’s music, providing a transparent little bit of proof that extreme profit-taking is going on above the uncooked value of products. And one more progressive financial examine, this time from the Groundwork Collaborative, sheds gentle on the issue, arguing that greater than half of the buyer worth worth will increase in the midst of final 12 months had been as a result of extreme income, based on the findings. Company income, by the way in which, stay at all-time highs.

Company income drove 53% of inflation in the course of the second and third quarters of 2023 and greater than one-third for the reason that begin of the pandemic, the report discovered, analyzing Commerce Division information. That’s a large soar from the 4 many years previous to the pandemic, when income drove simply 11% of worth progress.

“Businesses were really, really quick, when input costs went up, to pass that on to consumers. [But] had they only passed on those increases, inflation would have been maybe one to three points lower,” Liz Pancotti, a strategic advisor at Groundwork and one of many report’s authors, informed Fortune.

Much less enterprise, extra money

The truth is, company income have been so good, firms might have backed themselves right into a nook, Bloomberg Opinion columnist (and former Fortune editor) Justin Fox opined this week, citing House Depot’s earnings, which noticed a rise in greenback gross sales per sq. foot (because of rising supplies costs) but additionally fewer transactions. Company income have hit a brand new document in probably the most recent quarter, whereas the portion of nationwide output going to staff remains to be beneath pre-pandemic ranges, regardless of stable actual wage progress.

That top-profit, lower-volume dynamic is even hurting staff—who’re being scheduled for fewer shifts to service fewer customers, who’re themselves delay by ever-increasing costs, Bloomberg Opinion author Conor Sen wrote. Within the quick time period, that pattern might present itself in some optimistic modifications, like a four-day workweek. However in the long term, firms will refuse to surrender their fats revenue margins with out a struggle, and can attempt to minimize wherever potential. The tech industry, whereas a small a part of the general financial system, is prime proof of this dynamic, with Google, Amazon and loads of smaller firms this month saying plans to shed the less-profitable elements of their workforce as they pivot to the hopefully-more-profitable AI sector.

In the meantime, consumer-facing firms have been upfront with traders about their price-raising methods—and so they don’t appear inquisitive about a reversal. PepsiCo’s CFO Hugh Johnston stated final spring the corporate might “increase margins during the course of the year;” development supplies large Holcim stated in October it will increase its margins to make up for falling demand, and consumer-products large Procter & Gamble this summer season boasted of an $800 million profit increase, because of falling commodity prices that it will not go on to customers.

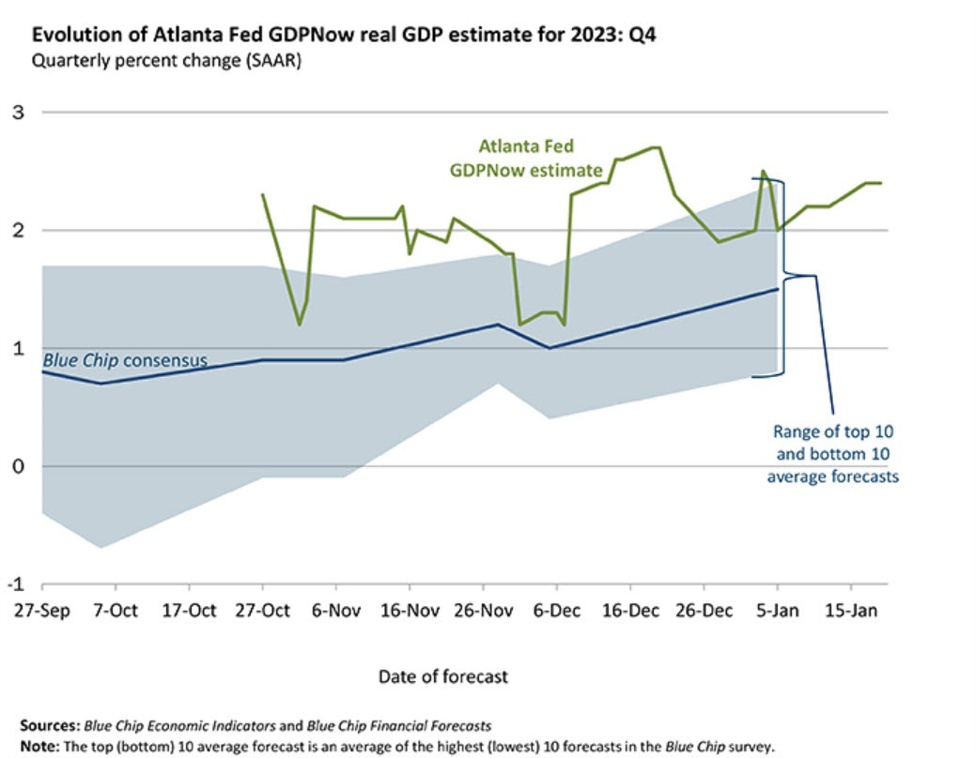

That each one provides as much as consumer-inflation charges which are, nicely, inflated, based on Groundwork. Firm income are “probably why we saw inflation in the realm of 7% to 9% for a while, instead of the 5% to 7% range,” Pancotti informed Fortune. Now that “we’re in the 3% range, if you took corporate profits away, we should already be at the 2% target” that the Federal Reserve has set, she added.

After pandemic-era upheavals, “on the whole, things are really stabilized, but we’re still seeing significant gaps between consumer and producer prices,” she stated.

It’s not simply the left making this argument. The Federal Reserve Financial institution of Kansas Metropolis has additionally discovered company income taking part in an outsize function in worth progress. The Kansas Metropolis Fed, in a current examine, discovered that progress in markups accounted for greater than half of consumer price inflation for 2021, a “substantially higher contribution than during the preceding decade.” Final month, the largest review to date of greedflation, from the Institute for Public Coverage Analysis and Widespread Wealth, checked out 1,300 firms throughout 4 continents and concluded that profiteering by a comparatively small set of firms pushed up shopper costs “significantly higher” than would have occurred from the supply-chain shocks alone.

Societe Generale’s Edwards, in his takedown of greedflation final 12 months, warned that firms’ greed might result in a revolt and social unrest. Calling profit-taking “unprecedented” and “astonishing,” Edwards famous that he had by no means seen this degree of company greed throughout 4 many years within the finance business, and warned that standard unhappiness at firms’ “super-normal profit margins” might usher in worth controls, of the kind final seen many years in the past.

To make sure, classical economists argue that blaming firms for attempting to spice up income is like blaming the rain for falling—profit-seeking is their mission, and it was to be anticipated, if something, from the unleashed pent-up demand that exploded because the financial system reopened post-pandemic. However more and more, mainstream in addition to progressive economists are making the case that the costs simply didn’t must go up this a lot.

Outdoors the U.S., firms in addition to governments have pushed again in opposition to worth hikes. The European grocery store chain Carrefour, which first tried to embarrass PepsiCo by stating price increases on its products with in-store signs, final month stated it will stop carrying PepsiCo products altogether. Belgian chain Colruyt additionally dropped merchandise from Mondelez, the maker of Oreos and Philadelphia cream cheese, after worth hikes.