quantic69

Note:

I have covered Sify Technologies Limited, or “Sify” (NASDAQ:SIFY), previously, so investors should view this as an update to my earlier article on the company.

Almost three months ago, I advised investors to participate in a heavily discounted rights offering conducted by leading Indian ICT solutions provider Sify Technologies, as the company’s rights were trading well below fair value at that time.

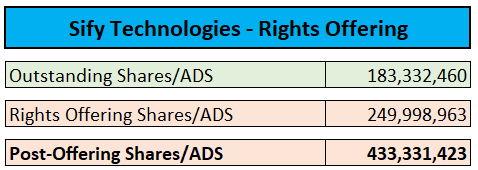

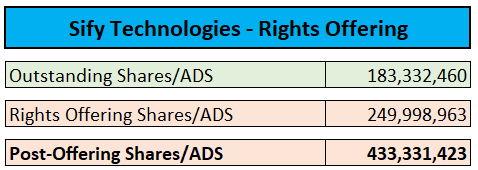

In aggregate, Sify issued approximately 250 million new shares/ADS for gross proceeds of just $30 million, thus increasing the number of outstanding shares/ADS by approximately 135%.

Regulatory Filings

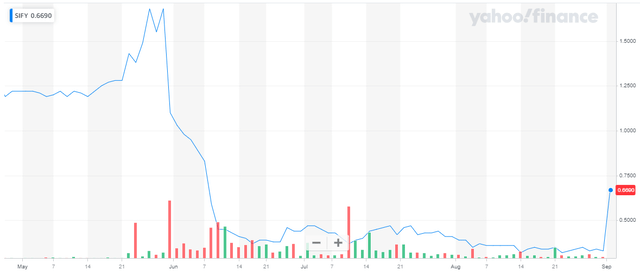

The rights offering caused the price of the company’s U.S.-traded ADS to crater by approximately 75%:

While participation in the rights offering and subsequent sale of the ADS into the open market provided readers with very solid gains, investors with more patience were rewarded handsomely, albeit solely as a result of Tuesday’s ill-fated momentum rally.

Even with the market experiencing some “AI-fatigue” as of late, the combination of the magic words “AI” and “NVIDIA” in a press release remains sufficient to attract the momentum crowd to a penny stock like Sify:

Sify Technologies Limited (NASDAQ: SIFY), India’s leading Digital ICT solutions provider with global service capabilities spanning data center, cloud, networks, security and digital services, today announced it has become an NVIDIA colocation partner with the NVIDIA DGX-Ready Data Center program, certified for liquid cooling.

(…)

With the NVIDIA DGX platform and its supporting infrastructure technology ecosystem, Sify customers now have access to high-density supercomputing and powerful performance, offered in scalable and flexible AI infrastructure solutions and accessed through an extensive colocation footprint.

The news resulted in the company’s ADS rallying by close to 200% in early trading on Tuesday before pulling back.

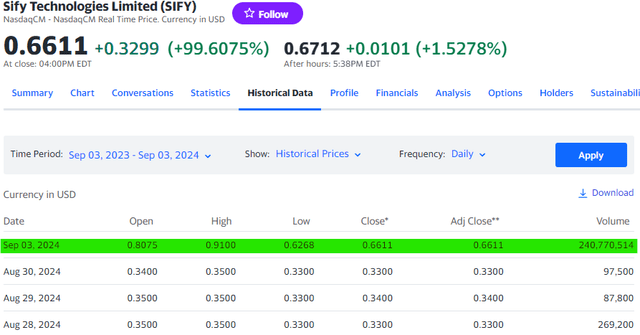

The ADS finished the session up by approximately 100% on massive trading volume:

As a result, the company’s market capitalization increased by almost $150 million to $286.5 million.

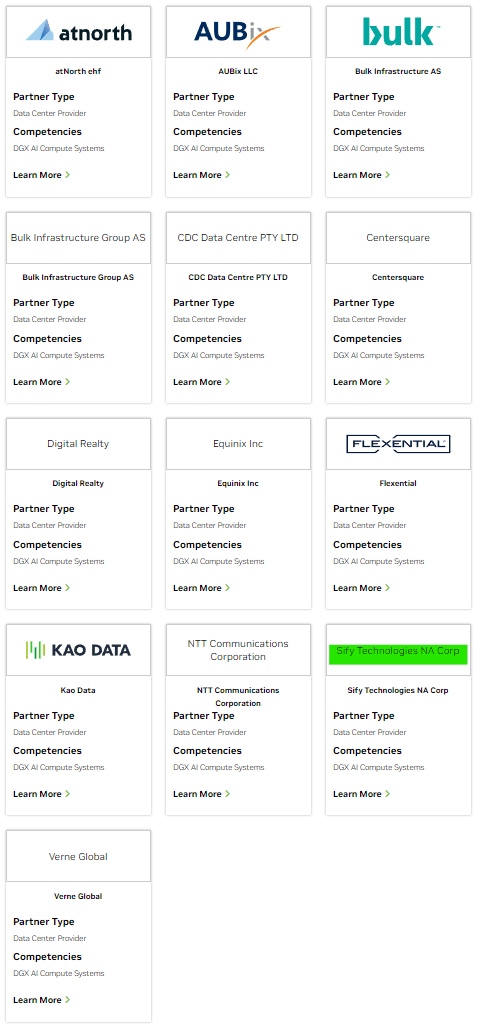

While there’s certainly nothing wrong with becoming “India’s first DGX-Ready Data Center partner certified for liquid cooling”, other Indian data center providers are likely to follow suit, thus mirroring developments in other parts of the world:

NVIDIA Corporation Website

Please note that NVIDIA Corporation (NVDA) is not looking for exclusive relationships, but rather to provide customers with a large worldwide network of partners for its rapidly growing AI technology platform DGX.

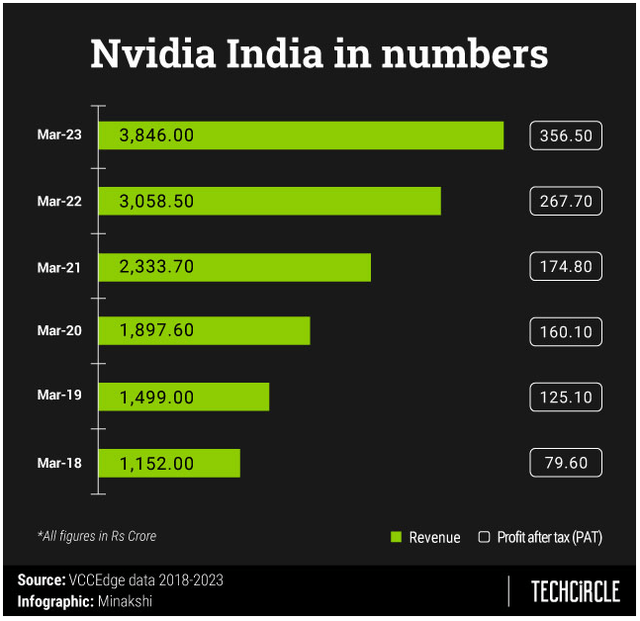

Remember also that NVIDIA’s sales in India, while growing nicely, remain a far cry from the company’s domestic stronghold and major Asian countries like China and Taiwan.

In the current fiscal year, revenues in India are expected to exceed $500 million, however not all of these sales will be datacenter and/or AI-related.

Similarly, private AI investment in India remains a tiny fraction of leading countries like the United States and China.

While there’s certainly ample room for expansion, Sify, now being a certified NVIDIA DGX partner, is not likely to have any measurable near-term impact on the company’s financial performance.

Please note also that data center services represented only 31% of the company’s $427 million in annual revenues in FY2024.

Lastly, with Sify being majority-owned by CEO and Chairman Raju Vegesna, outside shareholders have very little options to prevent additional value destruction similar to the recent rights offering.

At least in my opinion, there is no justification for Tuesday’s 100% rally, as the certification by NVIDIA is not likely to have any near-term impact on the company’s financial performance.

With momentum traders likely to leave for assumed greener pastures sooner rather than later, I expect the ADS to give back most if not all of Tuesday’s gains over the next couple of weeks.

Considering this issue, I would advise Sify shareholders to use the momentum rally to dispose of existing positions.

Risks

Apparently, the biggest risk to my bearish thesis would be a continuation of Tuesday’s momentum rally as additional traders get attracted by the hype. However, with the ADS having finished the session near day-lows, I would expect the price to move lower on decreasing trading volume.

Bottom Line

The power of AI has struck again, as evidenced by Tuesday’s 100% move in Sify Technologies’ ADS.

However, the fact that the company has become India’s first “NVIDIA DGX-Ready Data Center partner certified for liquid cooling” is not likely to result in any measurable near-term benefits to the company’s financial performance and certainly does not justify an almost $150 million increase in Sify Technologies’ market capitalization.

Given this issue, I am downgrading the company’s ADS from “Sell” to “Strong Sell” as I expect the stock to give back most if not all of Tuesday’s gains over the next couple of weeks.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.